The UK is facing the biggest collapse of a retail business since the demise of Debenhams, Edinburgh Woollen Mill and Sir Philip Green’s Arcadia empire in 2020. McColl’s, the convenience store and corner shop chain, could call in administrators as soon as today although it is working on a rescue deal with Morrisons, according to a report by Sky News here. But how did it come to this for McColl’s? The convenience store sector is one of the few areas of retail that is supposed to be growing – it suits our busy, on-the-go lifestyle and should also be boosted by more people working from home.

McColl’s has more than 1,100 shops across the UK and around 16,000 staff, 6,000 of whom are full-time. The company trades as McColl’s and Morrisons Daily convenience stores, Martin’s newsagents and RS McColl in Scotland.

When a retailer, or any business, runs into trouble there is much analysis about what or who was to blame. McColl’s has faced supply chain disruption in recent months and other challenges from Covid-19, but the root of its problems is pretty straightforward - the dramatic decline in tobacco and alcohol sales in the UK.

This was a group that was founded in 1973 as a cigarette vending machine business. It has been trying to transition its business model away from corner-shop newsagents selling papers, booze and fags to slightly larger grocery stores selling a wider range of food, think Tesco Express, Sainsbury’s Local, the modern convenience store. But this hasn’t been enough.

In Wednesday’s Off to Lunch I shared a chart from an Office for National Statistics report showing how physical and online retail sales have gradually converged in recent years. That same report also includes a chart showing how different product categories have performed and it highlights the decline in alcohol and tobacco sales…

That decline in alcohol and tobacco sales is equivalent to 76 per cent between 1989 and 2021. The drop in books, newspapers and periodical sales hasn’t helped McColl’s either. This is a business that was selling the two worst performing product categories in the UK over the last three decades. On alcohol and tobacco, the ONS added…

“In England in 2016, 15.5% of adults (aged 18 years and above) smoked, compared with 26.8% in 2000. Since 2005, adult drinking habits in Great Britain have changed. The overall amount of alcohol consumed in the UK has fallen, as well as the proportion of people reporting to be drinking, and the amount that drinkers report consuming.”

McColl’s actually did well to fight this trend for so long and its shares did okay after the company floated in 2014 with a valuation of £200 million.

The company’s strategy of converting its newsagents into larger convenience stores was a compelling one for markets because convenience has been one of the best performing segments in the UK grocery industry, taking share from large supermarkets. This is the latest forecast for the grocery industry from IGD, which was published last July. It predicted more growth for convenience…

However, McColl’s was also battling in this sector against the expansion of Tesco, Sainsbury’s, the Co-op and others. Some retail analysts have also questioned recent strategic decisions…

The collapse of key supplier Palmer & Harvey in 2017 (whose products included tobacco) ultimately sent McColl’s on a downwards spiral from which it hasn’t recovered. Morrisons is likely to rescue at least some of the stores, although shareholders face being left with nothing whether there is a deal or not.

THG’s annual report

THG’s annual report has been published this morning. EY, its auditor, has given the Manchester-based company’s accounts a clean bill of health, including its revenue recognition, valuation of intangibles and adjusted profit measures. However, I thought EY’s message to the audit committee on related party transactions was interesting. While it said accounting for the transactions - mostly property deals with founder Matt Moulding - was “appropriate”, it added:

“The control deficiencies we identified during 2021 have not been fully addressed, and whilst improvements have been made this requires further action. This includes more timely and robust challenge of related party transactions by the Related Party Committee which was addressed after the year end. In addition to the CEO, there were still common directors of both THG and Propco entities throughout 2021. These deficiencies have been acknowledged by the Related Party Committee and a plan is in place to address these observations as described within the Related Party Committee report on page 171.”

Musk and Twitter…

Elon Musk has attracted $7.14 billion of investment for his Twitter deal from 19 backers including Larry Ellison, Binance, and Sequoia. This is more evidence of what we spoke about last week – that he has to take the economics of Twitter seriously and the proposed takeover is not just some big game. Musk’s strategy for Twitter itself is not clear, but the takeover is part of a wider plan for his business empire. This is not just about free speech and a “digital town square”, it is about protecting Tesla and diversifying his financial interests. You can read more on that here from Platformer, which reports on how Twitter staff are perplexed by Musk’s plans for the company.

One last point for today about this deal – so much for the doubts about whether Musk could raise the money. He has rapidly pulled together a consortium of banks and investors for the debt and equity. Binance’s involvement is a sign of the times. The crypto exchange will diversify its finances by investing in the deal and is also in prime position to take advantage if Musk looks to integrate crypto payments into Twitter.

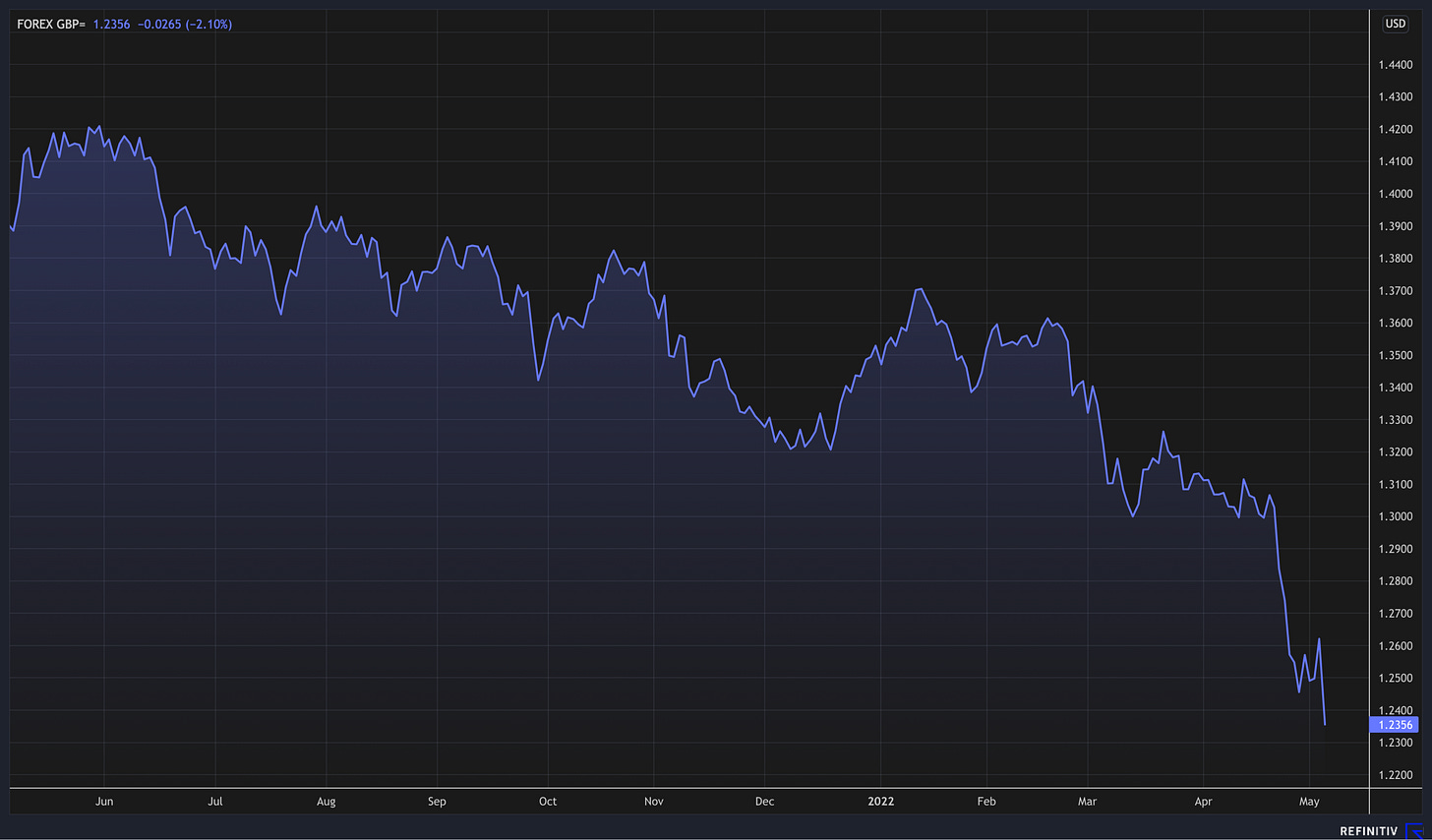

A chart that helps you understand the world

This is the pound v the dollar over the last year. It was a tumultuous day for US markets yesterday, with the Nasdaq falling 5 per cent, its worst day since June 2020. However, what this chart suggests is that for all the concern about the US economy, markets are more concerned about the UK. It is a pretty clear signal that markets think that the Bank of England will not be able to increase interest rates to control inflation with the same aggression as the Federal Reserve because of concerns about the slowing economy. Given the Bank’s warning yesterday that a recession could be on the way, that is a fair bet.

You should also read this

A year on from Debenhams stores closing, towns and cities across the UK are still trying to fill the empty units and have a variety of plans to do so, including bowling alleys, go-karting, hotels and demolition (Business Live)

I missed this piece earlier in the week but I still wanted to flag it because it is a fascinating read on how Apple has been successful after the death of Steve Jobs, the tension between Tim Cook and Jony Ive, and why chief executives can’t always be visionaries (NYT)

Those happy birthday messages from John Bercow and Jay from The Inbetweeners aren’t as popular as they once were. Cameo, the video app, is laying off 25 per cent of its workforce (The Information)

And finally…

I spend too much time thinking about Fantasy Premier League and fantasy NFL. It brings together my interests in sport and finance. In a similar vein to markets, you have to try to assess value, identify trends and try to get ahead of the competition when everyone is armed with the same information. Plus it’s just fun. Anyway, there will be more about this in Off for Lunch in the future (with potentially a league for subscribers next season). In the meantime, I will be spending my Saturday morning deciding how to approach the final few weeks of the season. This is my current team. I have had a miserable few weeks and after topping my friends’ private league for much of the season I am now 14 points behind the leader. I am also more than 200 points behind the leader in a league with my former Times colleagues, the less said about that the better, although at least I am not bottom…I presume staff at PWC will now be spending Friday afternoons changing their teams after this news…

Thanks for reading. Off to Lunch will be back on Monday. If you want to contribute to the work of Off to Lunch, then please sign up for a paid subscription below. Alternatively, please just spread the word!

Graham