House prices and all those different reports...

Housing market cools + Off to Lunch this week + Other stories that matter + Manningcast

Hello and welcome to the latest edition of Off to Lunch…

We now have two clear pieces of evidence that the housing market is slowing in the UK. Halifax published its latest house price index this morning and that says the price of the average house fell 0.4 per cent in October. It also says that year-on-year prices are up 8.3 per cent, lower than the 9.8 per cent annual increase reported in September. This is the third time in four months that Halifax has reported a monthly drop in prices. Its report comes days after Nationwide said in its housing market survey that prices fell by 0.9 per cent in October, the first monthly drop it had recorded since July 2021. Nationwide and Halifax are therefore both reporting falling prices….

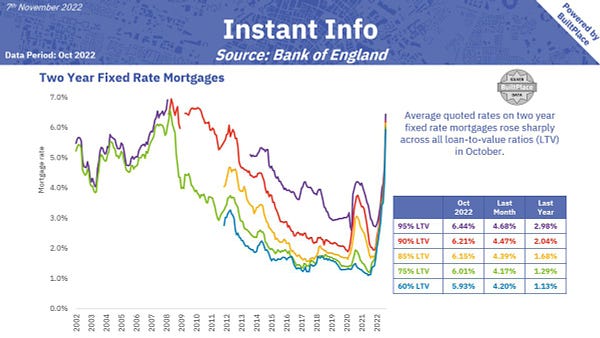

A drop in house prices has been widely forecast by economists because of the rise in interest rates on mortgages and the uncertain economic environment. Full-time employees could expect to spend 9.1-times their annual earnings on buying a home in 2021, according to research by the Office for National Statistics. That stretch was only sustainable when mortgage rates were at historical lows and cheap debt could fill the gap between income and house prices. However, the base rate of interest in the UK is now 3 per cent and mortgage rates for first-buyers have hit 6.5 per cent on the back of Liz Truss and Kwasi Kwarteng’s mini-Budget.

A unique aspect of reporting on the housing market is how many different surveys and reports there are. Nationwide, Halifax, the Office for National Statistics, HM Revenue & Customers, the Bank of England, the Royal Institution of Chartered Surveyors, Rightmove, and Zoopla all issue research relevant to the market.

In terms of house prices, Nationwide and Halifax publish the quickest data, and Nationwide tends to go first. Nationwide and Halifax’s latest reports are for October and obviously it is only November 7 today. As two of the biggest mortgage lenders in the UK they can use data from their own transactions to analyse house prices and do so at the mortgage approval stage, rather than when property sales are completed. These surveys deliver different house price numbers because they use slightly different methodologies, have a slightly different geographical spread (Halifax tends to have more customers in the north) and quite simply are tracking different properties.

In contrast, the ONS’s house price index uses data from Land Registry on completed sales and covers all transactions. This takes longer to publish. The latest ONS house price index was published on October 19 and covered August. The data for October will not be published until the middle of December. Rightmove’s data looks at the opposite end of the housing market by tracking the asking price that properties are initially listed at on its website.

The ONS has actually published a useful guide to all the different reports here. In terms of the other data sources I mentioned, HMRC tracks the number of transactions, the Bank of England tracks mortgage approvals and the Royal Institution of Chartered Surveyors tracks the activity and mood of estate agents.

All of these reports tend to be covered by the national media because of the interest in the housing market among readers (house price stories always attract big audiences online) and the quality of the research - Nationwide, Halifax, Rightmove and Zoopla dedicate significant resources to compiling their data and offering commentary alongside them, for instance.

Halifax works with IHS Markit on its house price index. A couple of things stand out in the latest report alongside the headline monthly number. Firstly, house prices are still 8.3 per cent higher than a year ago and more than five times higher than they were 30 years. So, any weakening of the market is happening from a position of historic strength.

Secondly, there is significant regional variation within the Halifax data. For example, house price growth actually accelerated in the North East in October while the rest of the country saw a slowdown. Overall, the regional differences vary from a 6.8 per cent year-on-year rise in house prices in London to an 11.7 per cent rise in the West Midlands. Yet because the average house price in London is so much higher than the national average - £551,320 versus £292,598 for the UK as a whole - that 6.8 per cent increase for London is still worth more in cash terms (£34,900) than any other area…

For more analysis on the housing market I recommend following Neal Hudson, an analyst at BuiltPlace, on Twitter. His account is full of interesting graphs and charts, such as the latest mortgage rates…

This week and podcast…

A quick reminder that from this week there are a couple of small changes to your weekly Off to Lunch schedule. Firstly, the Wednesday newsletter is being replaced by more impromptu editions to analyse big news or developments. Secondly, podcast episodes will now be launched on Tuesday mornings rather than Monday mornings.

As part of this recalibration (awful word, sorry) Business Studies is taking a short-break in its usual format this week. Instead of a look back at a big business story from the past with those involved, we have done a bonus episode that tries to make sense of what just happened over the last few weeks, specifically regarding pensions and pension funds, an area that nearly sparked a new financial crisis but is riddled with complexity. In this episode I speak with Tom Selby, head of retirement policy at AJ Bell (and my partner at Fantasy Gameweek), to try to understand liability-driven investments, the success of the Bank of England’s £65 billion bail-out and the debate around the triple-lock. This special episode will take the form of our usual bonus podcast content so it will be available on Friday morning and be for paying Off to Lunch members only. You can sign-up to become a member below and listen to all our podcast episodes here.

One last thing before I move on, Substack has announced an exciting new feature - Substack Chat - where writers and readers can hold more informal conversations and debates. A lot of Substack publications have been using Slack or Discord to host live Q&As and exchange ideas between readers. This new feature allows that to be brought on to Substack itself. I have a few ideas about how to bring this feature into Off to Lunch but I would love to hear from you about what you would find useful. Please contact me at the usual address - graham@offtolunch.com - with your ideas and thoughts…

Other stories that matter…

A look at how the owner of Budweiser, Anheuser-Busch InBev, will sell beer in Qatar during the World Cup when alcohol is mostly banned in the country. Budweiser thinks that more alcohol will be consumed in Qatar during the month of the World Cup than during an entire typical year. Alcohol is usually only available in Qatar in high-end restaurants and hotels (Bloomberg)

The story of how a collection of American crypto investors bought Crawley Town football club and are trying to modernise the League Two team. They have won the backing of long-time supporters with their transparency and investment, but the team is struggling on the pitch… (New York Times)

Business Live has done an interview with billionaire John Caudwell about how he built Phones 4u and his fortune. Initially a car dealer in Stoke in the 1980s, Caudwell identified mobile phones as a promising market and started buying Motorolas in bulk and selling them on. But Motorola ditched Caudwell as a customer and so he was forced to turn to Nokia, which led to spectacular results. “I'd taken Nokia market share on my own from one-and-a-half per cent of the market share to 20 per cent, which really did Motorola an immense amount of damage and which was very satisfying to me, given that they've been so utterly ruthless in the way they treated me.” An interesting read for any entrepreneur (Business Live)

Some Twitter users are leaving the social media site for Mastodon after Elon Musk’s takeover. This is a guide to what Mastodon is (BBC)

The relationship between the directors of Britain’s leading companies and their biggest shareholders is a mess. Chairmen claim that institutional investors don’t understand their companies, meddle in details and secretly team up with activist investors to push for change, according to a new report. This isn’t a good look for shareholders or big business (The Times)

Meanwhile, FTSE 100 chief executives have seen their pay packages rise by an average of 23 per cent to £3.9 million this year. Bosses have received higher bonus payments as the performance of their companies has improved following the easing of the Covid-19 crisis, PWC said in a report (Financial Times)

Another important story about FTSE boardrooms: there is an “appalling” shortfall of women in executive roles according to a report by Cranfield University and EY (Financial Times)

On a similar topic, analyst and investment expert Stephen Clapham has identified seven ways to judge the quality of a chief executive. Look at their track record, assess the strategy, check their CV… but you don’t have to meet them (Behind the Balance Sheet)

Finally, check out Off to Lunch’s Sunday press review for a round-up of the news and analysis in the weekend papers. Paying members got this sent to their inboxes yesterday. You can sign-up now to read it and get next week’s edition here.

And finally…

I mentioned this in the Sunday press review, but for those who haven’t seen it yet, I recommend watching Gary Neville guest-host Have I Got News for You. You can find it on the BBC iPlayer here. Neville does a solid job as the host given but admits that he was “caught with a few punches on the face on Qatar off Ian Hislop”.

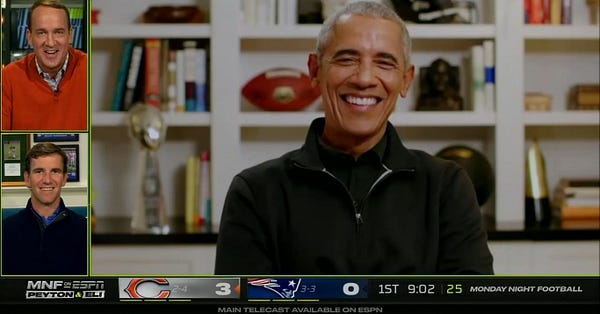

Sticking with TV and sport, on my recent trip to the US I got to watch Monday Night Football with Peyton and Eli, an innovation in sports broadcasting that is surely on its way to the UK at some point. For those who don’t know, this show involves former NFL quarterbacks and brothers Peyton and Eli Manning chatting virtually from their living rooms while a live NFL game is broadcast on the screen alongside them. They chat about the game, American Football in general and other topics. They are joined throughout the show by a collection of guests, including some proper A-listers. In the episode I watched they were joined by President Barack Obama.

ESPN, which is owned by Disney, broadcasts the Mannings alongside its traditional live NFL show, which includes the commentary and studio set-up you would normally expect. Sky and other sports broadcasters tried some interesting new formats during the Covid-19 lockdown - for example, Sky got players and analysts together to watch re-runs of big matches, However, in general live-sports broadcasting has followed a similar format for the last 30 years. Perhaps that is about to change…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham