The repercussions from the disappointing inflation figures on Wednesday are only just starting. A collection of mortgage lenders have already increased the interest rate on their mortgage deals after the inflation data caused gilt yields to rise sharply…

This is the front-page of The Daily Telegraph this morning…

Nationwide has said that it is increasing the interest rate on its mortgage deals by up to 0.45 percentage points, while Lloyds and Halifax have increased theirs by 0.2 per cent. Other lenders will follow today and next week…

This is going to put a new strain on the UK economy and the housing market. As The Telegraph story says, data from UK Finance, the trade body, shows that 3.4 million homeowners will come to the end of fixed-rate mortgage deals between now and the end of next year. These homeowners are going to see their mortgage repayments increase by hundreds of pounds a month, potentially by more than a £1,000-a-month if they live in London - much more than the hit from higher energy bills.

This time a year ago the average interest rate on a two-year fixed mortgage was 2.57 per cent and on five-year deals it was 2.79 per cent, according to Moneyfacts. A year before that - in 2021 - it was even lower. However, the average had increased to 5.34 per cent on a two-year deal and 5.01 per cent on a five-year deal at the start of this month. Now the average is heading to 5.5 per cent.

As a reminder, inflation came in at 8.7 per cent for April, higher than the 8.2 per cent that economists had forecast. What was particularly alarming was that core inflation actually went up from 6.2 per cent in March to 6.8 per cent. This measures strips out food, energy, alcohol and tobacco, categories prone to short-term fluctuations.

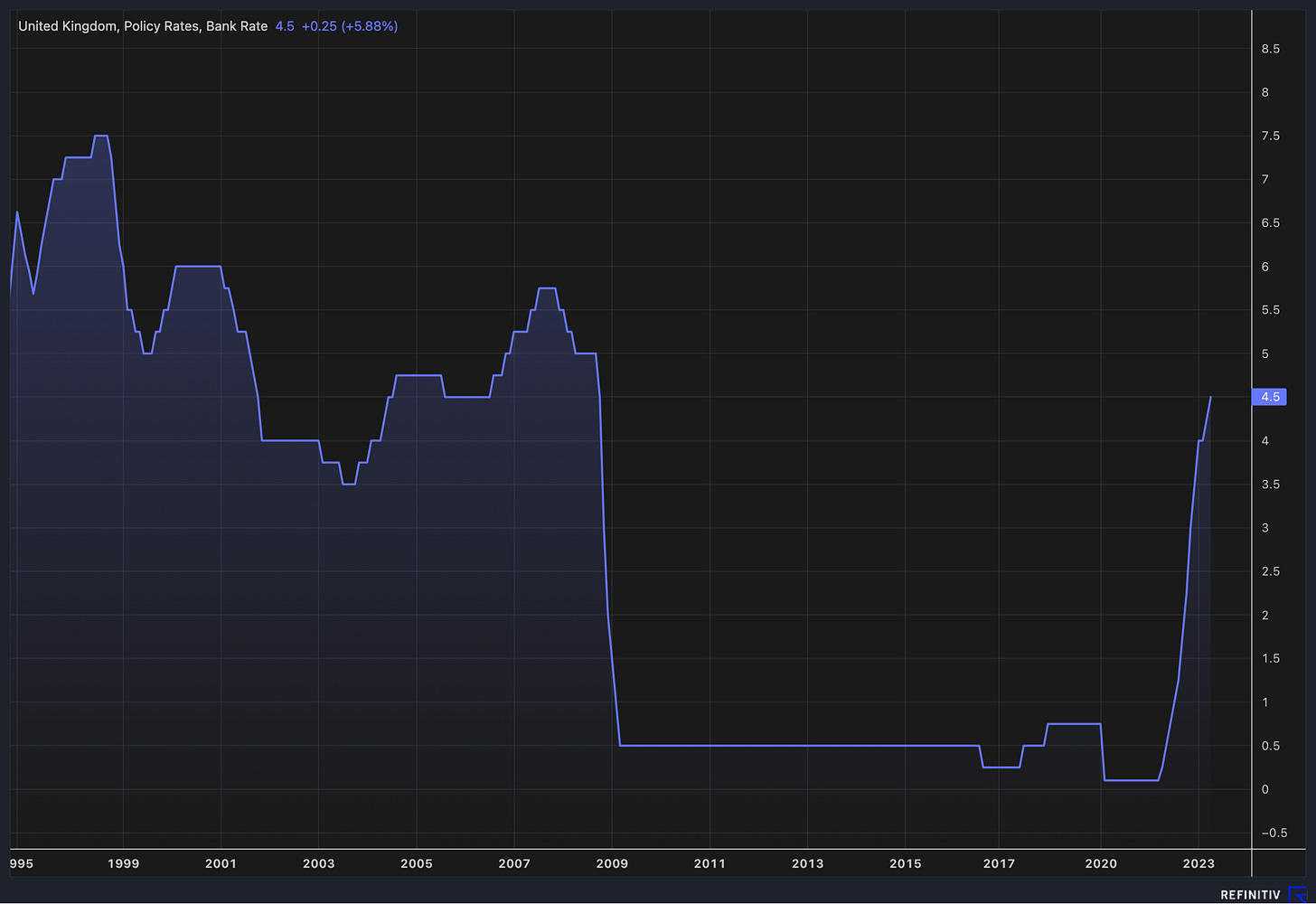

Traders and economists in the City are now forecasting that the Bank of England will have to increase the base rate of interest in the UK beyond the 4.5 per cent it sits at today to get inflation down. Their forecasts suggest that interest rates could reach 5.5 per cent. So far in the 21st century, interest rates have only been at 5.5 per cent or above for a matter of months - from 2000 to mid-2001 and a few months in 2007. This is how the UK base rate has moved over the last 30 years…

Gilt yields have risen sharply this week in anticipation of more rate rises. The gilt yield reflects the interest rate that the government pays on its debt, which ultimately feeds through to the interest rate that banks pay to access funds and therefore the interest rates on the money they lend to households and businesses. This is why some lenders are already increasing interest rates…

This is how the 2-year gilt yield, 5-year gilt yield, and 30-year gilt yield have moved. These graphs look at the last 10 years. The two spikes to the right you can see are the aftermath of Kwasi Kwarteng’s mini-Budget and today….

This is the 2-year gilt…

This is the 5-year…

This is the 30-year gilt yield…

Millennials are going to be squeezed by this the most. People in this generation - who were born between 1981 and 1996 - have just entered the property market. To buy a home they have had to pay a price inflated by years of strong house price growth - growth boosted by low interest rates and government support. They have only repaid a small portion of their mortgage so far. Now interest rates are going up sharply.

The Times has done a great piece this morning looking at how homeowners now outnumber renters in the millennial generation for the first time, but how this has come at the cost of them being laden with debt, lots of debt. The piece is here. It references data from Savills, including the graph below, which shows that people are buying a property much later than they were a decade ago. The thick green line shows how many people of each age lived in their own home in 2021, the dashed line shows the same figure for ten years earlier - there is a noticeable drop in the number of people in their late 30s and early 40s who live in their own home…

New figures on retail sales out today suggest the UK economy is holding up well. Sales volumes rose 0.5 per cent in April compared to a year ago, an improvement on the 1.2 per cent drop in March. However, as the pressure on mortgages shows, there is still much uncertainty ahead. This is despite optimism earlier in the week when the International Monetary Fund said it was no longer forecasting that the UK would have a recession this year and upgraded its growth projects (you can find those forecasts here)

Jeremy Hunt, the chancellor, pictured above, has been speaking to Sky News today and made some downbeat comments…

Other stories that matter…

1. The government is considering whether to give the Pension Protection Fund more powers so it can invest billions of pounds in UK businesses. At present the PPF takes on the pension funds of collapsed businesses. However, the government is looking at whether to allow the PPF to proactively take on more pension funds, such as those of struggling businesses or poorly-performing pension schemes. This would give it the funds to invest more in UK businesses. The Financial Times has the full story on this here. Chris Giles, the economics editor of the FT, does not think it is a good idea. He writes:

“Domestic and foreign companies just don’t think the UK is the best place to invest. That is why business investment has stalled.”

Full column here.

This idea is the latest part of a drive to boost investment in promising UK businesses and make the country a more attractive place to invest or list a company. Andrew Griffiths, the City minister, has told The Telegraph that pension funds need to embrace a “culture of risk-taking” and back more UK businesses. He said:

“We are working on removing points of friction, streamlining our regulations and encouraging a greater culture of risk-taking.”

Full story here

As an example of the challenges that the UK faces, Eli Lilly, the US drugs group, says it is no longer looking to build new laboratories in London due to the “stifling commercial environment”. The company said:

“While we believe in the potential of the UK’s biotech talent, and share the country’s ambition to be a life sciences superpower, the stifling commercial environment does not invite inward investment at this time.”

Full story by The Daily Mail here

Meanwhile, Tom Blomfield, the co-founder of digital bank Monzo, is leaving the UK to take up a job at Y Combinator in California, which backs promising start-ups. In an interview with Bloomberg he took a parting shot at the UK, saying:

“Within Y Combinator the range of projects that get worked on - from AI, to space rockets, to supersonic jets, to nuclear fusion - it’s kind of breathtaking. That ambition and that sort of belief that you can achieve anything I think is very, very powerful and intoxicating, and doesn’t exist as much in London.”

Full interview here

2. Not a great week for Twitter and Elon Musk. Ron DeSantis tried to launch his campaign to be president via an interview with Musk on Twitter Spaces, the social media group’s audio tool, but it kept crashing. Platformer, the tech newsletter, has done a piece on the chaos behind the launch and how Twitter Spaces now had just three staff working on it, down from 100 before Musk’s takeover. Piece here. According to Press Gazette, the amount of traffic that Twitter diverts to media websites is dropping, a sign that how much people use the site and its influence is dropping. Story here. A leading engineer at Twitter has just announced he is quitting too. BBC story here and tweet below:

3. Ivan Toney, the Brentford striker, has been banned from football for eight months for breaking Football Association gambling rules. There is a lot about this story that doesn’t feel right. It highlights the tension at the heart of sport having a close relationship with betting, including sponsorship rights. Also, is this really the best way to help someone who the FA concluded has a gambling addiction? Ed Warner, the former chairman of UK Athletics, has written eloquently about this topic here.

This issue is not unique to the UK. The NFL in America is juggling a similar dilemma as betting becomes more widespread there. Last month it banned five players, including four players from the Detroit Lions, for breaking betting rules. Calvin Ridley, the Jacksonville Jaguars wide receiver, was banned for the entirety of last season for betting on games. He wrote a public letter that was published by The Players’ Tribune in March and is well worth your time. You can read the full letter here. This is an extract:

“I f***ed up. I’m not here to sugarcoat anything. In 2021, I made the worst mistake of my life by gambling on football.

“I paid the price, believe me. I’ve seen all the jokes. I’ve seen all the hate. And I can shoulder all of that, no problem. All I want is for people to understand that, when I made those bets, there was a hell of a lot more going on with me.”

4. Shares in Nvidia, the chip maker, rose by a quarter on Thursday, adding more than $180 billion to the value of the company and making it one of the biggest one-day movements in the history of US markets. Nvidia is now worth $939 billion, behind only Apple ($2.7 trillion), Microsoft ($2.4 trillion) Alphabet ($1.6 trillion), and Amazon ($1.2 trillion) in the list of the most valuable US companies.

Nvidia shares rose after the company published financial results that were well ahead of expectations and said it expects to benefit from demand for AI technology. Nvidia makes chips that are used to train and develop AI technology, including Open AI’s ChatGPT.

Jensen Huang, the co-founder and chief executive of Nvidia, said equipment in data centres around the world will be replaced by AI chips - a market potentially worth trillions of dollars. Analysts said the forecast and the amount of money Nvidia is already making from AI shows the significance of the new technology. Stacy Rasgon, analyst at Bernstein said:

"In the 15-plus years we have been doing this job, we have never seen a guide like the one Nvidia just put up with the second-quarter outlook that was by all accounts cosmological, and which annihilated expectations.”

Dan Ives at Wedbush said:

"For any investor calling this an AI bubble, we would point them to this Nvidia quarter and especially guidance which cements our bullish thesis around AI and speaks to the fourth Industrial Revolution now on the doorstep with AI.”

This is how the company’s share price graph looks now…

For more on the chip industry and Nvidia check-out our latest podcast episode. More on that below…

5. “So why are so many business books truly terrible?” asks Harry Wallop in his latest column for The Times. Ouch. The column looks at how books and bookshops are enjoying a revival but that business books could be so much better. Piece here.

Podcast…

A reminder that the latest edition of our Business Studies podcast looks at the story behind Arm and how it became one of the most successful and talked-about technology companies that Britain has ever produced. You can listen to the episode on Substack here, Apple here and Spotify here.

Business Studies is now taking a short-break but will be back with a bang in June.

And finally…

A quick housekeeping note: there will be no Off to Lunch on Monday due to the bank holiday but we will be back on Wednesday. Paying members will also get the Sunday press review on Sunday as usual. I hope everyone enjoys the long weekend. To those going away next week - enjoy your holiday.

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham

Thanks for referencing my gambling piece Graham. Enjoyed this Off To Lunch as always!