Let me reassure you...

Trio of announcements + Podcast + R&D spending + Best restaurant in the world

There have been three significant news developments already today for the UK economy, all of which look designed to reassure markets - and rebel Tory MPs - about the government and Bank of England’s stewardship of the country’s finances.

The Bank of England announced just after 7am this morning (and before markets opened at 8am) that it was making changes to its £65 billion support package, which is due to end on Friday. Remember, this scheme was introduced after the price of government bonds (gilts) dropped and the yield rose on the back of the mini-Budget as investors sold out of the UK. The Bank was forced to announce the £65 billion support package to buy gilts to support the pension fund industry, which was being forced to sell them at a rapid rate to raise cash to cover liability driven investments (LDI). This Bank scheme is due to end on Friday, which has sparked concerns about the fall-out for the pension funds industry after that. Furthermore, the Bank has only actually bought around £5 billion of bonds since the scheme launched. So, the Bank has said today it will effectively be more aggressive in buying gilts in the final days of the scheme. For instance, today it has set its budget for the day at £10 billion for purchases, rather than £5 billion. It has also set out two other ways it will help pension funds to get hold of cash, including a Temporary Expanded Collateral Repo Facility (which allows funds to swap a broad range of collateral such as corporate bonds for cash) and the use of its Indexed Long Term Repo operation, which will also offer cash for collateral.

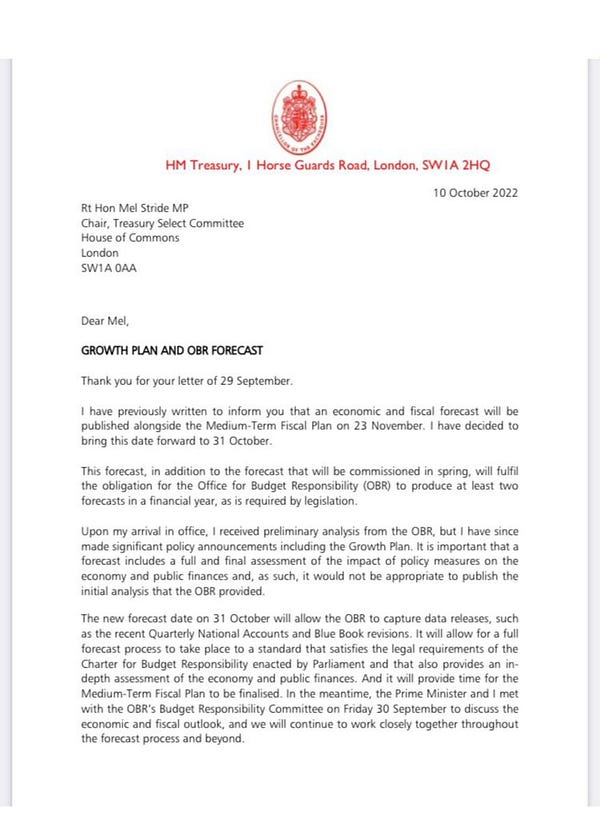

Kwasi Kwarteng has announced that the Treasury is bringing forward its “medium-term fiscal plan” to the end of October (Halloween, would you believe…) rather than the end of November and it will include forecasts from the Office for Budget Responsibility. This is where Kwarteng is expected to outline how the government will fund its tax cuts and drive economic growth. Crucially, the Bank of England is also due to announce its next interest rate decision on November 3.

The Financial Times is reporting that Antonia Romeo will not succeed Sir Tom Scholar as the permanent secretary of the Treasury and instead Liz Truss is now expected to “instead appoint someone as the Treasury’s top civil servant with years of experience of working at the finance ministry”. Romeo has never worked in the Treasury and is the permanent secretary at the Ministry of Justice. Story here.

There is, of course, no official confirmation that these moves are coordinated. But, with markets still unsettled and Truss and Kwarteng facing criticism at the Conservative party conference last week, it looks like the government has taken steps to build some bridges. The moves have been broadly welcomed….

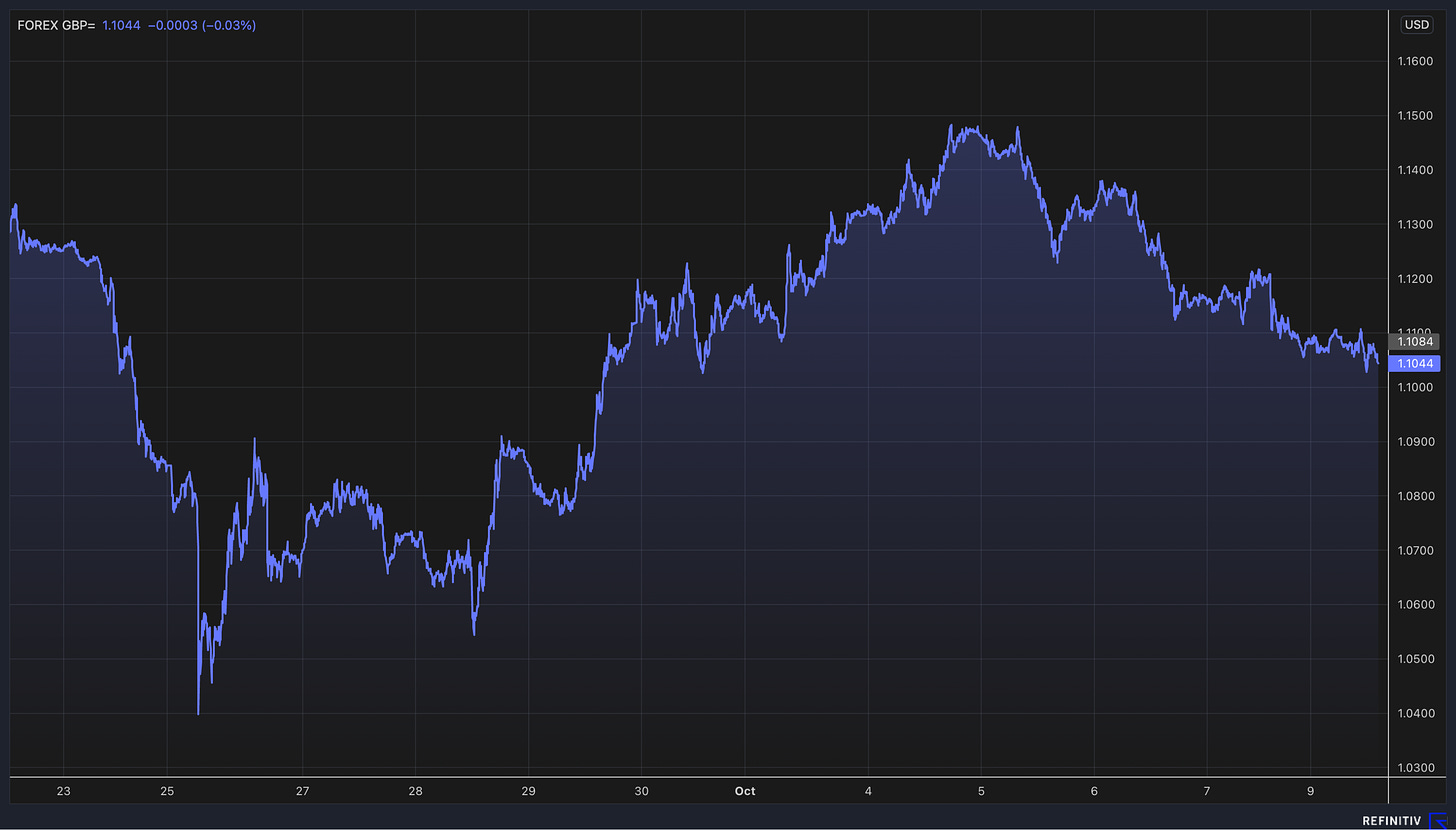

This is how markets have reacted to the latest news. This is the pound v the dollar since the mini-Budget on September 23. The pound has been sliding again in recent days after recovering its losses from the mini-Budget…

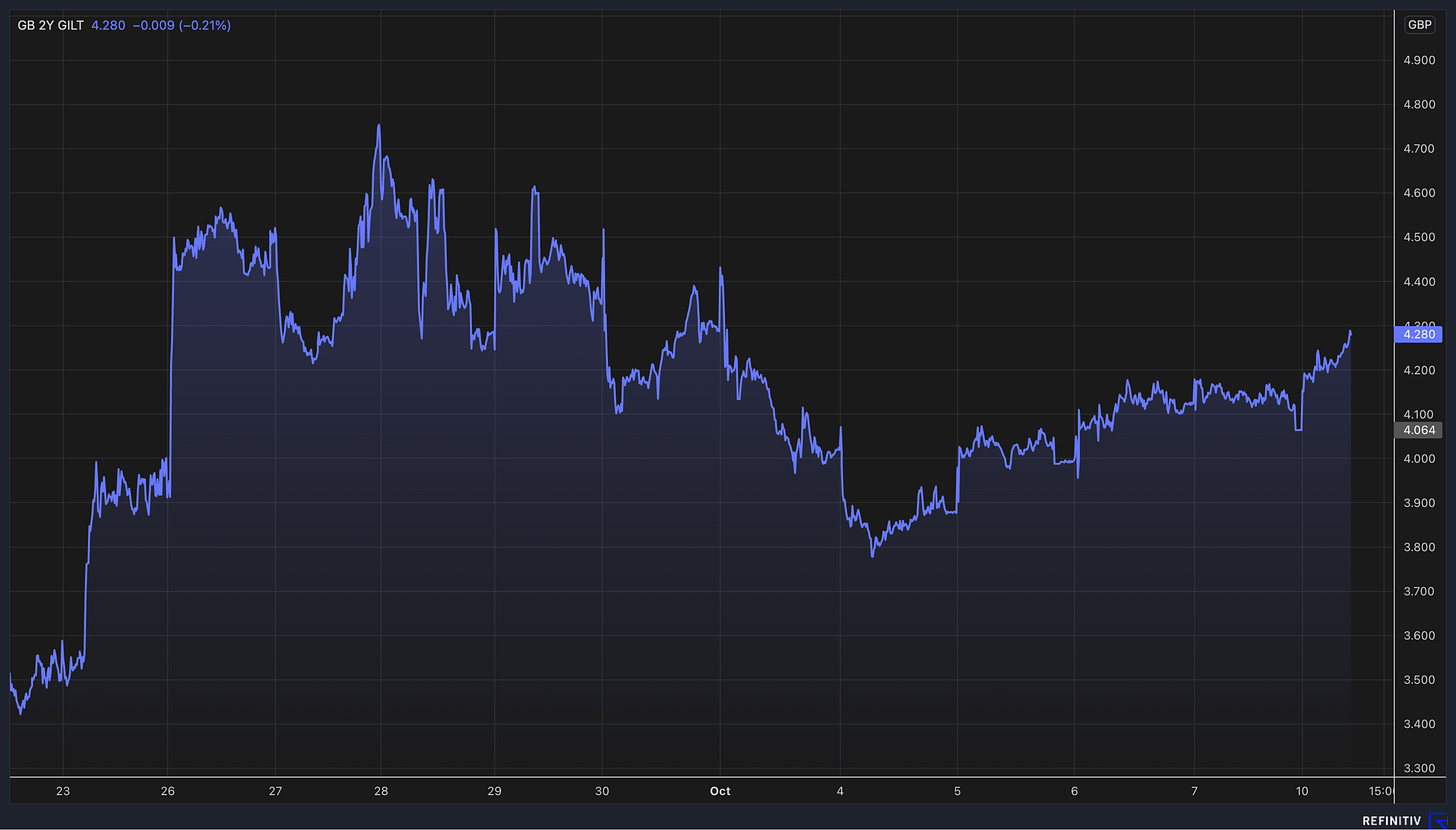

This is the yield on two-year gilts. The sharp rise at the start is the reaction to the mini-Budget…

And this is the yield on 30-year gilts. The cliff-edge in the middle is the Bank’s initial announcement about the £65 billion package…

From these graphs you can see why the government and the Bank still want to reassure markets. After the hit from the mini-Budget there was a recovery after the Bank’s announcement on Wednesday September 28 (the pound rose and yields fell) but in recent days the pound has started steadily falling again and yields have steadily rising again. Frankly, not much has changed so far since the announcements on Monday morning…

Podcast…

Episode three of our Business Studies podcast went live this morning. It includes a chief executive talking about situations they would never expect or want to face. Humphrey Cobbold, chief executive of PureGym, discusses how to get through an existential crisis - in this case, the closure of all his company's gyms during lockdown. I suspect you will not have heard a chief executive talk so frankly or openly about the challenges their business faced before. There is so much in the 30-minute episode including:

What happened the day after lockdown was announced in 2020 and PureGym had to close all its sites (the business didn't even know where the keys were for some of its facilities)

What do you do when someone serves you with a winding-up order?

Why going on BBC Question Time is important and more business leaders should speak out publicly

How to keep senior staff motivated after they missed out on a pay-out from an IPO

The post-lockdown challenges facing PureGym, including how Humphrey Cobbold justifies expanding in Saudi Arabia despite its human rights record

You can listen to the episode here.

Remarkable R&D data…

David Smith, economics editor at The Sunday Times, pointed out at the end of his column yesterday that the Office for National Statistics put out some pretty extraordinary data on research and development spending at the end of last month. It has re-published estimates on R&D spending in the UK with a new methodology that captures more of what small and medium-sized firms are doing. The result is a dramatic upgrade in the estimates for R&D spending by businesses in the UK for 2018, 2019 and 2020 of more than £15 billion a year, a 60 per cent increase. Notably, it means that R&D spending has now hit the government’s target of reaching 2.4 per cent of GDP.

This poses all sorts of crucial questions, as David Smith touches on in his piece here. One of the reasons that productivity - basically output per employee - has lagged behind in the UK compared to other economies was supposedly that we do not spend as much as other countries on R&D. Is that just wrong? Are we already spending enough on R&D but have bigger problems than we thought elsewhere, such as with skills? These are vital issues for the future of the UK economy.

Josh Martin, an economist at the Bank of England and on secondment from the ONS, has done a great thread on this, which I have included below. In short, he wonders whether it all just means we need to spend more on R&D than we thought.

My other conclusion from all this was the importance of data and the ONS when making judgments on the economy and policies for the future. One of my favourite columns when I was at The Times was this piece by David Wighton about putting too much weight on the latest data because it is often revised and changed. Remember the double-dip recession that never was under the David Cameron government? Economic data can shape the mood, narrative and debate in politics, but it can also change…

Other stories that matter…

An interesting look at the biggest companies by market capitalisation in the 1980s, 2000s and 2020s as part of an attempt to analyse who might be the biggest in the 2040s (Market Sentiment)

Goldman Sachs is pulling back on its ambition to become a big consumer bank through its Marcus brand (Bloomberg)

Attempts in the United States to build a high-speed train line are going even worse than Britain’s (New York Times)

Finally, if you want a round-up of what was interesting in the Sunday papers, and there was plenty, you can find it in Off to Lunch’s Sunday press review here.

And finally…

The best fine-dining restaurant in the world is located under a Greggs in a small Cumbrian town. According to Tripadvisor and its reviewers the best restaurant is the Old Stamp House in Ambleside. My description of the restaurant is a bit of an exaggeration - it’s a very cosy place in the heart of one of the Lake District’s prettiest towns and has a Michelin star - but it’s not far off, there really is a Greggs above it. Its success is part of the extraordinary cultural revolution in Cumbria and the Lake District spearheaded by Simon Rogan opening L’Enclume in Cartmel in 2002. L’Enclume became the first restaurant in the north of England to get three Michelin stars earlier this year. The Old Stamp House remains notably cheaper than L’Enclume and I don’t know anyone who has been disappointed by their food there despite the lofty expectations. The food and atmosphere is cosy, unpretentious and just fantastic. You can read Tripadvisor’s full list of the best restaurants here. The Old Stamp House is number one ahead of restaurants in Rio de Janeiro, Italy, and Spain.

Thanks for reading. Off to Lunch will be back on Wednesday. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox and contribute to the work of Off to Lunch

Best

Graham