What happens next? Silicon Valley Bank fall-out

Reaction to HSBC deal + 57 statements in UK + Markets fall

Hello and welcome to the latest edition of Off to Lunch…

There is good news and bad news on the collapse of Silicon Valley Bank.

The good news - HSBC and the UK government have announced that HSBC is buying the UK assets of Silicon Valley Bank for £1. This will ensure that deposits are protected and that businesses who used the bank should not suffer any disruption or notice any change…

HSBC has said in a statement that SVB had deposits of around £6.7 billion in the UK as well as loans of around £5.5 billion. It made a pre-tax profit of £88 million in 2022.

Noel Quinn, HSBC’s chief executive, said the deal will give the bank access to “innovative and fast-growing firms” who used SVB. SVB is estimated to have had 3,300 customers in the UK. HSBC’s statement is here

Regulators in the US have also said they will protect deposits, although they still working on a deal to sell all or parts of SVB’s assets there.

Unsurprisingly the HSBC deal has been welcome in the start-up and venture capital world. Venture capitalists had warned that start-ups and tech businesses faced an existential crisis without a rescue deal because they would not be able to access their cash…

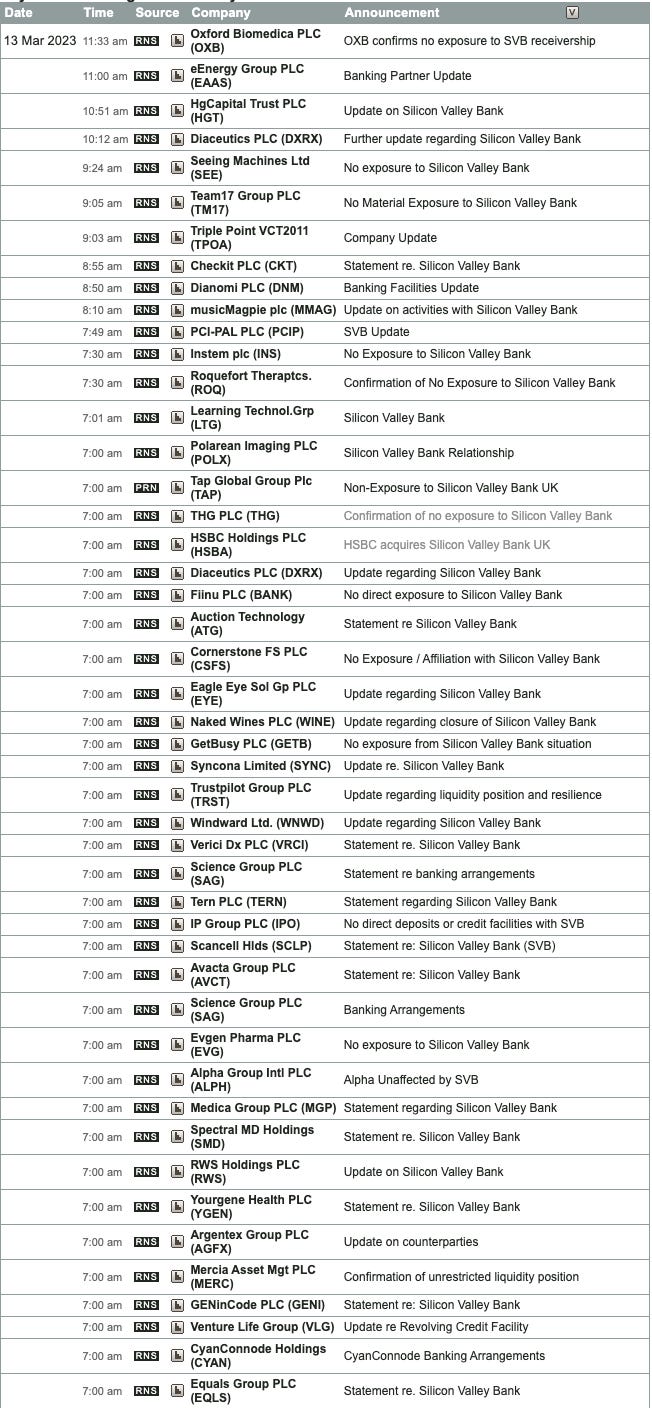

To give you an insight into the scale of the problem that the collapse of SVB could have caused, I have counted 57 different statements from listed UK companies on Monday morning about the issue…

Many of these statements are from tech businesses reassuring investors that they have no exposure to the bank. For instance, there is this from THG, the Manchester-based company:

THG PLC ("THG" or the "Group"), the proprietary technology platform specialising in taking brands direct to consumers ("D2C") globally, notes the evolving situation in relation to Silicon Valley Bank ("SVB").

THG confirms that it does not have any exposure to SVB, either in relation to cash deposits or debt facilities

However, some do have exposure. This includes Trustpilot, the online review service, which said that SVB was its “principal banking partner”. It added:

Our immediately accessible cash is $24 million, made up of $19 million cash on deposit with another bank, $4.5 million guaranteed by the US Federal Reserve following their announcement on 12 March, and amounts due to be returned under the guaranteed deposit insurance schemes in the UK.

The Board is confident in Trustpilot's' liquidity position and resilience. Meanwhile, we have put in place measures to proactively manage our cash position during this period of uncertainty, and wider unpredictability in the current macroeconomic environment.

Shares in Trustpilot are down 4 per cent on Monday morning. Naked Wines, the online wine retailer, also said that SVB was one of its banking partners but that it thinks just £0.6 million of the £32 million of cash it has is at risk. Its shares are also down about 4 per cent. Statement here.

I briefly summarised the story behind the collapse of Silicon Valley Bank in the Sunday press review (which you can find here). SVB is the biggest bank failure since the financial crisis. It was only the 18th biggest bank in the US but had $200 billion of assets and lent to thousands of tech businesses, including in the UK.

In simple terms SVB collapsed because its customers - tech businesses and founders - withdrew money quickly and the bank didn’t have the funds to pay them because it had suffered losses on the bond market.

SVB was vulnerable to some specific issues because it served start-ups. Start-ups tend to raise cash by selling shares to investors. They are not necessarily suitable for loans because they are yet to generate the cash flow to pay them back or build the assets to offer as collateral. Therefore, SVB was used by many start-ups as a place to hold the cash they had raised but not get loans.

So SVB invested these deposits in, among other places, government bonds. When interest rates rose it had a problem for two reasons. Firstly, struggling start-ups needed their money back and secondly, the value of SVB’s investment in government bonds fell. As concerns about SVB rose, venture capital investors urged the start-ups they had invested in to get their cash out of the bank, exacerbating the problem.

For a more thorough and eloquent explanation of the collapse of SVB, check out Matt Levine’s superb piece for Bloomberg here

For context, this is what has happened to the yield on two-year US government bonds over the last year as it tracked rising interest rates. The drop at the end is the market reaction to the uncertainty caused by the collapse of SVB, which could postpone more rate rises…

The market reaction to these statements brings me to the bad news. Stock markets are down overall. This is a reflection of the potential fall-out from the collapse of SVB hitting other banks and businesses but also a reaction to the fact that interest rates may not rise as much as previously forecast anymore, particularly in the US, which has hit bank shares. The FTSE 100 is down 2 per cent, as is the Cac in France and Dax in Germany. The biggest faller in the FTSE 100 is Standard Chartered, the Asia-focus bank, which is down 5 per cent. HSBC is down 3 per cent.

In the US, First Republic Bank is down 60 per cent in pre-market trading in the US. There have been growing concerns and rumours over the weekend that the California-based bank could be in trouble. However, the bank says it has shored up its finances with backing from the Federal Reserve and JP Morgan…

For some reassurance on the fall-out, check out this piece from the Noahpinion newsletter on Substack, which covers the resilience of the leading US banks and the strength of the Federal Deposit Insurance Corporation, which protects bank deposits…

Other stories that matter…

Some positive news on post-Brexit regulations and migration. Businesses across the UK are making more use than expected of new rules that make it easier to hire skilled workers from around the world. Visa applications for healthcare and social care workers, in particular, have surged. The law firm Eversheds Sutherland is quoted as saying: “It has been a little bit of a gift to employers experiencing skills shortages.” This is one of the reasons why net migration to the UK hit a record high last year (Financial Times)

An interesting piece on the forlorn efforts to innovate the battery. Charging times and battery life have failed to develop at the same speed as the technologies they power. A miracle breakthrough is unlikely, despite claims to the contrary (Doomberg)

Barrow-in-Furness in Cumbria has seen an influx of investment from BAE Systems, which builds the UK’s nuclear submarines in the port town. Barrow is set for another boost from the new UK-US-Australia defence deal (The Times)

The Economist has published an A to Z of economics phrases and tried to explain them in simple terms. It’s a pretty useful guide to economics and a helpful glossary for writers too… (The Economist)

An interview with Anne Hidalgo, mayor of Paris, which includes some interesting thoughts for local leaders in the UK looking to boost their area. She has been criticised for making it more difficult to drive around Paris but says: “A city’s creativity doesn’t depend on cars. That’s the 20th century. We’re in the 21st.” (Financial Times)

For a round-up of all the interesting business news and analysis in the Sunday papers our Sunday press review was sent to paying members yesterday. You can sign-up to read it here

And finally…

Everything Everywhere All At Once dominated the Oscars, winning seven awards, including best picture, best actress, best supporting actor, best supporting actress, best director, and best original screenplay - in other words, most of the main awards. Brendan Fraser won best actor for his role in The Whale. For those who want to see the film who haven’t already it is available to stream in the UK on Amazon Prime.

In other media news, Gary Lineker is back at the BBC (and tweeting again). The BBC appears to have backed down on the issue. Tim Davie, director-general, has apologised for the disruption to BBC programmes and announced a review of the BBC’s social media policy regarding freelancers outside news and current affairs…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham