Hello and welcome to the latest edition of Off to Lunch…

It’s the day after the Budget, which means that Rishi Sunak and Jeremy Hunt are out and about promoting their policies. They have been at a builders warehouse in London, which is the image above. If you have any suggestions about what the chancellor is saying then please let me know…

Various economists and business groups are also having their say about the Budget. One of the most cutting criticisms is from UKHospitality, the trade body, which said it was a “copy-and-paste Budget” that didn’t do enough to support bars, restaurants and hotels…

But the chancellor has been fighting back against criticism and took umbrage with a question from Amol Rajan at the BBC…

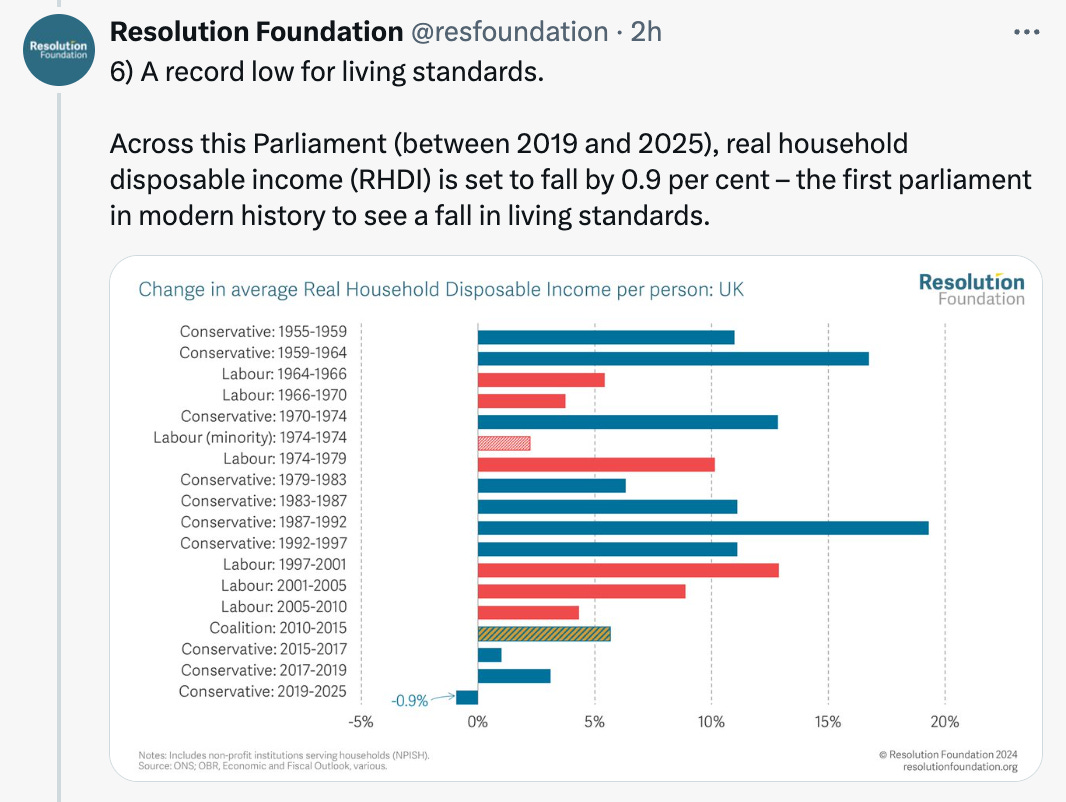

Nonetheless, detailed analysis of the Budget has noted that big challenges remain for the UK economy. The Resolution Foundation and the Institute of Fiscal Studies, the think tanks, have published their in-depth analysis of the Budget today. This has become a tradition for the day after the Budget. Their analysis includes some downbeat graphs on living standards…

And raises concerns that taxes will have to rise…

It is worth pointing out that financial markets have been relatively unmoved by all this, unlike the days of Liz Truss and Kwasi Kwarteng’s mini-Budget, when Off to Lunch was basically a collection of graphs showing dramatic movements in financial markets. The graph below shows the pound against the dollar. The pound has gained about 0.75 per cent against the dollar so far this week, although this is mostly due to the dollar weakening against a collection of international currencies.

As Paul Johnson, director of the Institute for Fiscal Studies, notes, the Budget was unable to tackle many of the challenges facing the UK economy…

However, there are two other charts from the IFS and Resolution that I want to pull out because they identify striking things about the Budget. Firstly, there is this chart on population growth and what that means for public spending…

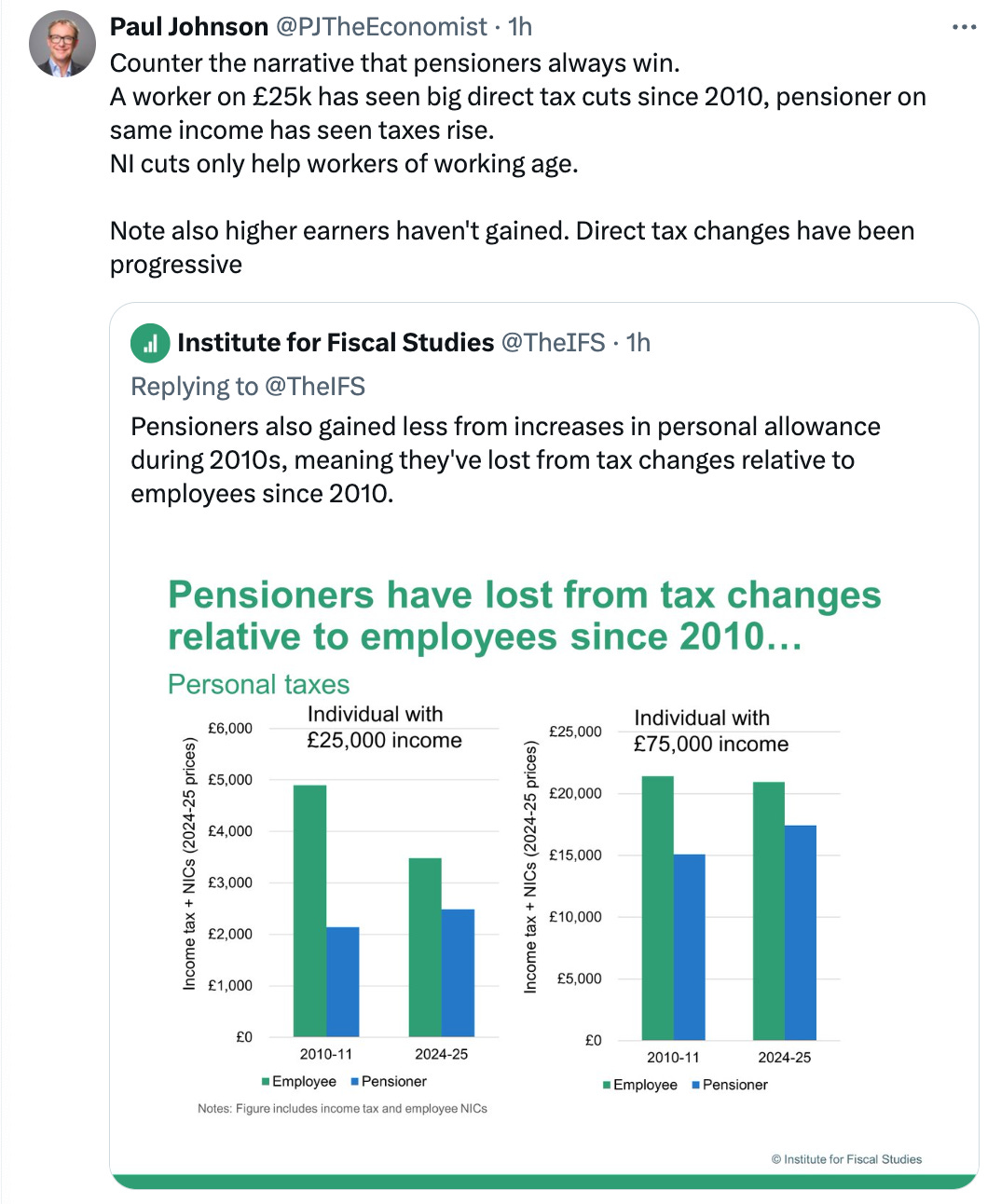

Secondly, both Resolution and the IFS have noted that the Budget benefited the millennial generation rather than pensioners. Research has shown that millennials (who were born between roughly 1981 and 1996) have been frustrated by rising property prices, stagnant wages and limited career prospects since the financial crisis. This frustration has been stoked by a perception that older generations in the UK are enjoying a better deal, such as lucrative pensions thanks to the triple-lock. But, as Resolution and the IFS show below, this is not necessarily the case…

For more on this I recommend reading an analysis by Bloomberg here. You can also find the full report by the Resolution Foundation here and the IFS here

Introducing the new Business Leader Expert…

I am delighted to reveal that Tom Beahon, the co-founder and chief executive of Castore, is joining Business Leader as a regular columnist. Tom will offer invaluable insight into being the founder and chief executive of one of the UK’s fastest-growing companies. His first piece is about the importance of mentors and his relationship with Mohsin and Zuber Issa, the brothers behind petrol station company EG Group and Asda. You can read it by clicking on the image below…

Other stories that matter…

1. Nationwide has agreed a deal to buy Virgin Money for £2.9 billion. The building society and bank will be the second largest provider of mortgages and savings in the UK, behind Lloyds, if the deal goes ahead. Nationwide has identified consumer lending, credit cards and business banking as areas where Virgin can help it to expand. You can find a joint statement from Nationwide and Virgin here

2. There will no longer be co-chief executives at Marks & Spencer because Katie Bickerstaffe is to stand down from the role in July. Stuart Machin will remain as chief executive. “We have built a strong team, made great progress, and it is now right that the business and function heads report directly to Stuart,” Bickerstaffe said. You can find the full statement from M&S here

3. The author David Epstein has interviewed Cal Newport about his new book Slow Productivity, which is about how to get the best out of yourself over the long-term without burning out. “Every commitment that you make brings with it some amount of administrative overhead, such as emails or meetings,” Newport says. “I call this the ‘overhead tax’. The problem with taking on too much work at once is that all of the resulting overhead tax begins to pile up. The more things on your plate, the more of each day is spent servicing these administrative demands, leaving less time for actually executing the underlying work. This reality leads to a paradox: the more things you’re doing at once, the less things you’re actually accomplishing.” You can read this interview here

4. Our ability to make good decisions is skewed by the fact that we are too optimistic about the future, according to an analysis of forecasts by former poker player Annie Duke. You can read this piece here

5. Bloomberg Businessweek has done a fun piece on how the Aeron became the king of office chairs and how new rivals are trying to replace it. You can read the feature in full here

Podcast…

The new episode of our Business Leader podcast looks at the story of how Ophelia Brown built Blossom Capital, a venture capital firm which has raised around $1 billion (£789 million) from investors since she launched it in the UK in 2018. Blossom is a rare success story - it is a female-led start-up and venture capital firm but is also thriving away from the traditional heart of this industry in Silicon Valley. Blossom uses the money it has raised to invest in promising businesses in Europe. We speak to Ophelia Brown about how she founded the business, raised the money, and what she has learned along the way.

You can listen to the episode on Substack here, Apple here and Spotify here

And finally…

Picking up on the theme of Tom Beahon’s first column for Business Leader on mentors, I have a book recommendation for you. I have just finished reading Watford Forever, a book about how the unusual partnership between Sir Elton John and Graham Taylor propelled Watford from the bottom division of professional English football to the top. Sir Elton was the chairman and owner of Watford, Taylor was the manager. The book follows the story of their partnership and how they were able to work together behind-the-scenes. It’s a fascinating story and you can find the book here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox