What next? Part II...

UBS/Credit Suisse and banking + Spin-outs to watch + Avanti and trains + Iraq

Hello everyone and welcome to the latest edition of Off to Lunch…

Financial markets are shaky after UBS agreed to buy Credit Suisse for $3.25 billion in an all-share deal.

The emergency rescue deal was thrashed out over the weekend during talks between the banks and Swiss regulators. The deal values Credit Suisse at less than half its stock market value on Friday and a fraction of the $50 billion it was worth in 2018 before a series of scandals emerged.

Credit Suisse shareholders have been almost wiped out by the deal but will at least have a small stake in UBS. However, $17 billion of debt owed by Credit Suisse through additional tier 1 bonds is being wiped out, angering the bondholders. For an interesting perspective on this check-out a piece in the Financial Times by someone whose firm invests and trades in bank bonds - Jerome Legras, managing partner at Axiom Alternative Investments. He suggests this wipe-out could lead to investors reconsidering whether to invest in bank bonds, a key part of how a bank funds itself:

“In the longer term, this could raise issues of financial stability given this case was driven by market panic on a bank with high capital and liquidity that was supported by its supervisor.”

Piece here

The European Central Bank has put out a statement looking to reassure investors about this issue. It said that if there was a crisis in a eurozone bank then holders of additional tier 1 bonds would only face losses if shareholders in the bank were wiped out first. The statement reads as a mild rebuke of Swiss authorities…

The uncertainty around this issue is one of the reasons why shares in banks have fallen on Monday. The FTSE 100 was up 0.3 per cent at Monday lunchtime. However, look at the top fallers on my Refinitiv screen…

This graph shows how the UK’s leading banks have seen their share price fall sharply in recent days, ending a strong rally in the months before that. Standard Chartered is yellow, Natwest is blue, HSBC is white, Lloyds is purple and Barclays is turquoise…

Friday’s edition of Off to Lunch was headlined “What next?” The answer was this UBS-Credit Suisse deal. For those wondering what the deal means for the banking system and the UK economy then what matters now is how the market reacts, specifically how investors in other banks react. As I mentioned on Friday, Credit Suisse, like Silicon Valley Bank, faced some specific issues, notably a series of scandals that encouraged clients, such as wealth management clients, to move their money elsewhere. Confidence in a bank is key. When it is lost it leads to disaster…

There are three interesting pieces on the history of banking crisis that I wanted to flag because the writers have tried to look at what history says about what may happen next.

The historian Niall Ferguson writes for Bloomberg that the key lies with Jerome Powell, head of the Federal Reserve, and how quickly he presses ahead with more interest rate rises to tackle inflation:

Jay Powell must be torn between his impulse to vanquish inflation and his fears for financial stability. On the one hand, he reveres Paul Volcker. On the other, he recalls his time as a young official at the Treasury in January 1991, when it was the Bank of New England that was about to go under. Then, as last weekend, there was a debate about whether to make the uninsured depositors whole. Powell’s boss, Robert Glauber, was for administering a haircut to them. He lost the argument to Fed governor John LaWare, who warned that, if uninsured depositors got burned, “There will be a run on every American bank when they open Monday.” Powell will also recall that the Fed cut rates right the way through 1991.

That piece is here.

Meanwhile, the Investor Amnesia newsletter has looked at a collection of bank runs from the past to see what can be learned from them. It looks at 1866 and 1907 in particular. 1907 was a crisis that saw John Pierpont Morgan Senior (aka J.P Morgan) lead efforts to put money into collapsing banks, just as Jamie Dimon, the current boss of JP Morgan, led efforts to put money into First Republic Bank last week. More here.

Finally, Adrian Wooldridge also writes for Bloomberg about how this shows that understanding history and geopolitics is vital for businesses and therefore the drop in people studying humanities at university is alarming. Piece here

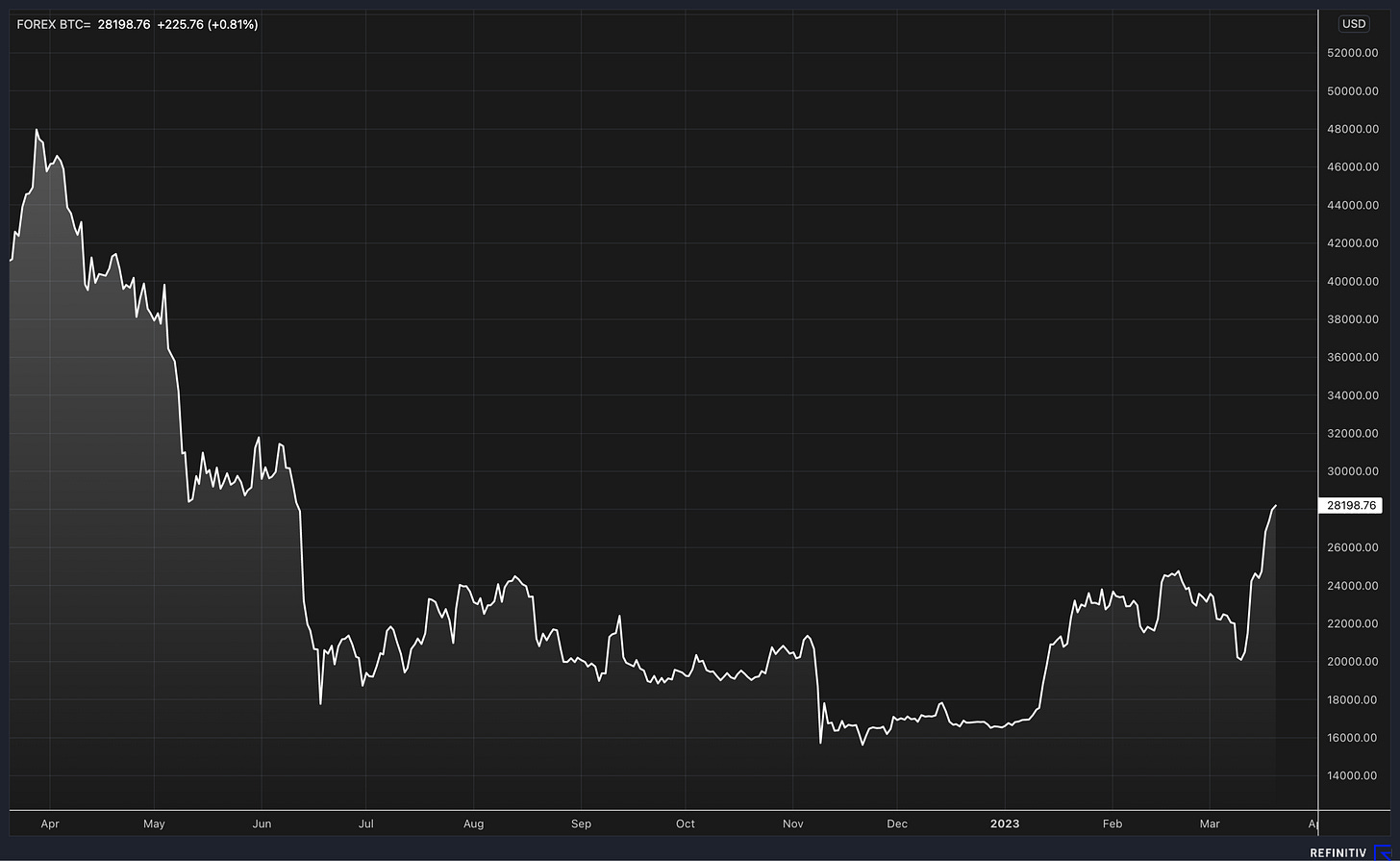

One last thing to note, the concern about banking has led to a surge in the price of bitcoin, which is now up more than 70 per cent in 2023, although still lower than it was a year ago. This is bitcoin over the last year. You can see the recent spike at the far-right…

A housekeeping note before I round-up other interesting stories. I had intended to write about Manchester, levelling up and the Budget today, before the UBS-Credit Suisse deal happened. That piece will be with you soon…

Other stories that matter…

Here is an interesting list of ten university spin-outs in Europe that are attracting the attention of venture capital investors. Five of them are in the UK (Sifted)

The Preston-born hedge fund billionaire Michael Platt has put his superyacht up for sale for €140 million. The reason? He wants a bigger one (Bloomberg)

The New York Times has published a big read, including graphics, on the struggles of the millennial generation as they hit middle-age. It is based on a survey of more than 1,000 readers. It is a story of debt and constantly changing jobs. One question gets some particularly gloomy answers from the respondents of the survey - do they expect to have a mid-life crisis. One respondent says: “Many of my similar-age friends also have young children. It feels too early for a midlife crisis, or we’re still too occupied by child care for additional crises.” Another says: “This is a joke, right? Who has midlife crisis money? That’s a boomer problem, not a millennial problem. We just increase our Lexapro.” For those who don't know, Lexapro is an anti-depressant… (New York Times)

A report by the Northern Powerhouse Partnership has said that regions across the UK should be handed more fiscal powers by the Treasury, including replacing council tax, stamp duty and business rates with a land tax. A portion of employer National Insurance contributions - 1p - should also be dedicated to local infrastructure, the report proposes (Financial Times)

Avanti, a joint venture between First Group and Italy’s Trenitalia, has had its contract to run the West Coast Main Line extended by another six months despite facing criticism for services being delayed and cancelled. Gary Neville is not happy…

On a similar topic, I have written a column for The Times about the status of levelling-up post-Budget. The opportunities and optimism is there, particularly in cities. What needs to be done next is obvious. Investment in the transport network in northern England is much-needed. But it is not happening. The comments from readers underneath show the strength of feeling on this issue… (The Times)

Lastly, check-out Off to Lunch’s Sunday press review for a round-up of news from the weekend, including the John Lewis Partnership looking to bring in an external investor and the weekend coverage of UBS’s deal to buy Credit Suisse. You can sign-up to read it here.

And finally…

It is 20 years ago today that troops from the US and UK launched an invasion of Iraq. There is a lot of coverage and analysis around this sombre anniversary. I highly recommend listening to two podcast episodes that The Rest is Politics have done about it. Alastair Campbell and Rory Stewart offer unique experiences and insights into what happened and the legacy of the war. Stewart is not afraid to challenge his co-host on the government’s failings and Campbell’s perspective has clearly changed over the years…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham