There is only one place to start this edition of Off to Lunch and that is the victory for the lettuce…

Yes, the Daily Star is celebrating one of the most memorable moments in its history, and certainly its best PR stunt, after a lettuce it bought lasted longer than Liz Truss as prime minister. The lettuce - and Truss’s resignation - have made news around the world. Quartz described the lettuce stunt as being “as brilliant as it was ruthless”. NBC News in the US simply wrote: “Lettuce 1, Liz Truss 0”.

In terms of what happens next? Well, as Chris Mason, the BBC’s political editor, said on the BBC last night, we have no idea who will be the next prime minister in two weeks time. The candidates have to submit their nominations by 2pm on Monday and have the backing of at least 100 MPs, a high threshold given there are only 357 Conservative MPs. If there are more than two candidates, MPs will vote and the two left will go to an online vote by Tory members. If there are two candidates, MPs will hold an indicative vote to show members who their favourite is (ie please vote for this person). If there is only one candidate, they are the prime minister. If members do get a vote then we should find out who is prime minister next Friday. The government’s fiscal statement is due to be the following Monday - October 31. There seems to be a sense of momentum growing around the idea that could be delayed. We shall see…

The bookies have the race to be the next prime minister as a battle between Rishi Sunak and Boris Johnson, and it’s really close. Betting markets tend to be efficient when it comes to political issues so they are worth paying attention to. These are the latest odds according to Oddschecker. The most popular bet on Oddschecker right now, including all sport, is Boris Johnson to be the next prime minister. Ivanowitch in the 12.40 race at Clairefontaine is also attracting interest…

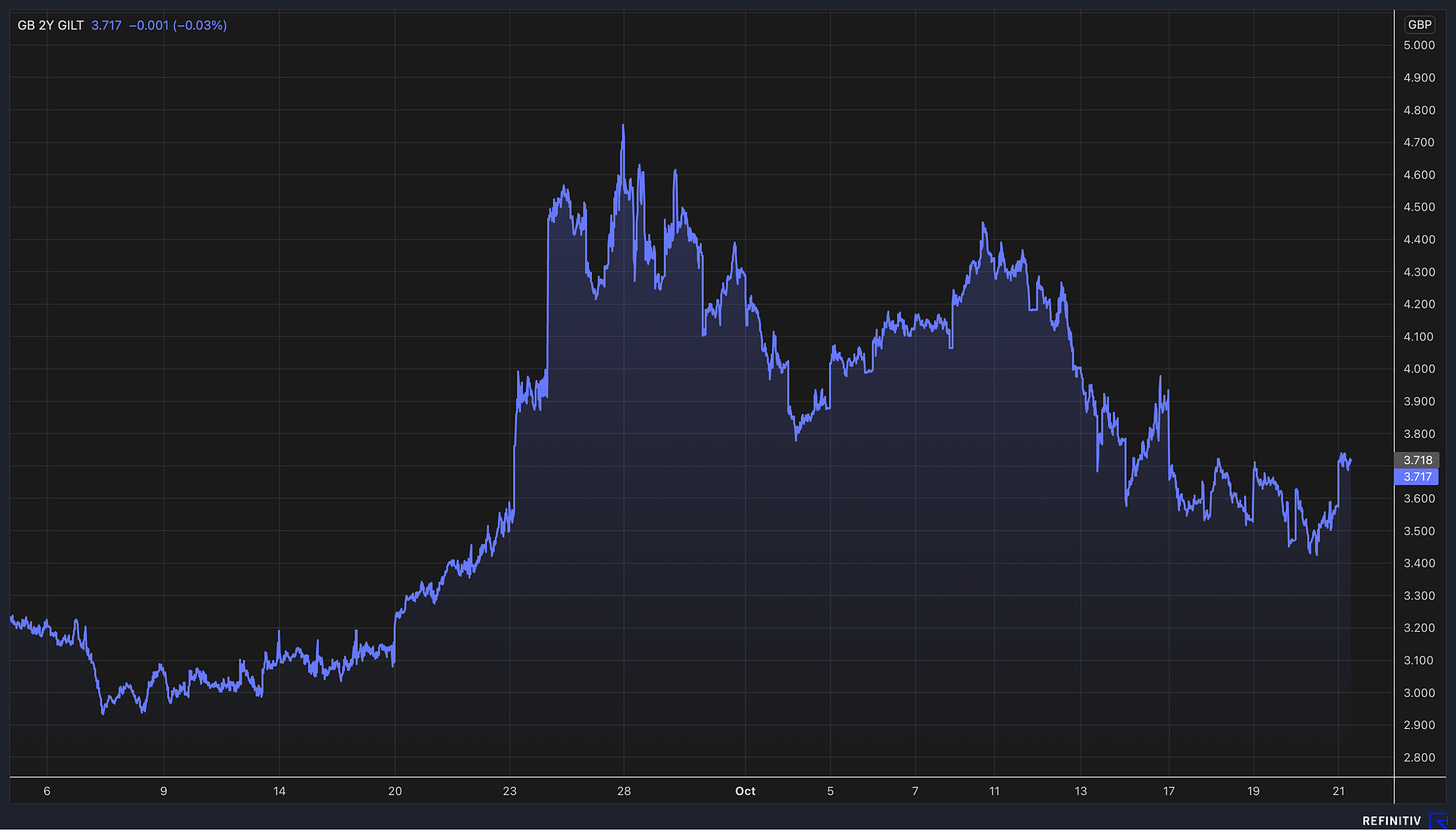

On the financial markets, let’s now look at how the pound, two-year gilt yields and 30-year gilt yields moved during Liz Truss’s tenure. She started on September 6, the mini-Budget was on September 23 and the Bank of England’s £65 billion move to shore up pension funds was on September 28…

This is the pound v dollar, with the euro v dollar included in white as a comparison…

This is two-year gilt yields…

And this is 30-year yields…

I want to zoom out on the 30-year graph now to show you how dramatic the last 44 days have been to this market relative to what came before. This is the last 30 years for 30-year gilt yields…

Finally, amidst the drama of Downing Street, Ben Broadbent, deputy governor at the Bank of England, gave a significant speech yesterday in which he basically said that financial markets have got ahead of themselves in predicting interest rates of more than 5 per cent (this prediction is what has pushed gilt yields up and moved other markets). Broadbent warned that the consequences of interest rates rising to these levels would be a deep recession, given the mortgages held by households and debts held by businesses. The Guardian has the story here. John Authers of Bloomberg has some analysis here. Deputy governors of the Bank of England don’t make comments like this idly, they are usually trying to send a message…

Podcast bonus content…

Episode four of our Business Studies podcast featured an interview with Tim Steiner, chief executive of Ocado, on building the online grocery and technology company. I have interviewed him before and been on results calls with Ocado but I have never heard him speak so openly about the challenges of building and leading the company. It is a fascinating insight into founding, building and leading a big business in the 21st century, something few have achieved in the UK. You can listen to the episode here on Substack or wherever you get your podcasts.

There is bonus content for Off to Lunch members below. This looks at comments from Tim Steiner about what comes next for online grocery shopping, particularly the rapid delivery market. The likes of Gopuff, Getir and Gorillas have attracted billions of dollars of funding from venture capital funds with their pledge to get groceries to your house in 15 minutes. These companies have focused on a small collection of cities and towns in the UK so far. However, after some initial success they have been forced to cut jobs and dramatically cut their valuations this year after burning through the cash they raised. Istanbul-based Getir is now understood to be in talks to buy Berlin-based Gorillas. Ocado is offering its own rapid-delivery service through its Zoom brand, which offers a bigger range and slightly slower deliveries than Gopuff, Getir and Gorillas. Tim Steiner has some really interesting views on what comes next for this market, which you read below. If you aren’t an Off to Lunch member already, you can sign-up below too…

Episode five of Business Studies will go live on Monday and it’s an entirely different story. I speak to Gerald Ratner about one of the biggest catastrophes in British corporate history and how a speech changed his life and business forever. The Ratners Group was the biggest jewellery company in the world when Ratner gave a speech in 1991 describing one of his products as “crap”. After that, everything changed. Criticising your own brand or products in public became known as “Doing a Ratner”. But did this story happen the way we remember it? Or has time distorted what really happened? Find out on Monday….