Hello and welcome to the latest edition of Off to Lunch…

The Bank of England has dampened growing expectations that interest rates could be cut next year. Andrew Bailey, the governor of the Bank, said there is “still some way to go” in the fight against inflation as the monetary policy committee voted to hold interest rates at 5.25 per cent in the UK.

Financial markets had rallied ahead of the announcement today about the Bank’s latest decision because of a growing belief that central banks around the world will cut interest rates next year. However, while the Bank’s decision to hold rates at 5.25 per cent in this meeting was expected, there will be disappointment around its hawkish commentary on the outlook.

In contrast, the Federal Reserve in the US signalled last night that it could cut interest rates by 0.75 percentage points next year. The base rate of interest in the US stands at between 5.25 per cent and 5.5 per cent. Jerome Powell, chair of the Fed, said the US is “likely at or near its peak for this tightening cycle”.

The FTSE 100 was up 2 per cent this morning following the comments from the Fed. This is how the FTSE 100’s performance in 2023 so far now looks. A Santa rally - the nickname given in the City for a bounce in financial markets in December - is well underway…

However, that rally has unwound slightly after the Bank’s comments, with the FTSE now up only 1.5 per cent on the day.

The Bank’s monetary policy committee, the nine-member group which sets interest rates in the UK, voted 6-3 to hold rates at their meeting. The three votes against holding rates at 5.25 per cent were actually votes to increase interest rates to 5.5 per cent by Megan Greene, Jonathan Haskel and Catherine Mann.

The Bank indicated that interest rate cuts are still some way off by including a particular wording in its statement. The phrase is in bold…

The MPC will continue to monitor closely indications of persistent inflationary pressures and resilience in the economy as a whole, including a range of measures of the underlying tightness of labour market conditions, wage growth and services price inflation. Monetary policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with the Committee’s remit. As illustrated by the November Monetary Policy Report projections, the Committee continues to judge that monetary policy is likely to need to be restrictive for an extended period of time. Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.

You can find the Bank’s statement here

Other stories that matter…

1. Thames Water has appointed Chris Weston, the former boss of Aggreko and British Gas, as its new chief executive. Weston will lead efforts to turnaround the debt-laden water company. Story here and Thames Water statement here

2. Family-owned businesses have an advantage over others because they take a long-term perspective, have robust internal management processes and are conservative with their spending. That is according to new research by McKinsey. You can read more from Inc magazine here and see the research by McKinsey here

3. Mashable has published a fascinating list of the tech that died in 2023 and why. The piece looks at why some products - like the Amazon Halo and Google Glass - failed, and why others - such as Netflix delivering DVDs - were replaced by new innovations. You can read the list here

4. From Business Leader, a look at how the new generation of young workers - Generation Alpha - will differ from previous generations. This new generation - born between 2010 and 2025 - is more focused on working for businesses that reflect their values, are reliant on tech and want instant feedback rather than annual reviews. You can read more here

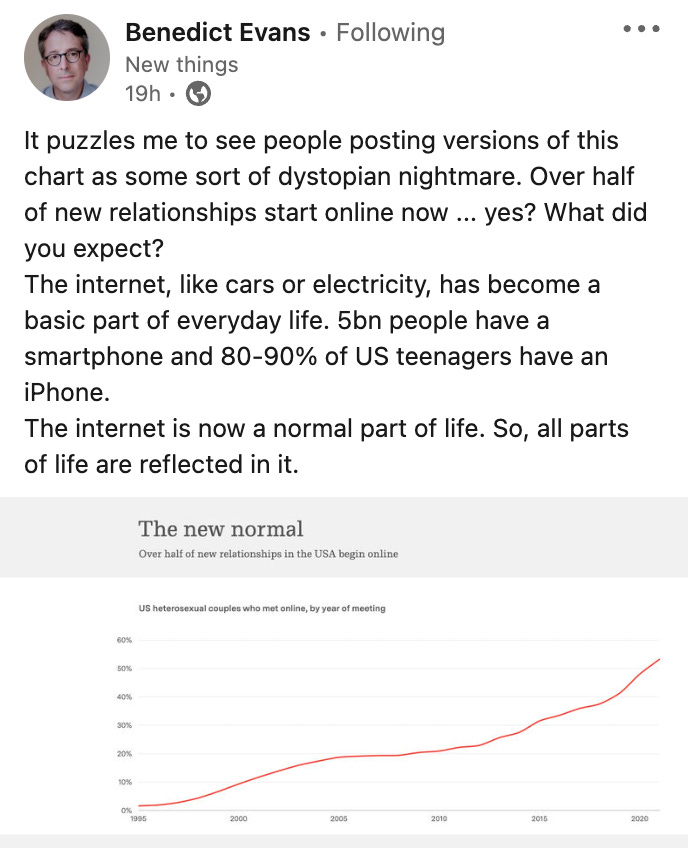

5. Tech analyst Benedict Evans has published his latest annual presentation looking into the macro and strategic trends in the industry. This presentation is always worth checking out and includes plenty of interesting facts. As you may expect, AI features prominently. You can find the presentation here and see one of the interesting facts below about how more than half of new heterosexual romantic relationships now start online…

Podcast…

A reminder that the latest episode of our Business Leader podcast looks at one of the most promising new businesses being built in the UK. We speak to Alex Kendall, the co-founder of Wayve, about why his London-based company may hold the answer to self-driving cars being on our roads, not the tech giants in Silicon Valley or the automotive industry in Detroit.

You can listen to the episode on Substack here, Spotify here or Apple here

And finally…

It’s the middle of December, so it’s probably time to talk about some Christmas movies in this section. Firstly, yes, Die Hard is definitely a Christmas film and should be enjoyed at this time of year. Secondly, this year is the 20th anniversary of the release of Elf, another excellent Christmas film. To mark that anniversary some people have started to take the film far too seriously. The Guardian, for instance, has looked at why Elf may be “a chilly lesson in capitalism”. You can read more on that here

As an aside, The Wall Street Journal has also done a great piece on the business behind watching films and TV shows on planes and how airlines decide on their line-up. Here is an extract:

Airlines worldwide spend an estimated half a billion dollars a year on movies, television shows, live TV, podcasts and music, according to Anuvu, which helps United, Southwest and other airlines select the right mix of content…

Airlines take this question seriously. In a major about-face, United is outfitting all of its planes with seat-back screens. They are now on about half of its fleet. The airline took pricey seat-back entertainment systems off planes years ago as more travelers brought their own devices. United Chief Executive Scott Kirby has said the screens will make passengers “pick United more, and more often”.

You can read that piece here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox

Best

Graham