Hello and welcome to the latest edition of Off to Lunch. There is more news about Thames Water today…

The regulator of the water industry has warned that Thames Water has “significant issues to address”. Ofwat made the comments in a statement it has issued about the “financial resilience of the water sector”. This is Ofwat’s first public intervention since it emerged that the government is looking at whether to temporarily nationalise Thames Water due to concerns about its £14 billion of debts.

This is what an Ofwat spokesperson said:

“Over the last day or so, there has been a lot of commentary about financial resilience in the water sector with considerable focus on Thames Water in particular.

“We have been clear that Thames Water has significant issues to address – their environmental record and leakage performance, for example, are poor. Alongside the turnaround of their operational performance, they need to improve their financial resilience too.

“But that is all in the context of a company that has strong liquidity – it recently received an additional £500 million from shareholders and has £4.4 billion of cash and committed funding.

“Overall, the sector is continuing to attract international capital and is especially attractive to long-term investors such as pension funds. Indeed, there has been an additional equity injection of around £2 billion since 2020, with companies acting to strengthen their financial position.

“Ofwat will continue to keep companies’ financial resilience under close scrutiny and work with companies to ensure they take action to ensure that they have the financial backing to deliver for customers and the environment.”

Meanwhile, The Guardian is reporting that those involved in talks about the future of Thames Water - the government, Ofwat and investors - have been told that the company could need as much as £10 billion to improve its infrastructure to regulatory standards. The story quotes an unnamed minister as saying that the government has “no true grasp on the costs involved” when it comes to protecting Thames Water. You can read that story here

The Times also has a story that Sir Adrian Montague, the City grandee, could be appointed as the new chairman of Thames Water amid concerns about the future of the company. Has the government influenced this appointment? Sir Adrian is the former chairman of Aviva but has also worked for public sector bodies including Network Rail and British Energy. Story here

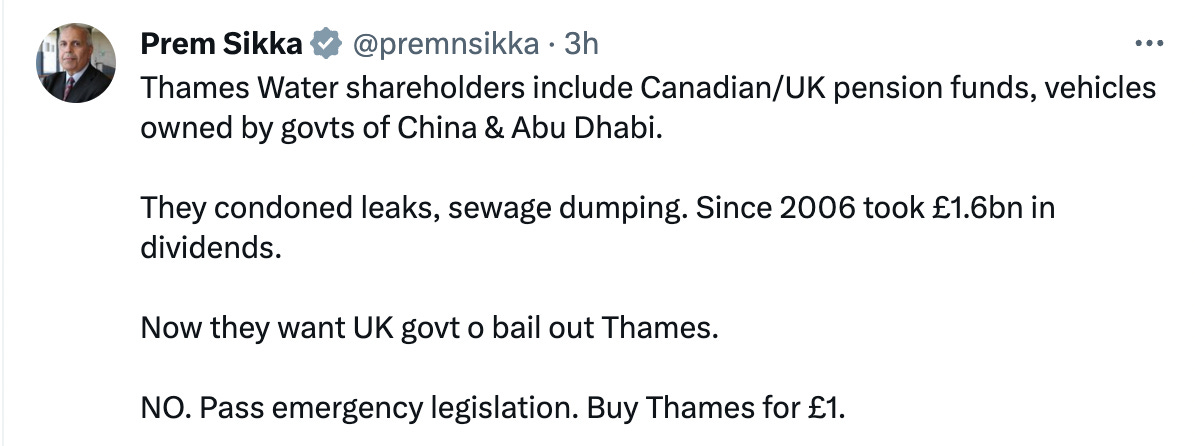

Thames Water is the largest water company in England. It provides water to 10 million customers in the south-east as well as sewage and waste-water treatment to 15 million. The reason this story has sparked so much attention is because it has reignited the debate about how essential services should be funded and owned. These Twitter posts show some of the reaction, including from those who you may expect to favour privatisation…

For more details on Thames Water’s complex corporate structure, FT Alphaville has tried to break it down by publishing a mind-bending graphic, which you can find here. Tim Short, a former investment banker at Credit Suisse First Boston, has also written what amounts to a case for the defence of Thames Water. He says that the corporate structure of Thames Water isn’t that complex, that paying dividends with debt is not inherently wrong, and that there is “no obvious risk” to the supply of water in the south-east and the operating company has “manageable debt levels”. You can find that piece here

Other stories that matter…

1. OpenAI, the company behind ChatGPT, has picked London for its first office outside the US. Other countries have been trying to attract OpenAI, a pioneer of artificial intelligence technology, so this is a coup for the UK. Sam Altman, the chief executive, said: “We see this expansion as an opportunity to attract world-class talent and drive innovation in AGI [artificial general intelligence] development and policy.” You can find the company’s statement here. Meanwhile, a collection of leading media companies including News Corp and the New York Times are in talks to create a new coalition that would involve them working together on the challenges that AI poses for the industry, such as chatbots being trained on their technology. Story here

2. An upgrade to the UK transport network has been successfully completed and opened - a £207 million tram extension in Edinburgh. Areas to the north of the city are expected significant economic benefits according to an analysis by property website CoStar here

3. Andy Haldane, the former chief economist of the Bank of England, appeared on Robert Peston’s ITV show last night. Haldane, of course, warned about the threat of inflation much earlier than others at the Bank. He made some interesting comments on the show about the Bank and inflation…

4. What role should the state play in technological innovation? The UK government is trying to help private companies build on the big strides they have made with quantum computing, where the country has emerged as a world leader. The government could help by improving quantum skills in the workforce and encouraging other companies to invest in the technology. However, the UK’s record on state intervention in technology is patchy, including a disastrous attempt to develop satellites in the 1970s. This is all looked at in an interesting analysis by Tech Monitor here

5. The Crown Estate has reported a 42 per cent increase in annual profits to a record £443 million. The Crown Estate owns property on behalf of the King. Its profits are paid to the Treasury but 25 per cent then goes towards funding the running costs of the monarchy. The Crown Estate’s history goes back to 1066 and it is one of the biggest landowners in the UK. The organisation’s profits were boosted by signing deals for six more offshore wind farms on the seabed around the UK, which it owns. The Crown Estate’s property also includes Regent Street, Windsor Great Park and retail parks across the UK. The value of its total portfolio rose 1.3 per cent to £15.8 billion in the year thanks to the offshore boost. However, the value of its London properties fell by 6.5 per cent to £7.2 billion and the value of its regional properties dropped 11.8 per cent to £1.5 billion. You can find the full results here

And finally…

The video game industry in the UK is world-leading and a real success story. One of the key players is Sports Interactive and its game Football Manager, which millions of people have spent hours of their life playing. The game is so addictive that it has been cited in divorce cases. The latest version of the game, Football Manager 23, has attracted 5 million players every month. However, Miles Jacobson, the studio director of Sports Interactive, has posted a blog in which he says the latest game “wasn’t what we’d wanted to deliver” and had “fewer new features than normal”. He added: “There are lots of reasons why this happened – but at the end of the day, as the head of the studio, the responsibility lies with me.” Jacobson then went on to lay-out Sports Interactive’s plans for the future, including a move to a new graphics engine and the introduction of women’s football for the first time. The blog represents an interesting and unusually transparent attempt to communicate with customers by a company that has inspired fierce loyalty. You can read the blog here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham