How the chairman of UK housebuilder was at centre of global golf deal...

The business news that matters

Hello and welcome to the latest Off to Lunch…

The chairman of Persimmon, one of the UK’s largest housebuilders, played a key role in brokering the golf merger between the PGA Tour and the Saudi Arabia-backed LIV Golf, according to documents released by a US Senate investigation…

In a fascinating and unexpected insight into how a global deal was done, emails suggest that Roger Devlin made contact with a PGA board member to raise the prospect of talks with LIV Golf. Devlin did so after discussions with Yasir Al-Rumayya, the head of Saudi Arabia’s Public Investment Fund, the backer of LIV Golf, and Amanda Staveley, the financier who brokered PIF’s takeover of Newcastle.

The PGA Tour and LIV Golf announced plans to merge last month, shocking the world of golf. The sport has been split since LIV launched at the end of 2021 with billions of dollars of funding from Saudi Arabia and signed-up a string of top players to its new competitions.

The Senate permanent subcommittee on investigations held a hearing about the merger on Tuesday, which is controversial because of Saudi Arabia’s involvement and its human rights record. The subcommittee questioned Ron Price, chief operating officer of the PGA Tour, and Jimmy Dunne, a member of the PGA board, who are in the image above. After the hearing the Senate released a report and documents which showed Devlin’s involvement…

Devlin, 65, is also chairman of Sunningdale Golf Club in Berkshire and was on the board of the Royal & Ancient, the Scotland-based body that set the rules of golf. He was also previously the chairman of William Hill and senior independent director at the Football Association.

This is what the Senate report said about Devlin’s involvement:

The earliest known outreach regarding the possibility of an agreement between PGA Tour and PIF occurred on December 8, 2022 That day, in an email to incoming PGA Tour board member Jimmy Dunne, British businessman Roger Devlin wrote that he had been ‘invited’ by the top PIF official to help resolve the ongoing dispute between PGA Tour and LIV Golf.

Specifically, Mr. Devlin informed Mr. Dunne that Governor Al-Rumayyan and Amanda Staveley, a ‘valued adviser’ to Governor Al-Rumayyan, had invited Mr. Devlin to ‘help find a solution to the issues that divide LIV and the PGA.’

Mr Devlin explained that Governor Al-Rumayyan had ‘great ambitions to support, grow and modernise the sport and is clearly well equipped to fund these goals’ and offered potential ideas including ‘co-sanctioned regular PGA tournaments which could come together designated as an Aramco Series’ and a ‘Golf Development Fund’ which ‘would be managed and administered by Saudi Golf in cooperation with the governing bodies.’

Mr Dunne declined the invitation to discuss any potential deal at that time, but Mr. Devlin sought to revive discussions on April 14 2023. Mr. Devlin specifically noted in this April 14 email: ‘I believe we have a window of opportunity to unify the game over the next couple of months, otherwise I fear the Saudis will doubledown on their investment and golf will be split asunder in perpetuity.’

Below are three of the emails that Devlin sent to Dunne. Firstly, the December 8 email referenced above…

Secondly, here is an email from January 3…

And lastly, this is the April 14 email also referenced by the Senate report…

You can read the Senate report and see the documents it released here. You can also read more on this story in The Times here and Fortune in the US here.

Other stories that matter…

1. The 2020s are “turning out to be a very risky era for the public finances”, according to the Office for Budget Responsibility. UK government debt could rise above 300 per cent of GDP by the 2070s due to the challenges posed by an ageing population, climate change and geopolitical tension, the OBR, the UK’s fiscal watchdog, also says in its latest report on fiscal risks and sustainability. UK national debt cleared 100 per cent of GDP earlier this year. You can find more from the OBR below…

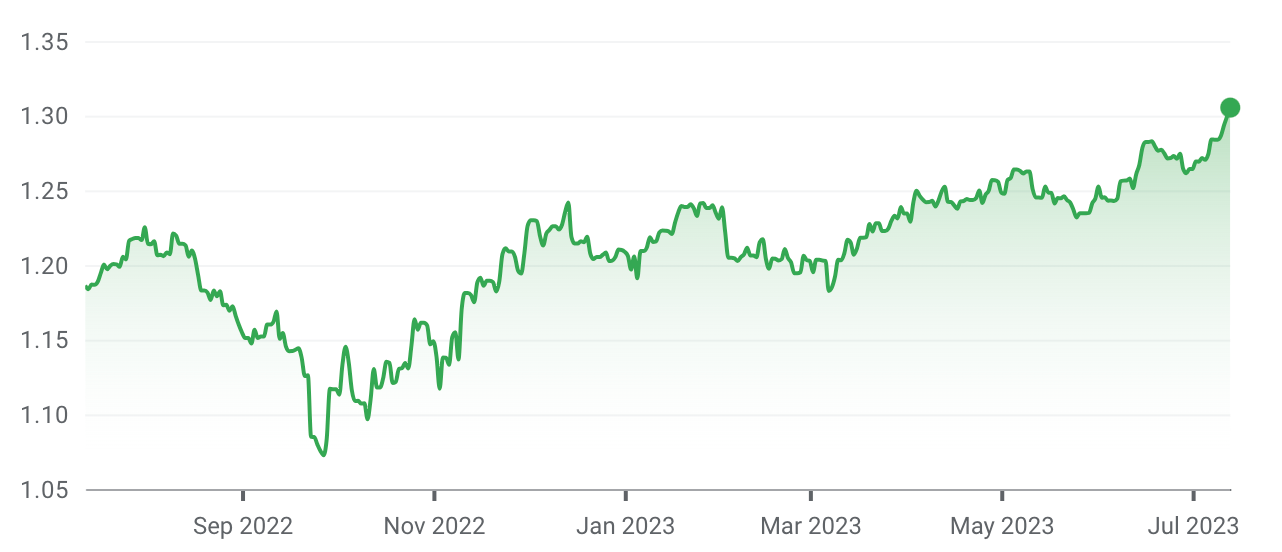

Looking more short-term, the pound has risen above $1.30 after the latest GDP data from the Office for National Statistics showed the UK economy contracted by 0.1 per cent in May, which was a better performance than expected. The consensus among economists was that the economy would shrink by 0.4 per cent in May because there were three bank holidays in the month. You can find the ONS data here. Separate research from the Bank of England shows that UK lenders have reported the biggest rise in mortgage defaults since 2009. A net balance of 30.9 per cent of lenders said the default rate on secured loans to households rose in the second quarter of 2023. The Bank of England report is here.

This is how the pound has moved against the dollar over the last year, courtesy of Google Finance…

2. The boss of the British Business Bank has admitted that the taxpayer-backed economic development agency has been complicated to work with. Louis Taylor wants great independence from the government so that it can recycle profits from the investments it makes. Interview in The Times here

3. Michael Gove is working on plans to turn Cambridge into the UK’s Silicon Valley by adding up to 250,000 homes, according to a report in The Sunday Times at the weekend (more in our Sunday press review here). The idea has been met with some ridicule, including criticism that it would ruin what makes Cambridge special. But as an excellent piece from Jonn Elledge says, many of the UK’s cities can and should be bigger, and that is key to levelling-up the UK economy. You can read the piece on this here. We covered a similar topic with Roger Madelin in our podcast episode on regeneration here

4. However, expanding cities or building new towns is not easy, as a new feature on Northstowe explains. Northstowe is a new town in Cambridgeshire and the biggest since Milton Keynes was developed in the 1960s. But residents who have moved into the 1,200 homes that are already occupied are concerned about the lack of facilities, including shops. "It's like building a home without a kitchen,” says one resident. BBC piece here

5. The commission-free trading platform Public.com is launching in the UK. Customers in the UK will initially be able to trade US stocks and access data, but the company plans to expand this service. Public.com is a rival to Robinhood and this is the company’s first expansion outside the US. Bloomberg story here

6. Women’s football in England is in a start-up phase and would benefit from the Football Association partnering with a strategic investor to fund its expansion and short-term costs. These are the findings of an independent review led by former player and TV analyst Karen Carney, which also calls for a dedicated TV broadcast slot for women’s matches and minimum salaries. Financial Times story here

7. Google has launched a new tool that makes it easier to schedule meetings by letting people automatically book a slot in your calendar that you have marked as available. The new tool is similar to Calendly, an app that I have used more and more over the last few months. Google will also let you mark on your calendar if you are working in the office, at home, or somewhere else. TechCrunch story here

And finally…

There will be no Ashes test match north of Nottingham when Australia come back for their next cricket tour of England in 2027. This year the men’s test matches are at Edgbaston in Birmingham, Lord’s in London, Headingley in Leeds, Old Trafford in Manchester and the Oval in London. However, in four years time the matches at Headingley and Old Trafford will be replaced by Trent Bridge in Nottingham and the Ageas Bowl in Hampshire.

This is unfortunate. Not only are Headingley and Old Trafford two of the most vibrant cricket grounds in the country, but this is not exactly spreading the Ashes tour across the country. These test matches bring thousands of supporters to the cities and boost the local economy, yet the north of England and other parts of the country will miss out completely in 2027. Trent Bridge and the Ageas Bowl are two brilliant grounds that deserve an Ashes test, as does the south coast more generally, which will host an Ashes test for the first time. However, the schedule for 2027 means three-fifths of the series will be played in a small corner of the UK in the south and south-east. As Michael Atherton writes in The Times today:

Most pertinent of all is the case for geographical reach and fairness, with two Tests in London guaranteed. Yorkshire and Lancashire are two of our three greatest cricketing counties (Surrey the other), both hotbeds of the game with strong, competitive leagues and large playing populations. Durham (like Cardiff, no longer a Test venue essentially) has produced more than its fair share of England cricketers of late, most the products of club and state schools.

You can read Atherton’s piece in full below

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham