Thanks for reading Off to Lunch. If this newsletter was shared with you please sign-up to become a paying member. You will get full access to today’s newsletter, our Sunday press review, be able to attend our events and contribute to the work of Off to Lunch

The graph above shows the pound against the dollar over the last 50 years. As you can see, there have been peaks and troughs but the general trend is down. I have marked the events that occurred around each trough on the graph. The latest trough is right now. The pound is down nearly 15 per cent so far in 2022 and is on course to pass the last trough it hit in 2020 to reach its lowest level against the dollar since 1985. In trading this morning the pound was trading at around $1.158. That low in 1985 saw the pound dip to $1.05. The low in 2020 was around $1.146.

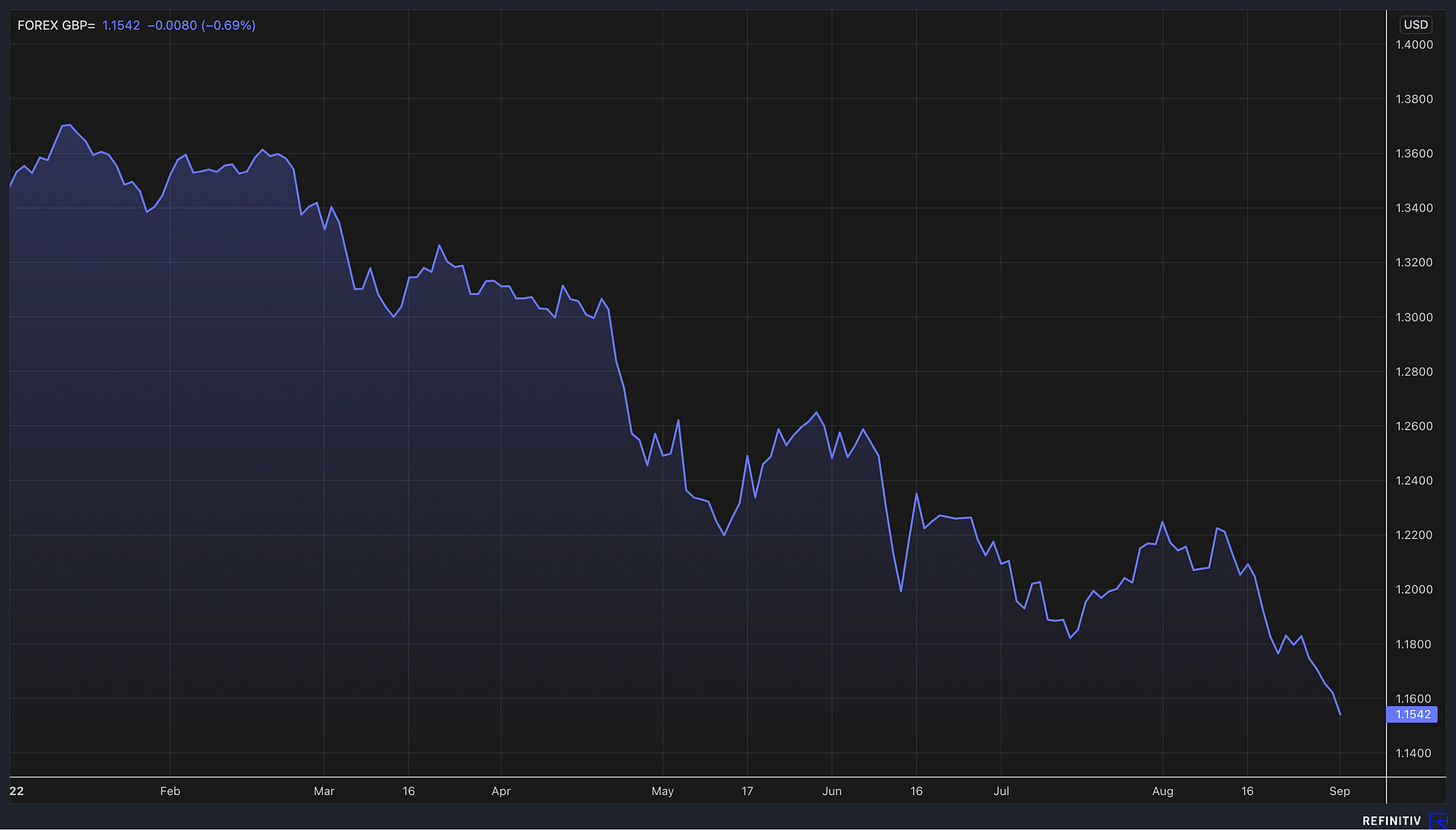

This is what the graph of the pound v dollar looks like so far this year…

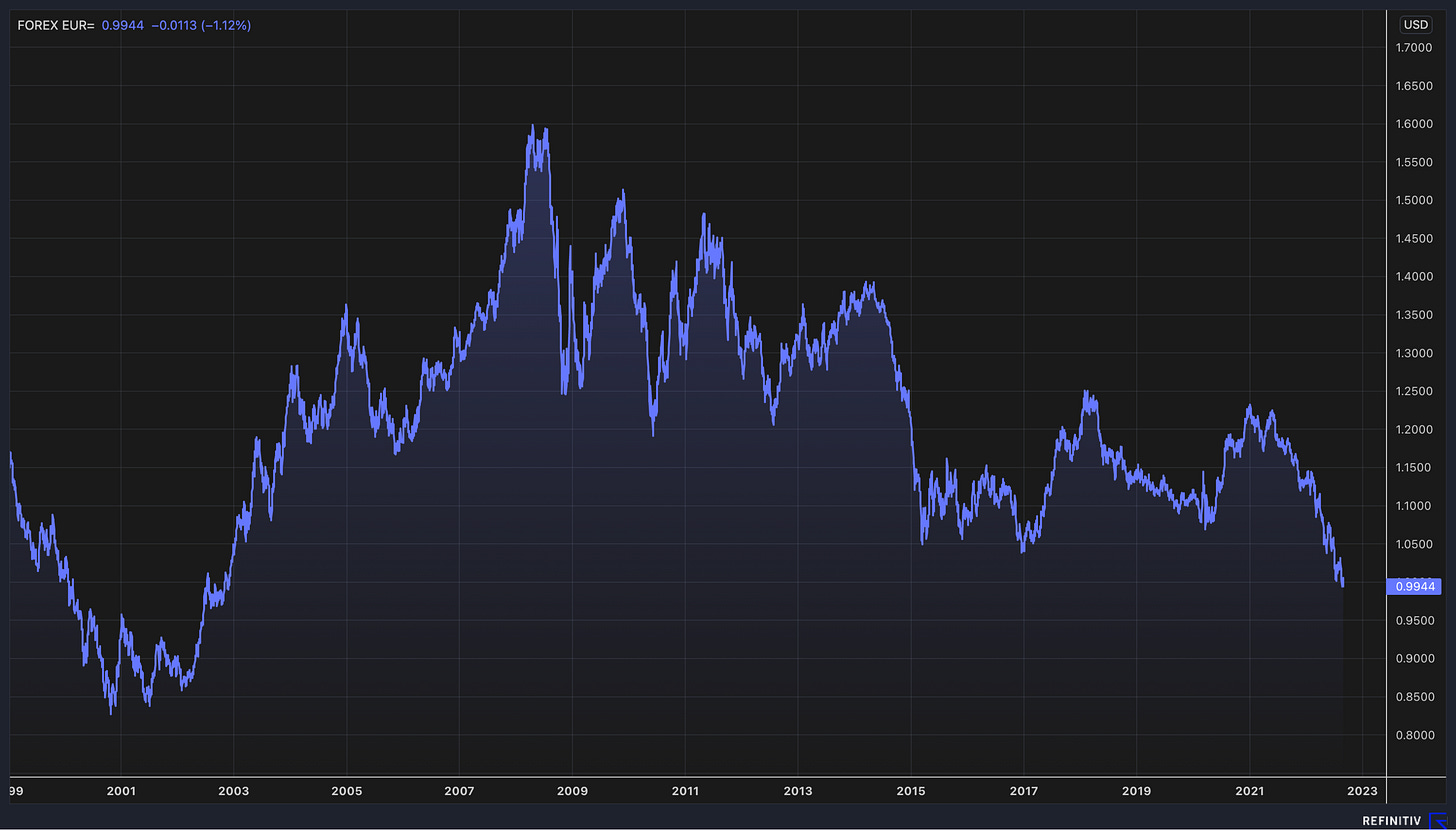

The pound is struggling against the dollar because, in simple terms, markets are rewarding the US for having a robust economy and the Federal Reserve for being aggressive in trying to stamp down on inflation. It is not just the pound that is suffering against the dollar. Look at the euro against the dollar since it launched in 1999…

To put this graph in context, it shows that the one euro is worth less than one dollar for the first time in 20 years.

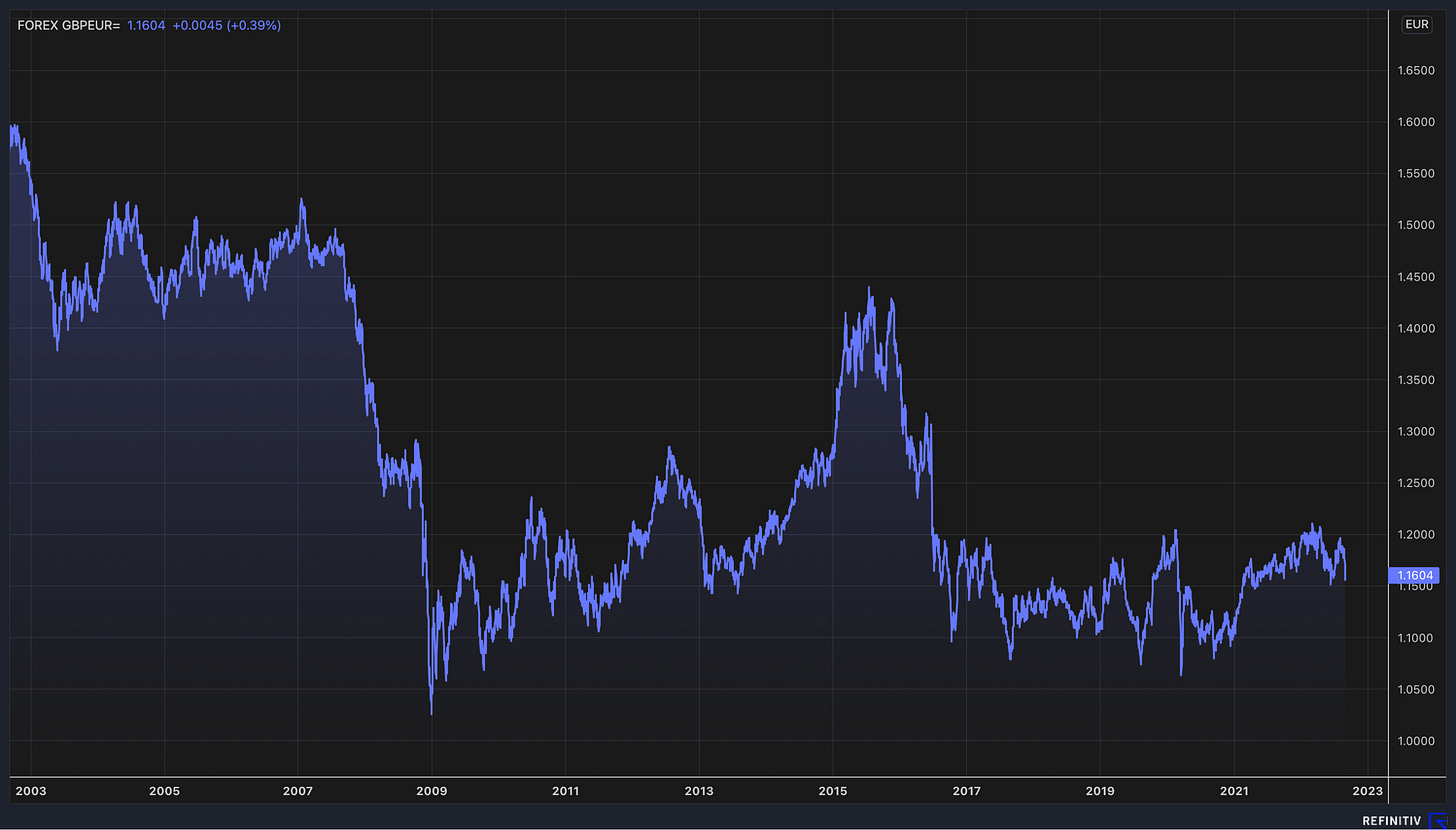

Next, let’s look at the pound against the euro over the last 20 years. This looks similar to the pound against the dollar apart from the last couple of years, when the pound actually gained some ground on the euro before a dip in recent months…

The pound’s drop against the dollar is an increasing problem for the government and the Bank of England. It means the government has to pay more interest on its debt and that the cost of importing things, including oil and gas, is going to get yet more expensive. As Chris Giles, economics editor of the Financial Times, pointed out, financial markets are betting that the Bank of England is going to have to get more aggressive on tackling inflation…

Kit Juckes, chief foreign exchange strategist at Société Générale, gave a particularly gloomy assessment of things in The Times this morning…

“Sterling’s support is waning. The UK economy is in recession, the balance of payments is catastrophic and more or faster rate hikes won’t do much to restore confidence.”

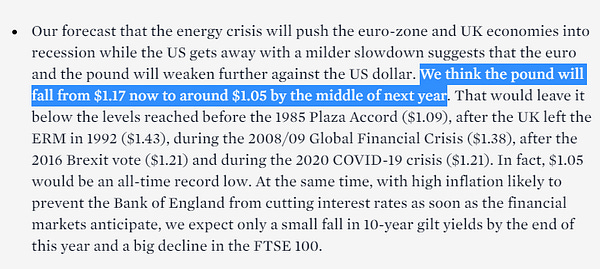

As Richard Fletcher, business editor at The Times and my former boss, pointed out, Capital Economics is forecasting that the pound will drop to its 1985 low against the dollar by the middle of next year…