One year on...

Ukraine, the world and markets + Podcast bonus content + Other stories that matter

Hello and welcome to Off to Lunch. Normally Friday’s edition is only available in full for paying members but today it is available for everyone, so please enjoy it and share it.

In the last couple of weeks I have been trialling an expanded round-up of news and analysis in the “Other stories that matter” section. However after feedback from subscribers I have gone back to a slimmed-down version for today, focusing on a smaller collection of content that I really think is worth your time. Off to Lunch is designed to pick out what actually matters and identify the signals from the noise. This should do that.

Right, into today’s edition…

Today, Friday February 24, is the first anniversary of Russia invading Ukraine, one of the most consequential events of the 21st century so far. There are some great pieces of reporting and analysis to mark this moment that I want to share with you.

Firstly, The Times has published diary entries from Anthony Loyd, the brilliant war correspondent, about life on the ground in Ukraine over the last year. This, of course, is by far the most important consequence of Russia’s invasion. This is an entry from Loyd in January 2022 after he spoke to a Ukrainian woman who had bought a gun in case Russia invaded…

I admired her spirit but was sure she was wrong. The Russians wouldn’t invade Ukraine, despite the build-up on the border. In 30 years of covering wars I have never believed anyone will be cynical enough to invade another country — until they do. On the eve of wars I am forever proved wrong. My naivety is my folly.

You can read the full piece here

Secondly, Politico has done a long piece about the build-up to the war. This includes interviews with key figures about the conversations that were happening among politicians and intelligence services. As you will remember, the US and British intelligence services constantly briefed that Russia was amassing forces at the Ukrainian border and that Vladimir Putin planned to invade. Liz Truss, the foreign secretary at the time, is one of the people who was interviewed. This is a quote from her…

“We were sitting on very serious, good intelligence, but — for whatever reason — that wasn’t necessarily the shared view of what was going to happen. Our allies had a different view.”

And this is Truss on her visit to Moscow on February 10 to meet Sergey Lavrov, Russia’s foreign minister

“This was my first visit to Moscow, and what really struck me was just how, compared to Kyiv which I visited shortly afterwards, Moscow was just very much business as usual in the city. You wouldn’t have known anything was going on. The Ministry of Foreign Affairs, likewise. Lavrov completely denied there were any plans to do anything. It was the usual stuff about ‘Russia’s security was being threatened,’ which I’d heard many times before. The sheer normality was odd, given the circumstances. It was surreal.”

That piece is here

For those looking to understand the historical significance of what has happened over the last year, The Rest is History podcast discussed this in an episode in December 2022 when they considered how historians would look back on the year, including some of the lighter moments…

The war in Ukraine has obviously been significant for the global economy, businesses and markets too. It is a key reason why inflation is still 10.1 per cent in the UK, pushing up energy and food prices.

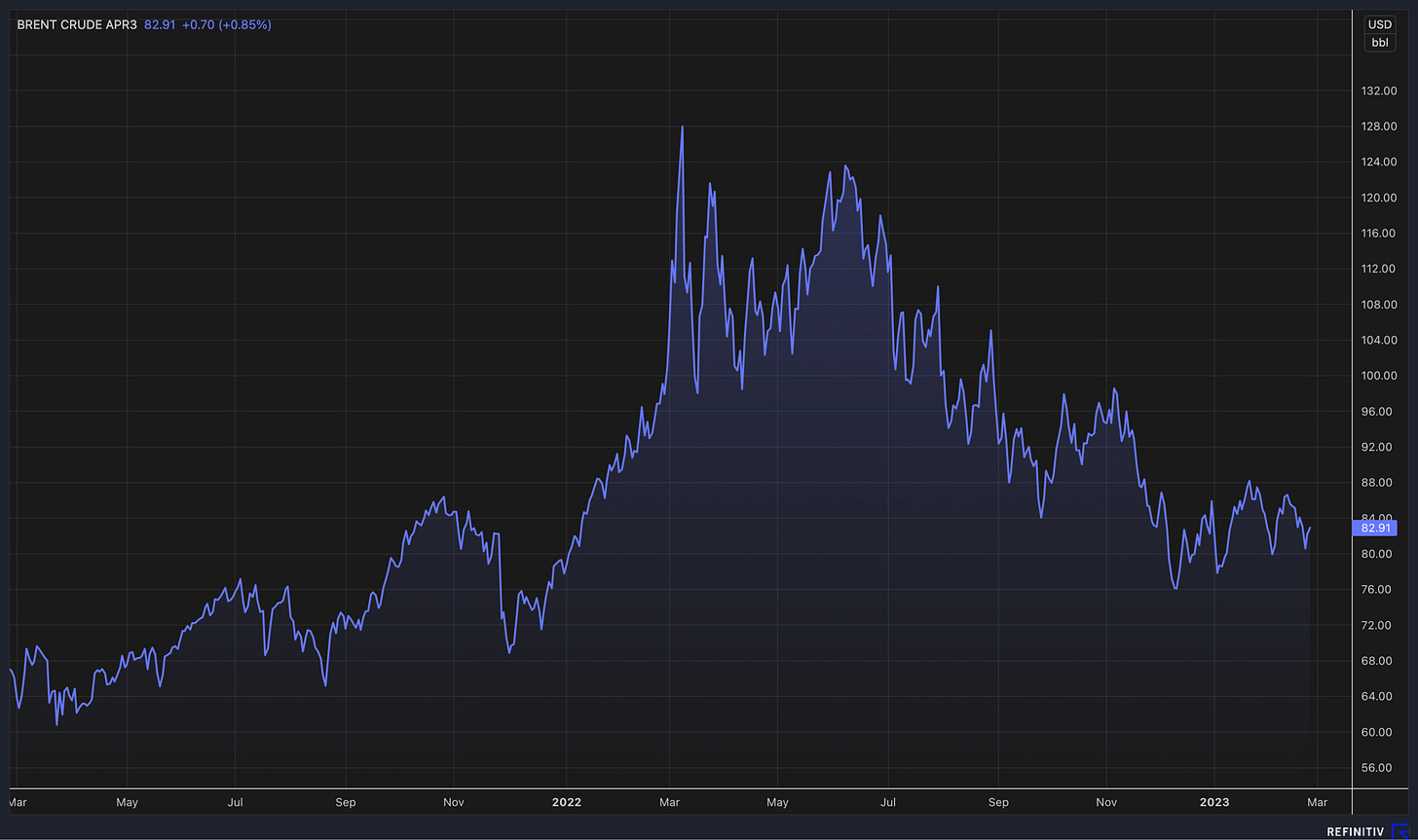

To illustrate this point, I wanted to look at movements in some key financial markets. This is the price of Brent crude oil over the last two years, which shows the build-up to the war and the aftermath…

This is natural gas prices on the New York Mercantile Exchange over the same period…

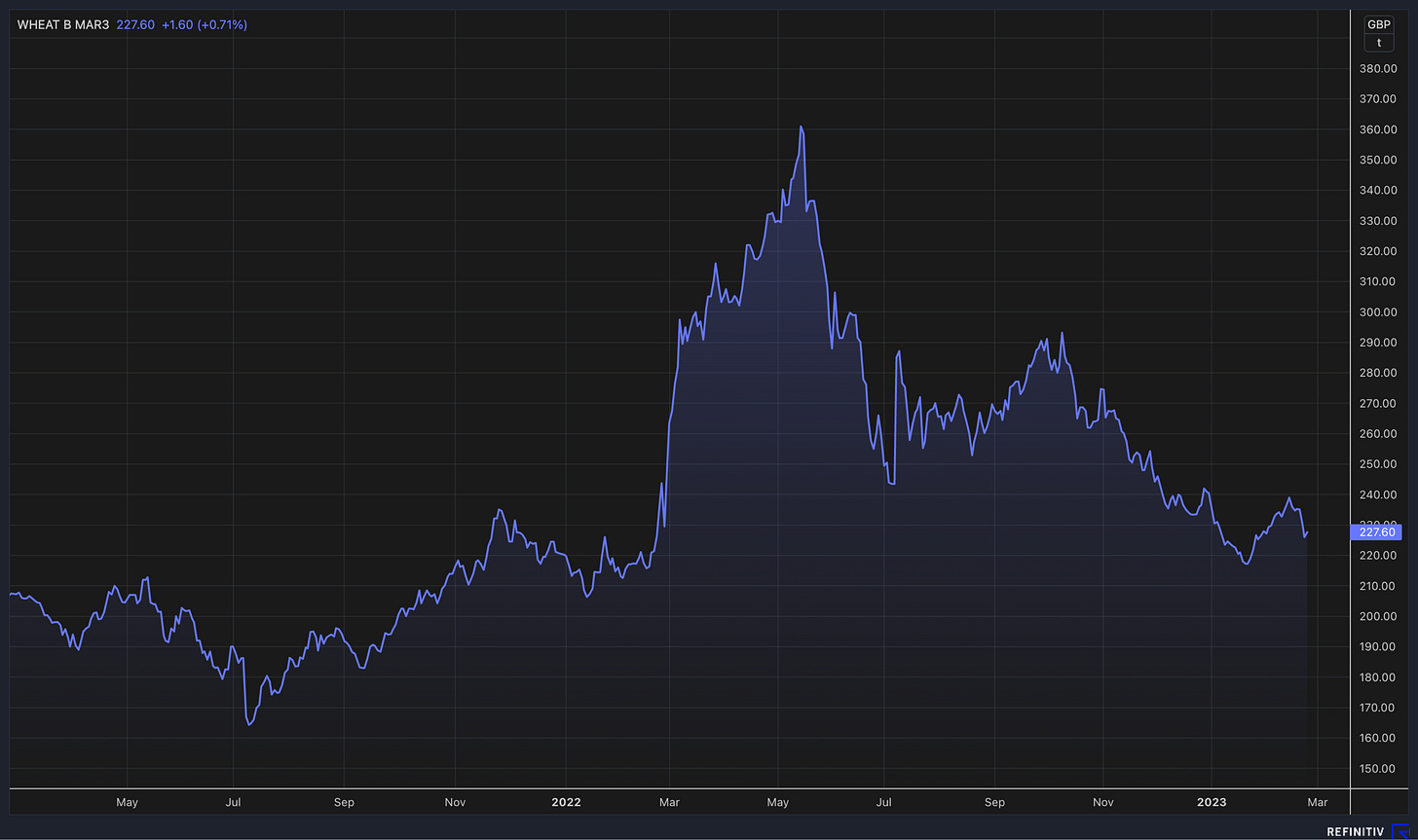

This is the price of wheat on the Intercontinental Exchange. Ukraine was one of the biggest exporters of wheat before Russia’s invasion…

Lastly, this is the share price for BAE Systems, Britain’s biggest defence group…

A string of Western companies pledged to pull out of Russia following the invasion. However, according to research, just 9 per cent of businesses have actually done so. You can read that report here. BP, for example, is yet to find a buyer for its Russian business, while Philip Morris International has admitted it may never do so. Jacek Olczak, chief executive of PMI, told the Financial Times this week that he would rather keep the business than sell on the Kremlin’s terms. He was quoted as saying:

“I cannot just lose the patience and leave it. It’s their money [shareholders], it’s not my money, I’m managing this for them.”

You can read the FT piece here

I interviewed Olczak for episode two of our Business Studies podcast and he spoke about this then. “I've been working for 30 years with Philip Morris and on a number of business development projects. I have never come across anything which is as complex as this,” he said. You can read his comments in full here.

Podcast bonus content

The new episode of our Business Studies podcast was released on Tuesday. You can listen to James Daunt: The boss who saved the bookshop on Substack here. It is also available on Apple here and Spotify here. You can listen on all other podcast platforms too.

There are a couple of questions and answers that I did not include in the episode that I wanted to share with you here. Firstly, this is what James Daunt said about how he learned to run a bookshop and be a leader. In the past he has spoken about learning from trial and error, so I asked him about the importance of that:

“I think everybody learns by trial and error in anything they do. I happened to set up my bookshop when I was 26 years old, so I was really young. Then I ran it for basically 20 years. Over that 20-year period I think I created a fabulous independent bookshop and learnt how to be a bookseller. I mean, 20 years - I am clearly a slow learner. 20 years is a long, long time. But I did learn and then I simply brought those principles to Waterstones.

My central ethos and the central value that I bring to running these businesses is that I trust my booksellers. I'm a bookseller. It's not me who creates good bookshops out there. I simply trust the individuals within each individual store to create good bookshops. All I do is constantly encourage that.”

Daunt was also really interesting on Covid-19 and the impact of lockdowns. He took charge of Barnes & Noble in the US in late 2019 but soon most of the world found itself in lockdown, meaning Daunt couldn’t travel and all bookshops had to close. On the face of it, this was a big problem for Daunt given that he was splitting his time between Waterstones in the UK and Barnes & Noble in the US. However, he was able to use this time productively by overhauling Barnes & Noble’s shops:

“As it happened, it was just a piece of luck. We knew that we had to change what the shops looked like physically. We also knew we had to sort out the inventory. Doing that when your shops are open is a slow, difficult process. It has to be planned extremely carefully, because evidently you disrupt the bookshop significantly. Now, if you're closed, it's really easy. And we just got on with it.

In the Waterstones days we'd have to do it overnight. We'd have to close shops for short periods whilst we did it and it was really disruptive. But as soon as Covid hit, frankly, rather than waste the opportunity, we seized it to get to work.

For our booksellers that kept them employed at a time of extreme uncertainty for most people in retail. Most other businesses just laid off everybody. We didn't do that. We kept all our experienced booksellers. And they worked really hard, I mean dramatically hard during that time, particularly when it was evident that we were going to reopen quite soon. Those who had their stores completely ripped apart had to put them together again really quickly. But they did a fantastic amount of work.

By the time we did reopen we had much, much better bookstores. And at the same time there was this extraordinary embracing of reading that went on, which meant we had many more customers than we'd had before. So we benefited twice over.”

The next episode of Business Studies will be available on Tuesday. More details about that on Monday…

Other stories that matter…

There is lots of innovation in the news industry right now. The co-founders of Instagram have launched a personalised news aggregator called Artifact (Tech Crunch) Meanwhile a Berlin-based start-up called Informed is bundling subscriptions and curating content through an app (The Rebooting) Also, Whatsapp appears to be working on a newsletter service (WABetaInfo) And The Ankler, a Substack focused on entertainment news, is expanding into a fully-fledged media business (Vanity Fair)

The author Michael Lewis has released a superb new podcast on cryptocurrency and how the FBI and other law enforcement in the US are tracking down criminals who steal money through bitcoin. It’s a great explainer for anyone looking to understand bitcoin and cryptocurrencies, plus it includes some amazing stories on the work the FBI is doing in this area. As Lewis says, these stories seem destined for a film or TV series. Oh, and it turns out cryptocurrency transactions are not as anonymous as its champions claim. Lewis has released the podcast as part of his research into a new book he is working on about Sam Bankman-Fried and the collapse of FTX (Against the Rules with Michael Lewis)

The creator of Succession, Jesse Armstrong, has said in an interview with The New Yorker that the fourth series of the show will be released next month and will be the last series. However, Armstrong does seem to suggest there could be spin-offs… (The New Yorker)

I have touched on this topic before, but Harry Wallop has written a fun column in The Times about how Amazon’s technology-focused grocery shops have actually made shopping far more complicated and annoying (The Times)

It’s now cheaper to rent a home than have a mortgage in the UK for the first time in 14 years (Bloomberg)

On a similar note, this really interesting graph shows the affordability of UK housing over the last two hundred years. Property is way more expensive today than in the early 1900s, but less so than in the 1840s…

There has been lots of analysis this week about leaders who have previously been successful but are now struggling to revive the flagging performance of their organisation. This has been largely focused on Jurgen Klopp and Liverpool, but it happens in business too. The Athletic have done a fantastic behind-the-scenes piece on the struggles of Sean McVay and the Los Angeles Rams over the last year. The Rams won the Superbowl in February 2022 and McVay, who is just 37, was heralded as a wunderkind and a new breed of leader and coach. But the last 12 months have been a disaster. This piece looks into what happened and McVay’s struggles to turn it around. In short, he has struggled with losing the best people around him - most of them were poached by rivals, a downside of success - as well as bad luck and going away from his tried-and-tested methods to try to fix things (The Athletic)

A trial of a four-day working week in the UK has largely been successful. 56 of the 61 organisations involved say they will extend the use of a four-day week beyond the six-month trial. Sainsbury’s, one of the UK’s biggest employers, is also now trialling a four-day week (Daily Mail)

Researchers at the University of Reading think you can beat the stock market by focusing on news that is incorporated into a share price slowly rather than obsessing about short-term factors (Klement on Investing)

A fascinating piece on how Greenland is trying to attract more tourists to its stunning landscapes but is also wary about the damage this could do (The New York Times)

And finally…

I’ve just got rounding to watching Dopesick, the US drama series which is based on the opioid addiction crisis. It tracks the crisis from the perspective of the Sackler family, whose company Purdue Pharma was behind Oxycontin, the drug at the centre of the scandal, as well as doctors, law enforcement, sales reps and people who became addicted. It’s a harrowing story, brilliantly told, and all the more shocking because it is true. Everyone should watch it.

It was initially released in 2021 and Michael Keaton has won a string of awards for his performance as a doctor who finds himself at the heart of the drug epidemic. It’s available to watch on Disney+. The series is based on a book by journalist Beth Macy called Dopesick: Dealers, Doctors and the Drug Company that Addicted America.

On a totally different note, when can we start saying that Harry Brook is the best batsman in world cricket? He is 184 not out after leading England to 315-3 in the latest Test match in New Zealand. He has now scored four hundreds in his first six test matches.

Thanks for reading. Off to Lunch will be back on Sunday with our press review. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham