Hello and welcome to the latest edition of Off to Lunch…

Mortgages and the housing market are top of the agenda again after HSBC pulled all its mortgage deals for new borrowers and Moody’s, the credit rating agency, said house prices are likely to fall by 10 per cent in the UK over the next two years.

HSBC pulled its mortgage deals on Thursday afternoon with little notice. It plans to reintroduce them on Monday with increased rates. Another of the UK’s biggest mortgage lenders, Nationwide, is increasing its mortgage rates by up to 0.25 percentage points.

The average two-year fixed mortgage rate now stands at 5.83 per cent while the average five-year rate is 5.5 per cent, the highest this year, according to research by Moneyfacts. Bloomberg is reporting that 5,056 mortgage products are still available in the UK. This is 4 per cent lower than the start of May, but the highest in June so far, suggesting deals are returning to the market, albeit with higher rates. Story here

Lenders have increased their mortgage rates after data released last month showed that inflation is not coming down as fast as expected, meaning the Bank of England is likely to increase the base rate of interest above the 4.5 per cent it currently sits at. The Bank’s monetary policy committee, which sets interest rates, is meeting again on June 22.

A new analysis from Moody’s highlights what the consequences of increased mortgage rates could be. It says that house prices are likely to fall 10 per cent over the next two years. This matter-of-fact quote from Moody’s report on the housing market summaries its view:

The combination of less affordable mortgages and high inflation putting a dent in incomes will trigger a correction in the UK housing market.

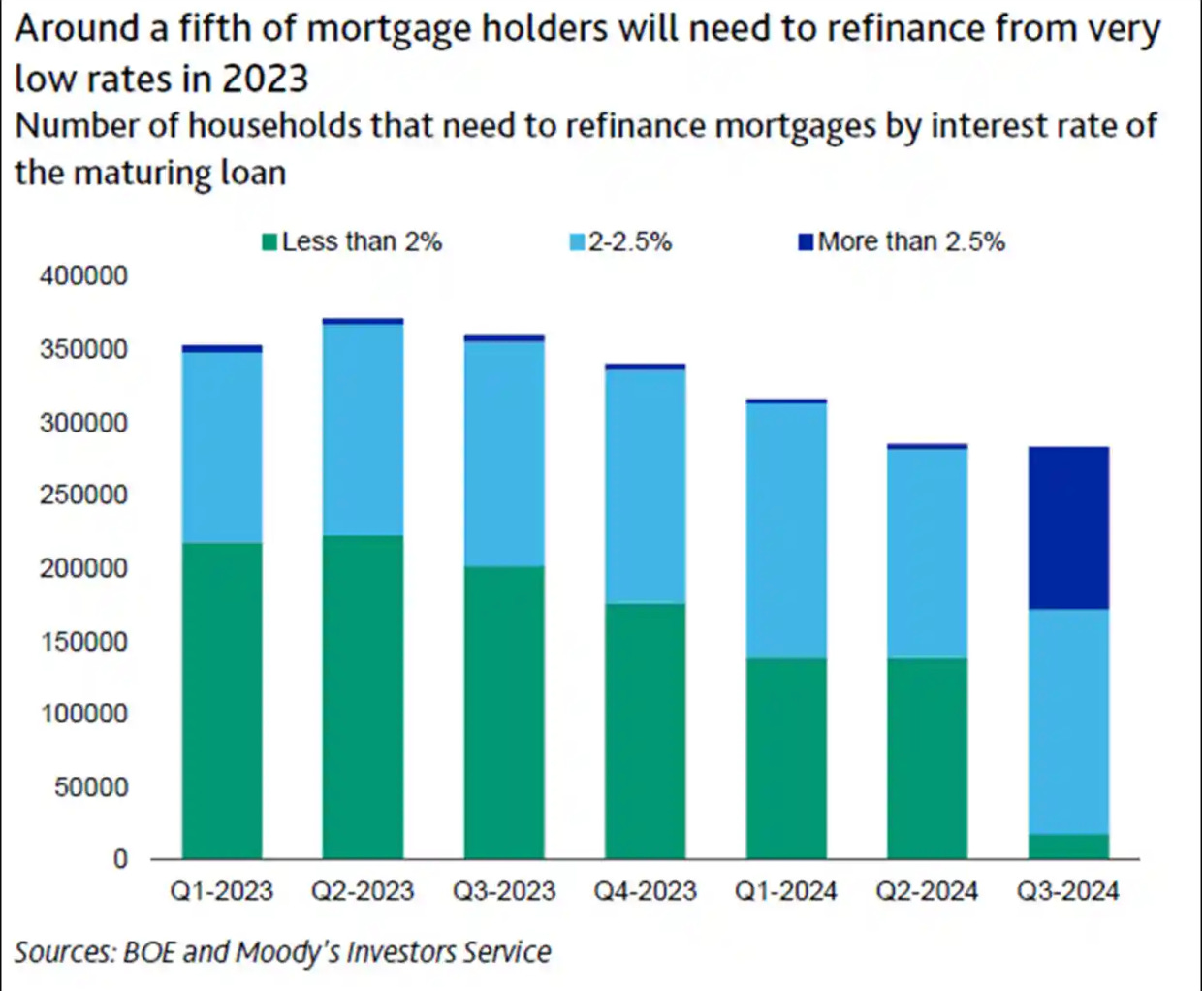

The report also includes the graph below which clearly shows why the rise in interest rates on mortgages matters so much. This shows the number of households whose current mortgage deals are coming to an end and the interest rate they are on. Remember, rates are now above 5 per cent, so any household in the green or blue is about to face a big financial hit…

Moody’s also explored what would happen if house prices fell by 21 per cent, not a scenario it is forecasting. It said this would cause a recession in the UK that would start in the second half of 2023 and last for six quarters. Unemployment would rise from 3.9 per cent to 6 per cent.

Given this backdrop, a piece from Ambrose Evans-Pritchard in The Telegraph caught my eye. The Telegraph’s world economy editor has written about how deflation is now the big issue, not inflation. He has written the piece after new data showed that inflation in China is just 0.2 per cent year-on-year, with producer prices dropping 4.6 per cent. Ambrose Evans-Pritchard writes that China needs to “export its way out of an economic depression”, meaning the price of the goods coming out of its factories and heading around the world is going to fall sharply. Rishi Sunak will have no difficulty halving inflation in the UK, he writes, but this may not be welcome if it is followed by deflation. Full piece here

Other stories that matter…

1. The Daily Telegraph, The Sunday Telegraph and The Spectator look like they are going to get new owners after Lloyds Banking Group appointed receivers to the company that owns the media brands, which had been controlled by the Barclay family. This is an extraordinary media and business story because of how quickly events have moved and the split in the Barclay family that has helped to cause it.

I started my career at The Telegraph and spent eight years working there, so I have a particular interest in this story. There are so many unanswered questions still, such as why Lloyds and its new-ish chief executive Charlie Nunn decided to act now, how that relationship has broken down in recent months over debts estimated to be more than £1 billion, and what may happen to other businesses that the Barclays family own, such as online retailer Very?

Telegraph Media Group is already attracting lots of interest from potential buyers. It is a media business that is profitable, growing its digital subscriber numbers and has a distinctive brand. The situation reminds me of what happened to Liverpool football club in 2010 when Royal Bank of Scotland took control from owners Tom Hicks and George Gillett after running out of patience with their debts. Liverpool was, as The Telegraph is now, a healthy business that attracted lots of interest from potential buyers. RBS appointed Martin Broughton as chairman to oversee the sale process and the club was bought by Fenway Sports Group, who eventually hired Jurgen Klopp and brought trophies back to Liverpool. RBS took a significant reputational risk by acting like it did, as Lloyds has now, but the future proved to be bright for Liverpool. You can find more details on that Liverpool saga by David Conn at The Guardian here. For the background to the split with the Barclay family check-out an excellent feature in The Times today here

2. A promising UK biotech company that is developing cell therapies to treat diseases and the rejection of organ transplants has agreed a lucrative partnership deal with AstraZeneca, Britain’s most valuable company. Quell Therapeutics was founded in 2019 as a spin-out from University College London. It has already raised tens of millions of pounds from investors, including £117 million in November 2021 (details here). AstraZeneca will work with Quell to develop its treatment for type-1 diabetes and inflammatory bowel disease. AstraZeneca has agreed to pay Quell $85 million upfront plus $2 billion or more if certain milestones are hit with the development of the treatment. AstraZeneca’s statement on the deal is here.

3. For those in the north wondering how TransPennine Express train services could be so bad, the new boss of the operator, Chris Jackson, who has been put in place by the government, has some answers. He said the business had become so complicated that there were 5,000 outstanding training days for staff. More details in this Manchester Evening News story here

George Osborne, president of the Northern Powerhouse Partnership, has been speaking today about the importance and opportunity of improving transport links in northern England…

Osborne has been speaking at the Conservative MP’s Northern Research Group event in Doncaster, with Rishi Sunak also due to make an appearance. More details in this story by The Yorkshire Post here

4. A British start-up co-founded by the former boss of Aston Martin, Andy Palmer, has launched a new e-scooter that it claims will address the safety concerns that people have about the scooters currently whizzing around on pavements, roads and in parks. Hilo’s scooter is called the Hilo One and includes collision sensors in the handlebars, strong lighting and a more robust front-wheel. More details here

5. Sheffield-based WANdisco was not so long ago hailed as one of the most promising tech businesses in the UK. It has reached a stock market valuation of $1 billion. But then it emerged in March that a collection of lucrative contracts it claimed to have with multinational companies didn’t actually exist. Trading in the company’s shares has been suspended ever since and WANdisco is now battling to survive.

The company, which helps big businesses move data to cloud computing services, is working to raise $30 million so it can relaunch. In a new statement today, WANdisco said that an independent investigation into the scandal has founded that orders from eight contracts were “false”. There were "no recent contracts, revenues, Proofs of Concept, technical engagements or sales relationships between any of these eight companies and WANdisco”, the statement says. WANdisco also said that it wants to change its name and will table a proposal to do so at its forthcoming annual meeting, a date for which is yet to be confirmed. “The change to the company name is part of a broader update to the company's overall brand to best reflect the values and vision embodied in the turnaround plan, including but not limited to improvements in disclosure, governance, and the board's future ambitions for the company,” the statement says. You can read the full announcement here.

6. Author David Epstein has written an interesting piece on the importance of writing down good ideas and facts that fascinate you. This is a practice that is proven to spark creativity and help with decision-making. Piece here. This column reminded me of a column that Julian Richer, the founder of Richer Sounds, wrote last year for The Sunday Times about how he always has a piece of A4 paper in his pocket so he can jot down ideas and keep track of his to-do list. Piece here.

And finally…

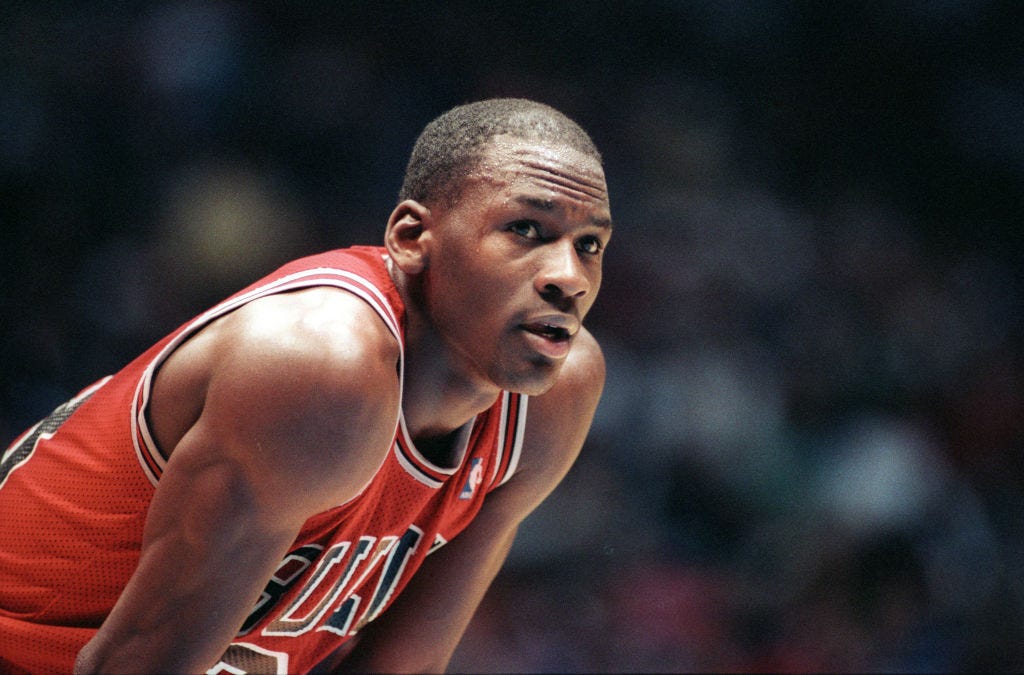

There are not many enjoyable business-focused films around but the newly-released Air is one. The film tells the story of how Nike agreed a deal in 1984 to partner with a young Michael Jordan to launch Air Jordan trainers. Until this point Nike had been largely focused on running shoes, but this deal transformed the company and the power of athlete endorsements. Matt Damon plays the Nike basketball talent scout who pushes for the company to sign Jordan while Ben Affleck provides an amusing entertaining and eccentric portrayal of Nike co-founder and chief executive Phil Knight. The film is available to watch on Amazon Prime here

The film is also a good reason to re-watch, or watch for the first time if you haven’t seen it already, The Last Dance on Netflix, a superb documentary about Jordan’s career at the Chicago Bulls, particularly his final season in 1997/1998. You can find it here.

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham