A scheduling note: There will be no Off to Lunch tomorrow, Friday February 9. We will be back on Monday

The Chinese economy is facing a growing problem with deflation. The latest official data shows that consumer prices in China fell at the fastest rate in 15 years in January and have now dropped for four months in a row.

The consumer price index shows that prices dropped 0.8 year-on-year in January. Meanwhile, producer prices - the price of goods sold by Chinese factories - dropped by 2.5 per cent year-on-year. The price of food has been one of the biggest drivers of deflation in China. Food prices fell by 5.9 per cent year-on-year in January.

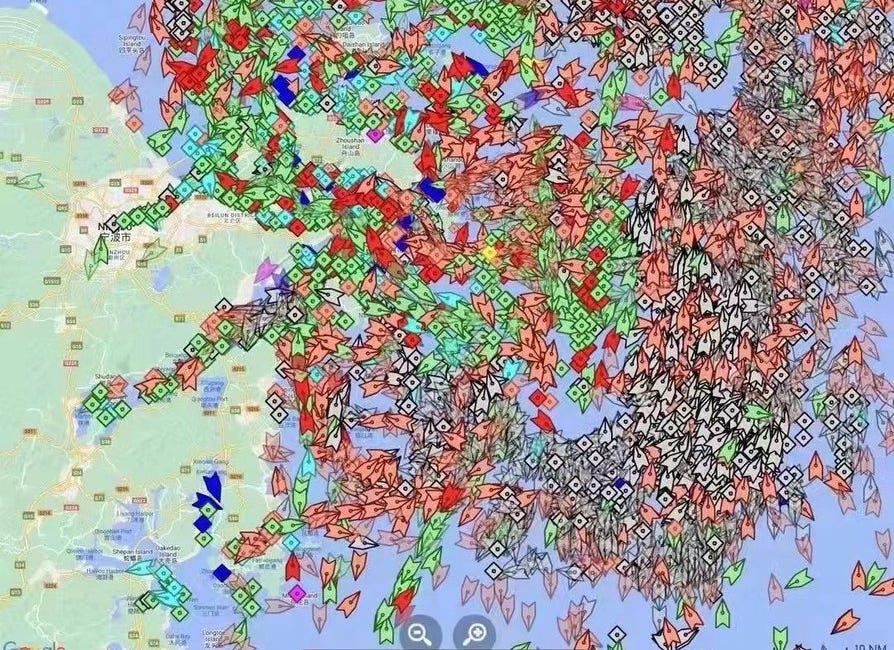

So does this matter to the UK economy and UK businesses? Well, China is the second-largest economy in the world and many of those goods being sold by Chinese factories are coming to the UK and many of those products bought at lower prices by Chinese consumers were from Western retailers or brands.

It is also worth pointing out that China provided early warning signs about surging inflation before it came to the UK. You can check-out the first-ever edition of Off to Lunch from two years ago for more on that…

I also recommend the latest newsletter from the excellent Klement on Investing, which is literally headlined “What happens if China sneezes?”. He writes:

As we might guess, commodity prices react about as sensitively to shocks in China as to shocks in the US.

You can find that piece here

Deflation, of course, brings different challenges to a business than inflation. These challenges can, in theory, be worse - consumers hold-off from spending money because they think goods will be cheaper in the future.

The Bank of England actually has a page on its website dedicated to explaining deflation (and why its target is to keep inflation at 2 per cent and avoid deflation). This extract outlines the vicious cycle that deflation can create:

What would you do if you knew the £100 bike you wanted to buy today, was going to be reduced to £90 tomorrow? You would probably wait to buy it for the cheaper price. When prices begin to fall, people expect they will continue to go down. This expectation results in people spending less today, in hope of buying at a cheaper price tomorrow. This is bad for businesses.

If prices fall, businesses are likely to make less profit. Businesses don’t like to see their profits fall, so they will try to do something about it. Let’s go back to that bike you wanted to buy. The owner of the bike shop is now getting £10 less for each bike and so may try to cut costs to make up for this loss.

You can find that explanation from the Bank here. It also touches on how deflation negatively impacts those with debt - the amount of money you owe remains the same despite prices falling (ie you have negative equity on your mortgage because the value of your home has fallen).

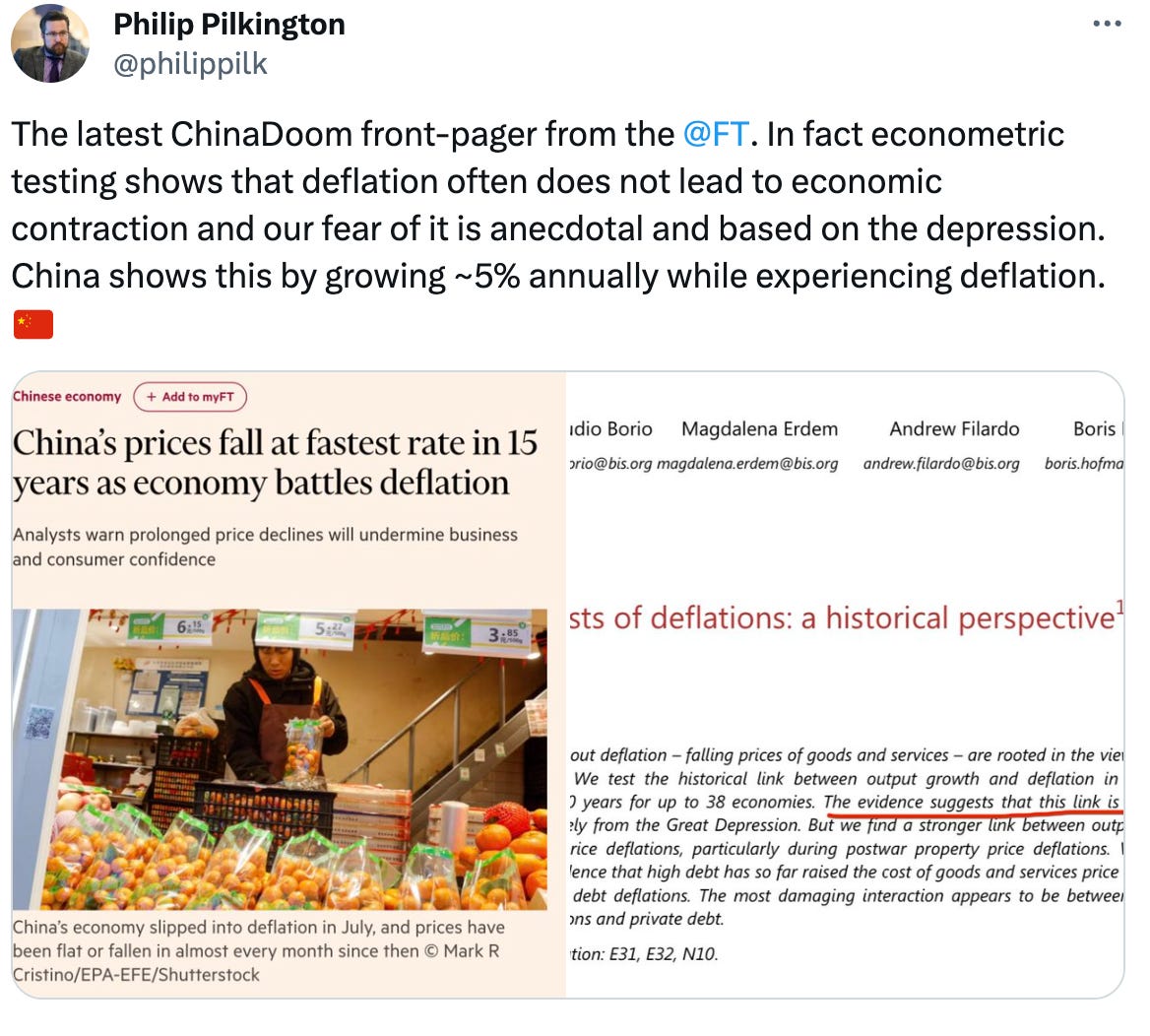

You can see some of the reaction to the Chinese data below. There are mixed views on how consequential this could be…

Other stories that matter…

1. The parcel delivery company Yodel is reportedly on the brink of falling into administration. The company is owned by the Barclay family, who also control online retailer Very and recently lost control of The Telegraph. You can read more in a story by The Telegraph here

2. The packaging group DS Smith says rival Mondi has approached it about a takeover bid. DS Smith shares have risen more than 10 per cent following the announcement, valuing the company at £4 billion. You can find the company’s statement here. We interviewed DS Smith boss Miles Robert on our podcast last year. You can find that episode here

3. The Labour leader Sir Keir Starmer is poised to officially abandon a pledge to spend £28 billion-a-year on green investments if his party wins the next election. You can read more in a BBC story here

4. OpenAI is working on new AI software that users will be able to download to their computer and use to complete a range of personal and work tasks such as booking tickets or organising data. This is according to a report by The Information, the tech website. You can read more here

5. Here is a list of 16 promising UK companies that could hit a $1 billion (£790 million) valuation in 2024. It includes Stenn, which helps businesses get cash from their invoices upfront, digital bank Tide and Fresha.com, a marketplace where you can book beauty and wellbeing appointments with local businesses. You can see the full list from Sifted here

6. I recommend checking-out a fascinating look back in history at what happened in 1914 when Henry Ford announced that Ford would share its profit with staff. The move meant that 25,000 employees saw their pay double and 10,000 people gathered outside Ford’s factory the next day looking for work. Ford had previously struggled with staff turnover. "The payment of five dollars a day for an eight-hour day was one of the finest cost-cutting moves we ever made,” Henry Ford later said. You can read more in the Market Memoirs newsletter here, including the views of Thomas Edison at the time.

Podcast…

The latest episode of our Business Leader podcast features an interview with Marc Allera, the chief executive of EE and BT’s consumer business. He explains how EE went from being an upstart mobile phone brand to a key part of BT and a business with big ambitions for the future. Plus, Allera explains what he learned from launching Sega’s Dreamcast games console and mobile phone brand Three in the early 2000s, which had mixed success.

You can listen to the episode via Substack here, Apple here or Spotify here

And finally…

I have just finished reading Four Thousand Weeks: Time Management for Mortals by Oliver Burkeman. It is one of a collection of new books that pushes back against the drive to manage every hour of your day to make you more productive. Instead, the book argues that it is more effective to accept that you will never get on top of all your tasks and that if we all obsess about managing our time then we will lose the ability to collaborate with others and work as a team. The book also promotes the importance of enjoying hobbies and a balanced life, a topic that has come up repeatedly in our recent Business Leader podcast episodes. The book is an interesting read, although it probably could have been shorter than the 288 pages it is. You can find it here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox

Best

Graham