For the business world the Queen’s Speech is often about bemoaning what hasn’t made the government’s plans for the year ahead. Those I have spoken to since the speech are concerned that proposals designed to prevent corporate scandals by overhauling the accountancy industry only featured in the supplementary document as a draft bill. Although that is better than not featuring at all, as some feared it might, it creates uncertainty for businesses and the accountancy industry. There is also disappointment that there was nothing to tackle the squeeze on household budgets or help businesses engulfed by rising costs. Expect more mutterings about the need for an emergency budget in the next few weeks, although Michael Gove has ruled that out during interviews on breakfast television this morning. However, for all that, let’s take a moment to celebrate something that actually made it into the Queen’s Speech - the Levelling Up and Regeneration Bill.

This could be far more significant over the long-term for businesses and local communities than anything else that did or didn’t make the speech. This was the mention the bill got in the speech…

I should also flag that backing for the Leeds-based UK Infrastructure Bank made it into the speech too. The UK Infrastructure Bank is already operating in an interim form (and hiring staff) but will now get officially confirmed. The UK Infrastructure Bank will help to arrange finance for key projects around the country that support levelling up and the shift to net zero. This looks to be a proper organisation, a cut above similar things the government has tried in this area before. Its chairman is Chris Grigg, the respected former boss of property developer British Land, and its chief executive is John Flint, the former boss of HSBC, obviously one of the biggest banks in the world…

Anyway, back to the levelling up bill. This is a wide-ranging bill that includes specific measures and lofty ambitions. The planning side of the bill has got a lot of attention in the morning papers, such as the front page of The Times, which focuses on how neighbours will be allowed to vote on whether loft conversions and conservatories could be built without planning permission. These are the key elements of the bill according to government documents published alongside the speech…

That top one is particularly significant. It refers to the 12 missions laid out in the government’s white paper on levelling up, which was published in February. Smart people who I respect, many of whom are critical of Boris Johnson’s government for other things, thought it was an impressive piece of work. For instance, this was the take of Paul Johnson, director of the Institute for Fiscal Studies…

Some of that ambition that Paul talks about should now be enshrined in law based on what was laid out in the Queen’s Speech. This would make the government accountable for hitting the 12 missions it proposed in the white paper, with annual updates on how it is doing. These are those missions…

Meetings these ambitions is a different challenge to announcing them, of course, but this is a promising start. Interestingly, one of the biggest property developers in the UK, Landsec, has announced today the creation of a new regeneration-focused business that brings together U+I, the urban-focused developer it bought for £190 million last year, and some of its existing operations. This comes just over a week after the boss of Landsec said the company was going to focus its investment outside London.

Compass resets for post-Covid life

A sure sign that life is getting back to normal after Covid-19 – Compass, which provides catering to businesses, schools and events, has said revenues have returned to their pre-Covid levels. Shares in the FTSE 100 company are up more than 8 per cent today on the back of its half-year results. Compass said it now expects revenues to grow by 30 per cent rather than 20 to 25 per cent in the year to the end of September. It has also announced a £500 million share buyback. The company said revenues in the first three months of 2022 were 99 per cent of their 2019 levels and are now running ahead. The company’s “business & industry: division is still trading below pre-Covid levels, although it increased from 68 per cent of pre-Covid levels in the final three months of 2021 to 83 per cent in the last three months as more people go back to the office.

Regional air travel

Teesside Airport has scrapped its direct flight to London Heathrow after just over a year with Conservative mayor Ben Houchen accusing Heathrow of “daylight robbery” over the landing fees it is charging. Improving regional airports is supposed to be part of levelling-up the UK, but don’t we seem to be going backwards at the moment? Manchester Airport has been beset by huge queues and Carlisle Lake District Airport, which opened with great fanfare in 2019, is not even running commercial flights anymore.

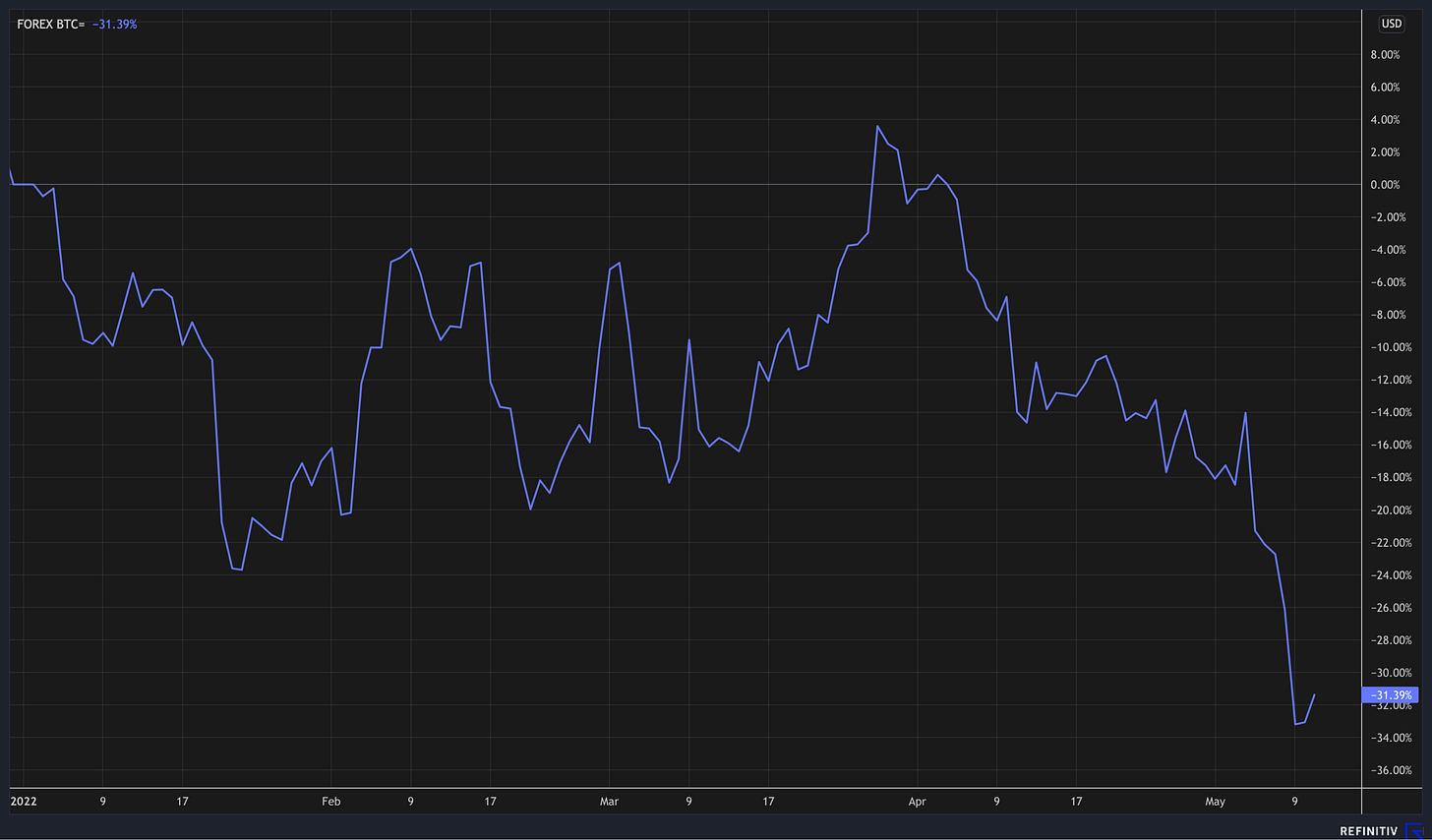

A chart that helps you understand the world

This is bitcoin so far in 2022. I featured a bigger version of this graph on Monday, but I now want to focus on that dip right at the end of the graph and what has happened this week. The talk in the crypto world this week is about TerraUSD, an “algorithmic stablecoin” that was supposed to never fall below $1 but has, er, fallen below $1. You can read more about it by fellow Substacks Today in Tabs and Platformer here and here. Bitcoin is caught up in all of this. For instance, Do Kwon, the developer behind TerraUSD, had pledged to buy billions of dollars of the cryptocurrency to support his stablecoin’s peg. For crypto bears, this is all more evidence of how dangerously linked the different markets are and how little there is underpinning the assets. However, crypto bulls are claiming bitcoin has done well to hold at this level ($30,000) given TerraUSB and the “sell everything” mentality in wider markets.

You should also read this

The squeeze on tech stocks and financial markets could have consequences for start-ups bleeding cash. No sector has raised money at such lofty valuations and bled so much cash as the rapid-delivery grocery firms. According to this report by The Information, concerns are growing internally at one of those firms, Gopuff. I expect there will be more stories like this over the next few weeks (The Information, paywall)

It’s the end of the Fifa football video games as EA Sports and football governing body have split. Say hello to EA Sports FC from now on (BBC)

It’s also the end of the iPod after Apple said it will stop production after 22 years (New York Times, paywall)

Google and Meta are laying subsea cables around the world that are helping to connect communities to the internet but could also be helping the tech giants to amass dangerous power (Rest of World)

If you are interested in tracking the progress of electric vehicles and the charging infrastructure in the UK, I recommend this Substack newsletter from Tom Riley (Fast Charge)

Thanks for reading. Off to Lunch will be back on Friday. If you want to contribute to the work of Off to Lunch, then please sign up for a paid subscription below. Alternatively, please just spread the word!

Graham