This table fascinates me (and not just because Man United’s failings mean I have lost interest in the Premier League table). It was published by the government at the end of last year and is called the “Levelling up power tech league”. It ranks UK cities on a series of financial measures: the amount of money that start-ups based there raised; the number of venture capital funding rounds; available jobs; average salaries; the number of unicorns ($1 billion valuation-plus) and the number of businesses on their way to becoming unicorns (futurecorns). The table forms part of the data I mentioned in the launch edition of Off to Lunch - that start-ups outside London raised more than all of France in 2021. Overall, $39.8 billion (£31 billion) flowed into UK tech last year, more than double what was invested in 2020, according to data from Dealroom.

I will be going to all the cities on this list this year to tell the stories behind the numbers, because what happens next is crucial. Who are the businesses to watch? Can they take the next step and become big businesses (something the UK still struggles with)? Whose existing market are they eating into? Are these cities becoming investment hubs that will boost the area around them? And how will the businesses and local economics cope with an economic slowdown?

On that last point, many of the businesses who raised money last year did so at a valuation that now looks toppy. The New York Times had an amusing article last week about how doom-mongers have been warning about a tech bubble since 2011 and are still waiting. However, the piece had a sting in the table – it said that while investors are avoiding using the B-word, they are talking about “recalibration” and “softening”. That could eventually look an awful lot like a bubble bursting. As I covered in Friday’s edition, economic data suggests there will be harder times to come.

On a far brighter note, Cambridge appears to be motoring on. The FT reports this morning that Cambridge Innovation Capital has raised £225 million to invest in start-ups. CIC has a contract with the University of Cambridge that allows it to back promising ideas coming out of academics at the university. It now has $1 billion in assets under management, the FT reports. You can read the full story here, but I thought this quote was particularly eye-opening (and promising) from Andrew Williamson, CIC’s managing partner, who also used to work in Silicon Valley.

“Every dinner party you go to, every parent you meet at a kid’s soccer game, they are working in innovation or entrepreneurship or commercialisation. It’s reached that critical mass where it’s feeding on itself.”

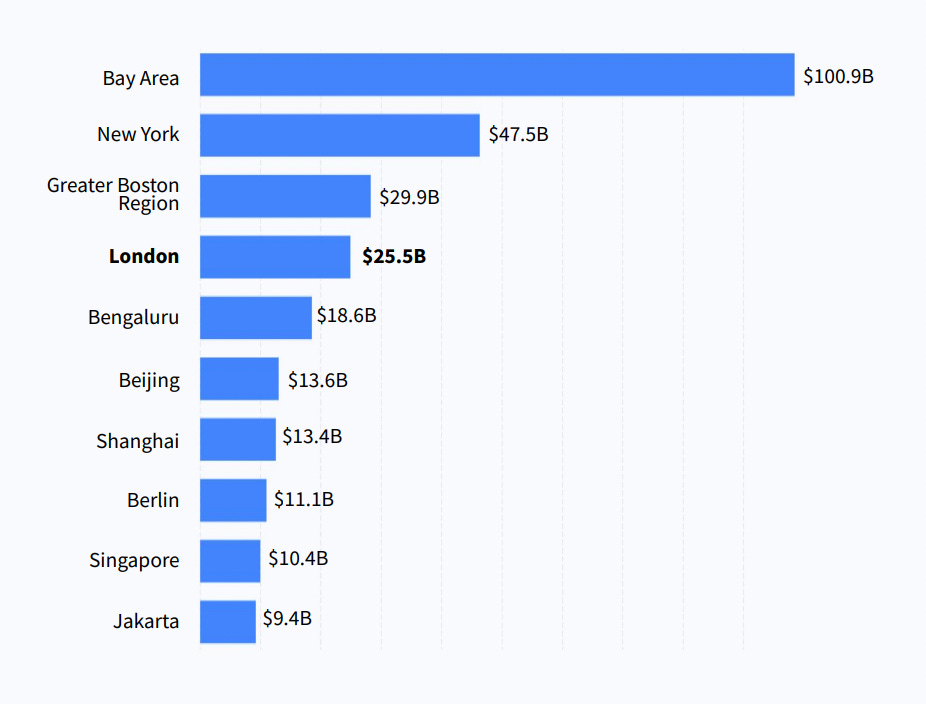

There are also two points I want to make about London. Firstly, it accounted for just over $25 billion of the tech investment that came into the UK last year. That puts it fourth in the world behind only the San Francisco Bay Area, New York and Boston (see graph below). It is a global powerhouse and that is only a good thing for the UK. The money and interest London attracts will flow through to other parts of the country.

Much of the money that was raised in London was by established businesses - 60 per cent came from “megarounds”, those above $100 million. In other words, there is a chance for the rest of the UK to catch-up as their start-ups become bigger and bigger. It is a virtuous circle.

The second point about London is that a “them and us” mentality appears to have developed between some of these tech hubs and the UK capital - Manchester, in particular, which was the fastest-growing tech hub in Europe in 2020. Healthy competition is no bad thing - look at the battle between San Francisco, New York and Boston in the US - but this is causing problems when businesses look to raise money in the City or float. Take THG, for example. Matt Moulding and the company have made mistakes since floating (he has said the IPO itself was a mistake) and the siege mentality around its Voyager House base at Manchester Airport isn’t helping. Only last week Moulding was posting cryptically on Instagram again…

Moulding and other tech founders feel the City should give them more space, but the City isn’t prepared to tolerate corporate governance failings when performance is flagging. Something has to give. Oliver Shah hinted in his Sunday Times column that THG is trying to flush out a take-private bid. That may be where this story goes next, but it is not inevitable.

Tensions between northern businesses and the City are not new and are not confined to tech. Sir Ken Morrison had a famously tempestuous relationship with the City when running Bradford-ford based Morrisons. “What’s the difference between a non-exec director and a shopping trolley?” he is quoted as a once saying. “You can get more booze into a non-exec director.” Sir Ken eventually ended up stepping outside after Morrisons controversial takeover of Safeway in 2004, but his brilliance was lasting. Morrisons ended up becoming a darling of the City under Marc Bolland and later David Potts, culminating in a £7 billion takeover by CD&R last year…

A chart that helps you understand the world

Ok, this is a table not a chart, but it neatly shows the explosion in cryptocurrencies and how the market has spread well beyond bitcoin. This is from the excellent Market Sentiment on Substack and you can read the latest newsletter here

You should also read this

Are US citizens moving abroad to escape cryptocurrency regulations? (Blockworks)

There is a flying taxi trial in Coventry today (Business Live)

And finally…

The Dropout and WeCrashed have brilliantly tracked the corporate scandals at Theranos and WeWork in the US as drama series. House of Maxwell on BBC does the same for the Maxwell family as a documentary. I have just finished the three-part series on iPlayer and it is worth your time. The story of Robert Maxwell’s downfall includes a reminder of the stellar work done by financial journalists in uncovering his crimes, in particular Bronwen Maddox and the FT. Episode three on Ghislaine Maxwell and Jeffrey Epstein features upsetting testimony from their victims, so be warned. It is a difficult but important watch.

That’s it for this edition. Thanks for reading. If you want to contribute to the work of Off to Lunch, then you can do so below by signing up for a paid subscriptions. Alternatively, please just spread the word.

Thanks again

Graham