It’s been an eventful week and it’s not over yet... Apologies for the later-than-usual Off to Lunch today, I wanted to ensure it included the result of the Office for Budget Responsibility’s meeting with Liz Truss and Kwasi Kwarteng and the market reaction…

Richard Hughes, chairman of the OBR, met with Truss and Kwarteng this morning. The UK’s public finance watchdog has been at the centre of the fall-out from the mini-Budget because it was not asked by the government to cost its proposals or rework its forecasts. This is the statement the OBR has put out…

According to that statement, Kwarteng will have new forecasts on his desk as soon as next Friday. However, the Treasury has said they won’t be published until November 23…

The Guardian broke the story about the OBR’s meeting with Truss and Kwarteng this morning. As Chris Giles, the long-serving economics editor at the Financial Times, said - this is not a normal…

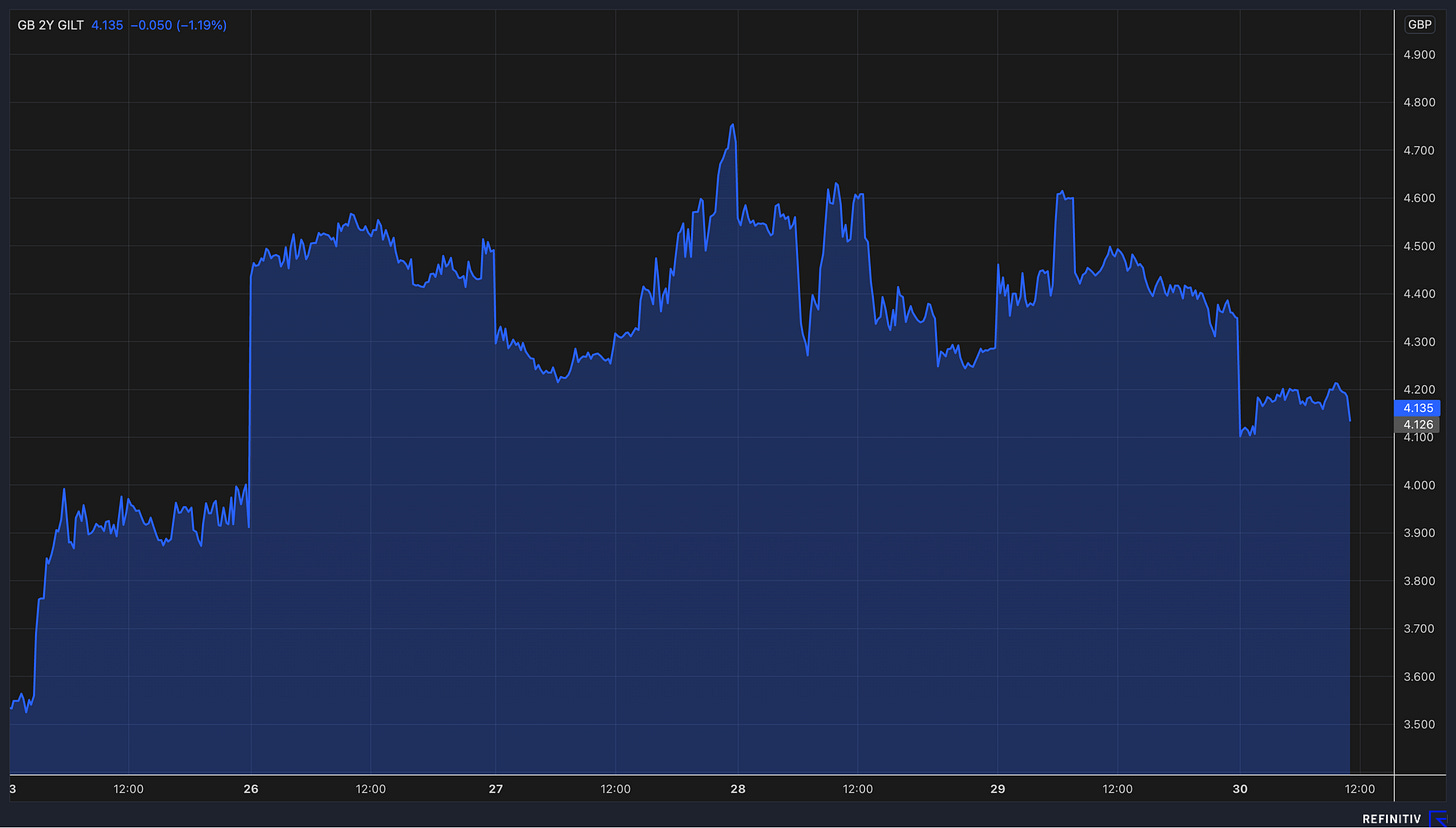

So, after all this, this is how the pound, 2-year gilt yield and 30-year gilt yield have performed since last Friday morning, before Kwarteng delivered his mini-Budget…

This is the pound against the dollar, which as you can see has now regained plenty of the ground it lost since Kwarteng spoke. It rose this morning on news of the meeting between the government and OBR, which has been taken as a sign that Truss and Kwarteng recognise the need to regain some credibility with markets. However, it has started falling again…

The two-year gilt yield is still well up, however…

The 30-year graph is remarkable. That cliff-face drop in the middle is after the Bank of England’s announcement on Wednesday that it was to buy gilts, government bonds, to protect the UK’s financial stability. This was, effectively, a £65 billion bailout for the pension fund industry and the economy.

Incidentally, for those looking for a quick explainer of some of the terms that have become a core part of the news agenda this week, Larry Elliott, The Guardian’s economics editor, has done a useful guide here.

Aside from what the OBR, Truss and Kwarteng do next, I think there are some important stories to watch closely over the coming days and weeks. Firstly, the fall-out in the pension fund industry. There are already questions emerging for the industry and regulators about how pension funds got themselves into a position where the Bank needed to step into the gilt market and effectively pump in money to prop it up. As Helen Thomas writes in this FT piece, the liability-driven investments (LDIs) at the heart of the crisis were a sensible thing to do. She writes:

At its most basic, it involves buying assets, often government bonds, to match future liabilities

However, the market spiralled in size and complexity (spot a theme with previous financial crises?)….

The result is that when gilts fall the fund is on the hook for margin calls on several hundred pounds worth of contracts compared with its original £100 of gilts. A sharp fall prompts a scramble for collateral, sparking more selling and downwards price pressure. On Tuesday, before the BoE stepped in, there was a liquidity squeeze: some funds couldn’t get cash fast enough to meet the increasingly urgent collateral demands.

There are now questions for regulators as to who was tracking this and why nothing was done. Lord Wolfson, the boss of Next, said on Thursday said he had previously written to the Bank of England expressing concern about LDI strategies. He said they “always looked like a time bomb waiting to go off”.

The Daily Mail has gone for the pensions industry this morning with a big read written by Guy Adams which is headlined: “Is the real scandal that reckless financiers were able to risk so much of our pension in what very nearly became a £1.5 trillion death spiral”. You can read it here.

For more on the political fall-out I recommend the plugged-in Fraser Nelson in the Telegraph who says that behind the scenes even Truss’s allies are concerned at her handling of this week. I thought this was a particularly articulate summary of the government’s economic plans…

To everything, there’s a season. There is a time to rip up failed orthodoxies, purge complacent mandarins, square up to a failing central bank. But to do all this when you’re asking world markets to lend you an extra £70 billion a year is, shall we say, brave. And to do this at a time of global market mayhem braver still.

The full piece is here.

The shape of the housing market over the next few weeks is also going to be important. Data has been published on this today and it is mixed. Nationwide’s latest house price index shows that prices were flat between August and September, the first time there has been no monthly rise since July 2021. This means prices are up 9.5 per cent year-on-year, down from 10 per cent year-on-year in August. So, signs of a slowdown, but nothing significant. There is also mortgage approval data, which is more positive. It shows approvals rose to 74,340 in August, up from 63,740 in July and the highest reading since January. The Bank of England said this was “a notable rise following a downward trend over the previous several months”. It was also ahead of forecasts from economists.

Given the turmoil in the mortgage market this week - with lenders pulling hundreds of deals and putting up the interest rates on 2-year and 5-year fixed mortgages in response to the rising yield on gilts - this could be as good as it gets for the housing market for some time. The FT has reported that the Financial Conduct Authority is holding talks with banks because of concerns about the sharp rise in monthly repayments that many households now face as they move on to new mortgage deals. Story here.

Podcast bonus content…

It’s been quite a week to launch our podcast, Business Studies. Thank you to everyone who has listened, shared it and got in touch with me over the last few days. The response has been incredible. For those who have listened to it yet, you can find episode one of Business Studies, an interview with Archie Norman, chairman of Marks & Spencer, here on Substack, here on Apple and here on Spotify.

As promised, there is bonus content below for paying Off to Lunch members, including some thoughts from Norman on the long-term economic outlook (we spoke before the mini-Budget and market chaos), business rates, an online sales tax and his time at McKinsey, the consultancy firm. You can sign-up to become a member via the link below if you are not already. It’s just £6-a-month or £50-a-year, that’s cheaper than one pint of beer or a glass of wine in 2022 Britain. For that, you get full access to Friday’s newsletter and our Sunday press review as well as all Off to Lunch’s other newsletters and of course the podcast itself…

Before that, I wanted to let you know that episode 2 will be available on Monday. It is an interview with Jacek Olczak, chief executive of Philip Morris International, the largest tobacco company in the world. It covers the controversial £1.1 billion takeover of Vectura last year and the company’s stated strategy of eliminating all cigarette sales. It’s a fascinating episode…