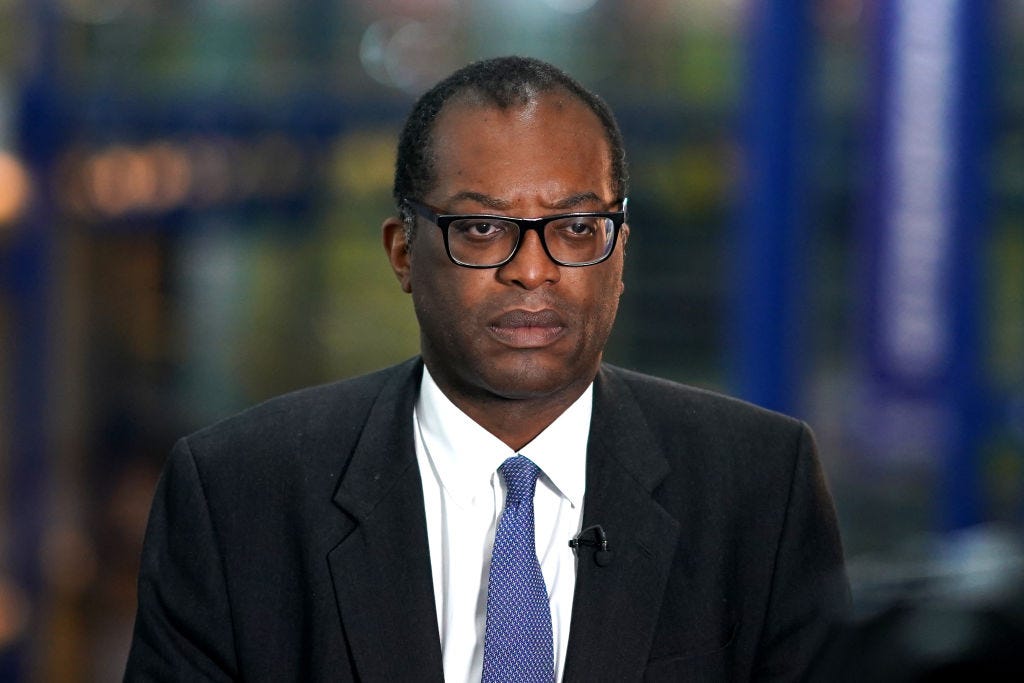

The pound is back where it was before the mini-Budget and the top rate of income tax in the UK is going to remain at 45 per cent. It’s like all that was written over the last week didn’t matter. Well, not quite, because the yield on gilts remains higher, the Bank of England has had to commit £65 billion to propping up pension funds and the future of Liz Truss and Kwasi Kwarteng - or at least their policies - is uncertain.

Kwarteng announced just after 7am this morning that the government was doing a U-turn on its decision to scrap the top rate of income tax…

The move followed a bruising day of coverage and analysis in the Sunday papers and at the start of the Conservative party conference…

You can read a round-up of the coverage in Off to Lunch’s Sunday press review here. Paying members received it yesterday, you can sign-up and pay today to read it and future newsletters…

I thought this comment from Chris Turner, analyst at ING Bank, was one of the most straightforward reactions today to the government’s U-turn on income tax…

This move is rather symbolic, being less about the amount of money it will save and more about the poor signal it had delivered with an ideological tax cut. The move looks driven by a backlash from her own party and perhaps the threat of a sovereign rating downgrade.

As a reminder, here is the government’s estimate of the cost of its proposals in the mini-Budget over the next five years. I have ringed the proposal to scrap the 45 per cent rate of income tax on those paid more than £150,000-a-year. It is a significant cost, but far smaller than the moves on national insurance and corporation tax…

Here is the latest reaction in markets. This is the pound since the evening before the mini-Budget up to lunchtime on Monday October 3…

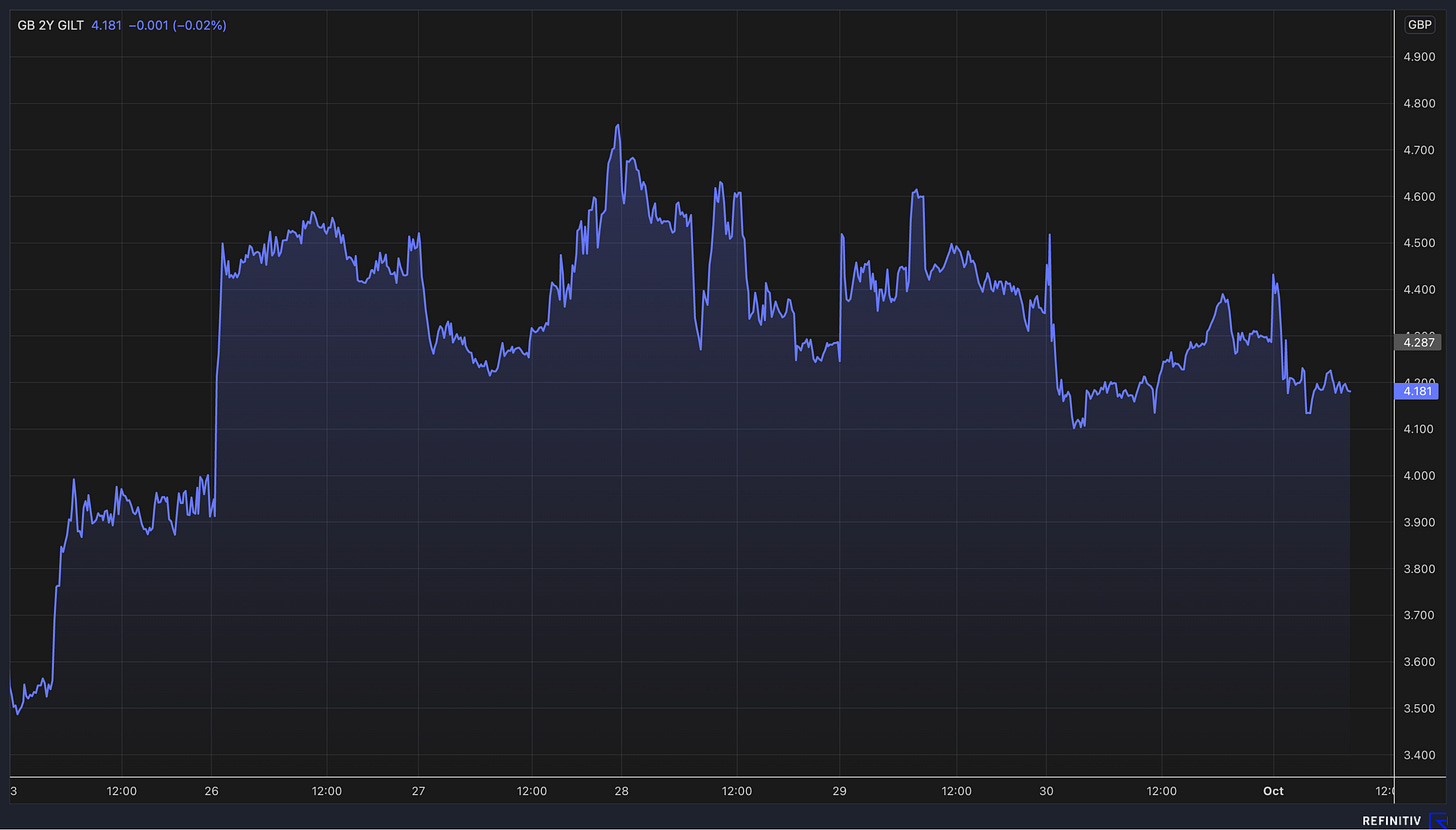

This is the yield on two-year gilts - basically the interest rate that the government pays on its bonds…

And this is the yield on 30-year gilts, with the cliff-edge drop in the middle representing the Bank of England’s intervention…

There was coverage at the weekend and some chatter in the corner of markets that the drama in UK assets is part of a wider strain on financial markets that could get worse, with some pointing to the issues at Credit Suisse, whose shares are down 8.5 per cent this morning after a statement at the weekend from its boss trying to reassure investors about its finances. On this topic I recommend the below for a level-headed take…

Kwarteng is due to speak at the Conservative party conference this afternoon. It will be fascinating to see what tone he takes, the same with Truss, who is due to speak on Wednesday morning. I will be keeping a close eye on how levelling up and key infrastructure projects are discussed this week…

Podcast

Episode two of our Business Studies podcast is now live. It is a look at one of the most controversial takeovers in British corporate history, a business strategy like no other and whether those involved in creating an enormous global health problem - smoking - should be trusted to play a role in fixing it.

In an interview with Jacek Olczak, chief executive of Philip Morris International, the owner of Marlboro and the largest tobacco company in the world, I ask about his stated ambitions to eradicate smoking and the cigarette - a product his business started selling from a shop in Bond Street, London, in 1847. Why did the cigarette maker buy Vectura, a company that makes treatments for respiratory diseases, and why should the tobacco industry be trusted? These questions and more are asked in an episode that raises issues that go well beyond business.

You can listen on Substack here, Apple here and Spotify here. Alternatively, Podfollow will take you directly to your preferred destination for podcast listening. Link here.

There will be bonus content on the interview coming for Off to Lunch members on Friday. Please get in touch with any feedback or questions you would like me to cover about the episode…

Other stories that matter…

Fascinating piece from historian Niall Ferguson on whether we are allowing gloomy news and events to overshadow positive long-term trends. Unfortunately, Ferguson thinks that there are many negative trends in the world right now - inflation, rising temperatures, expanding populations and worsening mental health in young people. But he ends the piece by predicting the downfall of the Russian, Chinese and Iranian regimes… (Bloomberg)

An alternative take on Trussonomics from the Faster,Please! US finance newsletter (Rishi Sunak is a fan): “Sometimes Mr. Market gets momentarily emotional and overreacts. It’s hard to see why tax cuts of around 1 per cent of GDP (including scrapping the top income tax rate and reversing a planned rise in corporate taxes) justify the pound falling to a record low versus the dollar — not to mention all the heated commentary about their supposedly ruinous effects.” (Faster, Please!)

Surging energy prices and the cost of living crisis have exposed how Europe is lagging the rest of the work in developing new technology and competitiveness, according to a new analysis by consultants of McKinsey, an issue the continent needs to resolve urgently (McKinsey)

Why Tokushichi Nomura II, founder of Japanese bank Nomura, is one of the fathers of modern finance (Investor Amnesia)

A row about the price of tickets for Bruce Springsteen's tour shows that businesses need to learn lessons about the new trend for dynamic pricing (Harvard Business Review)

And finally…

A slightly different And finally today - a family attraction! We went to the Jurassic World: The Exhibition at the Excel in London over the weekend and it really is a unique experience. Our son is too young to have watched the films yet but he loved every minute, so I can only imagine how much he would have enjoyed it if he had seen the films. They have put a lot of thought and effort into trying to make it as an authentic experience as possible, with actors playing the role of park rangers and scientists alongside the model dinosaurs (I think they were models….). It is not cheap - £23 for adults, £15.50 for children, under-threes are free and family packages are £18 per person. And the journey through the “park” only lasts about 45 minutes. But I don’t think you will be disappointed. The exhibition is running until the middle of January 2023 and you can get tickets here. You need to book tickets in advance as it sells out fast…

Thanks for reading. Off to Lunch will be back on Wednesday. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham