Bitcoin and UK plc

The business news that matters

Hello and welcome to the latest edition of Off to Lunch…

I wanted to take a quick look at financial markets today because there are a couple of interesting stories to point out.

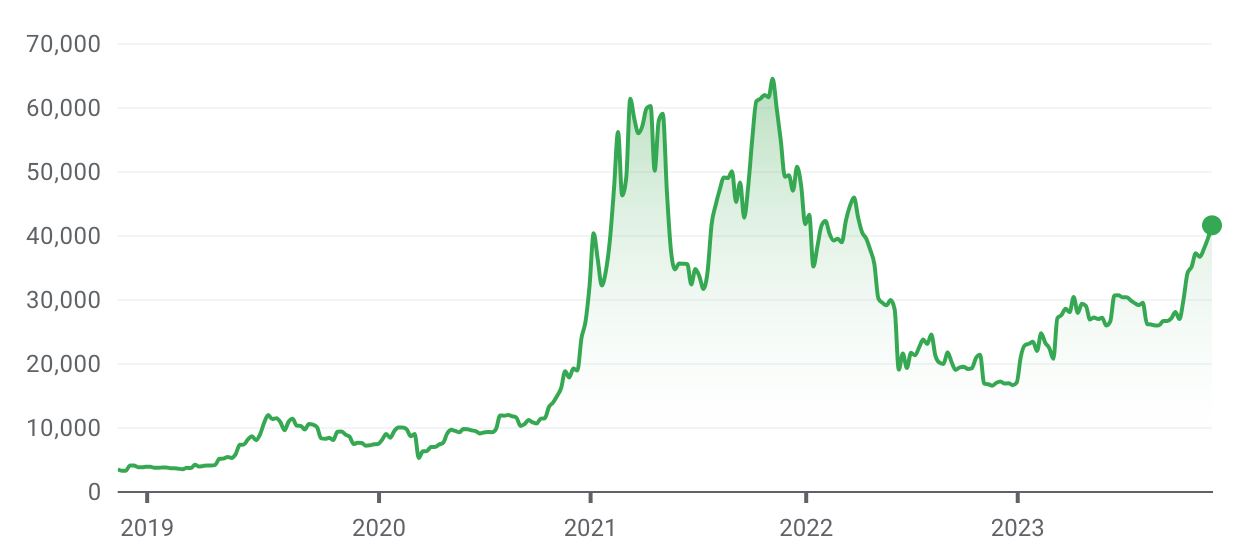

Firstly, the price of bitcoin has cleared $40,000 for the first time since early 2022 and is up more than 8 per cent today.

Cryptocurrency has been in the news recently for negative reasons. There was the fraud conviction for FTX founder Sam Bankman-Fried and then the founder of rival crypto exchange Binance, Changpeng Zhao, stood down and admitted to money laundering charges that will see his company pay $4.3 billion (£3.4 billion) in penalties. The death of Charlie Munger last week led to his views on cryptocurrencies being repeated. “I hate the bitcoin success and I don’t welcome a currency that’s useful to kidnappers and extortionists, and so forth,” Munger said.

But despite this stream of news, the price of bitcoin has steadily recovered over the last year, as the graph below shows…

Bitcoin has been rising as traders place more bets that central banks will start to cut interest rates next year. This means that assets offering regular interest-linked payouts are less attractive and traders have moved into some riskier markets. However, bitcoin has also benefited from a sense in markets that the demise of FTX and the problems facing Binance could actually help cryptocurrencies move into the mainstream, with more traditional financial institutions offering the opportunity to buy and sell bitcoin, especially since governments and regulators have not clamped down on it as anticipated…

But as the price of bitcoin goes up, the proportion of people in the UK looking to buy shares in companies seems to go down…

The Office for National Statistics has just published its latest annual report on who owns shares in publicly-listed UK companies…

As you can see above, the majority of UK shares are owned by overseas investors and the proportion held by UK individuals is down again.

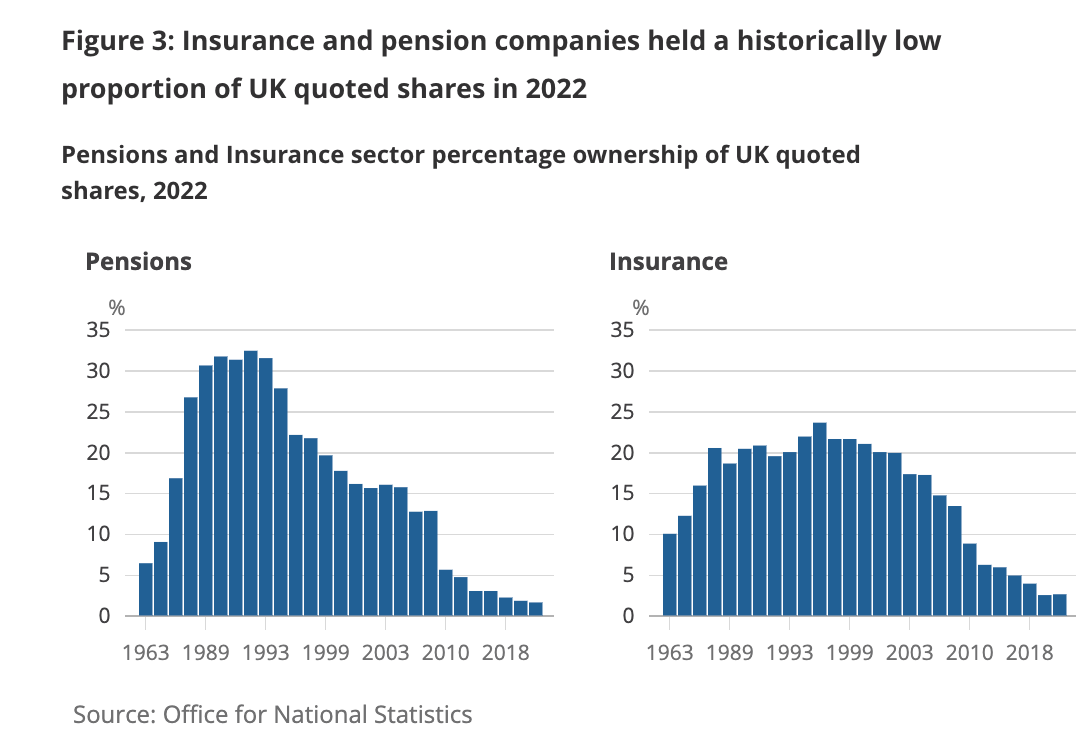

The proportion of shares held by insurance and pension funds has also dropped…

And this graph shows how tax-havens account for a significant proportion of shareholders…

The low proportion of shares held by retail investors - ordinary households - is a key factor in how businesses are often portrayed in the UK. Most people do not have a stake in the success of a business - beyond the one they are employed by - and instead the benefits of that success are enjoyed by overseas investors. This means the media often gives more attention to rows about bonuses for executives or price increases on products. The government has spoken about its ambition to boost share ownerships among the wider population and Jeremy Hunt, the chancellor, announced plans in the Autumn Statement to offer shares in Natwest to retail investors.

You can find the latest ONS report here

Other stories that matter…

1. Liverpool and other UK cities outside London have been failed by “poor leadership, lack of money, or inept execution - or often all three acting in combo”, according to Andy Haldane, the former chief economist at the Bank of England. You can read more about Haldane’s comments and a special report on the future of Liverpool’s economy by Business Live here. The Resolution Foundation has also published a new report today about boosting productivity in the UK…

2. The global success of Dyson’s Airwrap means the company has pivoted into being a big player in the beauty sector. However, the UK company faces growing competition from rivals. Dyson could now benefit from upping the price of the Airwrap and making the product even more exclusive - such as limiting where it is sold - according to an interesting analysis by Bloomberg here

3. Following the death of Charlie Munger, Warren Buffett’s right-hand man at Berkshire Hathaway, The Wall Street Journal has looked into what makes a strong no2 in a business. Here is an extract from the piece: “Succeeding as second in command takes a rare blend of confidence and humility, say people who’ve done it. The consummate right-hand person must be devoted to organisational success while accepting that someone else’s star will always shine brighter.” You can read more here

4. A note of caution about staff loyalty: it can encourage managers to exploit employees and lead to bad practices in a business. That is according to new research covered by the Financial Times here

5. From Business Leader, a look at why the history of ice cream contains lessons about the importance of protecting your intellectual property. You can read more in a feature here

Podcast…

The new episode of our Business Leader podcast is out tomorrow and is a cracker. It features one of the longest-serving chief executives in the FTSE 100 and will be sent to subscribers when it goes live in the morning…

A reminder that our current episode looks at the story of how Metro became the most-read daily newspaper in the UK after launching in 1999. How did this newspaper - which is free - disrupt a highly competitive industry and then survive a string of big challenges? We speak to Deborah Arthurs, the editor-in-chief, and Richard Thomson, the managing director…

You can listen to the episode on Substack here, Spotify here and Apple here

And finally…

Sticking with podcasts, the latest episode of Steven Bartlett’s The Diary Of A CEO features an interview with Walter Isaacson about his books on Elon Musk, Steve Jobs and other business leaders…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox

Best

Graham