A scheduling note: There will be no Off to Lunch tomorrow, Friday February 2. We will be back on Monday

The Bank of England has opted to hold interest rates at 5.25 per cent, but that is only part of the story coming out of Threadneedle Street today…

The Bank announced at noon that its monetary policy committee had voted to keep rates at the same level in the UK. However, there was a three-way split among the nine members. Six members of the committee, including Andrew Bailey, the governor of the Bank of England, voted to hold rates, but two wanted to increase them to 5.5 per cent and one member, Swati Dhingra, voted for a cut to 5 per cent.

A three-way split among the MPC is rare and highlights the dilemmas facing the Bank. Inflation is still at 4 per cent in the UK, well above the Bank’s 2 per cent target, and the key mandate for the MPC is supposed to be keeping inflation at close to this target. However, recent data has suggested that the UK economy is slowing and may have fallen into recession at the end of 2023, which could drag inflation down further after a sharp drop during the last 12 months.

This is a summary of the MPC’s view, courtesy of a statement released by the Bank:

At this meeting, the Committee voted to maintain Bank Rate at 5.25%. Headline CPI inflation has fallen back relatively sharply. The restrictive stance of monetary policy is weighing on activity in the real economy and is leading to a looser labour market. In the committee’s February forecast, the risks to inflation are more balanced. Although services price inflation and wage growth have fallen by somewhat more than expected, key indicators of inflation persistence remain elevated.

But the minutes of the meeting also outline the view of Dhingra and why she voted for a cut:

Waiting for lagging indicators of domestic relative price growth to fall sharply before reducing rates would come with a risk of overtightening. There might be potential upside risks from geopolitics. That said, consumer price inflation was already, and had been for some time, on a firm downward trajectory. Moreover, leading indicators, such as those from granular producer prices data, pointed to an easing in consumer prices. The outlook for demand remained weak, and less resilient than previously assumed, with vacancies falling more sharply than in some other advanced economies and consumption not having recovered to pre-pandemic levels. This further reduced the prospects of embedded persistence, shown in forward-looking indicators of domestic relative prices, such as monthly annualised rates of nominal pay growth and the Bank’s Agents’ surveys, and suggested lower pass-through of costs to prices.

You can find the Bank’s statement here

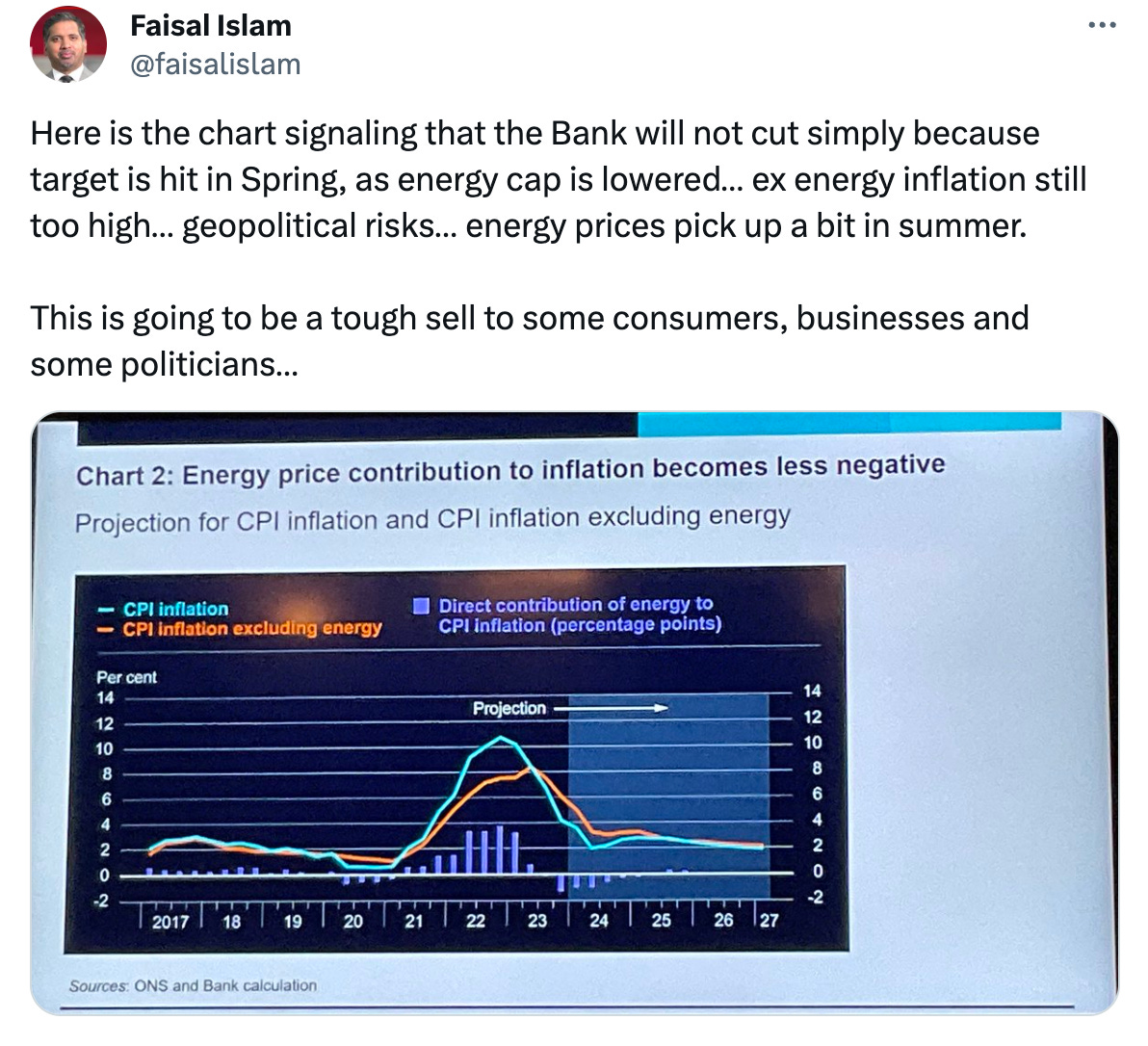

Alongside the decision on interest rates, the Bank has published the latest version of its Monetary Policy Committee and its projections for the UK economy. This report suggests a striking shift in what the Bank is expecting for the UK - particularly that inflation could be back at 2 per cent as early as this Spring…

However, Bailey and the Bank are suggesting that even if this happens they would not cut interest rates until they saw evidence that inflation would stay at this level…

As the post above says from Faisal Islam, the BBC’s economics editor, if the Bank does hold-off on rate cuts despite inflation being back at 2 per cent then that will make Bailey unpopular with consumers, businesses and the government, just as a general election looms…

You can find the Bank’s monetary policy report here

Other stories that matter…

1. Labour is hosting more than 400 business leaders at an event in London today. Rachel Reeves, the shadow chancellor, has pledged that the party will cap corporation tax at 25 per cent if they win the general election. More here

2. Councils in England face a £4 billion funding gap and the government must step-in with support to stop an “out of control” financial crisis. That is according to a report by the parliamentary Levelling Up, Housing and Communities Committee. You can find the report here and a BBC story here

3. A fascinating read from the Financial Times on why so little investment has gone into women’s health and why American entrepreneur Nicole Shanahan is spending $100 million (£79 million) on research about how to slow ageing ovaries. This paragraph is one of many striking passages in the feature: “In fact, science had neglected women’s health in general for decades, often seeing the differences in female bodies as confounding factors to be stripped out, rather than studied to improve the lives of more than half of the population. In the US, clinical trials were not obliged to include women until 1993. In the UK today, only about 2 per cent of medical research funding is spent on pregnancy, childbirth and fertility.” You can read the feature here

4. Some lessons on scaling-up a business from the authors of a new book called The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things Harder. The authors are two professors at Stanford University in the US. They have looked at how successful business leaders focus on making life as straightforward as possible for customers and staff, in particular how they recognise that this gets more complicated as a business gets bigger. “The Friction Project taught us that smart leaders eliminate wasteful work so people will have time and energy for work that is meaningful,” they say. “And meaningful work is often difficult, slow, and downright inefficient.” You can read a summary of the book by Inc. here

5. The Wall Street Journal has looked at how cricket - specifically the English cricket team - has learned from basketball that players should be more aggressive with their approach. It is an interesting look at the lessons that different sports can learn from each other. More here

Podcast…

The latest episode of our Business Leader podcast looks at the story behind Sir Stelios Haji-Ioannou and easyJet. Sir Stelios discusses how he built the airline, how it used distinctive marketing to fight fierce competition, how fly-on-the-wall documentary Airline became one of the most popular shows on television, and why he has launched a new award for young entrepreneurs.

You can listen to the episode on Substack here, Apple here or Spotify here

And finally…

Sticking with easyJet, for those of you looking to book your summer holiday, the airline has launched an eye-catching new promotion - “grans go free”. This deal means that parents going on holiday with their children will also be able to bring one grandparent with them for no extra cost. Multigenerational holidays have emerged as a trend since the end of the Covid-19 crisis, according to a story by The Guardian here

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox

Best

Graham