Forget what this deal means for Twitter, what does it mean for Elon Musk...

...because it has already cost him way more than $44 billion

This is Tesla’s share price graph since floating. It is important in understanding Elon Musk and his bid for Twitter. You can see the remarkable spike in 2020 and 2021 that rapidly propelled Musk to the title of richest person in the world. But right at the end you can also see the drop since he made his move for Twitter. Tesla shares fell 12.2 per cent yesterday, wiping $125 billion off its value and costing Musk roughly about the same as he has committed in equity to the Twitter deal - $21 billion.

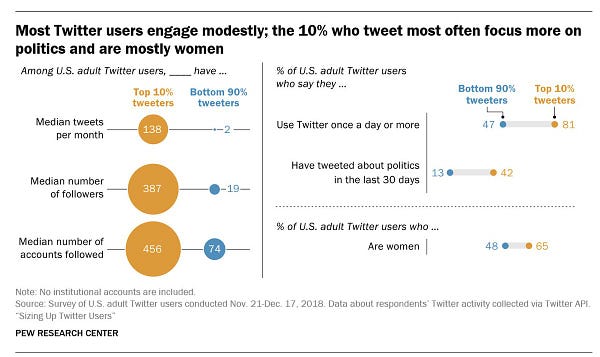

A lot has been written about what Musk’s takeover means for Twitter, less so about what it means for Musk. On what it means for Twitter I will be brief. The tweet below is a reminder that Twitter right now is far from perfect as a “digital town square”, which is how Musk has described it, and does not represent the views of the general population. It has 217 million daily users, many of them influential people, but Meta has 2.8 billion across Facebook, Instagram, Whatsapp and Messenger.

On what it means for Musk, it is important to remember that Musk’s public persona is different to Musk the businessman. His Twitter profile is how Tesla advertises, it is part of the brand. Below is a graph of how much Musk tweeted between 2010 and 2021, with the data sourced from Kaggle and reproduced by the brilliant newsletter Margins by Ranjan Roy and Can Duruk.

Look at this graph and then look back at Tesla’s share price chart. The correlation is striking. The two numbers were marked by Margins to identify moments when tweeting and the share price were particularly aligned. There is a debate to be had about cause and effect and whether the tweeting is driving the share price or vice-versa. However, at the very least we can say that Musk does not see tweeting as detrimental to Tesla.

Musk the businessman is a visionary but he is also a pragmatist. For instance, take this extract from Bloomberg’s colour piece on how the Twitter deal happened.

“One person said that while Musk has a public persona of shooting from the hip, in private he was curious, thoughtful and open to feedback.”

Much of what has been written about how Musk overhauls Twitter frames the social media company as some sort of billionaire’s plaything. Musk himself said in a Ted interview earlier this month that his bid for Twitter was “not a way to sort of make money”. But the financial structure of the deal does not give him that luxury. He is not just contributing $21 billion of equity (although much of this could come from other investors) but also a $12.5 billion margin loan against his Tesla shares. This is a risky deal for Musk.

The drop in Tesla’s share price was a predictable response to the prospect of Musk selling some of his 16.7 per cent stake to fund the takeover and potentially being distracted from running the electric carmaker.

Given this hit and the risk Musk is taking on, it is worth considering why he thinks it is worth it and how Twitter fits within his broader empire.

Margins, whose graph I showed you earlier, has the most interesting theory on this. In short, this deal is all about protecting the benefits Tesla gets from Twitter, consolidating and diversifying Musk’s assets, and setting up his next big payday. You can read the full newsletter below:

Some sort of consolidation of Musk’s assets appears to be underway following reports last week of him registering companies in Delaware. This has led to speculation that he could be creating a super-company to hold all his assets:

The proposed takeover of Twitter and the expansion of Musk’s empire mean his lieutenants are going to become more and more important. They have had a relatively low profile so far, but the Information has a thorough piece on them here. The key figures include Drew Baglino, head of powertrain and energy engineering at Tesla, Gwynne Shotwell, president of SpaceX, and Jared Birchall, who runs Musk’s family office. That family office is based in Austin, Texas and is called Excession. The Daily Mail has done a piece on “secretive friend” Birchall here while Reuters has looked at Excession here.

Here are two final examples of Musk being a pragmatist. He donated to Republican and Democrat senate candidates during the 2020 election cycle. Also, for all his passion for free speech, he has reportedly tried to shut down critics of Tesla in the past.

The break-fee of $1 billion for the Twitter deal is significant. If Musk sees the cost of the deal outweighing the benefits, he can pull the plug at a small cost (for him at least). As a pragmatist, I have little doubt he will scrap the deal if the sums no longer make sense.

Fed v Markets

Tech stocks appear to be bearing the brunt of concerns that the Federal Reserve and other central banks are in danger of increasing interest rates too fast. We covered the concerns about a slowdown in Friday’s newsletter, including the lockdowns in China, and Ambrose Evans-Pritchard at The Telegraph has his own unique take on it here (including praise for Andrew Bailey). Yesterday the Nasdaq had its worst day since September 2020, dropping 3.95 per cent. This is the Nasdaq since the start of 2020.

As you can see, it is still above its pre-Covid levels, but the trend since the start of 2022 is clearly down. The Nasdaq won’t be helped today by Google-owner Alphabet missing expectations last night with its quarterly results.

However, I want to take this opportunity to be a bit more optimistic. Yesterday’s drop was exacerbated by Tesla’s big fall and the Nasdaq is suffering from some tech stocks struggling to adapt to post-Covid reality, like Netflix or Peloton. The Dow Jones Industrial Average and the FTSE 100 look rather different. This is the FTSE 100

While there is downbeat news and a lot of noise out there, stocks are not just being driven by concern about the global economy. In fact, this morning in the UK there are companies upgrading their profit forecasts, including Lloyds Banking Group and advertising giant WPP, both reliable bellwethers for the economy and the mood of consumers and businesses. Charlie Nunn, the chief executive of Lloyds, said the outlook for the UK economy “remains uncertain” while Mark Read at WPP said his company was “very mindful of the impact of the broader macroeconomic environment”. Yet both companies also reported strong demand for their services.

A tweet that helps you understand the world

This is one of the leading figures in the UK venture capital industry warning start-ups that they need to recalibrate their funding expectations. Pretty clear evidence that the market has changed in 2022.

You should also read this

I can’t imagine UK farmers will be happy with this idea to cut tariffs to zero on food imports. The link to the article is included with the publication at the end (FT, £)

£22,500 for anyone who can find a new store for Lidl (BBC)

Fidelity to allow bitcoin to be added to retirement savings and investment pots (Times, £)

Chinese company Nreal to trial augmented reality glasses in UK (CNBC)

Lisbon is top location in the world for remote working, ahead even of Miami (Bloomberg)

And finally…

The NFL draft takes place tomorrow night in Las Vegas, where the best college players will be picked by teams, starting with the Jacksonville Jaguars, who had the worst record last season. If you want to understand more about the NFL, or are already a fan of the sport (like me) or just want a good podcast to listen to then I recommend Around the NFL. Presented by Dan Hanzus, Gregg Rosenthal and Marc Sessler, this is a US-based podcast that has attracted a big following in the UK (it regularly features in the top 10 sports podcasts in the UK). The show’s popularity in the UK is partly due to their wit and dry humour but also Dan, Gregg and Marc simply being knowledgable, passionate, engaging and likeable. Around the NFL has done live shows in the UK and (claim to fame alert) I ended up on the front row at one last year and featured on their Twitter feed in a rather ridiculous pose…

Tragically, Chris Wesseling, one of the presenters, died of cancer in February 2021. The podcast has featured some moving conversations about grief in the last year. The Times did a piece on that here and you can contribute to a fundraising for his wife and son here.

Thanks for reading. If you want to contribute to the work of Off to Lunch, then please sign up for a paid subscription. Alternatively, please just spread the word!

Thanks again

Graham