And this from the Wall Street Journal…

And this…

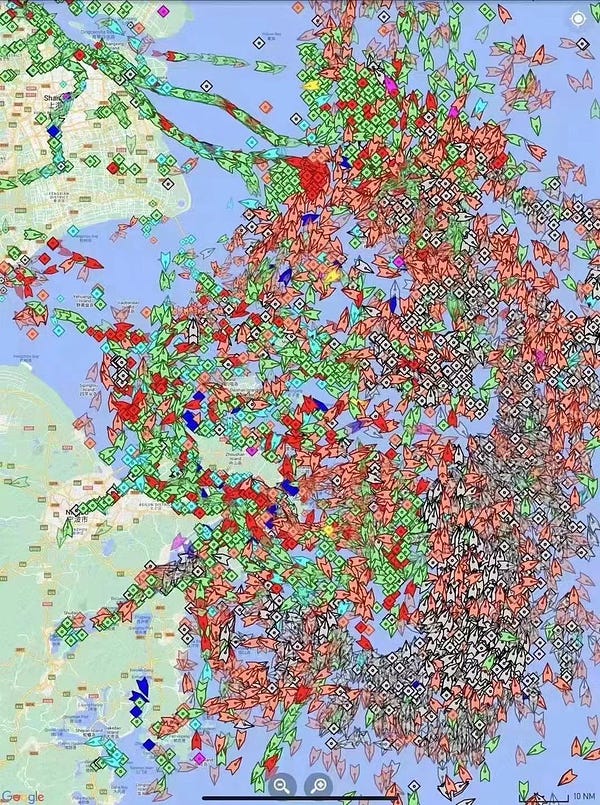

I had planned to start today’s newsletter with something upbeat, something constructive. But this is what people in the City are talking about right now. That first tweet has been shown to me numerous times this week – online and in person. There is real concern that the Covid lockdowns in China are delivering another blow to supply chains and the global economy, which are already under strain. As well as the traffic jam of ships outside Shanghai, half of Apple’s suppliers are in areas hit by lockdown according to a report by Nikkei.

On top of the concern about China, there is discomfort in the City that central banks and politicians are not being frank about what the consequences of increasing interest rates could be for the economy (as explained in that WSJ article). There is a sense that a recession is a real possibility, if not likely, and that the International Monetary Fund's forecast earlier this week that the UK economy will grow by 3.7 per cent this year will end up being optimistic.

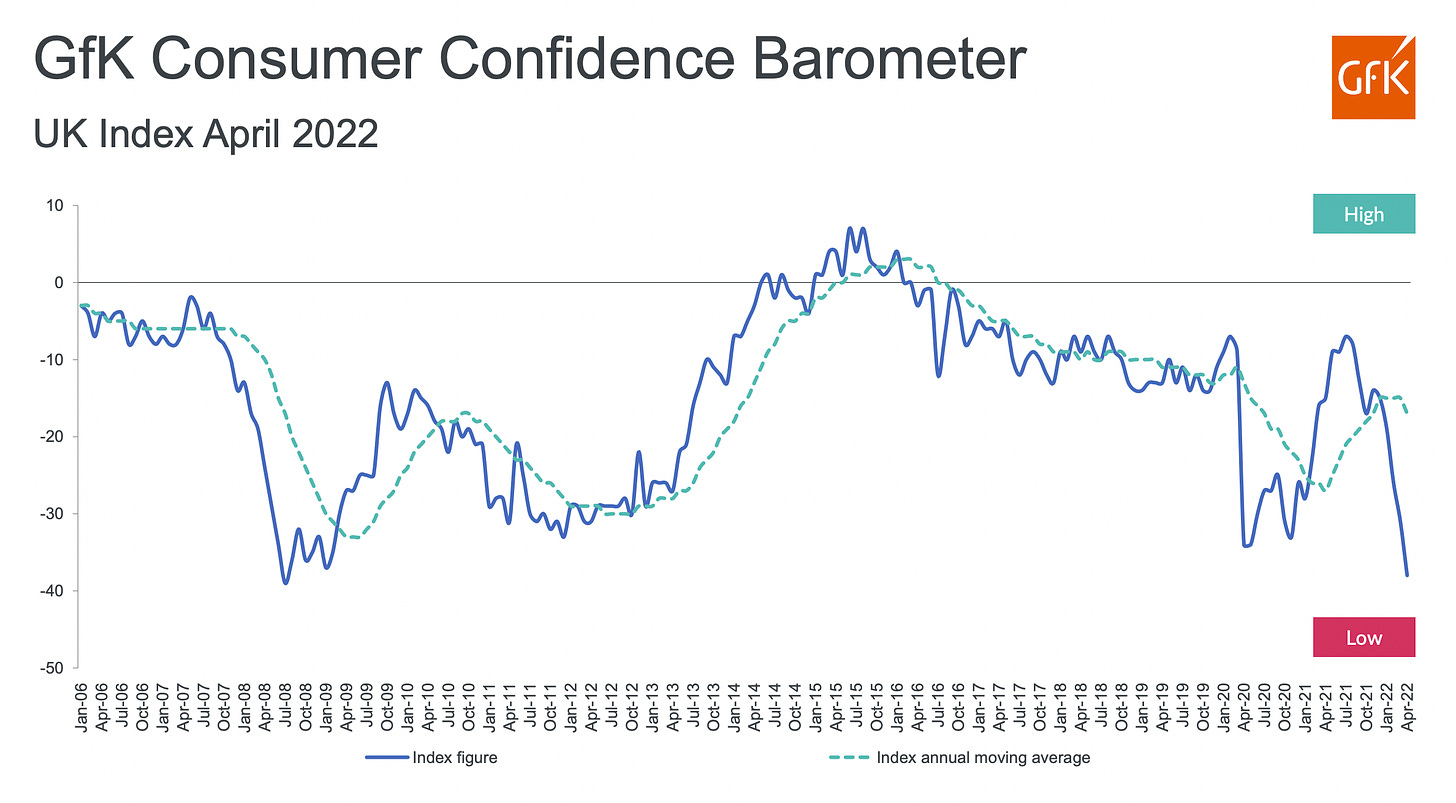

The GFK consumer confidence figures published this morning are undeniably grim. This survey is considered the benchmark for the mood of households by economists and is closely watched by the Bank of England. GFK’s main consumer confidence reading fell to –38, only just above the record low of -39 that it hit during the financial crisis in 2008. This from Andy Bruce at Reuters is worth noting….

Interestingly, there already seems to be a shift in tone from the Bank of England. Andrew Bailey, the governor of the Bank, said last night that it is “walking this very, very fine line” as it tries to balance tackling inflation with “the risk that creates a recession and pushes too far down on inflation”. Bailey was speaking at the IMF and World Bank spring meeting in Washington and his comments have led some to wonder if he had an early sight of the GFK numbers.

Apologies again for the downbeat start…

Sport will be a winner from Netflix’s woes

Plenty has already been said and written about Netflix’s brutal week and there will be more to come at the weekend. A lot of it is noise. Streaming is not going anywhere and neither is Netflix – it still has 222 million subscribers, 33 per cent more than it did pre-Covid at the end of 2019. However, here are two signals we can take away from Netflix’s disappointing results.

Firstly, the share price reaction. The 35 per cent fall on the day after the results was a response to a significant downgrade of short-term and long-term expectations for Netflix. There was also alarm at boss Reed Hastings sounding so concerned on the earnings call and announcing the company was looking at introducing advertising (investors hate sudden strategic shifts). But, as John Authors said in his superb Bloomberg column, it also revealed one of the “fallacies” behind investing in the big tech companies - they are all priced to dominate and yet they can’t all dominate. As a result, expect to see more and more takeover chatter about Netflix.

The second point is about content. The heart of this Netflix story is straightforward - its content simply hasn’t been good enough to drive more growth. This is a company whose success has been built on mega-hits – House of Cards, Squid Game and more. What we have had so far this year? Inventing Anna? Is it Cake? Love is Blind? They currently score 6.9, 5.7, and 6.1 out of 10 on IMBD. My brother-in-law has a rule that he won’t watch a film or TV series unless it has scored more than 7 on IMDB. That rule works pretty well for me too. A few years ago Netflix may have been able to get away with an underwhelming quarter, but not now – not with surging inflation putting pressure on household finances and competition from powerful, well-funded rivals. Those well-funded rivals include Apple, which is currently offering viewers the Oscar-winning film Coda (8 on IMDB), sci-fi series Severance (8.7 on IMDB) and the promise of a new series of Ted Lasso (8.8 on IMDB, the same, incidentally, as Succession).

It is a credit to Netflix that its quality content has got it this far. However, it now faces a challenge that any maturing subscription service eventually faces - how to stop churn (subscribers cancelling their subscriptions) and keep growing revenues. Advertising is one way, but rethinking its content is another. BSkyB considered sports to be central to reducing churn as it grew through the 1990s and 2000s, BT has also reduced its churn on the back of winning the rights to show Premier League and Champions League. Broadcasting live sport attracts a loyal fanbase and offers the prospect of unscripted drama beyond what any scripted show can do. Ted Sarandos, Netflix’s co-chief executive and chief content officer, was asked about the company’s stance sport on the earnings call by an analyst at JP Morgan and said this:

“We're not quite so sure that you can add the big profit stream by adding sports. Other folks are trying it, and we're going to, and we've gone down this other path. In the meantime, we're incredibly excited about Formula 1: Drive To Survive as an example of sports-adjacent programming that our members really value. We've grown the sport tremendously. We're taking that bet in the world of tennis and golf and others coming up. And we also have an incredible sports documentary business that keeps growing. So I'm not saying we never would do sports, but we would have to see a path to growing a big revenue stream and a big profit stream with it.”

I think Netflix and the other streaming services will eventually be forced to bid for more live sport. Apple and Amazon are already moving further into sport. Apple will show baseball on a Friday night this summer while Amazon has won the rights to show Thursday night games in the NFL from September. Amazon is paying an extraordinary amount to show American football. The contract with the NFL is thought to be worth $1 billion a year for 10 years. It has also poached Al Michaels from NBC to be its main commentator in a deal worth more than $10 million a year. There will be more deals like this to come…

Robinhood coming to the UK

The US trading platform announced this week it has agreed to buy Ziglu, a UK cryptocurrency business. After scrapping plans to launch in the UK in 2020, Robinhood has made it clear it plans to use this deal to bring its brand across the Atlantic. Ziglu is one of the few crypto businesses that has won approval from the Financial Conduct Authority’s registration scheme.

While the likes of Hargreaves Lansdown, AJ Bell, Interactive Investor and Etoro helped to fuel a surge in amateur trading in the UK during lockdown, the country has not yet seen anything on the scale of Robinhood and its commission-free trading. This deal could be a significant development for wannabe amateur traders but also companies, who could have a new army of retail investors to deal with. Who knows, we may even see the UK equivalents of Gamestop and AMC emerge in a new meme-stocks craze

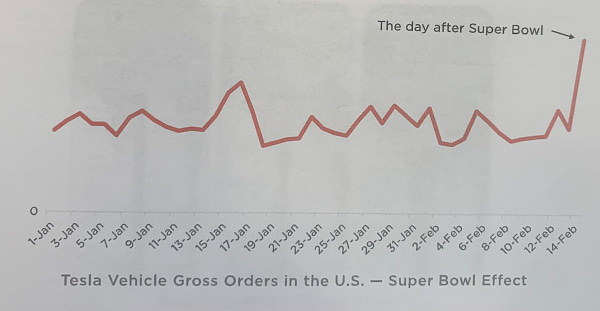

A chart that helps you understand the world

Tesla does not pay to advertise but saw a surge in orders after the Super Bowl because it benefited from other car brands advertising their electric vehicles.

You should also read this

Harry Wallop on the hunt for a coffee shop, hotel or even burger bar to work in (The Times)

And finally…

After quoting him in the launch newsletter for Off to Lunch, let me hand you over to Nassim Nicholas Taleb for a recommendation – the superb The Rest is History podcast.

Thanks for reading. Hope you liked the upgraded logo and design. Please spread the word about Off to Lunch and upgrade to a paid subscription below. Enjoy the weekend.