So here we go again, another big financial statement from the government. Let’s hope it turns out better than the effort below from Jeremy Hunt. Thank you to Jim Pickard at The Financial Times for reminding me of this moment, which happened on the day that London 2012 started ten years ago…

The Treasury was certainly doing its best to give Hunt some stature ahead of the Autumn Statement…

In this quick round-up of the reaction to the Autumn Statement I want to start by looking at the graph below. This shows the yield on two-year gilts immediately after the mini-Budget on September 23, as featured in Off to Lunch on that day: “You are going to see this graph alot...”. The spike at the end of the graph was the reaction to Kwasi Kwarteng’s announcement. As we know, things got worse in the following days…

This is the same graph today…

As you can see, the spike from the mini-Budget has been undone, with the yield falling from almost 4 per cent to 3 per cent. When I last looked at my Refinitiv Eikon screen before sending this edition, the two-year gilt yield was basically flat for the day, up just 0.08 per cent.

Presenting the Autumn Statement to the House of Commons, Hunt said the government’s economic plan revolved around “stability, growth and public services”. The chancellor said the government wanted to “protect the vulnerable”, “be honest about the challenges and fair in the solutions” and, in a swipe at Liz Truss and his predecessor Kwarteng, said that “unfunded tax cuts are as risky as unfunded public spending”.

Here is a round-up of the measures that stood out in the Autumn Statement

The threshold for paying 45 per cent rate of income tax cut from £150,000 to

£125,140

Other thresholds for income tax, national insurance and inheritance tax frozen until April 2028 (given the rate of inflation, this is therefore a tax rise)

Dividend allowance cut from £2,000 to £1,000 and then to £500 by April 2024

Annual exemption on capital gains tax cut from £12,300 to £6,000 and then £3,000 from April 2024

Threshold for national insurance contributions for employers fixed until April 2028

The Tesla Tax: electric vehicles to start paying road tax

Stamp duty changes announced by Kwarteng (threshold for paying increased from £125,000 to £250,000 and for first-time buyers from £300,000 to £425,000) to be reversed from 2025

Windfall tax on oil and gas companies expanded from 25 per cent to 35 per cent of profits and extended by another two years to March 2028. Electricity generators will also pay a temporary 45 per cent levy

£13.6 billion package to support shops, pubs and other small businesses on business rates. The multiplier - the annual inflation-linked increase in business rates - frozen for next year and 230,000 small businesses allowed to claim relief of up to 75 per cent.

£2.3 billion increase in spending on schools per year

£3.3 billion increase in spending on NHS per year

Foreign aid budget to be 0.5 per cent of GDP rather than national target of 0.7 per cent

Sizewell C nuclear power station to go ahead

HS2 to go-ahead, including link between London and Manchester. Northern Powerhouse rail to also go-ahead

Level of capital spending frozen from 2025 (this amounts to cut given rate of inflation)

New taskforce set-up to work on ideas about how households and businesses can cut energy usage by 15 per cent by 2030

Triple-lock protected. Benefits and state-pension to rise in-line with inflation - 10.1 per cent

Cost-of-living payments worth £900 for those on means-tested benefits as well as £300 for pensioners and £150 for people on disability benefits

Cap on energy price guarantee to rise from average of £2,500 to £3,000 from April 2023 (meaning people will pay roughly £500 more on their energy billions next year)

Government’s research and development budget protected as part of ambition to make the UK “the next Silicon Valley”

Here is a round-up of tweets that caught my eye during the Autumn Statement. Some offer serious takes on the Autumn Statement but some - like the excellent Ken Clarke parody account - just made me laugh…

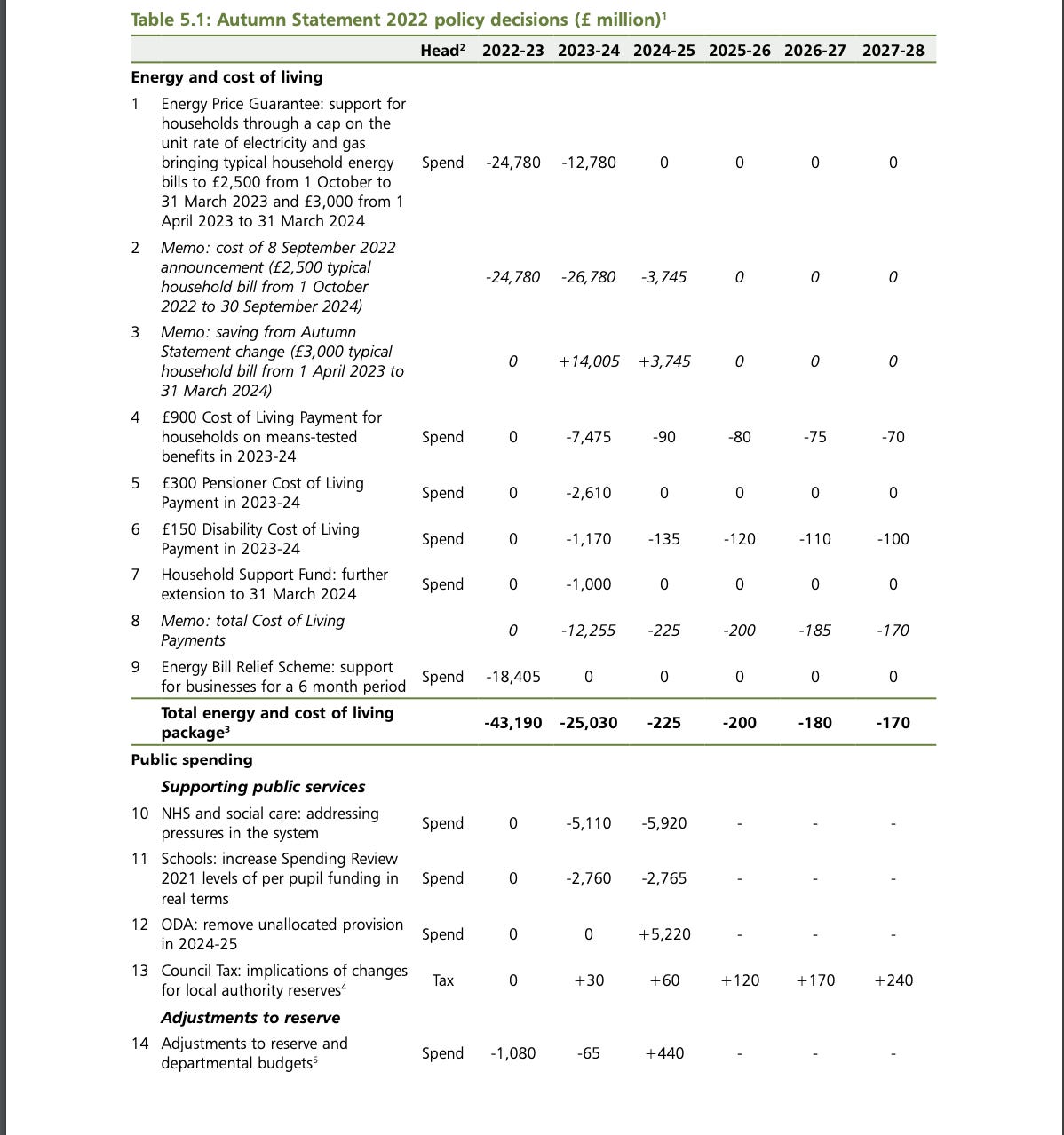

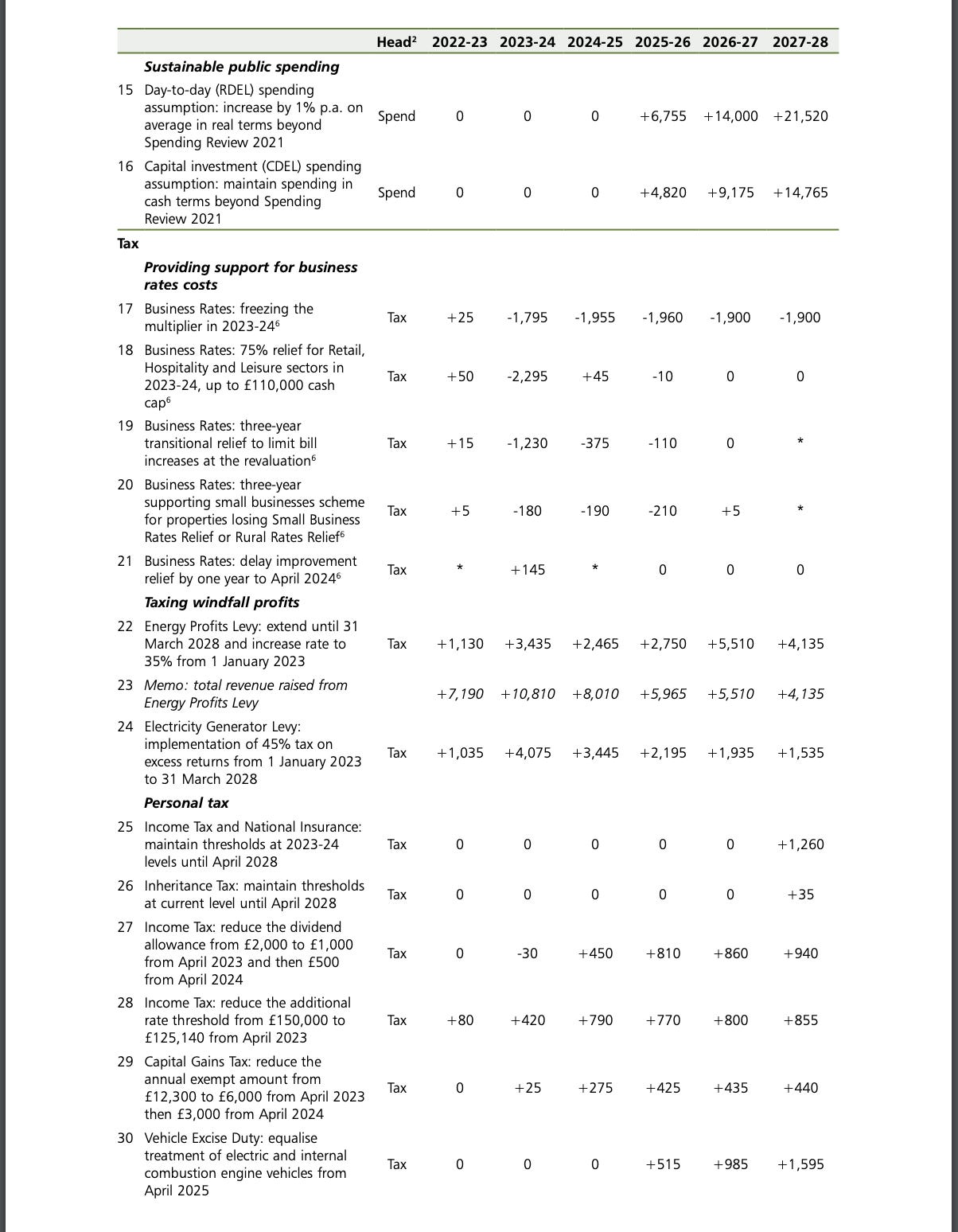

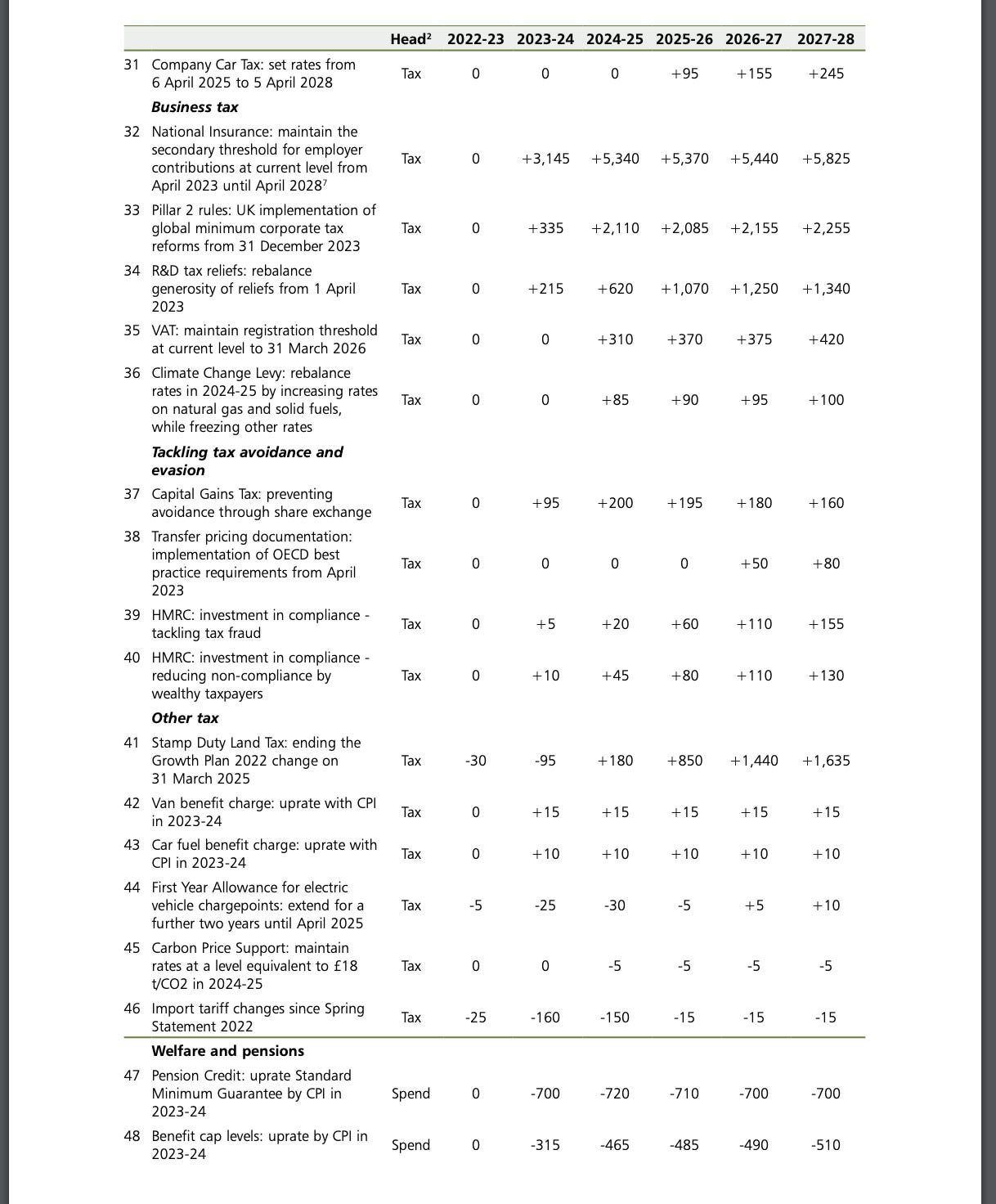

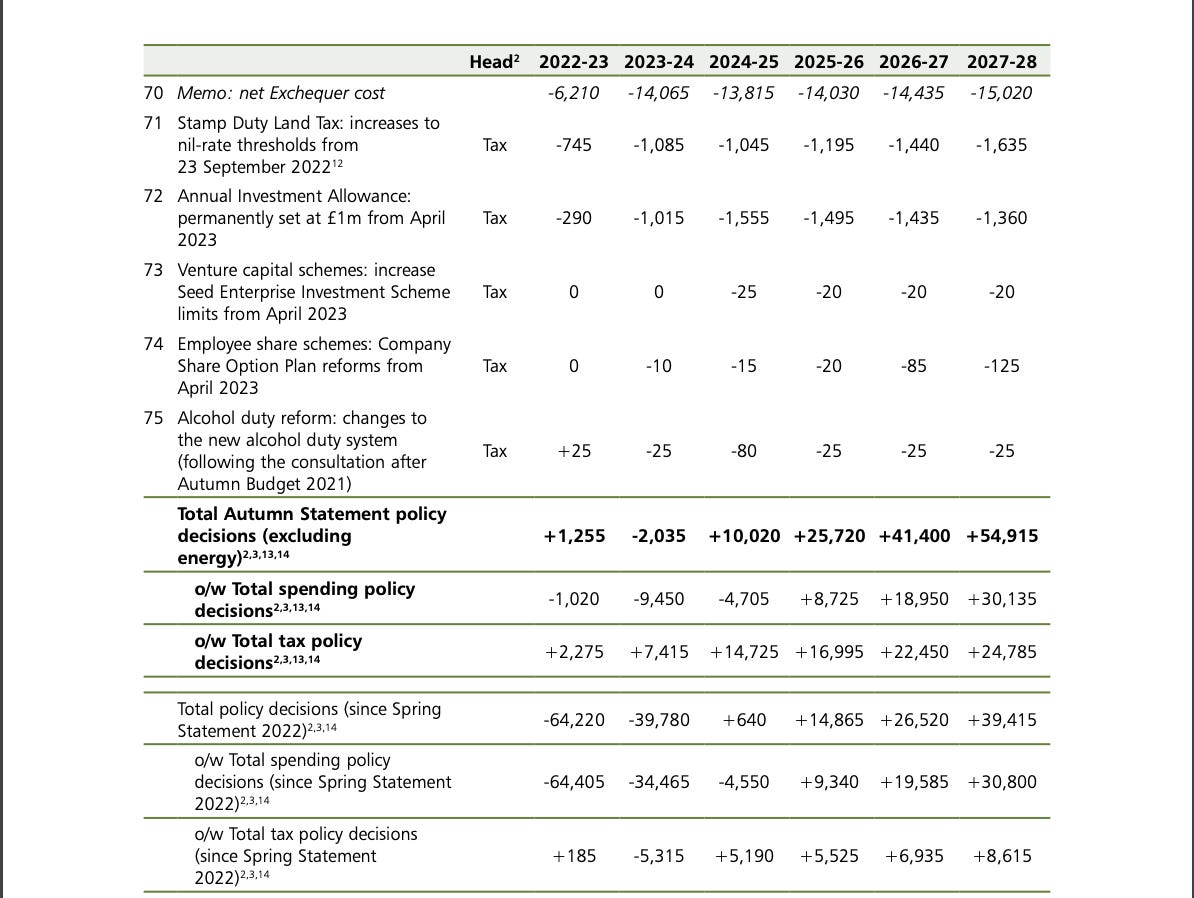

One last thing, these are the extracts from the just-published Autumn Statement document which show the cost of all this. A couple of things stand-out. Firstly, the central role of energy prices in all this - including the amount being spent on the energy price guarantee (£24.8 billion this year) and the amount being brought in by the windfall tax on oil and gas companies (£7.2 billion this year). Secondly, the freezing of the threshold on national insurance thresholds for employer contributions is a big, big tax rise, worth £25 billion over five years…

New podcast episode…

A quick note to say that the new episode of Business Studies will land first-thing tomorrow morning. It’s an interview with Ed Smith, the chief selector for England cricket between 2018 and 2021, on the success of the England cricket team, the art of decision-making and what elite sport and business can learn from each other. It’s a fascinating episode. It will be available on Substack, Apple, Spotify and all the usual places from 6am. Off to Lunch subscribers will be emailed when it is live.

Thanks for reading. Off to Lunch will be back tomorrow. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch