When you lose credibility with financial markets every bit of uncertainty, every slight contradiction and every tiny new problem is pounced on. You don’t get the benefit of the doubt, everything is questioned, including things that everyone was once comfortable with. This happens to struggling companies with their share price and it happens to countries and their economies, like the UK right now. Much has been written since the mini-Budget about the UK losing financial credibility with markets because of the government proposing unfunded tax cuts. Over the last 24 hours we have seen what can happen without that credibility. Markets are volatile, every comment is pounced on, and the UK is basically balancing on a tightrope with investors….

Firstly, I thought it was worth quoting an investor on the importance of credibility. Not any investor either, but Warren Buffett. Buffett buys stakes in companies, not government debt like UK gilts, of course, but the same principles apply. Here are two quotes from him on this issue:

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.

Trust is like the air we breathe. When it’s present, nobody really notices. When it’s absent, everybody notices.

These quotes help to reaffirm what investors are thinking when it comes to the UK. “The market” is often referred to as a single entity or a herd, and trading algorithms do mean that it can pull in a combined direction at times. But it is also a collection of individual fund managers and institutions all with their own targets to meet and clients to keep happy.

Anyway, this is what has happened over the last few hours. Andrew Bailey, the governor of the Bank of England, is in Washington DC for the International Monetary Fund’s latest meeting and he said this last night regarding the Bank’s £65 billion intervention in the gilt market to support pension funds:

“We have announced that we will be out by the end of this week. We think the rebalancing must be done. My message to the funds involved and all the firms involved managing those funds: You've got three days left now. You've got to get this done.”

These comments led to these front pages and the pound falling overnight…

A rather different story then appeared on the Financial Times website in the early hours, suggesting someone in authority was trying to tidy up Bailey’s comments…

The Bank of England has signalled privately to bankers that it could extend its emergency bond-buying programme past Friday’s deadline, according to people briefed on the discussions, even as governor Andrew Bailey warned pension funds that they “have three days left” before the support ends.

The pound recovered its losses after the FT published its story. In his daily column for Bloomberg, the excellent John Authers wrote that Bailey’s comments were “on course to go down as an all-time central banking gaffe”. Bailey should not have left himself so little wriggle room when the stakes are so high and it is clear that the problem has not yet been resolved, Authers wrote in his piece, which is here. He also pointed out this tweet from investment firm CrossBorder Capital…

This morning a spokesman for the Bank has said the gilt-buying scheme will end on Friday. In a statement reported by Reuters they said:

“As the Bank has made clear from the outset, its temporary and targeted purchases of gilts will end on 14 October. The governor confirmed this position yesterday, and it has been made absolutely clear in contact with the banks at senior levels. Beyond 14 October, a number of facilities, including the new TECRF, are in place to ease liquidity pressures on LDIs.”

All clear? No, and you are not alone. On top of this, the Office for National Statistics has published data this morning which shows that the UK economy contracted by 0.3 per cent in August. This is only one month of data, and the impact of scheduled summer maintenance on North Sea oil and gas production played a role, but it is notably worse than the flat reading of 0 per cent expected by economists. Frankly, this is just not a great time for the UK to get worse-than-expected economic data and got me thinking of “not now” gifs and memes…

Could all this push the government into an even bigger U-turn than the one it did when scrapping plans to get rid of the 45p tax rate? The Independent has a story from the usually well-sourced Anna Isaac and Andrew Woodcock that Downing Street has asked staff to go through the mini-Budget “line by line”. Options apparently include staggering the rise in corporation tax from 19 per cent to 25 per cent, rather than scrapping it completely as the chancellor did, and delaying the 1p cut in the basic rate of income tax to 19p for a year. Story here.

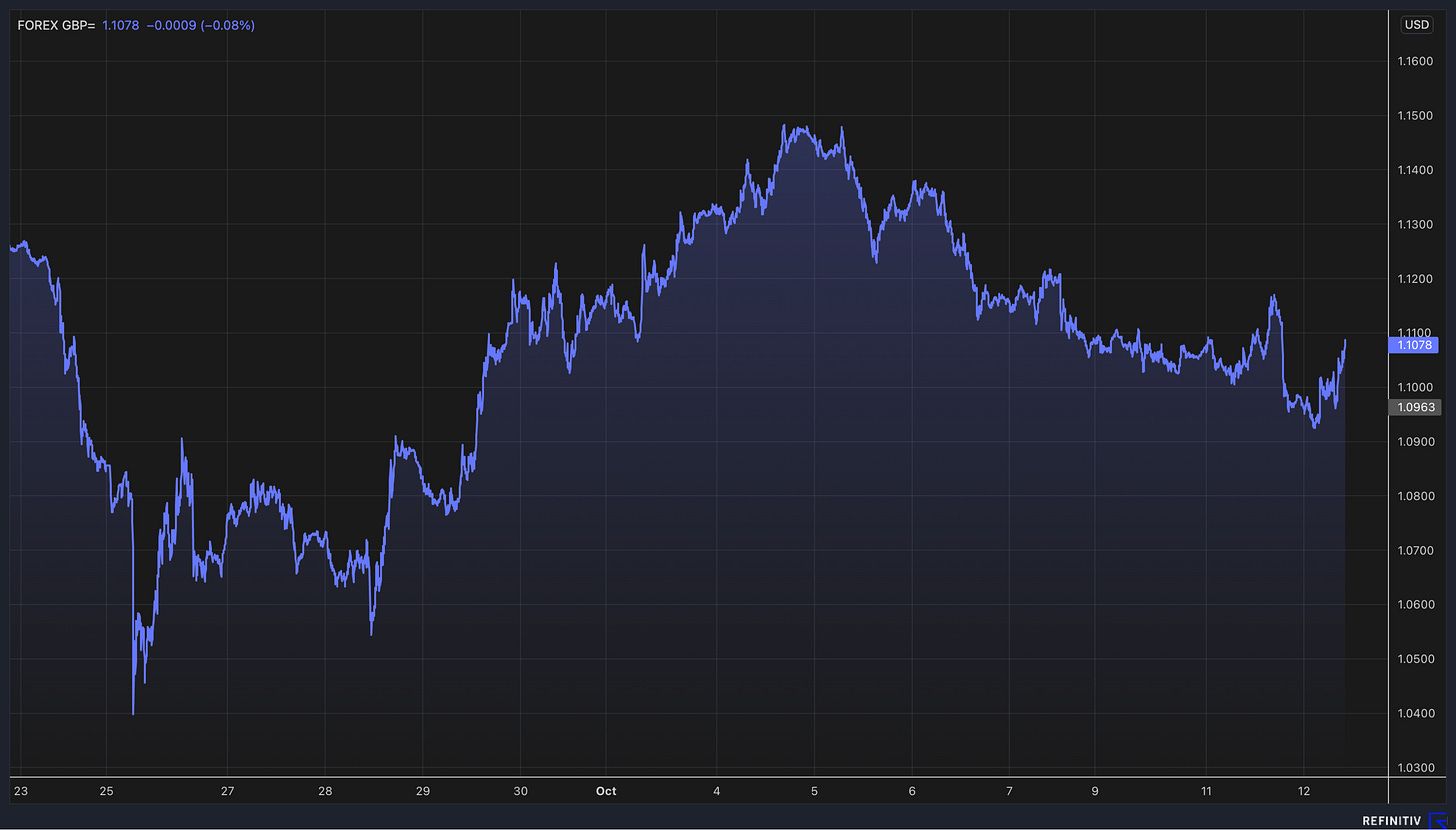

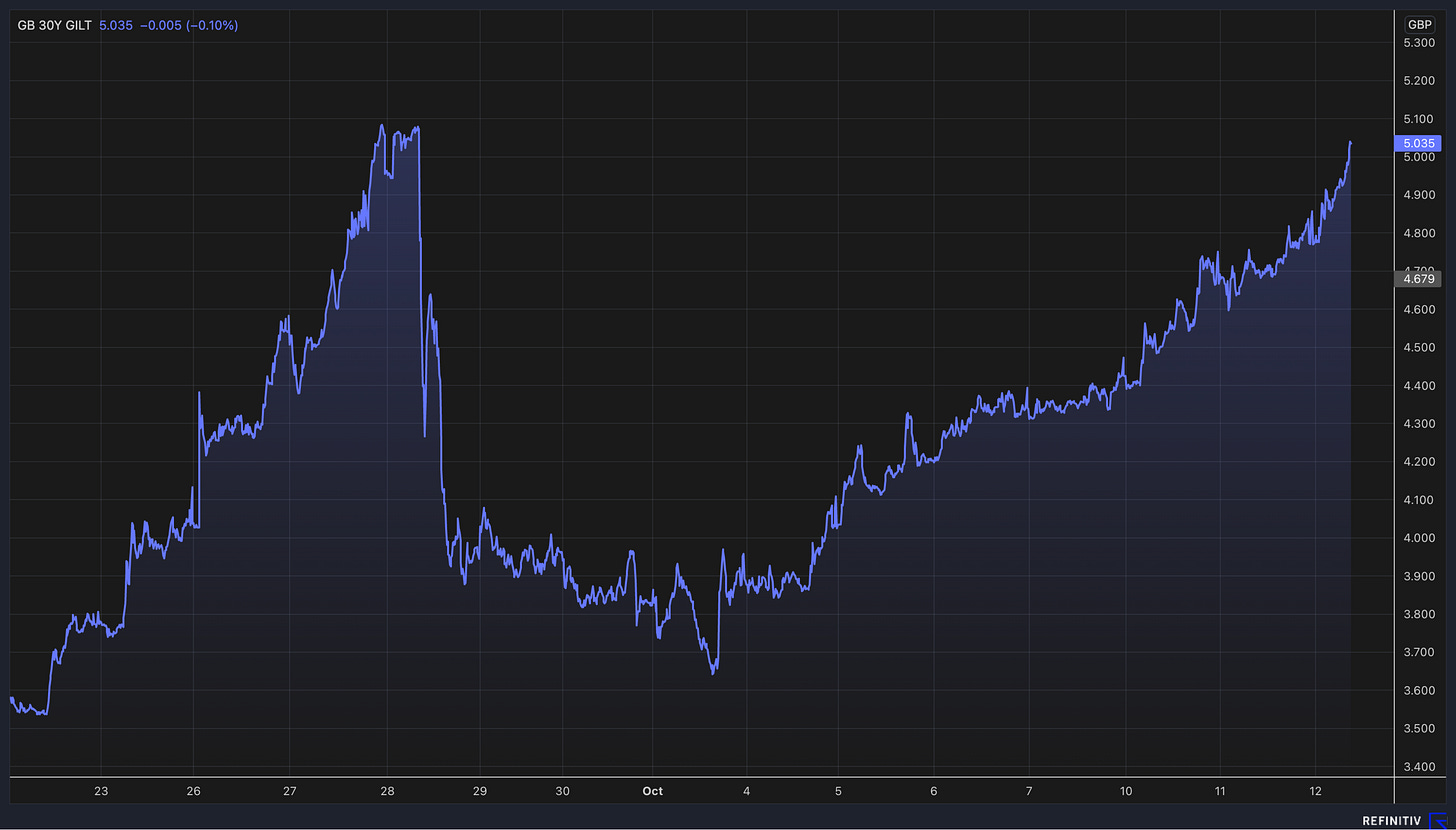

This has been the reaction in the markets, as told by the three graphs I have been constantly publishing over the last three weeks - the pound v dollar, the 2-year gilt yield, and the 30-year gilt yield since the mini-Budget.

Firstly, the pound…

And here is the 2-year gilt yield…

And finally here is the 30-year yield…

The pound fell after Bailey’s comments in Washington but rose after the FT story. The two-year gilt yield rose on Bailey’s comments (as the price of gilts fell) before falling back after the FT story. However, the 30-year yield has carried on rising through the day and indeed the week, which will be alarming to the Bank as this is the market that had put pressure on pension funds. The yield is back above 5 per cent and almost back to where it was before the Bank announced its £65 billion intervention two-weeks ago…

For further reading on this, I recommend the following.

Sir Jim Ratcliffe, the billionaire owner of Ineos, criticising the lack of “rigour” behind the mini-Budget. I have heard similar to this from a lot of business leaders in the last few days. The failure in the decision-making process behind the mini-Budget, the absence of rationality, of pragmatism, and of understanding that you have to play the hand you are dealt is totally alien to how a chief executive has to run their business. It has left many exasperated. FT story here.

On this note, City strategist Joachim Klement explains clearly and logically why he thinks Trussonomics simply won’t work. Analysis here.

The Bank of England’s attempts to tackle inflation while also pumping money into the financial system to shore it up (which is likely to stoke inflation) is making it a case study for central banks around the world. WSJ piece here.

Podcast…

A reminder to check out the latest edition of our Business Studies podcast, which looks at how PureGym, Britain’s largest gym chain, got through the Covid-19 crisis despite having to close all its sites. It’s a fascinating case study on crisis management, adaptability and leadership. There is bonus content coming for subscribers on Friday…

You can listen here on Substack, here on Apple, and here on Spotify.

Other stories that matter…

Facebook owner Meta is launching a $1,499 virtual reality headset as it steps up its efforts to promote the Metaverse. So what’s it like to use? Find out here (Platformer)

Nouriel Roubini, aka Dr Doom, aka one of those who warned of the risks facing the financial system before the financial crisis in 2008, has written what sounds like a charming new book called Megathreats: The ten trends that imperil our future, and how to survive them. These threats include debt, climate change and the battle for technological supremacy between the US and China (FT)

E-scooters are often a menace on pavements, roads and in parks, but trials around the UK in places such as Portsmouth show they are also saving people money and reducing congestion (The Economist)

Really interesting read in the Financial Times about the battle between Unilever and a brand it owns, Ben & Jerry’s, over corporate purpose and ethics. For those who don’t know much about this story, this piece is a good place to start (FT)

Fantasy Gameweek…

For those who haven’t signed up already, and I know many of you have, please check out Off to Lunch’s sister publication Fantasy Gameweek. It offers help and analysis for the 10 million people playing Fantasy Premier League and takes lessons from the world of finance and markets into trying to help you win your mini-league with friends and colleagues. You can sign-up here.

Thanks for reading. Off to Lunch will be back on Friday. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham