What next?

Banks, markets and interest rates + Budget reaction + Other stories that matter + Ted Lasso

Hello everyone and welcome to the latest edition of Off to Lunch. Happy St Patrick’s Day to all our Irish readers…

I was in Manchester for the Budget on Wednesday speaking to business leaders there. Today’s edition was going to focus on Manchester, the progress of levelling-up and the reaction to the Budget. That is why there was no Off to Lunch in the immediate aftermath of the chancellor’s statement on Wednesday.

But that analysis is now going to wait until Monday because, well, there is drama in financial markets. For now, here is a brief summary of Manchester: the city was buzzing, but that had more to do with Man City beating RB Leipzig 7-0 the evening before and Snoop Dogg being in town for a gig at the AO Arena than anything Jeremy Hunt said…

In terms of the Budget, I thought two proposals stood out: 30-hours of free childcare for children from 9-months-old, rather than from 3-years-old as it is at present (but only from 2025 and not for any families where one of the parents earns more than £100,000) and the abolition of the £1.073 million lifetime allowance on pensions, which capped the amount that people could save in their pensions tax-free. Both these measures are designed to get more people into work - parents and older workers who were tempted to retire early.

The other thing that stood out is how policies on infrastructure and levelling-up are increasingly caught in a web of forecasts about GDP and debt by the Office for Budget for Responsibility, which encourages the chancellor and Treasury to focus on balancing the books over the short-term and not make the investment that is needed over the long-term. This is why the Budget was greeted with a shrug of the shoulders by many I spoke to in Manchester.

The significance of the Budget was reduced by events in financial markets and the banking system. After the collapse and rescue of Silicon Valley Bank, which we covered on Monday, shares in Credit Suisse and First Republic Bank tumbled. Credit Suisse shares recovered after the Swiss central bank offered a CHF50 billion (£44 billion) emergency loan on Wednesday. Then on Thursday night a collection of the largest US banks, led by JP Morgan, said they were bolstering First Republic Bank by putting in a combined $30 billion.

First Republic is based in California and describes itself as the 14th largest bank in the US. It is slightly bigger than SVB, but not globally significant. In contrast, Credit Suisse is one of 30 banks that has been identified by the Financial Stability Board, the international financial watchdog, as a global systemically important bank. You can find the full list of those banks here. Credit Suisse employs more than 5,000 people in the UK and has a base at Canary Wharf.

Shares in Credit Suisse are down more than 5 per cent today and shares in First Republic Bank are set to fall by around 10 per cent when Wall Street opens on Friday afternoon. This shows that concerns around the banks and the financial system have not been entirely resolved. Bill Ackman, the US hedge fund boss, has tweeted about his concerns…

There are challenges for First Republic Bank and Credit Suisse that are unique to these banks. It was the same for SVB. Credit Suisse has been under-pressure for some time. The slump in its share price this week was sparked by Credit Suisse saying it had identified a material weakness in its financial reporting and the key investor Saudi National Bank saying it wouldn’t put any more money into the bank.

For a more detailed guide to the chaotic last two weeks in the banking industry I recommend reading the latest column from John Authers at Bloomberg. That is here.

Authers offers some thoughts on what could happen next. Some disruption was inevitable as central banks raised interest rates aggressively to fight inflation, he writes. This has happened before, such as when Paul Volcker put up rates in the early 1980s. The big question now is how the rest of the financial system stands up to this stress and whether the Federal Reserve, European Central Bank and Bank of England put up interest rates more slowly than they intended. “It’s very hard to work out exactly where problems will appear, as apparently minor mistakes can make all the difference,” Authers says.

The Organisation for Economic Co-operation and Development (OECD) said on Friday that central banks should keep raising rates (story here) and that the UK economy will shrink this year.

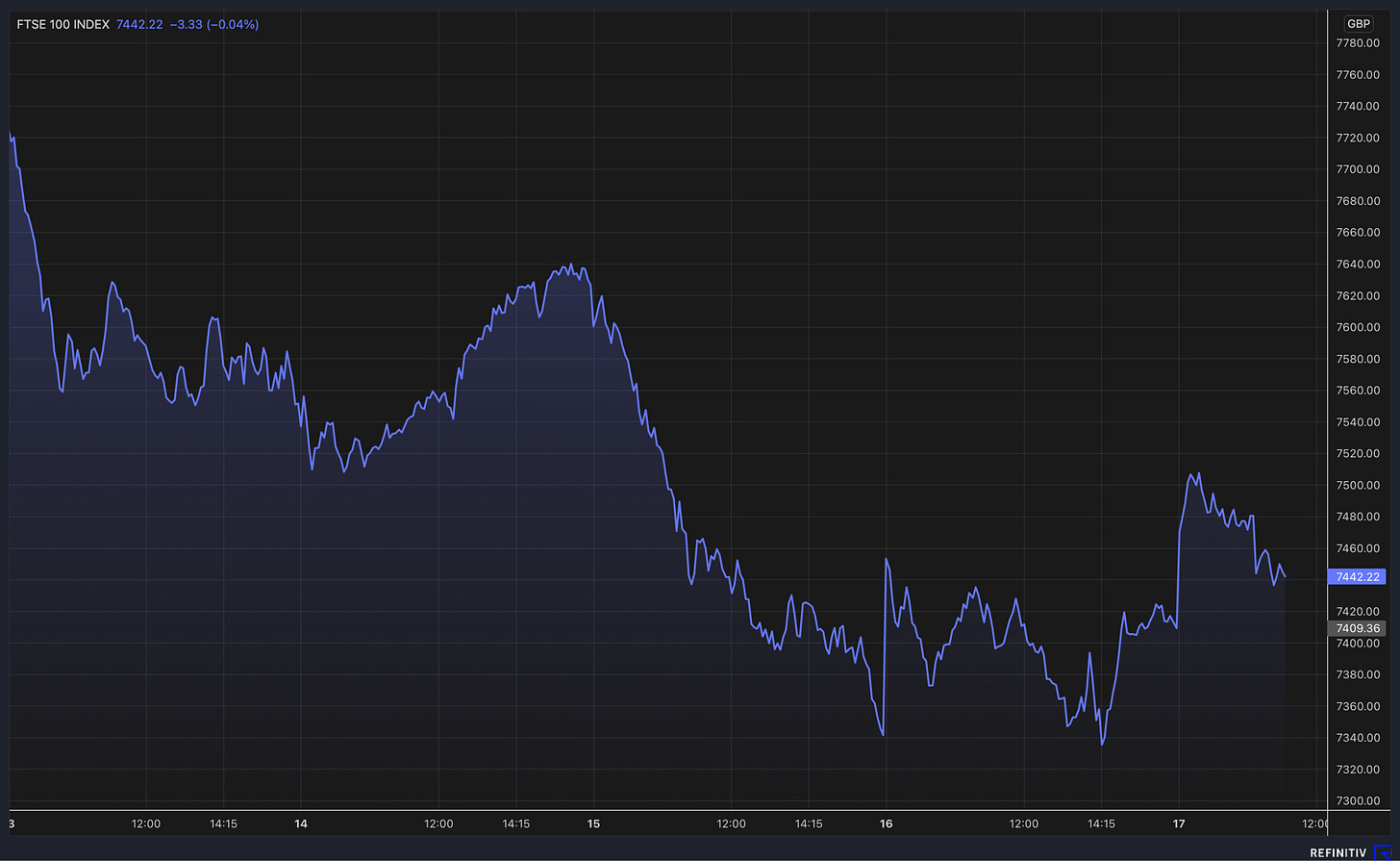

These graphs show what a rollercoaster week it’s been for markets and banks….

This is the FTSE 100 this week…

This is Credit Suisse…

And this is Credit Suisse over the last 20 years. A remarkable rise and then a slow, gradual decline…

In contrast, the concerns around First Republic Bank developed at a rapid pace…

Podcast…

The latest episode of Business Studies went live on Tuesday and features an interview with Andre Lacroix, chief executive of Intertek, about leadership.

Lacroix is one of the longest-serving chief executives in the FTSE 100 and before Intertek he ran FTSE 250 car dealer Inchcape and Disneyland Paris. He also worked for Burger King and Pepsico. Lacroix has a diverse range of experiences and has used this to write a book about leadership - Leadership with Soul. Hence the title of the episode: The FTSE 100 chief executive who wrote a book.

The episode is a fascinating insight into how to think about leadership, understanding risk and what businesses can learn from. In the episode Lacroix talks about why every major crisis can be traced back to a failure of leadership, what he has learned from the brilliance of Ayrton Senna and why London remains a great place to base an international business, despite other companies choosing to move their listing.

You can listen to the episode on Substack here, Apple here and Spotify here.

Other stories that matter…

After the government announced more support for childcare in the Budget, is the next step for businesses to do more too by offering extended and equal parental leave to mothers and fathers? This analysis from the US suggests it is good for the economy and good for diversity, by boosting the number of women in the workplace (The Overshoot)

Former staff at Harrogate-based telemarketing firm Amvoc are considering legal action after they were allegedly told about its collapse and the loss of their jobs via email. Around 450 people have lost their job. Staff say there were informed of the collapse of the business via an email late on Tuesday night (The Business Desk)

The Cardiff Capital Region, a collection of local authorities in south Wales, has bought the disused Aberthaw power station in the area for £8 million with a view to leading a regeneration project (Business Live)

Dick Fosbury, the athlete who revolutionised the high jump by jumping backwards rather than forwards, died last weekend. The brilliant David Epstein has written about the story behind his famous innovation. He writes: “Breakthroughs - whether personal, or for an entire domain - often start with individual experimentation, and only later do the principles of why it obviously worked become clear.” The lesson for businesses? “We should all think about how we can use our influence essentially to underwrite smart risk-taking and experimentation, even within the confines of a well-defined goal.”(Range Widely)

About 4 in 10 of the new customers on an online investing platform developed by Vanguard are under the age of 30, highlighting the potential interest among the younger generation in trading stocks and shares (Financial Times)

A non-executive director at Baillie Gifford’s Scottish Mortgage Investment Trust, one of the leading tech investors in the UK, has left and subsequently gone public with his concerns about a process to appoint two new board moments and the risks associated with its investment in unlisted assets. It’s really unusual to see a non-executive director speak out like this (Financial Times)

The new version of Open AI’s chatbot ChatGPT has been released - GPT-4 - and experts seem to agree that it is another significant step forward. This column by Tyler Cowen, an economics professor and author of the superb book Talent, claims that AI technology is going to transform childhood, with children growing up with a personalised AI assistant if their parents allow it. “The available services likely will include education and tutoring, text or vocalizations of what the family pet might be thinking, dancing cartoon avatars, and much more. Companies will compete to offer products that parents think will be good for their kids.” A thought-provoking piece (Bloomberg)

Sticking with childcare, Ember, the tech company behind the heated mugs used by Rishi Sunak, has gone into baby bottles by launching a portable heated bottle. As someone with a three-month-old daughter, this sounds incredibly useful. But at a price of $400 I will pass… (Tech Crunch)

Lastly, I selected an article for Informed’s daily brief this week and in return Off to Lunch subscribers can get a one-month trial of the app. Informed is a new app that offers access to a curated collection of articles from the world’s leading news providers, many of which are usually behind a paywall. These articles include those from UK newspapers and many of those flagged by Off to Lunch. You can download the app and get your one-month trial by clicking this link and using the code EXPERTS. Informed is based in Berlin and launched at the end of last year after raising €5 million in funding.

And finally…

The new series of Ted Lasso started this week on Apple TV+. For those who haven’t watched it yet, now is a great moment to do so. It’s a show that turns out to be very different to what you thought it would be…

As a preview, check out this Twitter thread on the history of the show…

…and check-out this interview with Phil Dunster, who plays Mancunian striker Jamie Tartt, but is actually a stage-trained actor from Northampton. Piece in The Times here.

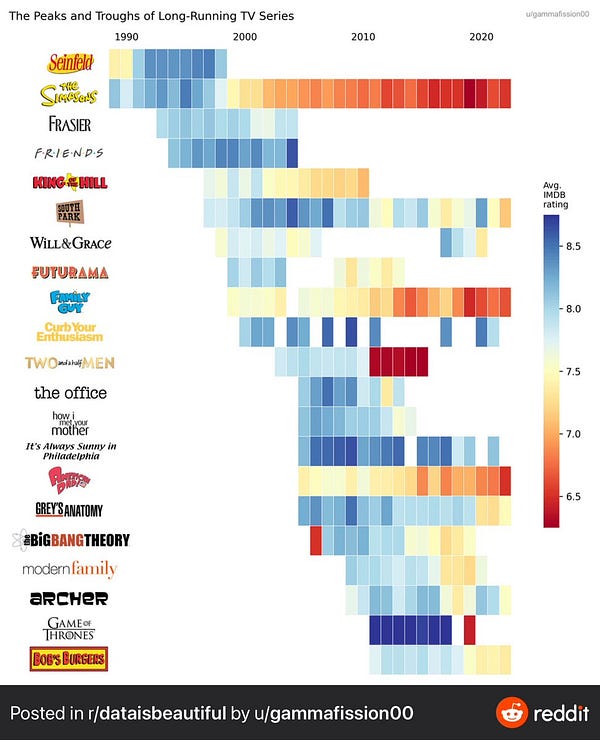

Finally, this great graphic was shared with me this week. It is a guide to the IMDB review scores for a collection of top shows and each series they have done.

I have written before about using IMDB reviews to find films and TV series to watch (my brother-in-law’s rule is never to watch anything rated as lower than 7 on IMDB). This graphic shows you when these TV shows were at their best and worse. Ted Lasso, for what it’s worth, has a score of 8.8 on IMDB, putting it in the top 100 shows of all time. The Last of Us is at 9 and Succession is also at 8.8…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch