Hello and welcome to the latest edition of Off to Lunch…

2021 saw the release of WeWork: Or the Making and Breaking of a $47bn Unicorn and the following year was the premiere of the TV show WeCrashed, starring Oscar winners Jared Leto and Anne Hathaway. Countless podcasts and business case studies have been published on the company. And yesterday we received confirmation that it’s officially making a comeback.

If you look at all of IWG – and now we’re now up to over 4,000 buildings – it's only had $300m invested in it (overall net net). Whereas WeWork put in more than $10bn.

We couldn't understand the model, but we certainly believe, like they did, that it was the right business, but theirs was a highly risky strategy.

This is an extract from our podcast conversation with Mark Dixon, the founder and chief executive of rival coworking company IWG. Despite once being valued at $47bn, WeWork racked up massive debts, laying off thousands of employees and blowing billions of pounds in investment. An agreement was struck in a New Jersey bankruptcy court yesterday that laid out the company’s restructuring plan.

Around $4bn (£3.1bn) of WeWork's debt has been wiped out and there will be a roughly $12bn (£9.4bn) reduction in future rent expenses. The company will operate as a private company under new majority owner Yardi Systems, which provides property management software to landlords across the globe. According to a statement from WeWork, the plan will allow it to “deliver sustainable and profitable growth“.

The same statement also provides an insight into how it's looking to change public perception. Among the plan’s details, it says that WeWork will “end the substantial operating losses that characterised the company’s years of hypergrowth and subsequent contraction”.

Yardi Systems and other investors will inject $400m of equity capital into WeWork. One of those investors is Japanese conglomerate SoftBank, which has lost more than $14bn on its bet on the company since initially investing in 2017.

The face of WeWork’s rise and fall, Adam Neumann, said in a statement to the New York Times’s DealBook newsletter, that the plan “appears unrealistic and unlikely to succeed“. The statement came days after he officially put to bed his ambitions to buy the firm back. Sour grapes? Only time will tell.

Are you a CEO, founder or finance director looking to scale your business?

Our ambition – one shared by our partner OakNorth Bank – is to help more companies achieve their potential. To do that, we’re bringing a community of entrepreneurs, founders and leaders together to talk about the challenges they face and get advice on how to overcome them.

Over breakfast, you'll have the opportunity to network with peers and discuss and share your journeys. And we'll be running a panel discussion with leaders at Deliciously Ella, Total Fitness and Mowgli Street Food.

If you're interested in joining us or finding out more, click here.

Other stories that matter…

1. The housing market “appears to be showing signs of resilience”, according to the Nationwide house price index. House prices increased 0.4 per cent in May, while consumer confidence has also improved noticeably in the past few months (charted below). You can read more here.

2. Speaking of Nationwide, its proposed merger with Virgin Money is under investigation by the Competition and Markets Authority. The £2.9bn deal would create the UK's second-largest savings and mortgage provider. You can read more here.

3. London Stock Exchange data shows that investors are selling more of their stock here than anywhere else in Europe. Despite new listings remaining low, the volume of follow-on transactions has already reached $11.5bn this year. Volumes for the LSE’s French and German counterparts have both been less than $5bn. You can read more here.

4. Google has admitted that it hasn’t quite nailed its latest AI overview feature. This comes after a series of embarrassing gaffs, including telling people to drink urine to pass kidney stones and add glue to thicken up pizza sauce. You can read more here.

5. QR codes are on the out. Customer complaints, low numbers of tips and the fact that it’s “seen as a little bit tacky“ have all contributed to many restaurants in the US ditching them. The Wall Street Journal has spoken to people who liken them to self-checkouts and assembling IKEA furniture. I respectfully disagree but you can read more here.

And finally…

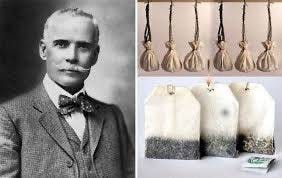

Thomas Edison once said: “There's a way to do it better. Find it.” Innovation is not easy and, frankly, questioning absolutely everything in a process can be unbearably tedious. However, that’s often where the magic happens. Sometimes, it’s just down to dumb luck.

The X account VisionaryVoid has posted a fascinating thread covering “remarkable inventions and discoveries you (probably) might not realise were born out of accidents“. These include X-rays, Velcro, anaesthesia and tea bags.

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign up below to get Off to Lunch sent directly to your inbox.