The retail industry is split. How this divide plays out from here will affect the future of the high street, how much we pay for online shopping, and how businesses interact with the government.

A collection of Britain’s biggest shops have set up a new lobby group called the Retail Jobs Alliance to push for a reduction in business rates. Crucially, they have said they are “open to the possibility of funding this through the introduction of a new online sales tax”. The members of this group include Tesco, J Sainsbury, Wm Morrison, the Co-operative Group, Kingfisher (the owner of B&Q), Waterstones, and Greggs. Together they employ about 1 million people.

This is a significant development for the future of the retail industry and relations between businesses and the government in the UK.

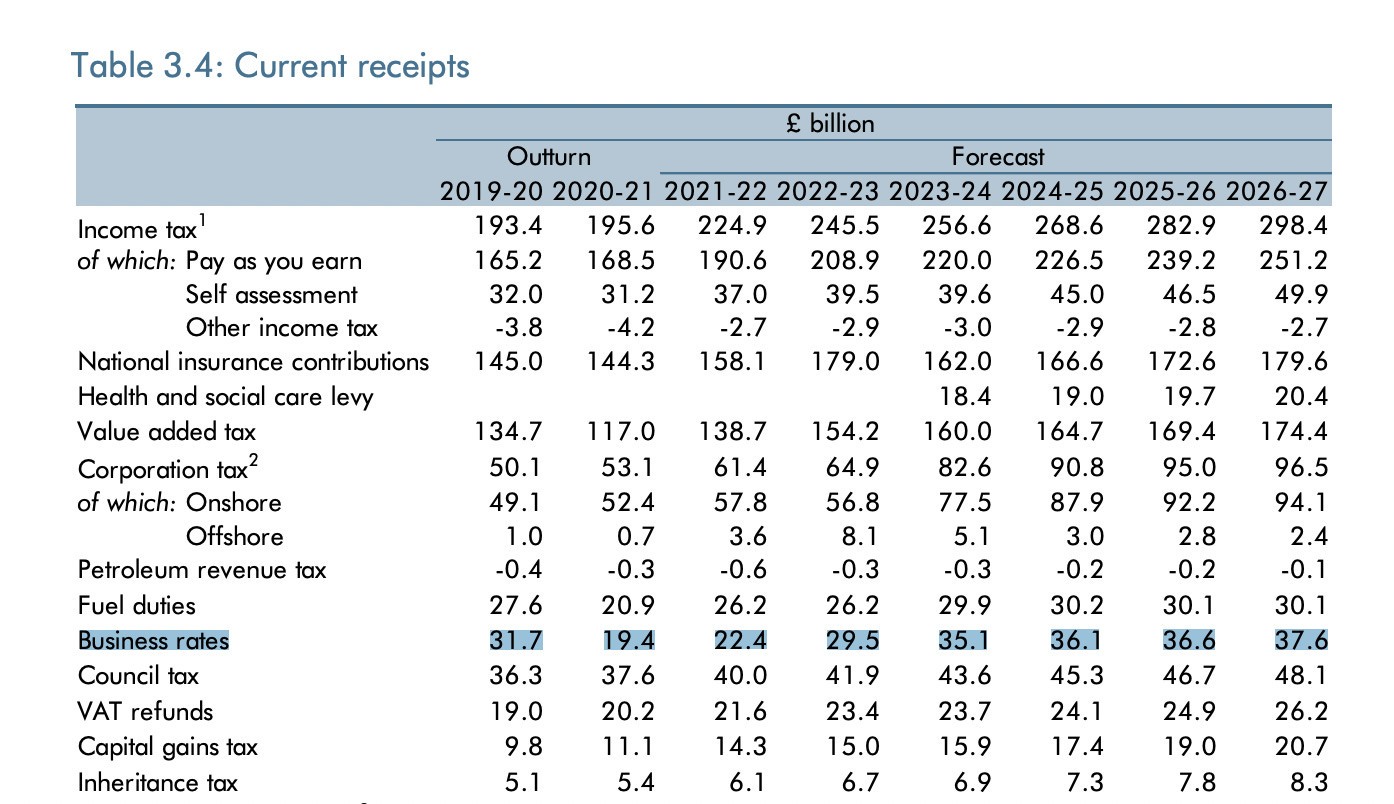

Firstly, it is signal from some of the UK’s biggest retailers that they are willing to accept a tax on online sales in order to reduce the tax they pay on their physical shops. Here is a quick reminder of the cost of business rates from the Office for Budget Responsibility’s March forecasts…

As you can see, it is one of the biggest sources of revenue for the Treasury and is due to rise dramatically in the next few years. Pre-Covid, Tesco was paying much more in business rates than corporation tax (roughly £700 million v £370 million in 2019). The tax is charged on commercial property through a calculation based on the rental value of the property and the rate of inflation. However, retailers feel the tax is outdated (its origins go back to the Tudors) and that it places disproportionate importance on the economic value of physical shops when the online world is growing so fast. This chart from the Office for National Statistics shows how online and in-store spending in the UK are gradually converging each year (although not as fast as some suggest)…

A 1 per cent tax on online sales has previously been suggested as a way to cut business rates by 20 per cent. Tesco’s results for the year to the end of March showed online grocery sales of £5.9 billion, so a 1 per cent tax on that is £59 million. A 20 per cent reduction to a £700 million business rates bill would be worth £140 million.

Who would pay for this online sales tax though? Would it just be passed on to customers by the retailers that are hit with it? It threatens to push up the price of online shopping. The Retail Jobs Alliance are aware of how critics of the proposal will portray it. So, in a letter to Rishi Sunak outlining their idea they refer to business rates as a “shops tax”. This is an extract from the letter:

"A meaningful cut in the Shops Tax would make a big difference to retailers' ability to invest more in the shops and stores that we know customers value, as well as to create jobs.

"This would make it easier for everyone in the retail sector to mitigate inflationary pressures, keep existing shops open and open new ones.”

A second reason this move is important is that it is being done outside the main business trade bodies in the UK, such as the CBI and the British Retail Consortium. The Retail Jobs Alliance is describing itself as a one-issue group. The problem for the CBI and the BRC is that their members are split on business rates and the online sales tax. They have found it difficult to agree a clear stance. Both organisations have tech giants among their members (you can read more about that here) as well as traditional UK retailers like John Lewis, Next, and Currys who have spoken out against an online sales tax and have a bigger proportion of their sales online than Tesco.

There are going to be more and more issues where the interests of bricks-and-mortar and online businesses are not aligned – advertising, data, planning, other taxes. A collection of online retailers including Ocado and Asos have already backed their own trade body called the Digital Business Association. This threatens to reshape how businesses and the government interact. It also means the government will have difficult decisions to make on who it wants to side with.

You should also read this

A preview of the Federal Reserve’s announcement on interest rates tonight from John Authors and the balancing act it is trying to strike (Bloomberg)

The co-founder and boss of craft beer brand Brewdog is to grant staff £100 million of shares to staff, a 5 per cent stake in the company and part of his 24.2 per cent stake. Brewdog will also share 50 per cent of profits from its bars. The Aberdeen-based company has faced criticism over its treatment of staff (Twitter)

Airbnb said in its results it expects a bumper summer for travel following similar comments by a string of airlines (Times)

EDF has warned of the risk of more delays and cost increases to the Hinkley Point C nuclear power station (Reuters)

The US Securities and Exchange Commission is stepping up its efforts to clamp down on cryptocurrency scams by hiring new staff (Coindesk)

Kraken, one of the leading cryptocurrency exchanges, is launching an NFT platform (Block)

Buy-now-pay-later borrowings through Klarna will show up on your credit report from next month. The key question now is how credit rating agencies and lenders will choose to use and score that information (BBC)

A chart that helps you understand the world

This is the share price graph for Cazoo, the UK-based online car dealer, since it listed last year. Cazoo floated through a special purpose acquisition company (Spac) deal, which basically involved it reversing into a shell company that was already listed and had agreed to buy it. Cazoo is listed in the US, not the UK, and its struggles on the stock market show that for all the complaints that markets in the UK don’t understand tech companies or give their founders the freedom to work, life is not necessarily easier across the Atlantic. Alex Chesterman, the founder and chief executive of Cazoo, said the company is suffering from an irrational fear in markets. The comments from beneath that Times story from readers are not sympathetic and worth a read…

And finally…

It is the Miami Grand Prix in Formula 1 this weekend and it is one of the hottest sporting tickets of the year for business leaders, corporate sponsors and celebrities, particularly in the US. The track has been built around the Miami Dolphins’ Hard Rock Stadium and even includes a fake marina with yachts. It is also a big weekend for cryptocurrency. Miami is the unofficial cryptocurrency capital of the world and there are going to be adverts everywhere. I take a close interest in F1 because my wife is the motor racing correspondent for The Times. You can follow her on Twitter here. I have asked her to report back on the prominence of crypto at the event and in Miami itself…

Thanks for reading. Off to Lunch will be back on Friday. If you want to contribute to the work of Off to Lunch, then please sign up for a paid subscription below. Alternatively, please just spread the word!

Graham