You are going to see this graph alot...

Quick reaction to mini-Budget...

This graph shows the yield on two-year gilts over the last 10 years. The spike at the right is what happened today after Kwasi Kwarteng’s “mini-Budget”, which was actually one of the most significant fiscal policy announcements in the last 50 years. At the time of writing the two-year gilt yield was up by more than a third of a percentage point today - the biggest daily rise since November 2009. This yield reflects the interest rate the government pays on short-term borrowing. The spike is, shall we say, not ideal…

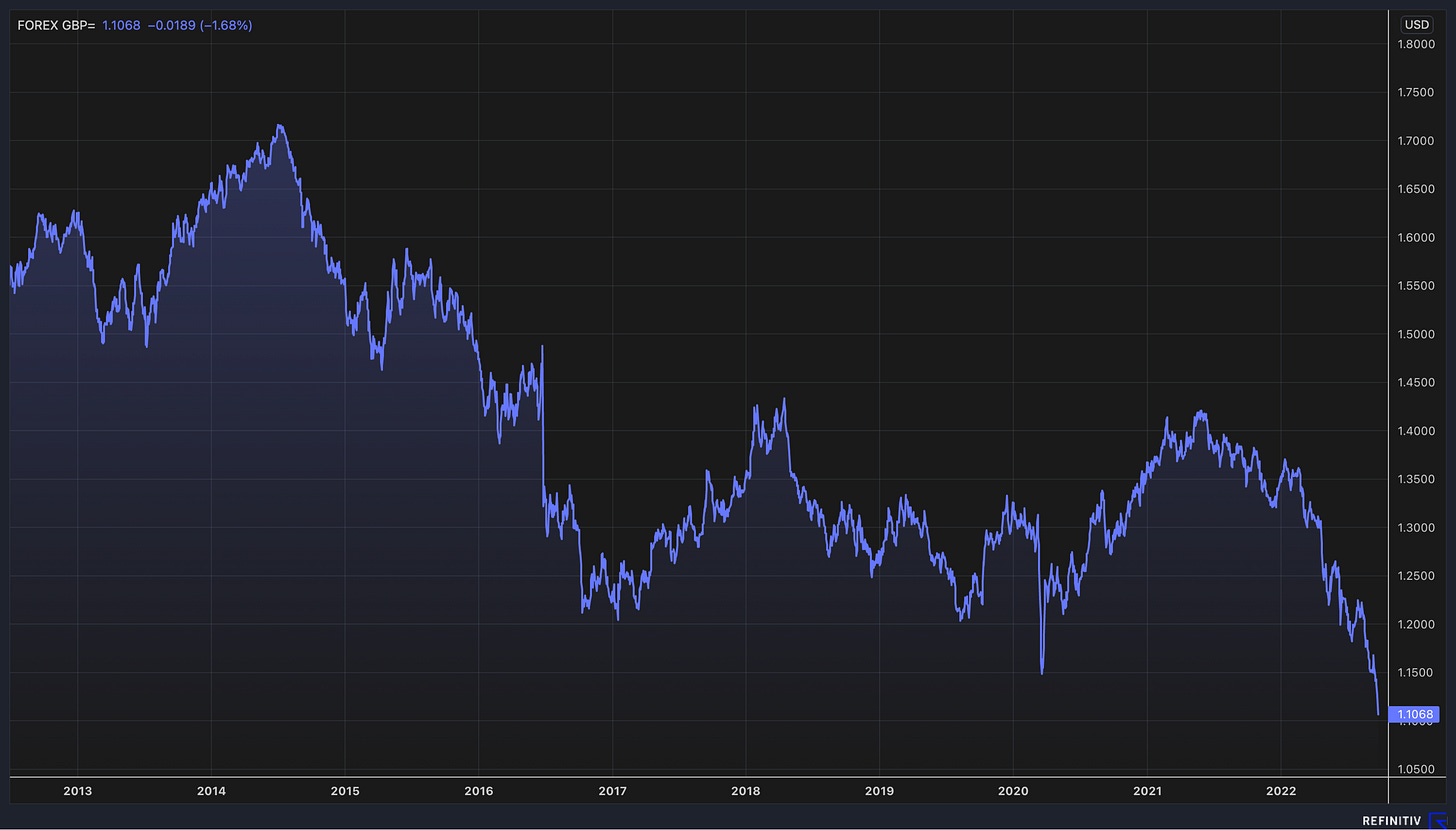

The pound has also fallen to fresh 37-year lows against the dollar. This is the pound against the dollar over the last 10 years…

These graphs reflect the market reaction to the government’s announcements and what it means for public borrowing (it’s going up) and inflation (it could stay higher for longer). Paul Johnson at the Institute for Fiscal Studies said this about the mini-Budget…

As we have mentioned in Off to Lunch before, the 1970s saw various failed attempts to tackle inflation and get the economy growing, many of which made the situation worse. Curing inflation eventually meant introducing medicine that was as painful as the symptoms…

You will see a lot of the graphs above over the next few days because they reflect the gamble and uncertainty surrounding the government’s proposals. Julian Jessop, previously the chief economist at the right-of-centre think tank the Institute of Economic Affairs (and who is thought to have advised Liz Truss’s team during the summer) said on the BBC that this market reaction was a predictable response to the measures announced and that the Bank of England was now likely to increase interest rates faster to counter inflation. On that last point, traders agree…

However, Jessop added that this hit was worth it because of the boost these tax cuts should bring to the economy.

Below is a summary of the measures announced (and their cost) from the Treasury document published after Kwarteng’s speech…

These are remarkably big numbers. Look at that those figures in bold at the bottom. They show that the total cost of the government measures is £161.5 billion.

Many of these announcements were trailed in advance and some simply represent a reversal of proposals from Boris Johnson and Rishi Sunak (a penny for their thoughts). To summarise the most impactful tax changes, there was:

-A reversal of the increase in national insurance contributions. This is worth an average of £330 a year to households. The extra money for the NHS will now come from additional borrowing.

-A cancellation of a planned rise in corporation tax from 19 per cent to 25 per cent next year.

-Confirmation of a cut to stamp duty, with the threshold that homebuyers start paying it increased from £125,000 to £250,000 and from £300,000 to £425,000 for first-time buyers, plus extra relief. This amounts to a discount of up to £2,500 for all homebuyers and £11,250 for first-time buyers.

-The scrapping of IR35 tax rules for self-employed workers and contractors.

-The rabbit out of the hat was the top rate of income tax - 45 per cent for those earning more than £150,000 - being scrapped from next April. The government will also bring forward the reduction in the basic rate of income tax from 20 per cent to 19 per cent to next April.

The business reaction so far has been largely positive. Tony Danker, director-general of the CBI, Britain’s leading business lobby group, said: “There’s plenty business can work with”. In the retail industry there is a delight at VAT-free shopping coming back for tourists but concern at the lack of any proposals to overhaul business rates, the tax on commercial property which has hurt struggling high streets…

Finally, I wanted to mention levelling up. The phrase only appears three times in the government's The Growth Plan 2022 document and two of these mentions are just the actual department, the Department for Levelling Up, Housing and Communities. Interestingly though, Simon Clarke, the new levelling up secretary, was sat next to Kwarteng during his speech (Truss with the other side), surely a deliberate choice designed to emphasise the government’s focus on that policy. During his speech, Kwarteng made a comment that I think summaries how this government will take a different approach to levelling up than Johnson did:

“If we really want to level up we have to unleash the power of the private sector.”

This package of measures was about the government getting out of the way and encouraging the private sector to lead on levelling up. Having said that, proposals for new investment zones are going to be a key part of the levelling up agenda from here and they will involve the government choosing which areas it wants to benefit from a looser planning regime and what Kwarteng described as an “unprecedented set of tax incentives”, including discounts on stamp duty, business rates and national insurance. 40-odd regions have already expressed an interest in being investment zones. There was also a welcome pledge from the government to get infrastructure projects built, but the list of projects it has said will be prioritised (page 35 of this document) is comically long. We have heard pledges like this before from government. Much more progress is needed…

Podcast

A reminder that our podcast Business Studies will launch on Monday with an interview with Archie Norman, chairman of Marks & Spencer. Off to Lunch subscribers will be notified by email when it is published and you will be able to listen to it on Substack here or other podcast platforms. There will be bonus content for paying members of Off to Lunch, including extra questions, answers and my thoughts…

Other stories that matter…

Liz Truss’s economic plan reminds the Wall Street Journal of Ronald Reagan (WSJ)

Great anecdote from former Downing Street adviser Jimmy McLoughlin about how the soft power of the Queen helped persuade Apple to sign-up for a new HQ at Battersea Power Station and how Tim Cook remembered him at a bar in Palo Alto years later… (Jimmy McLoughlin’s Notebook)

Princeton University has achieved what Malcolm Gladwell describes as the “holy grail” of higher education - its endowment fund is so big that the institution has become self-funding and could in theory let in every student for free (Oh, MG)

The shortlist for the FT Business Book of the Year Award has been revealed. My vote would go to The Power Law, a fascinating look at the venture capital industry (FT)

And finally…

There is a special night ahead for anyone going to The O2 to watch the Laver Cup - Roger Federer’s last appearance as a professional tennis player will be playing doubles alongside his rival Rafael Nadal…

People paid £35 yesterday for tickets just to watch Federer practice alongside Nadal, Novak Djokovic and Andy Murray at The O2 before they all headed out to dinner. It should be a memorable evening tonight for anyone lucky enough to attend…

Thanks for reading. Off to Lunch will be back on Sunday for paying members with our press review. If you enjoy Off to Lunch then please share it with others and spread the word. If you want to upgrade to a paid membership please click the link below.

Best

Graham