Is cash use on life support?

Hello and welcome to the latest edition of Off to Lunch…

The Isle of Man hit the headlines late last year when its Treasury flopped on its flip to phase out the Isle’s 1p, 2p and 5p coins. After consulting residents, retailers, and business leaders, the decision was solidified to keep the currency despite not minting any fresh 1p and 2p Manx coins since 2016. Today, China is showing signs of a transition to a cashless society.

Three years ago, China became the first major economy to launch a digital currency. Experts speculating from afar surmised that the move was born out of a desire to take back power from Chinese tech giants Alibaba and Tencent, whose Alipay and WeChat pay apps have reigned supreme.

After a slow rollout of the digital yuan, or e-CNY, the nationwide currency picked up considerable steam last year. People’s Bank of China said that total transactions in July last year had reached 950 million, with a cumulative value of 1.8trn yuan (£198.2bn), up from 100bn yuan (£11bn) the previous August.

While sceptics talk of a Black Mirror-esque scenario where a central bank digital currency (CBDC) is linked with a social credit score, Bahrain’s top central banker addressed the World Economic Forum over the weekend to discuss the future of CBDCs.

In the UK, The British Retail Consortium said 19% of purchases were made with notes and coins in 2022. This marked the first time that cash use had grown in a decade. Impressive, considering that more than half of all transactions in 2014 were paid in notes and coins.

A recent global survey of business leaders and execs by consulting firm Protiviti found that 1 in 3 of them believed that their home country would go ‘cashless’ as soon as 2028.

Speaking on the topic, the billionaire founder of Phones4u John Caudwell said:

As a business owner, and particularly a retail business owner, cashless is absolutely best. Cashless businesses reduce potential crimes by dishonest employees, burglary or under-the-counter tax-dodging payments. And, of course, cashless businesses are more convenient and more efficient.

All that said, as a consumer, and one who keeps close tabs on my personal finances, I still like using cash for day-to-day spending on low-cost items. A statement full of 50p purchases can make it more difficult to spot any bigger anomalies.

And, for the next decade at least, we have to bear in mind the challenges for older, less digitally confident people.

Let us know what you think of our inevitable cashless society. How would going cashless affect your business?

Podcast…

The latest episode of Business Leader talks to Kevin McCabe and tells the story of how he built a property empire and then ended up running Sheffield United, his beloved football club.

It is a story that has highs, lows, controversial goals and legal battles…

You can listen to the episode on Substack here, Spotify here and Apple here

Other stories that matter…

1. The boss of HSBC Noel Quinn has unexpectedly announced his retirement after less than five years in charge. He has steered Europe’s biggest bank through the pandemic, significant restructuring of the bank’s global operations and record profits. The succession hunt is and you can read more about who is in line to replace him here.

2. Whitbread, the owner of hospitality brands Premier Inn, Beefeater and Brewers Fayre, has announced plans to cut 1,500 jobs and shut 126 restaurants across the UK. Despite strong annual results, including a pre-tax profit rise of 19%, the company’s new cost-cutting strategy would help fund their investment in “building a more tailored, integrated restaurant in our hotels as well as the construction of new hotel rooms across the estate". You can read more here.

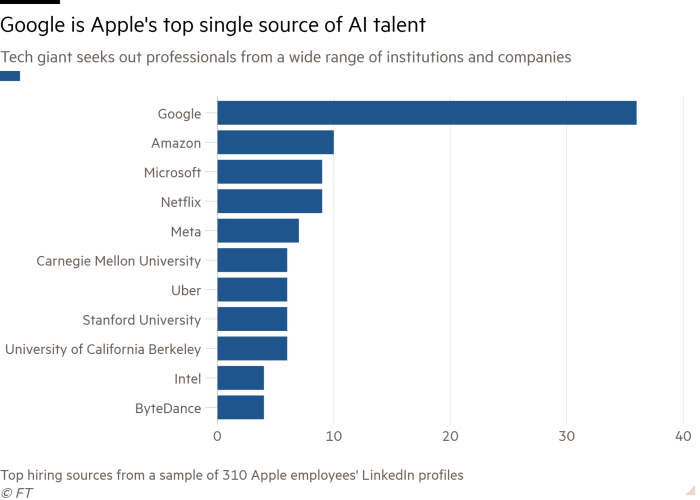

3. Apple has been on a Google poaching mission, according to analysis from The FT. The iPhone maker has been targetting Google’s artificial intelligence experts as it looks to expand its global AI and machine learning team. You can read more here.

4. The Abu Dhabi-backed takeover of The Telegraph is officially off. RedBird IMI, which is largely funded by Manchester City owner Sheikh Mansour bin Zayed bin Sultan al-Nahyan, has admitted defeat saying that it would halt the takeover and put the media firm up for sale, as its plans are “no longer feasible". You can read more here.

5. Train strikes are on track to cause major disruption over the Bank Holiday weekend. The walkout by members of the Aslef union will affect travel across the country next week and you can read more about where and when here.

And finally…

The second episode of The Jinx - Part Two has dropped on Sky/Now TV. If you haven’t watched the first series (available on catch-up), I couldn’t recommend it more highly. The documentary focuses on Robert Durst, the disappearance of his first wife, the murder of one of his friends and the killing of his neighbour.

Durst was a man of extreme privilege as the eldest son of New York City real estate magnate Seymour Durst, who created the National Debt Clock in the Big Apple. That’s about as much as I can reveal because series one’s cliffhanger ending is one of the most shocking moments of TV…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox