Hello and welcome to the latest Off to Lunch…

There are two fascinating reports out this morning about the state of the UK. There is the Bank of England’s latest Financial Stability Report, which looks at the health of the financial system, and a report on regional inequality, poverty and productivity by the Fabian Society, a left-leaning think-tank.

Let’s look at the Bank’s report first and then the Fabian Society’s work, which is called A Good Life In All Regions…

The photo above is Andrew Bailey, governor of the Bank of England, presenting the Financial Stability Report this morning. Despite his wearied expression, there was good news from the Bank - the UK’s largest banks all passed the latest annual stress test. This stress test looked at the finances of the banks in a scenario where interest rates hit 6 per cent (we are at 5 per cent already), the UK entered a deep recession where GDP fell 5 per cent, unemployment more than doubled to 8.5 per cent and house prices fell by 31 per cent. The banks took losses of £125 billion on bad loans but were still “resilient”, the Bank of England said.

Alongside this stress test, the Bank’s latest Financial Stability Report shows the strain on the UK economy today. However, it also contained some good news by suggesting that the pressure on households from debt will be less than it was during the financial crisis, despite the rise in mortgage rates.

Here are five key graphs from the Bank’s report that I wanted to pick out:

Firstly, the yield on 10-year government bonds - called gilts in the UK - has risen in the UK ahead of other countries. This increase feeds through to higher mortgage rates and higher interest charges for the government on its debt…

Second, all the leading house price indicators show that house prices are levelling off or falling…

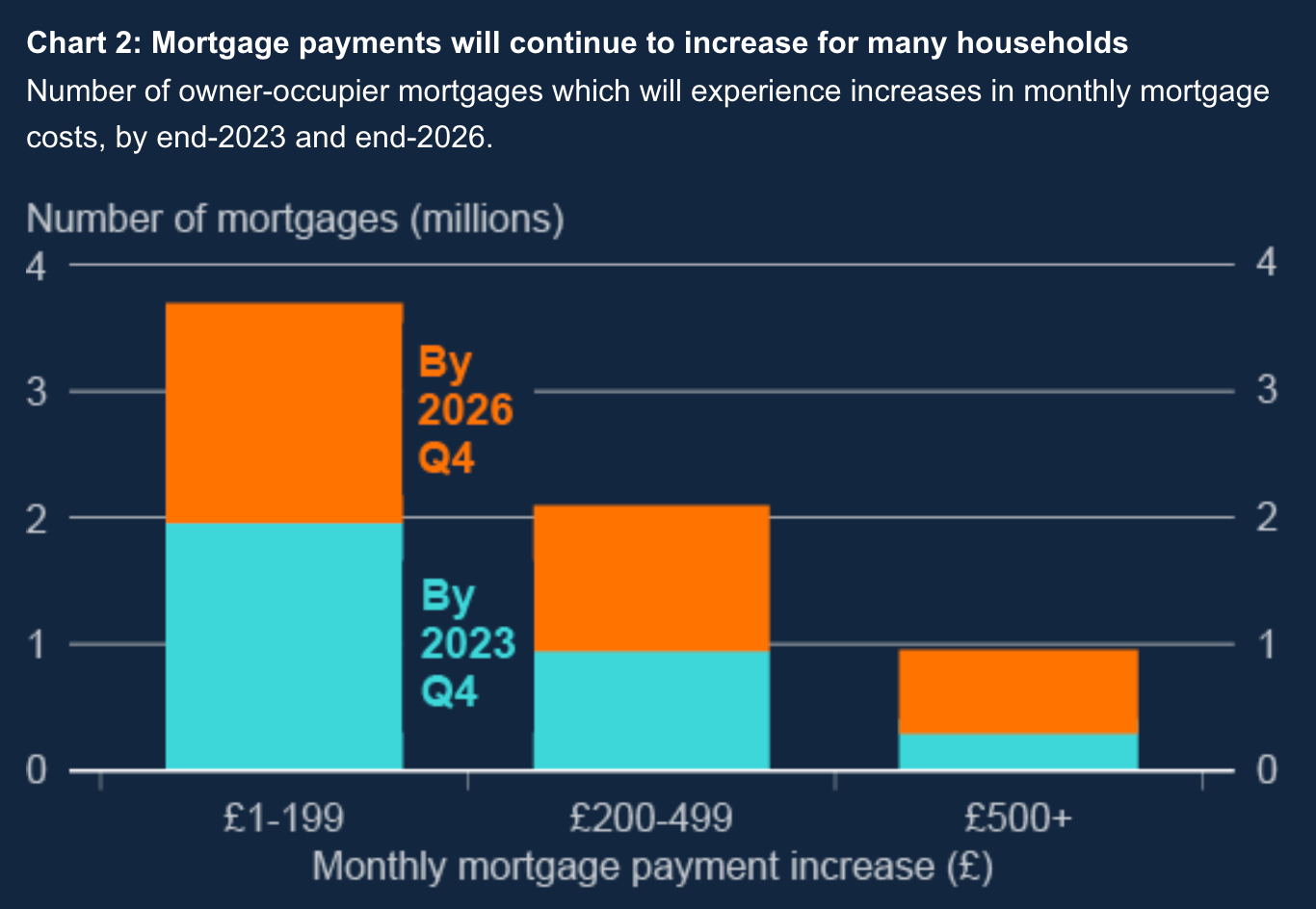

Thirdly, nearly one million households in the UK will see their monthly mortgage payments increase by at least £500-a-month between 2023 and the end of 2026. This is due to higher interest rates on new mortgage deals...

However, households are carrying less debt than they were during the financial crisis. This graph shows household debt compared to household income…

Lastly, only a limited percentage of corporate debt in the UK is due to expire over the next couple of years. This means many businesses can wait to refinance and avoid taking on debt with higher interest rates in the next couple of years…

If you want to read more on this then you find the Bank’s report in full here. You can also watch Bailey take questions about the report in a press conference below…

Other stories that matter…

1. Nearly half of the net new jobs created in England since 2010 have been in London and the south-east according to a new report by the Fabian Society. 46 per cent of the new jobs were in London and the south-east while just 2 per cent were in the north-east, the report said. The Fabian Society, a left-leaning think tank, warned that the UK is suffering an “overheating” problem, where areas with high productivity also have high poverty because the cost-of-living is high. This is primarily an issue in London boroughs. The report, the result of 18 months of work, emphasises the need for jobs and investment to be more evenly spread across the country. It calls for the devolution of more services to local authorities - such as buses, job centres, and childcare - as well as more power for mayors and councils on tax and spending. The British Business Bank should also be given extra powers to invest in promising businesses outside the south-east, the Fabian Society report says.

Here are three interesting graphs from that report:

Firstly, the UK is more centralised than other countries…

Secondly, a look at how productivity and poverty compare across the country…

Finally, this is capital investment in the UK compared to France and Germany. The UK is in red…

You can find the full report here

2. High Speed Two Limited, the public body leading construction of HS2, is looking for a company to design and build a £270 million monorail that will link the new Interchange Station in the West Midlands with Birmingham Airport and the NEC. Story here

4. Residents in Redcar, Yorkshire, want a vote on whether there should be a trial of hydrogen heating in the town. Redcar is the only candidate left for the hydrogen trial after Whitby in Cheshire pulled out due to local opposition. However, Redcar residents have written to the government to warn there is a "lack of substantial local support" for their town to run the trial. Story by The Yorkshire Post here

4. The estate agent group Winkworth has warned that pre-tax profits for this year are expected to be lower than 2022 and below City forecasts because of a drop in the number of property sales being completed in the UK. Winkworth said that revenue from property sales was down around 20 per cent in the first half of 2023 compared to the same period last year. Revenue from lettings was up 11 per cent. The statement from Winkworth is the latest evidence that a slowdown in the housing market could affect the volume of transactions more than house prices. This would mean it is worse for estate agents than housebuilders. Statement here

5. A fascinating interview with author Anupam Jena about this new book Random Acts of Medicine, which looks at how seemingly random events can have long-lasting consequences. For example, children born in autumn can help their grandparents to live longer because when they have their annual check-up each autumn the flu vaccine is more likely to be available and they are more likely to have it, meaning the grandparent is less likely to catch flu from them. Also, marathons increase the risk of someone who has had a heart attack in the area dying by 15 to 20 per cent because road closures can delay access to hospitals. Piece here

And finally…

After looking at some sports photography in yesterday’s edition, I have another image for you today. Check out this photo from the steelworks in Redcar earlier this month. The steelworks is being demolished and this is what is left. It looks like a sci-fi movie…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham