Hello and welcome to the latest edition of Off to Lunch…

Elon Musk might be destroying Twitter, Sam Bankman-Fried might have destroyed FTX, inflation in the US might be peaking and the UK economy might be heading for a recession. It’s been quite a week of news and there is a lot to make sense of.

The drama surrounding Musk and Twitter has been extraordinary and the leaks coming out of Twitter HQ to tech journalists have clearly made this a colourful story to report on. A new owner making sweeping changes at a business and kitchen-sinking expectations (even warning of bankruptcy) is not unusual. Neither is staff saying that they preferred the old way of doing things, especially when many of them were sceptical of Musk before the takeover. But because it is Musk and because it is Twitter, every twist and turn is being chronicled. Check out Platformer for the latest on the story, where Casey Newton has been doing a superb job of tracking the latest goings-on inside the company. You can read today’s piece here. For a lighter take, check out Henry Mance in the Financial Times, who has chronicled his changing views on Twitter throughout the week. You can read that here.

As for the UK economy, data out this morning shows that it contracted by 0.2 per cent in the third quarter of 2022 (July, August, September) compared to the previous three months. This puts the UK on course for a recession, which is two consecutive quarters of economic decline.

Nevertheless, there is some good news here. Remember, a recession has already been widely forecast, with the Bank of England’s setting out a gloomy scenario last week where interest rates hit 5.25 per cent and the UK has a two-year recession. Also remember that the Bank’s subtle guidance is that interest rates of 5.25 per cent won’t happen and that two members of the Bank’s monetary policy committee voted for a smaller increase in interest rates last week (0.25 per cent and a 0.5 per cent) than the other seven members who voted for 0.75 per cent because they feared that the UK is already in recession. Anyway, the good news today is that the 0.2 per cent drop in the size of the economy is less than the 0.5 per cent consensus forecast among economists and the Office for National Statistics has said that around half of that 0.2 per cent drop is due to the extra bank holiday and the period of mourning following the death of the Queen in September.

The outlook is still gloomy though, I am afraid. The UK economy is 0.2 per cent smaller than it was before the start of the Covid-19 crisis in early 2020 and is about to become even smaller, if the forecasts of the Bank and other economists are right. In contrast, other developed economies like the US, Germany and France are bigger than they were before the pandemic, as the Financial Times reports here.

Sticking with economic news, US markets rallied on Thursday as traders and investors bet that inflation may have peaked and the Federal Reserve won’t need to increase interest rates much more (they currently stand in the range of 3.75 per to 4 per cent). Data published in the US showed that the consumer price index had slowed to 7.7 per cent in October compared to the same month a year earlier, down from 8.2 per cent in September and 9.1 per cent in June.

John Authers at Bloomberg has done a superb analysis on why markets reacted so positively - namely that the “core” measure of inflation, which strips out volatile price movements in food and fuel, also slowed notably. You can read that piece here. The tech-focused Nasdaq index closed up 7.4 per cent, its biggest daily rise since 2020, while the pound gained 2.9 per cent against the dollar as the US currency weakened against a collection of global currencies, which reflects that markets now believe the Fed will not increase interest rates as high as previously thought.

I want to finish this round-up by looking at Sam Bankman-Fried and FTX.

Bankman-Fried and FTX were supposed to be the credible faces of crypto. A smart and safe place to trade. As early as last month, Bankman-Fried was addressing questions about being a modern-day J.P. Morgan. While Morgan stepped in to save struggling banks in the early 1900s as he built his eponymous banking empire, Bankman-Fried was going to do the same for struggling crypto businesses in the early 2020s. The 30-year took questions in Congress, was a big donor to the Democrats, and seemed to accept that the crypto industry needed regulation. In July The Economist described him as “Crypto’s last man standing”

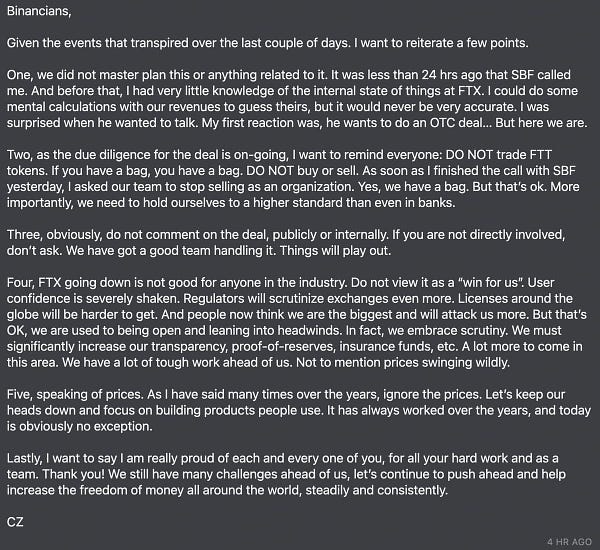

Well he isn’t standing anymore. FTX is looking for a bail-out to avoid bankruptcy and has blocked customers from withdrawing their money. At the start of 2022 it was valued at $32 billion after a collection of venture capital funds put in more money. What happened next is not entirely clear yet. The factors seem to include complex and ill-advised lending by FTX’s businesses against its own assets going wrong (this could well turn out to be a kind description of what happened, but let’s see), a panic that led to customers withdrawing their money, and a rivalry with Binance and its boss CZ Zhao, who are at various stages over the last week has gone from the saviour of FTX (he said Binance had agreed to buy it) to being blamed for its downfall (he sparked concern about FTX by publicly warning about its finances last weekend, then agreed to buy and rescue FTX, then pulled out).

There is some great analysis around on FTX. I recommend this from Matt Levine of Bloomberg, who did an extraordinary interview with Bankman-Fried in the summer in which he openly debated whether FTX was a Ponzi scheme. He did not say that it was a Ponzi scheme, but many people who heard that interview felt he had implied that. Levine says he actually likes Bankman-Fried and was one of the few in the crypto industry not blind to its problems. The Economist has also looked at the rise and fall of FTX here.

To bring this back to the start of today’s edition, much of the FTX story has played out on Twitter. See below for some of the key statements from Bankman-Fried and Zhao over the last week. These are their tweets in chronological order. Zhao is CZ_Binance. Bankman-Fried is SBF_FTX…

As the headline of today’s edition says, it’s been quite a week…

Podcast bonus episode…

As promised, rather than bonus content for the podcast this week, we have a full bonus episode of Business Studies. Instead of taking a look at a big business story from the past, this episode tries to make sense of what has just happened. Specifically we look at pensions, which have been at the centre of the news agenda over the last two remarkable months. Why did the Bank of England have to step in with a £65 billion support package to help pension funds? Is the problem solved now? Does anyone fully understand liability-driven investments (LDIs)? And is it fair that the triple-lock for state pensions is under review? I am joined by Tom Selby, AJ Bell’s head of retirement policy and a leading expert on pensions, to discuss all that and more.

The episode is available below for paying Off to Lunch members. If you aren’t a paid member, you can sign-up by clicking the link below. It costs just £6-a-month or £50-a-year. For that you get access to all podcast bonus content, full access to Friday’s newsletter, the Sunday press review and more…