Chat GDP...

The business news that matters

Hello and welcome to the latest edition of Off to Lunch…

New figures show that the UK economy was flat in the third quarter of 2023.

The Office for National Statistics has said that GDP (gross domestic product) was broadly the same in the three months to the end of September compared to the previous quarter. GDP rose by 0.2 per cent in the three months to the end of June.

This may seem a pretty downbeat result for the UK but it is better than what economists were forecasting. The consensus among economists according to a poll by Reuters was that the economy had declined by 0.1 per cent in the third quarter.

The graph below from the ONS shows how GDP has moved over recent quarters…

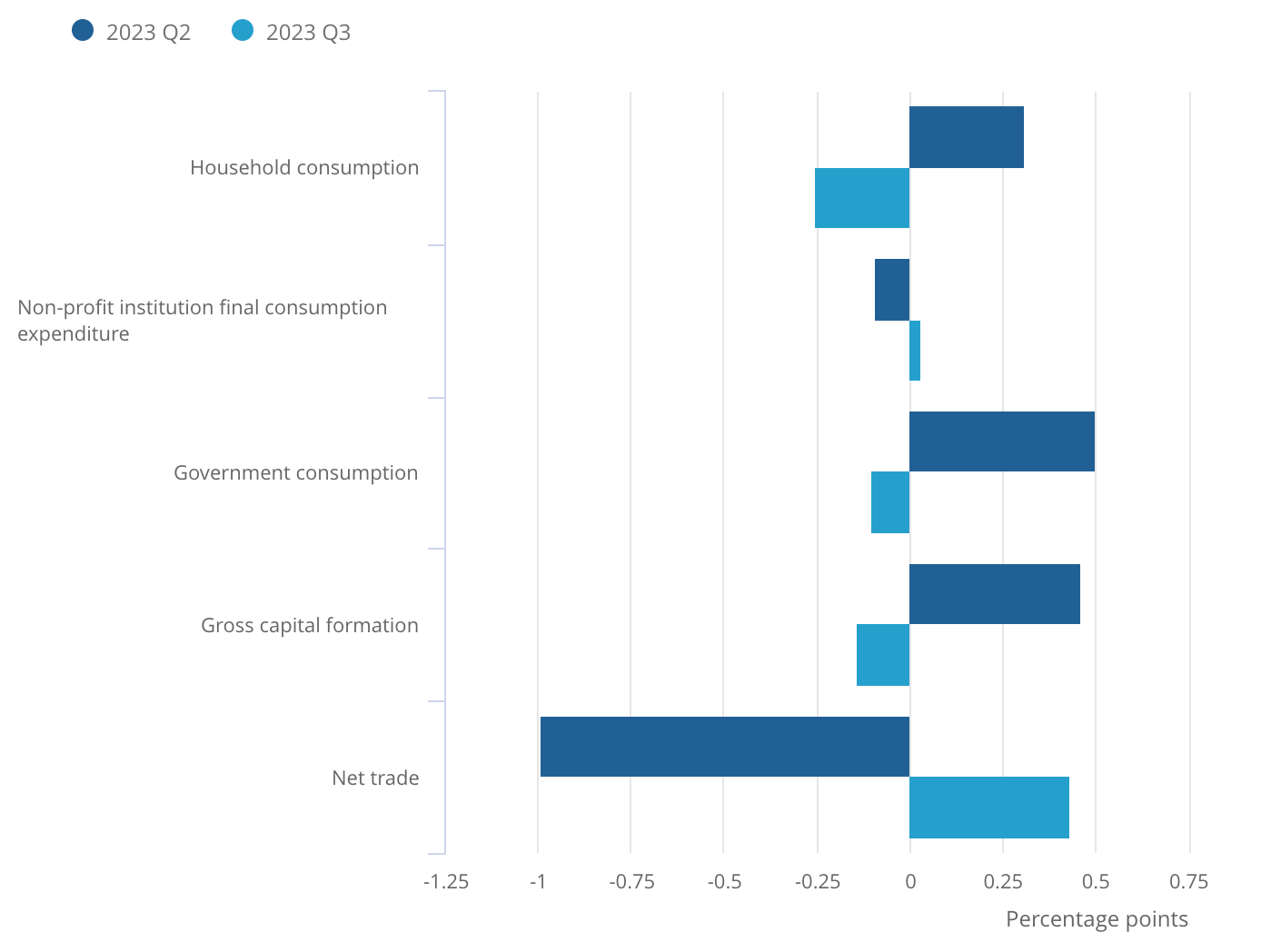

This second graph shows how a fall in household consumption has held back GDP. Consumers are grappling with rising bills and shop prices as well as higher interest rates on their mortgage or an increase in their rent…

Here is some of the reaction to the figures…

In other economic news, Redrow, one of the UK’s largest housebuilders, has warned that annual profits are likely to be at the bottom end of its forecast because of a "lower than anticipated sales rate due to the more subdued Autumn housing market”. Shares in Redrow are down more than 5 per cent following the news. You can find Redrow’s statement here

Meanwhile, the Bank of England has said it will model a big bond market shock to look at how such an event could impact the financial system. The Bank will work with 53 financial institutions on the scenario-planning. The move follows concerns about the chaos in bond markets following Liz Truss and Kwasi Kwarteng’s mini-Budget last year. You can find the Bank’s statement here

Lastly, check-out the graph below from tax expert Dan Neidle. It shows how small businesses are deliberately holding back their sales growth to avoid hitting the £85,000 threshold to register for VAT….

Kevin Hollinrake, the business minister, has actually responded to the post already…

Other stories that matter…

1. OpenAI’s announcement about new updates to ChatGPT and the artificial intelligence summit in the UK last week has prompted lots of new analysis about the future of the technology and its impact. Here is a round-up of the most interesting. Bill Gates has claimed that AI is quickly going to change how everyone uses computers. Writing in a blog post, he said: “In the near future, anyone who’s online will be able to have a personal assistant powered by artificial intelligence that’s far beyond today’s technology.” You can read that piece here. The Economist has looked at how AI technology will allow brands - and celebrities - to be in all markets and all formats at all times. You can read about that here. Lastly, the Financial Times’s data expert John Burn-Murdoch has looked at the potential impact of AI on white-collar jobs, including how a study by Boston Consulting Group staff found ChatGPT-4 significantly increased the speed and quality of their work. That piece is here

2. Natwest has announced that its former boss Dame Alison Rose will forego £7.6 million in share awards and bonuses following the row about Nigel Farage losing his bank account with Coutts.. The company said that “good leaver status is not applicable under the relevant share plan rules” but that “no finding of misconduct has been made against Ms Rose by NatWest Group”. Rose has admitted talking to a BBC journalist about Farage’s status with Coutts, which is owned by Natwest, but denied sharing any confidential customer data. You can find Natwest’s statement here

3. Sir Patrick Vallance, the former chief scientific adviser to the government, has offered seven key lessons on how the UK - and businesses- can reach net zero. Although these lessons specifically relate to net zero, they are useful for any business trying to hit a target. They include: “Have a clear, time-bound, measurable objective” and “Be prepared to take portfolio risk and accept that things will fail. Don’t view the failure as a waste of public money.” You can read more via the New Statesman’s Green Transition newsletter here

4. New academic research has shown the importance of story-telling and entertainment in education. Using stories and people rather than just listing events and facts can make learning more interesting and engaging. These findings apply to way more than just school education. You can read more in the Klement on Investing newsletter here

5. Using loans from family members to support your business is a bad idea, according to a report by Charles Stanley. Apparently the bank of mum and dad should support property or day-to-day spending instead. You can read more in the Financial Times here

And finally…

A reminder that we are looking for a deputy editor-in-chief to work alongside me on building Off to Lunch, our podcast and Business Leader magazine. This is one of the most exciting projects in the media industry and there will be more exciting news about plans soon. You can find more information about the job, and apply, by clicking here. We will be closing applications this weekend…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox

Best

Graham