BP has published remarkable quarterly results this morning - remarkable because the amount of money it has made in the last three months has overshadowed the huge financial hit it is taking from leaving Russia. In 15 years of covering corporate results there were only a few times when an announcement dropped at 7am and you knew there was a story that went beyond the business world. BP’s today are another. Boris Johnson has been asked about them on Good Morning Britain…

BP has reported profits of $6.2 billion (£4.9 billion) for the three months to the end of March, well above the $4.1 billion it reported in the final three months of 2021, more than double what it reported in the same period a year ago, and the highest for a quarter since 2008. This has sparked new calls for a windfall tax on the company’s profits given that BP has been boosted by the rise in the price of oil and gas, which is driving a cost of living squeeze in the UK.

These profits were measured by underlying replacement cost profit, the preferred measure of the oil and gas industry. However, BP has also posted a loss of $20.4 billion on profits attributable to shareholders. This includes non-cash accounting charges and the $25.5 billion writedown on the value of BP’s investments in Rosneft and Russia.

Given that the Russia costs had been flagged by BP in February and there are local elections in the UK this week, it is that first profit number that is getting the attention this morning. So should BP face a windfall tax that could be used to financially support households under pressure from rising bills? These are the key points on both sides of the debate

Yes

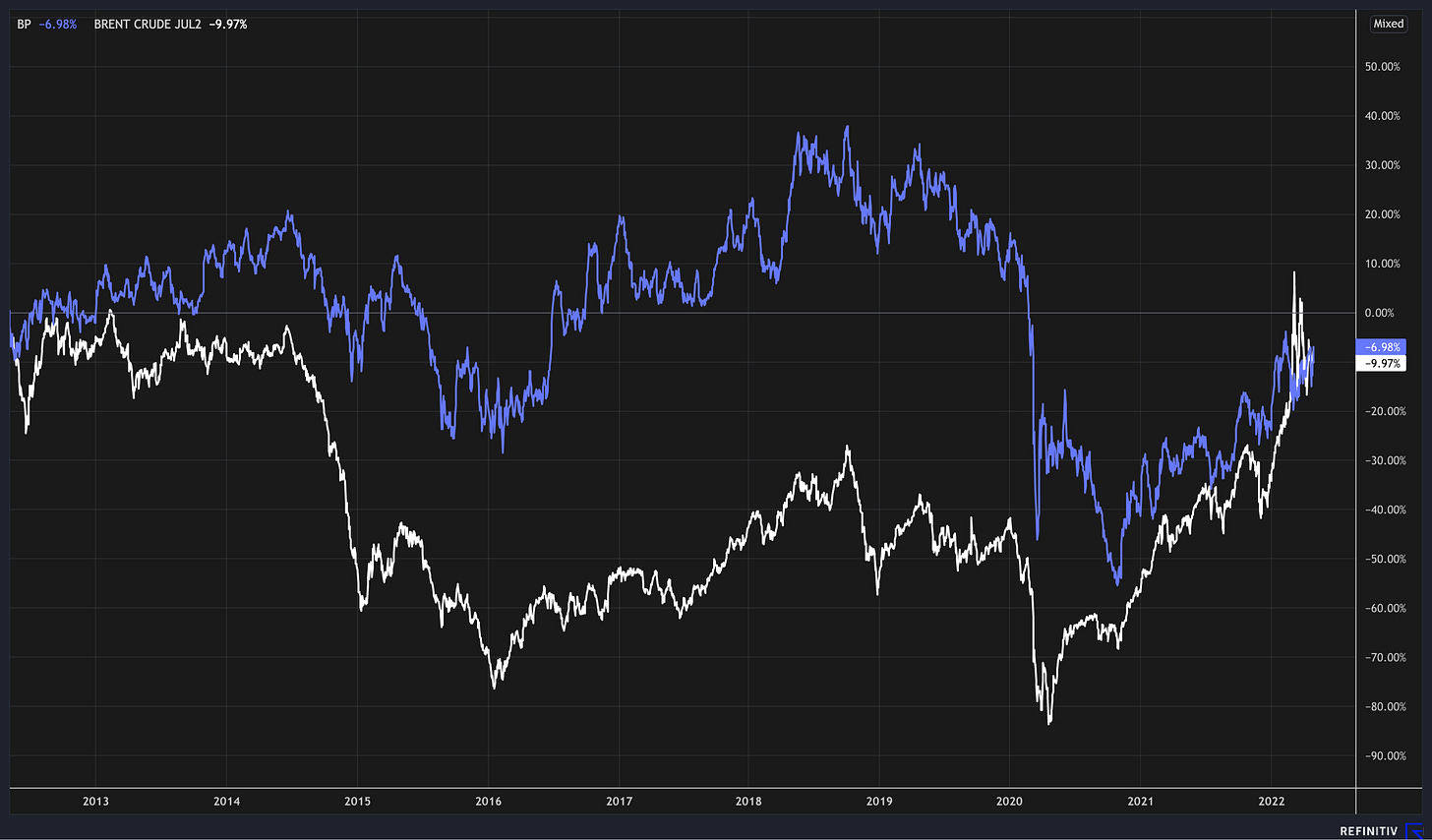

BP’s profits and the price of oil are undoubtedly linked. Look at this graph tracking BP’s share price and the price of brent crude oil over the last decade. Over that period oil is down 10 per cent and BP 7 per cent.

BP has itself said that its profits have been driven by “exceptional oil and gas trading, higher oil realisations and a stronger refining result”. It isn’t providing much detail about that trading though…

Rather than increasing investment, BP says it will use 60 per cent of its surplus cash flow (ie extra profits) on share buybacks and 40 per cent on strengthening its balance sheet. This has led to a new $2.5 billion share buyback being announced alongside the results. Ed Miliband, the shadow climate and net zero secretary, isn’t happy about this…

No

BP says it is investing up to £18 billion in the UK between now and 2030 on a range of initiatives, including oil and gas, wind power, and electric car charging networks. “We’re backing Britain,” chief executive Bernard Looney said this morning. The company knows it has a fight on its hands regarding the windfall tax, so has prepared its case today…

Boris Johnson has said in an interview with Good Morning Britain that a windfall tax could hold back investment and lead to higher energy prices in the long-term. These comments suggest a rowing back from the government’s position last week, when Rishi Sunak appeared to open the door to a windfall tax. "If you put a windfall tax on the energy companies, what that means is that you discourage them from making the investments that we want to see that will, in the end, keep energy prices lower for everybody," Johnson said.

Slightly bizarrely, BP seems to have undermined this argument…

BP also said it expects to pay up to £1 billion of tax on its profits in the UK in 2022 without a windfall tax. This is the most for “many, many years” according to Looney.

There are other angles to this debate too - such as BP is saying that its annual profits could now be $2 billion a year lower by 2025 because of its exit from Russia - but these are the key points being made by both sides.

This row could get worse for the government. Shell is due to publish its quarterly results on Thursday, the morning of local elections…

Arm and a leg

Interesting story in the FT this morning that the government is going all-out to try to get Softbank to float Arm in the UK rather than New York. I tend to agree with this column from Cat Rutter Pooley from February saying the government should accept defeat and let the Cambridge-based chip designer float on the Nasdaq instead. The government would be better off focusing on helping the new wave of promising tech companies emerging in the UK, such as PragmatIC Semiconductor, which has just announced expansion plans. I was in the audience when Softbank and Masayoshi Son revealed their £24.3 billion takeover of Arm in 2016. That was the moment to keep Arm in the UK if that is what we thought was best, not now. Instead, the government celebrated and promoted that deal (senior political figures were in the audience that day too). These contrasting quotes from my Guardian story in 2016 from Philip Hammond, then the chancellor, and Hermann Hauser still stand out today.

Tesco gets an Uber

Despite continuing doubts about the profitability of rapid grocery delivery services like Getir and Gorillas, they keep on expanding. Tesco has now announced it is going to partner with Uber to expand its rapid delivery service. This is a notable development because Tesco had been using its own in-house service, called Whoosh, and it will partner with Uber at 20 stores across the UK, including Edinburgh, Bradford and Norwich. This is not just a London thing…

You should also read this

Cryptocurrencies could be used to reward video game players for being good (Coindesk)

A series of breakthroughs for UK-based nuclear fusion team (Telegraph, £)

Landsec, one of the UK’s biggest commercial property developers, shifts focus away from London and towards Manchester (FT,£)

And finally…

The Batman scores 8 out of 10 on IMDB so passes my brother-in-law’s test and we finally watched it at the weekend (trips to the cinema have become rare with a 2-year-old at home). I have mixed feelings about it. The film started off promisingly as a David Fincher-style serial killer thriller in the mould of Seven and Zodiac (two of my favourite ever films) but then seemed to lose its discipline in the final hour and just go through a series of big action scenes we have all seen multiple times already. This disappointing final hour would have been ok were it not for the total running time of the film being 2 hours 56 minutes, which was too long, and the fact the film needed to do something different to stand alongside Christian Bale and Christopher Nolan’s Dark Knight trilogy. Maybe this is a generational thing on may part. Did fans of the Michael Keaton Batman films feel the same way about the Dark Knight films? I might just be getting old. Let me know what you thought and what film is worth watching next…

Thanks for reading. Off to Lunch will be back tomorrow. If you want to contribute to the work of Off to Lunch, then please sign up for a paid subscription below. Alternatively, please just spread the word!

Graham