New figures released this week could show that inflation has dropped below 10 per cent in the UK for the first time since last August. Not so long ago it would have been absurd to mark such a milestone. But that is where we are today. Inflation would still be well above the Bank of England’s 2 per cent target, but this would be welcome progress in getting it down.

This graph shows how inflation has moved in the UK over the last 25 years by looking at the consumer price index (CPI), the primary measure of inflation…

The consensus among economists is that CPI will fall from 10.4 per cent in February to 9.8 per cent in March when Office for National Statistics publishes the latest data on Wednesday. Economists have been wrong before, but inflation in the US has already gone below 10 per cent and year-on-year comparisons are now crossing over with the start of the Russia-Ukraine conflict, which began on February 24 2022, so there are reasons to believe they will be correct.

Any drop in inflation is significant for households for two obvious reasons. Firstly, it means prices and household bills are not rising as fast as they were and are now dropping month-on-month for some items. Secondly, it means that the Bank of England may not have to increase interest rates beyond their current level of 4.25 per cent. A survey by Bloomberg News found that more than half of economists think that the Bank will hold rates at its next meeting in May, although markets are betting that rates could increase again in September. Full story here

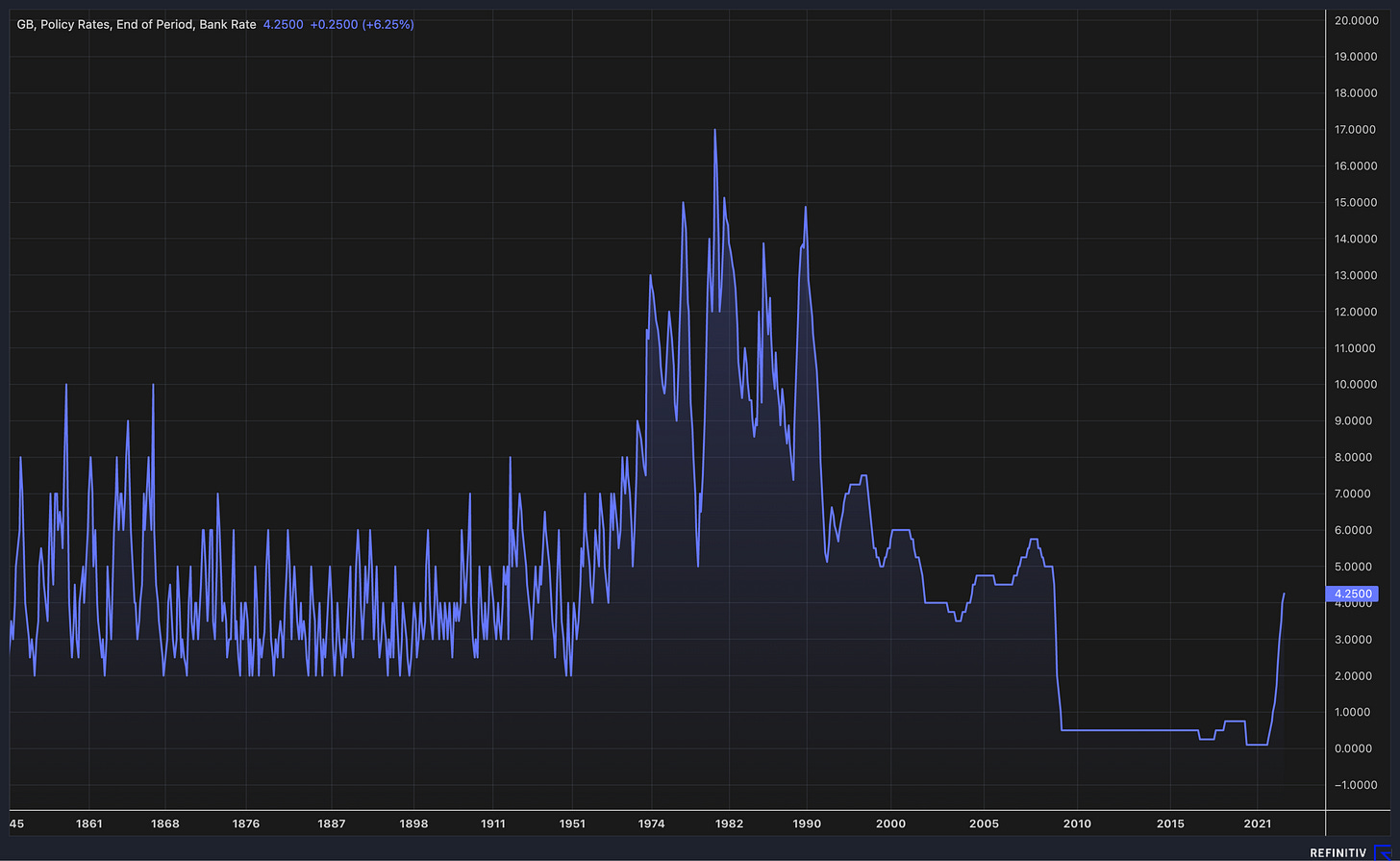

This is how the base rate of interest in the UK has moved since the 1840s, graph courtesy of Refinitiv…

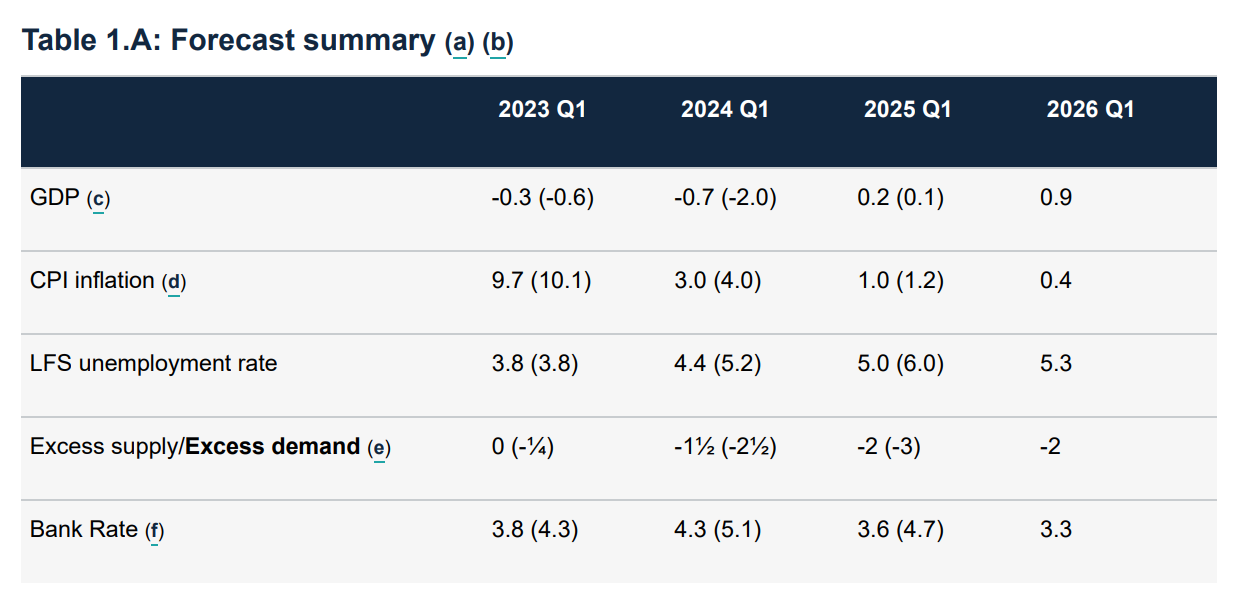

This feels like a useful moment to remind you of the Bank of England’s latest forecasts, which it published as part of its monetary policy report in February. The numbers in brackets are what the same forecast was in its November report

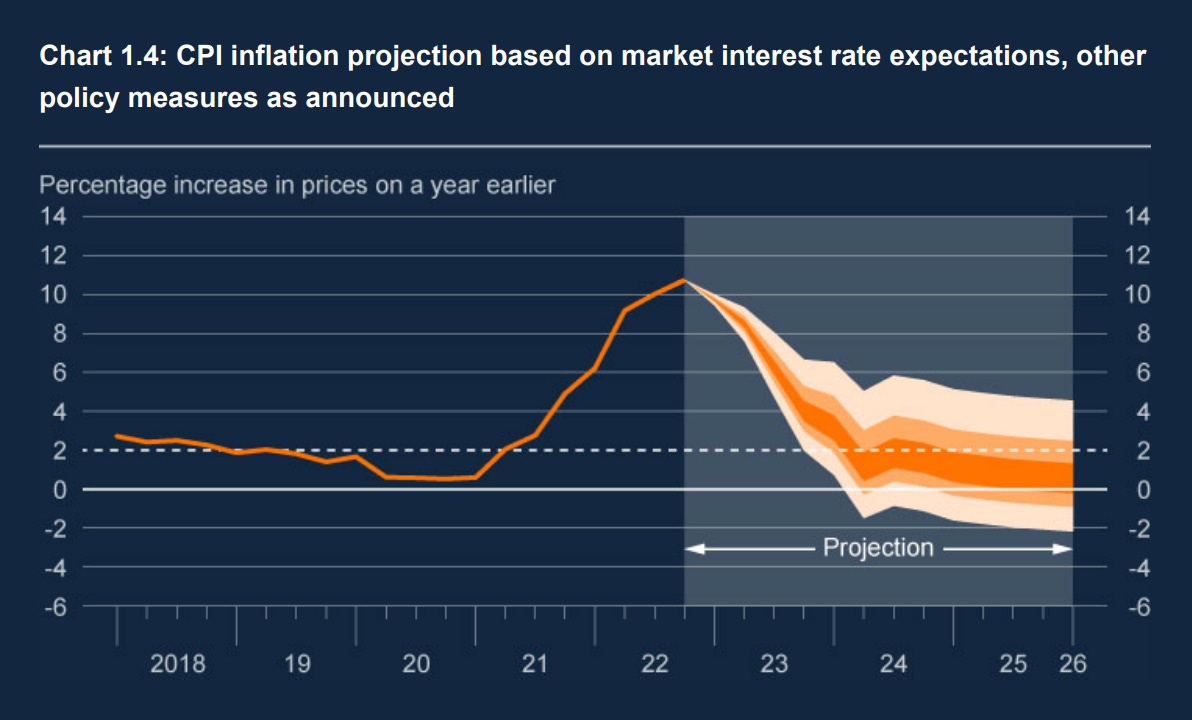

This is its forecast for how CPI will move in more detail, with the fan chart designed to show the range of potential outcomes…

And this is what financial markets are forecasting for interest rates in the future according to the Bank’s report in February, which maps out how they could move over the coming months…

Charlie Nunn, the chief executive of Lloyds Banking Group, gave an interesting insight into the importance of interest rates to households and the UK economy in an interview at the weekend. Lloyds is the biggest mortgage lender in the UK so is particularly relevant on this issue. Nunn said that it was not necessarily the peak for interest rates that matters but how long they stay at current levels, which is way above the level they have hovered at since the financial crisis, as you can see from the graph above. Nunn told The Sunday Times:

“The bigger debate for most customers is do we stay at 3 per cent or 3.25 per cent for longer, or do we come back down towards 2 per cent or below. That’s probably going to be the bigger challenge for families and businesses over the next two or three years.”

You can read the full interview with the Lloyds boss here

Podcast…

A reminder that our latest podcast episode looks at lessons from the Dot-com crash with Rob Hornby, the managing director of Alix Partners in London. You can listen to the episode on Substack here, Apple here and Spotify here. The new episode of Business Studies arrives on Tuesday and you can listen to all our previous episodes being clicking the icon below…

Other stories that matter…

Shares in Manchester-based online THG are up more than a third after private equity group Apollo approached it about a takeover (Reuters)

Another example of how local department stores across the UK are being repurposed. The fast-growing call centre group ResQ has got a £750,000 levelling-up grant to convert the second floor of the old Hammonds of Hull department store into office space for 520 staff. The ground floor of the Hull department store, which closed in 2019, has already become a food hall (Business Live)

A look at why political beliefs make people inherently illogical and unreasonable in debates. This piece explains a lot about why social media is such a heated place to discuss politics (Thinking in Bets)

A remarkable fact: almost a third of all shoplifting arrests in New York City in 2022 involved just 327 people. These people were arrested and rearrested more than 6,000 times. Is this the same in the UK? (Marginal Revolution)

I enjoyed this piece from The Athletic about Premier League footballers who don’t actually like football. How much does this matter? How much does it matter in any career? We seem to hold certain professions to different standards irrespective of the skills of the individual (The Athletic)

Lastly, check out our Sunday press review for a round-up of all the interesting business coverage in the papers. Paying members were sent this on Sunday and you can sign-up to read it and get future editions here

And finally…

There will be no Off to Lunch on Friday as I am away for a short-break. We will be back on Sunday with the press review. As mentioned above, the latest Business Studies episode will also be with you on Tuesday as usual.

One thing I will be keeping an eye on this week is the brilliant Eliud Kipchoge running the Boston Marathon for the first-time later today. Kipchoge could become the first man ever to win all six of the world’s big marathon events if he wins this race and then adds New York City later this year. He has already won Berlin, Chicago, London and Tokyo.

The hills of Boston and unpredictable weather have the potential to derail any runner, even the fastest marathon runner of all time. The Wall Street Journal has done a great preview of the race and Kipchoge’s debut here. The New York Times has also looked at what happens when amateur runners try to keep up with Kipchoge’s absurd world record pace of a 4:37-per-mile. That is here.

Closer to home, congratulations to everyone who ran the Manchester Marathon on Sunday and best of luck to everyone running the London Marathon this Sunday. I have run the London Marathon twice and watched it numerous times. It truly is one of the great sporting events…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham