Hello and welcome to the latest edition of Off to Lunch…

The ONS has released its latest UK labour market figures this morning. The data is always eagerly analysed by businesses, economists and policy-makers because it is one of the key factors in how the Bank of England decides interest rate changes, which remain at 15-year highs.

The data shows signs of the jobs market stalling. The unemployment rate increased to 4.2% between December and February, the highest level for six months, while the rate of people with a job dipped and the economically inactive (those not currently in work or looking for a job) rose.

The ONS itself has said there are now “tentative signs the jobs market is beginning to cool”, while others are suggesting that if other data points to a weakening of the UK economy that the Bank of England could start to cut interest rates in the summer.

Unsurprisingly, MPs in the Labour Party were quick to point out the data that showed a weaker jobs market.

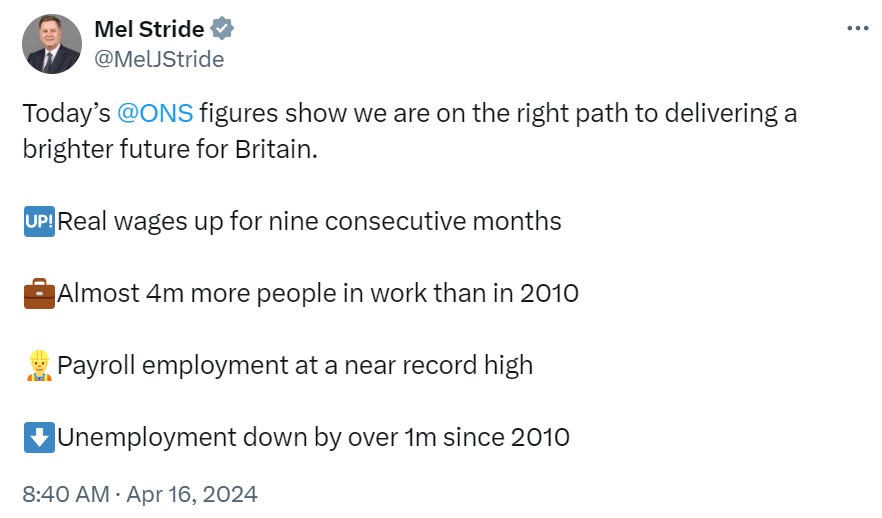

Although those in the Conservative Party highlighted other data in the release which showed wage growth is still strong, at 6%.

Regardless of the political spin, the data does leave the Bank of England with a tough decision to make knowing businesses will be watching closely. Real wage growth, which takes into account inflation, is now at its highest rate in almost two-and-a-half years, and could feed into higher inflation.

Figures for inflation in the UK are released tomorrow, with a slowdown once again predicted by analysts. But with the US experiencing a series of higher-than-anticipated inflation figures over the past few months, those setting interest rates are facing a difficult balancing act.

Watch this space…

Podcast…

The latest episode of our Business Leader podcast is out today and it looks at the story behind one of the biggest airlines in Europe. Having taken its first flight in May 2004, Wizz Air now carries more than 60 million passengers every year and is valued at well over £2 billion after floating on the stock market in London.

One of the threads in the conversation that stands out is how the company has grown by embracing risk. József Váradi, the company’s founder and chief executive, believes that this approach has been fundamental to the company’s growth:

If you want to be an entrepreneur, you must take risks and you must fail. If you are not prepared to fail, then you never test your own boundaries and you never stretch yourself beyond your comfort zone.

Personally, it's philosophical to me but it’s also practical. I'm encouraging people to take risks and I'm encouraging people to fail. We made that culture inherent in the company, that risk-taking is awarded.

He also discusses how he founded and built the airline, the challenges he has faced and his fascinating views on what it is like running a UK-listed business…

You can listen to the episode on Substack here, Spotify here and Apple here

Other stories that matter…

Apple has been knocked off its perch as the biggest global smartphone brand. According to new figures, Samsung has risen to number one following the rapid growth of low-cost Chinese rival Xiaomi. You can read more here

Another FTSE 100 firm has been snapped up. UK packaging firm DS Smith has been acquired by US-based rival International Paper. The deal is worth £5.8 billion, slightly above the £5.1 billion offered by UK-based Mondi a few weeks ago. You can find further details here

The UK boss of fintech challenger brand Revolut has said that the biggest threat to London’s fintech “supremacy” is across the pond. Addressing the Innovate Finance Global Summit yesterday, Francesca Carlesi said: “It’s not just about listing, it’s about talent.” You can read more here

Elon Musk has confirmed that Tesla will be letting go of more than 10% of its global workforce. He said: “This will enable us to be lean, innovative and hungry for the next growth phase cycle.” Find out more here

Superdry is to restructure to avoid being added to the list of big-name British brands that have disappeared from the high street. The company has confirmed plans to raise money to avoid administration and delist from the London Stock Exchange this summer. You can read more details here

And finally…

Big news coming out of the private equity world today centres around CVC Partners. The name of one of Europe’s largest PE firms will ring a bell for sports fans as the company that owns stakes in LaLiga, Premiership Rugby and the Six Nations, as well as making a rumoured $8.2 billion from its investment in Formula One. Other portfolio companies include luxury watchmaker Breitling and PG Tips.

The firm has finally announced its decision to list in Amsterdam at a valuation of up to €15 billion. With assets under management of more than £158 billion, the announcement delivers another hammer blow for the previously mentioned much-maligned London Stock Exchange and adds to the list of notable recent snubs including Tui, Arm Holdings and Ferguson.

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to get Off to Lunch sent directly to your inbox