Hello and welcome to the latest Off to Lunch…

This is a big week for data on the state of the UK economy and it has started with the news that wages are rising at the fastest rate since at least 2001.

The Office for National Statistics has reported this morning that basic pay excluding bonuses rose 7.8 per cent year-on-year in the three months to the end of June. That is up from a 7.3 per cent rise in the data last month and is higher than the 7.4 per cent consensus forecast among economists, which was compiled by Reuters. It is the biggest rise in pay since the ONS began collecting comparable data in 2001.

The pound has edged up 0.3 per cent against the dollar on the back of the data as traders bet that this makes it more likely that the Bank of England will have to increase interest rates again. That is because wages rising at this pace could help to imbed inflation in the UK at well above the 2 per cent target set by the Bank. The base rate of interest currently stands at 5.25 per cent.

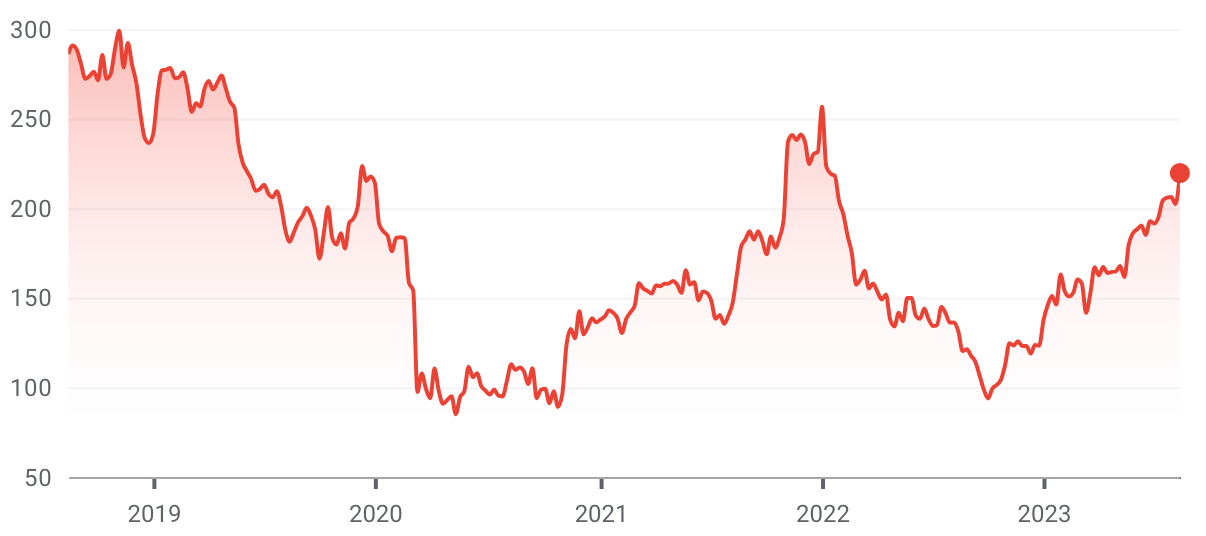

The rise for sterling this morning continues its gradual recovery since the Liz Truss and Kwasi Kwarteng mini-Budget in September 2022, as you can see from the graph below…

We will get more news on inflation tomorrow when the ONS publishes the latest official data on prices. The consensus among economists is that the consumer price index will fall to 6.8 per cent in July compared to 7.9 per cent in June, which would be the lowest rate of inflation since early 2022.

There is new evidence today that inflation is easing significantly from Kantar, the retail consultancy firm. Kantar has reported that grocery prices rose 12.7 per cent year-on-year in the four weeks to August 6. That rate of inflation is down 2.2 percentage points on the previous four weeks, which is the second-biggest monthly fall in inflation since Kantar started monitoring prices in 2008. The price of milk and sunflower oil has fallen, Kantar said. You can find the data here

However, now for some gloomier news on the economy. Despite the rise in wages, the ONS data also suggests that the labour market is weakening. The unemployment rate increased by 0.3 percentage points to 4.2 per cent in the three months to the end of June and is above pre-Covid levels.

James Smith, developed markets economist at ING, said that the sharp rise in wages was “undoubtedly uncomfortable territory” for the Bank of England but that there are “unmistakable signs now that the jobs market is cooling rapidly”. He said:

“This is undoubtedly uncomfortable territory for the Bank, though the doves can point to the fact that the timelier median pay growth data from payrolls did actually slow. And they’ll also note that much of the upside surprise today can be put down to revisions to past data, albeit the changes are predominantly to data earlier in the second quarter, so it’s not going to be a huge comfort.

“Interestingly though, these stubbornly high wage growth numbers are coupled with what are unmistakable signs now that the jobs market is cooling rapidly. The unemployment rate increased by 0.2pp to 4.2 per cent, while the ratio of unfilled job vacancies to unemployed workers now stands at 0.73, down from a peak of almost 1.1 and very nearly back to the pre-pandemic high of 0.64.”

For further reading on the state of the economy I recommend checking-out the ONS data in full here and reading Stephen Bush’s latest piece for the Financial Times, which looks at how low interest rates have made us all feel richer than we actually are over the last decade (for example, we have been able to buy nice cars via personal contract purchase schemes) and that the recent rise in rates is going to have significant political ramifications. Piece here

Podcast…

The new episode of Business Studies is out today and looks at the private equity industry. I speak to Garry Wilson, the co-founder and managing partner of Endless, about how he built one of the UK’s largest private equity firms and why his journey from Belfast to Leeds does not fit the stereotype that many have for this industry. It’s a fascinating episode that looks at how you do deals, how you turn-around a struggling business and why private equity is more friend than foe according to Wilson.

You can listen on Substack here, Apple here and Spotify here

Other stories that matter…

1. Shares in Marks & Spencer are up more than 7 per cent after the retailer said that it now expects profits to grow year-on-year and that there will be a “significant improvement” compared to its previous forecasts. M&S said in a stock market statement that food sales are up 11 per cent like-for-like compared to last year and that clothing and home sales are up 6 per cent. Statement here. You can hear more about M&S by listening to our podcast episode with Richard Price, the head of its clothing and home business. That episode is here. This is how the company’s share price looks over the last five years…

2. After years of rumours, now is the moment for Apple to buy Disney, according to an analysis by author Ted Giola. More here

3. The Economist has done an interesting piece on how Adobe could have become a modern version of Blockbuster or Kodak because AI technology threatens to make its software obsolete. However, Adobe has pivoted its business towards AI and now looks well set for strong growth, and to avoid the copyright disputes that are dogging the technology. Piece here. Sticking with AI, The Wall Street Journal has done a piece on the mad rush to hire employees with expertise in the area, which is causing salaries to surge. You can read that here

4. The New Yorker has looked at the booming growth of businesses helping retailers to deal with products returned by customers. Returns have surged thanks to online shopping. Piece here

5. Cricket has a genuine shot of making it in the US and is already big business in the country. That is according to a piece by the Huddle Up sports newsletter, which you can find here

And finally…

Some summer reading recommendations for you. The Financial Times has published the long-list for the FT and Schroders Business Book of the Year Award. It includes How Big Things Get Done, Unscripted, and The Case for Good Jobs, books that have been recommended to me by business leaders over the last year. You can find the full list here. Meanwhile, the consultancy firm McKinsey has also listed seven books that its senior executives are reading this summer. It includes How the World Really Works by Vaclav Smil, a superb book, and American Prometheus, by Kai Bird and Martin J Sherwin, which is the book that the film Oppenheimer is based on. You can find that list here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham