Hello and welcome to the latest Off to Lunch…

House prices in the UK have fallen by the most in a year since the aftermath of the financial crisis, according to the latest data from Nationwide.

House prices in July were down 3.8 per cent compared to a year earlier and down 0.2 per cent compared to a month earlier. That is the biggest annual fall in house prices since July 2009 and compares to the 3.5 per cent drop recorded in June. Prices have now fallen 4.5 per cent since peaking in August 2022.

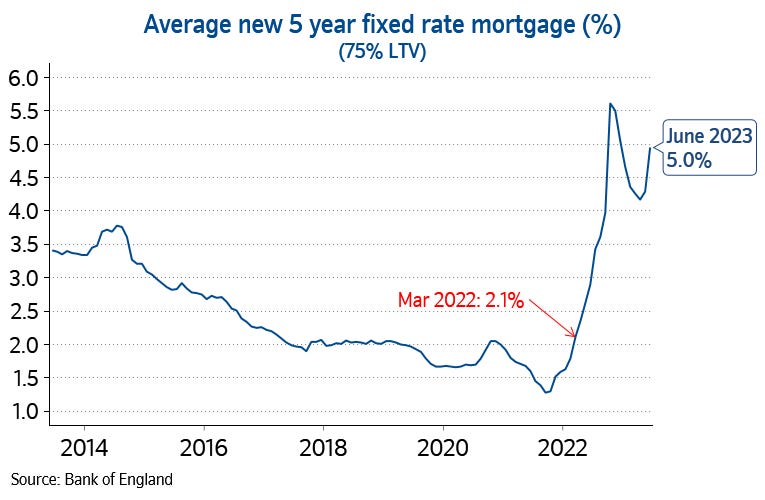

The decline isn’t that surprising given the pressure on prospective buyers from higher mortgage rates. Nationwide has released some graphs alongside its latest data to illustrate this pressure. Firstly, this graph shows the dramatic increase in the average interest rate on a new five-year mortgage over the last 12 months…

Secondly, this graph shows that the house price-to-earnings ratio in the UK is still well above the long-run average. This means that people are having to pay more for a property relative to their earnings than in the past…

Robert Gardner, the chief economist at Nationwide, expanded on this point by saying:

“A prospective buyer earning the average wage and looking to buy the typical first-time buyer property with a 20 per cent deposit would see monthly mortgage payments account for 43 per cent of their take-home pay (assuming a 6 per cent mortgage rate). This is up from 32 per cent a year ago and well above the long-run average of 29 per cent. Moreover, deposit requirements continue to present a high hurdle – with a 10 per cent deposit equivalent to 55 per cent of gross annual average income.”

Data from the Bank of England on Monday actually showed that mortgage approvals rose last month. However, Gardner said that data involves mortgage applications that pre-date the recent increase in interest rates and that mortgage approvals are still down by roughly a fifth on pre-Covid levels in 2019.

He added:

“Nevertheless, a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters) expectations. In particular, unemployment is expected to remain low (below 5 per cent), and the vast majority of existing borrowers should be able to weather the impact of higher borrowing costs, given the high proportion on fixed rates, and where affordability testing should ensure that those needing to refinance can afford the higher payments.”

Nationwide has published house price data since 1952 and its index is considered one of the most reliable and up-to-date sources of information on the property market. Nationwide tracks the price of owner-occupier transactions involving a mortgage it has approved. Nationwide was the second biggest mortgage lender in the UK in 2022 behind Lloyds Banking Group according to UK Finance, so its sample size is significant. Every three months it also publishes a regional breakdown of house prices, with the next data due in October. You can find Nationwide’s methodology here and the latest data here

Other economic data out today paints a mixed picture for the UK economy. Factory output dropped in July to the joint-lowest level since May 2020, according to the latest S&P Global and CIPS Purchasing Managers’ Index…

However, in better news, prices in shops have fallen month-on-month for the first time in two years according to the British Retail Consortium. This was driven by fashion retailers offering discounts on clothing and footwear as the spring/summer season comes to an end…

Other stories that matter…

1. HSBC has reported that pre-tax profits more than doubled in the first half of 2023 to $21.7 billion (£16.9 billion), up from $8.8 billion in the same period last year. The bank benefitted from rising interest rates around the world and a $1.5 billion boost from the acquisition of Silicon Valley Bank UK. HSBC has relaunched SVB as HSBC Innovation Banking. It says in the results:

“We are building similar businesses to the former SVB UK in the US, Hong Kong and Israel, and using our international network and balance sheet strength to offer new opportunities to expand globally to our clients in the technology and life sciences sectors.”

Noel Quinn, HSBC’s chief executive, has also commented on the debanking row sparked by Nigel Farage and Coutts. His comments are particularly interesting given that HSBC makes about two-thirds of its revenue in Asia, including China and Hong Kong…

You can read HSBC’s results in full here

2. BP, another of the UK’s biggest companies, also has results out today. The oil giant’s underlying profits fell 69 per cent year-on-year to $2.6 billion in the three months to the end of June, which was driven by a decline in the oil and gas price during the period. However, BP has increased its dividend payment to investors by 10 per cent and will buy back another $1.5 billion of shares over the next three months. You can find the company’s results here. BP shares are up more than 2 per cent on the news.

3. Away from corporate results, check-out this fascinating piece on the wife and husband who bought a former RAF radar station in the Shetland Islands and turned it into a spaceport for the UK. You can read the BBC piece here

4. Before Ryan Reynolds and Rob McElhenney bought Wrexham Football Club it was owned by two Cheshire property developers who were subsequently banned from being company directors in the UK for seven years. You can find out more about the controversial business dealings of Alex Hamilton and Mark Guterman here

5. Statistician Nate Silver has written about why left-wing politics gets the best coverage in the media and why Elon Musk is therefore right to change Twitter. Piece here

6. There has been lots of coverage recently about Jason Belmonte, the Australian tenpin bowler, after he became the first professional player to score a perfect 300 three times on live television. Belmonte has revolutionised tenpin bowling by using two hands instead of one, winning 15 major championships in the sport, more than any other player. Even Bloomberg has now written about the man it says is comparable to Michael Jordan, Tiger Woods and others who have changed the way their sport is played. Piece here

New podcast episode…

The new episode of our Business Studies podcast is out today and features an interview with Richard Price, the managing director for clothing and home at Marks & Spencer. Price discusses his efforts to revitalise M&S fashion and attract a new generation of shoppers to the 139-year-old high street retailers. He also talks about an extraordinary career in retail that has spanned the early days of Next, Tesco and Sir Philip Green and BHS. You can listen to the episode on Substack here, Apple here and Spotify here

And finally…

The Ashes ended yesterday with Stuart Broad taking the wicket that won the final test for England. This left the men’s series drawn at 2-2. Broad announced his retirement during the match then ended up hitting his final ball as a batsman for six and taking a wicket with his final ball as a bowler to win the match. Quite an ending. Mike Atherton’s piece on Broad and the match is well worth your time. You can read his piece in The Times here and the Australian view from Gideon Haigh here. Despite Australia retaining the Ashes courtesy of winning the previous series, Haigh describes this series as a “shared moral victory”

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham