Hello everyone and welcome to the latest Off to Lunch…

Shares in Unilever have risen by 5 per cent after the consumer goods giant said sales have grown by more than expected and the worst of inflation has passed.

Unilever is valued at more than £100 billion and is one of the UK’s largest companies. It owns a collection of beauty, personal care, home care and food brands including Dove, Persil, Lynx deodorant, Hellmann’s mayonnaise and Magnum ice cream.

The company said in a stock market statement this morning that underlying sales rose 9.1 per cent in the first half of 2023 compared to the same period last year. That is better than the 8.3 per cent forecast by City analysts. Underlying profits rose by 3.3 per cent to €5.2 billion.

Those who have accused big companies of profiteering during the cost-of-living crisis will note that Unilever reported an improvement in its operating margins - they were up 10 basis points to 17.1 per cent. That profit margin is well ahead of what supermarkets have reported. For example, Tesco said its operating margin in the UK and Ireland was 3.8 per cent in its last annual results.

Unilever said that its rise in sales included a 9.4 per cent rise in prices and a 0.2 per cent drop in the volume of what it sold. In its European business, which includes the UK, Unilever reported a 14.2 per cent rise in prices and a 6.8 per cent drop in volume. That was a much bigger rise in prices than in the rest of the world. In Unilever’s Asia Pacific Africa division, there was an 8 per cent rise in prices and a 1.1 per cent rise in volumes. Meanwhile, there was an 8.6 per cent price rise and a 1.8 per cent volume rise in the Americas. The worst-performing division by product was ice cream, where sales volumes fell by 5.2 per cent, with squeezed households cutting back on spending.

Hein Schumacher, Unilever’s new chief executive, said Europe was “very challenging”. However, Graeme Pitkethly, Unilever’s finance director, offered optimism on pricing, saying:

“We have passed peak inflation.”

The rise in Unilever share price comes after a rocky five years for investors, as this graph shows…

Some financial analysts think that UK stocks are well-set to bounce back as the pressure from inflation eases. This is because the economic uncertainty is already factored into their share price. For example, Alex Brazier, managing director for the BlackRock Investment Institute and a former Bank of England official, told Bloomberg today:

“The UK is going to need further growth damage in order to get inflation down to target, so it’s a pretty bleak growth outlook. But equity performance so far this year means that that’s actually reflected in market prices.”

The bounce in Unilever shares today supports that analysis. You can find the company’s results in full here

Other stories that matter…

1. The UK government will spend £110 billion on debt interest this year. That represents 10.4 per cent of public revenue, the highest level for any developed economy in the world, according to research from Fitch, the credit rating agency. Financial Times story here

2. Games Workshop, the maker of Warhammer figures, has posted another set of stellar annual results. Revenue rose 13.5 per cent to £471 million in the year to May 28 while pre-tax profits rose 9 per cent to £171 million. Those are record revenues and profits for Games Workshop, which floated in 1994 and is based in Nottingham. The company is valued on the stock market at £3.7 billion (just less than Marks & Spencer) and has grown rapidly in recent years, as this share price graph shows…

Games Workshop does not say much publicly so what the company writes in its results is always interesting. Kevin Rountree has been chief executive since 2015 after joining the business in 1998 as assistant group accountant. He says in the latest results:

Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains...

The first element [of our strategy] is that we make high-quality miniatures. We understand that what we make may not appeal to everyone, so to recruit and retain customers we are absolutely focused on making our models the best in the world. In order to continue to do that forever and to deliver a decent return to our owners, we sell our miniatures for a price that we believe represents the investment in their quality.

You can find the company’s results here

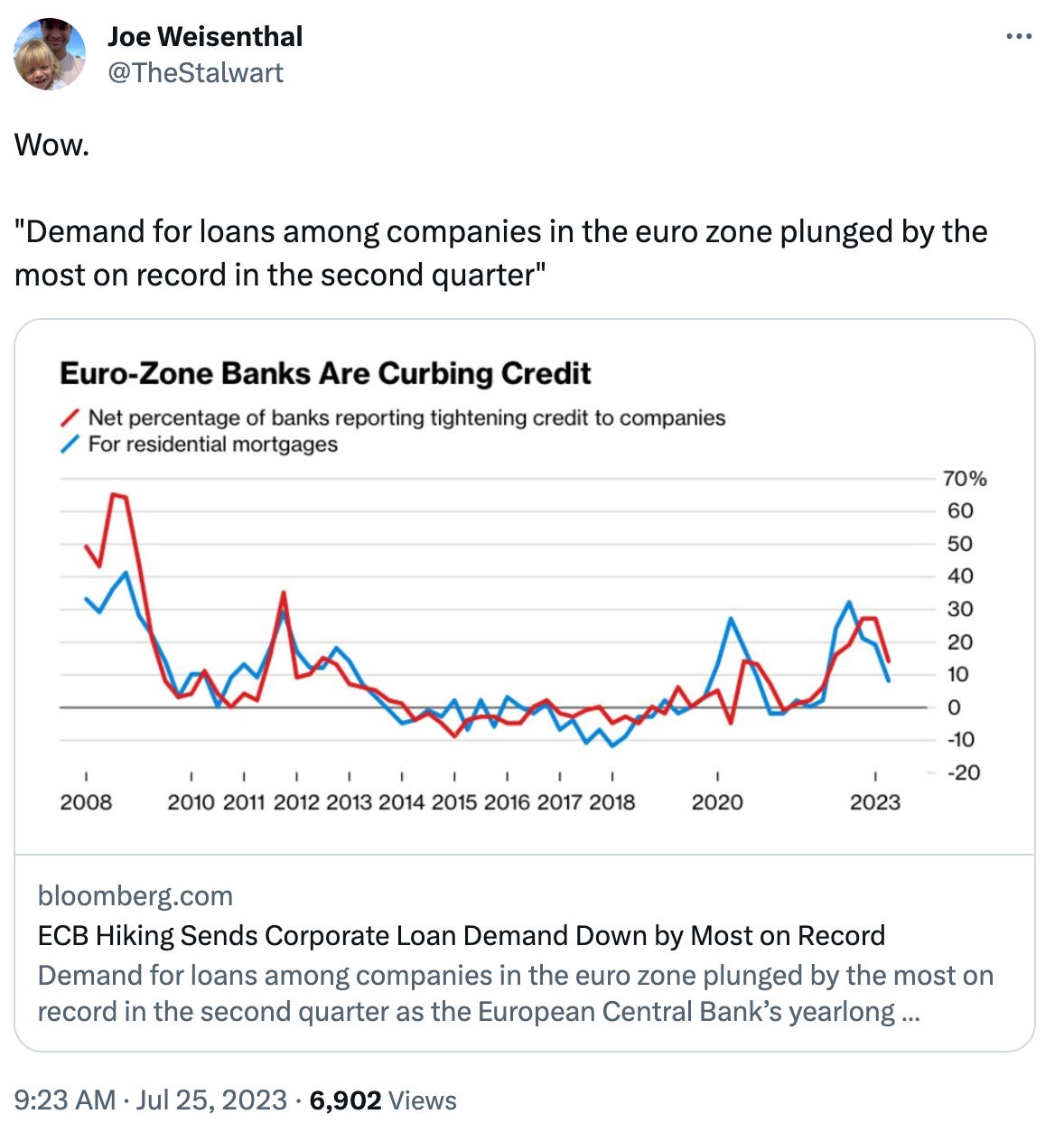

3. Banks in the eurozone have reported the biggest-ever drop in demand for loans from businesses. This is evidence of a notable slowdown in the European economy and shows the impact that rising interest rates are having. The data was included in a new survey by the European Central Bank. The ECB and the Federal Reserve in the US will announce their latest decision on interest rates this week.

4. The world’s largest battery could be built in Manchester after plans were approved by the local authority. Carlton Power wants to build the battery at the Trafford Low Carbon Energy Park on the site of an old coal power station. Carlton now needs to raise £750 million to go ahead with construction. Telegraph story here

5. Another tech company is trying to move in on Twitter’s territory - TikTok has launched text-only posts. Story by The Verge here. Meanwhile, Axios is reporting that Elon Musk has told people that X, the new brand for Twitter, can be a trillion-dollar company. Walter Isaacson, Musk’s biographer, said: “This is an idea he has thought about for 25 years — a financial platform that helps anyone profit from creating content.” More here

Podcast…

The new season of our Business Studies podcast has launched today with the story of how Richard Harpin built Homeserve into a company that was sold to Canadian company Brookfield for £4.1 billion in 2022. It is a story that involves unexpected twists, setbacks and lessons about how you really build a business. You can listen on Substack here, Apple here and Spotify here

And finally…

Gregg Wallace: The British Miracle Meat aired on Channel 4 on Monday night. An unremarkable title, but a remarkable programme. I don’t want to spoil anything, but here is a round-up of some of the reviews. The Guardian described it as a “full-blooded roar of a show that deserves an immediate watch”, “flawless” and “the kind we barely see any more”. The Times has published an article on other documentaries that have caused such shock in the past. The Telegraph is unimpressed and describes it as “odd”. If you want to find out more you can find The Guardian piece here, The Times here and The Telegraph here. You can find the 30-min show on All4 here. Watch it for yourself and see what you think…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham