Hello and welcome to the latest edition of Off to Lunch…

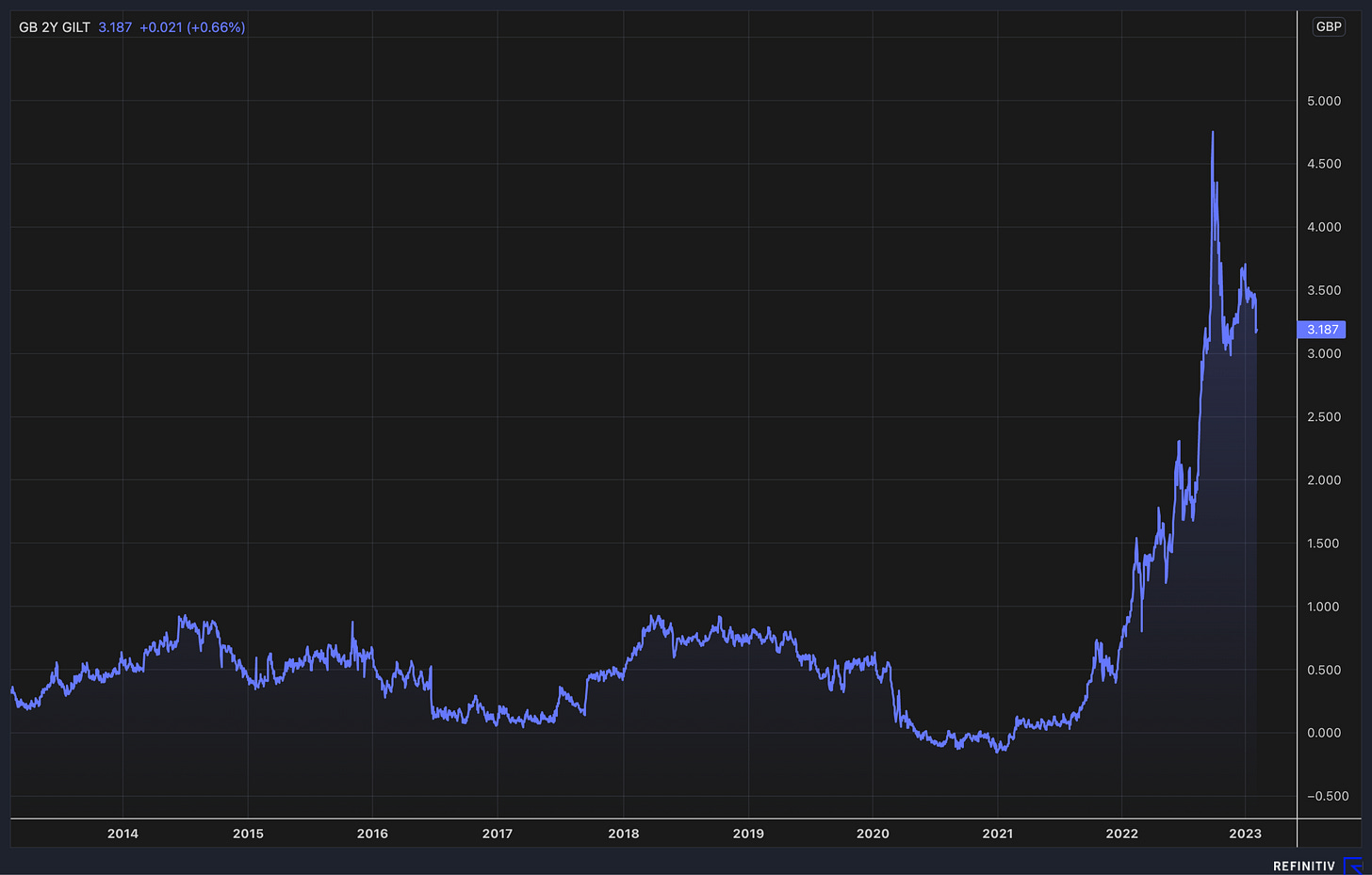

Last autumn I spent a lot of time in this newsletter looking at some important financial graphs. Those graphs were the pound against the dollar, the two-year gilt yield and the 30-year gilt yield. The graphs illustrated the view that global markets were taking on the UK - and Liz Truss - at the time. Gilt yields - which reflect the interest rate the government must pay on its debt - are directly linked to mortgage rates, so the graphs were also relevant to people’s lives and finances. As you will remember, they told a grim story about the state of the UK and the pain that might be ahead for households.

I wanted to have a look at these graphs again given it has been a significant week of economic and corporate news. The Bank of England increased interest rates to 4 per cent from 3.5 per cent on Thursday. However, this was only part of the story:

Two of the nine members of the Bank’s rate-setting committee voted to hold interest rates at 3.5 per cent

Huw Pill, the chief economist of the Bank of England, told Times Radio on Friday that the Bank is wary of putting interest rates up too much. “It is important we guard against the possibility of doing too much.”

The Bank upgraded its forecasts for economic growth and downgraded inflation. It is now forecasting a shorter and shallower recession, with the economy declining by 1 per cent over five quarters rather than nearly 3 per cent over eight. This will be followed, however, by a period of stagnation rather than any roaring recovery. The Bank is also forecasting that inflation will fall to 4 per cent at the end of the year. It stood at 10.5 per cent in December

In short, these developments suggest that interest rates may not go up much more, if at all. That is certainly how financial markets have read the situation. However, the Bank is still concerned about the outlook for the economy and inflation…

So while there is optimism that things are not as bad as feared, the health of the economy is precarious - in the UK and globally. For evidence of this, look at Apple’s financial results. The world’s most valuable company reported its first drop in sales since 2019 when it published its results on Thursday (you can read them here). Most of the other big US tech companies have published downbeat results too. The Financial Times has calculated that Amazon, Meta, Alphabet and Microsoft have incurred more than $10 billion in charges from making people redundant, which is an extraordinary number. These four companies alone have announced about 50,000 job cuts. Full story here.

Signs of strain in the UK economy include the housing market, where prices fell 0.6 per cent month-on-month in January, according to Nationwide. This is the fifth month in-a-row that prices have dropped - there hasn’t been a stretch like that since 2008. Higher mortgage rates are still hanging over the housing market and the economy. The Financial Times noted earlier this week that there has been an increase in people overpaying on the mortgage because they are trying to pay it down at reduced rates on the existing deal before their interest rates goes up. Full story here.

Nonetheless, central banks are less concerned about inflation than they were. A key factor behind this is a drop in the price of oil and wholesale energy prices. This means that although oil giants ExxonMobil and Shell reported record annual profits this week - Shell’s more than doubled to $39 billion, the highest since it was founded in 1907 - the taxpayer bailout of Bulb Energy may now only cost £260 million rather than £6.5 billion. This is because the price of the electricity and gas that Bulb needs to buy to supply households is not as high as feared. More on that here.

Anyway, let’s have a look at the charts I mentioned…

Here is the pound against the dollar over the last ten years…

And this is the two-year gilt yield over the same period…

Finally, the 30-year-gilt, which reflects a more long-term view on the direction of interest rates and the UK economy…

Overall, the graphs neatly summarise what I have written above. Things haven’t turned out as badly as feared during the chaos of the mini-Budget and Liz Truss’s government. But these are still challenging times…

Other stories that matter this week…

If you haven’t already read The Times investigation into British Gas debt collectors using locksmiths to break into vulnerable people’s houses to install prepayment meters then you should. A truly shocking story and one that has already forced the company, the industry regulator and the government to act (The Times)

Tech Nation is to close. The government-backed organisation was set-up under David Cameron’s coalition to promote the UK tech industry. Tech Nation has supported start-ups and the tech industry by connecting them with potential investors, getting visas for overseas workers and publishing research. However, the end was nigh after the government awarded a key tech contract and funding to Barclays Eagle Labs ahead of Tech Nation (Tech Crunch)

ChatGPT is the fastest-growing consumer app ever, beating TikTok and Instagram (Reuters)

Part of a trend or a one-off? Howden Joinery has on-shored production of cupboard door frontals from Italy to, er, Howden in Yorkshire. As a consequence it has significantly expanded its factory in the town and created 100 new jobs (Business Live)

FTSE 100 company Johnson Matthey is to use its facilities in Swindon and Runcorn to supply US group Plug Power with key components for green hydrogen fuel cells (The Times) Meanwhile, Honda and General Motors have announced they are going to develop a hydrogen fuel cell together. Despite plenty of scepticism, hydrogen could still have a big role in the net-zero future (Reuters)

Potential owners of football clubs will have to prove the source of their wealth to have their takeover approved. That is one of the government proposals designed to overhaul the regulation of football in the UK. Football clubs will only be allowed to play in competitions approved by an industry regulator. The Sun says it has seen a leaked government paper outlining the plans (The Sun)