A bigger problem than the one they were trying to fix...

Cost of mortgages could soon be bigger issue than energy prices...

Only one place to start today, and that’s the pound, or what’s left of it. In early morning trading it fell nearly 5 per cent against the dollar to $1.035, an all-time low. It has subsequently recovered to just over $1.07 and is down a slightly more respectable 1 per cent on the day.

The previous all-time low was hit in 1985 in similarly brief circumstances, with a recovery immediately afterwards. Andy Bruce at Reuters has done a superb thread on reporting in 1985 about the pound’s slump…

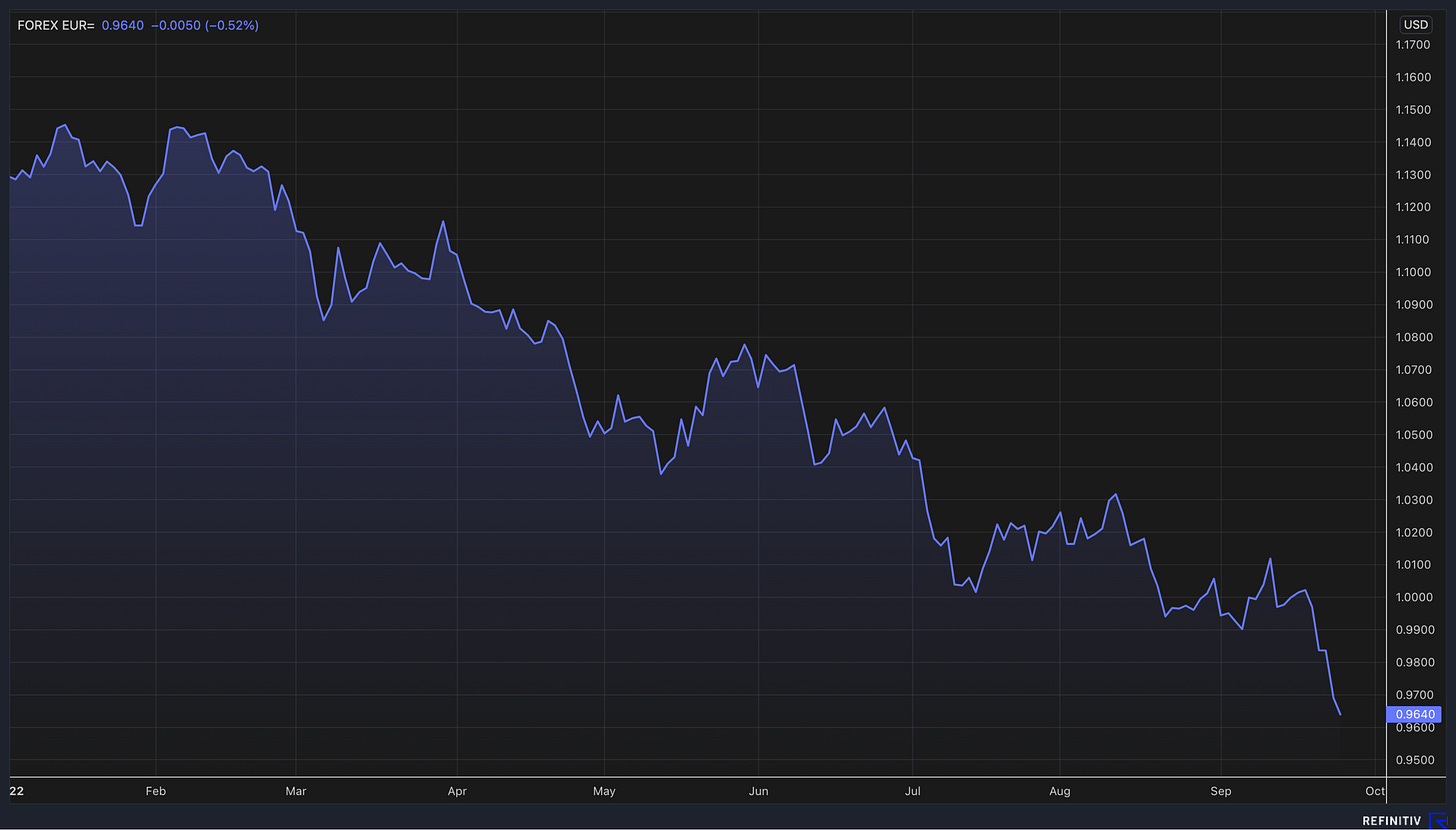

This is how the pound’s performance against the dollar in 2022 now looks. It’s not pretty…

Over the weekend I saw supporters of Liz Truss and Kwasi Kwarteng say that the pound is not the only currency to have performed poorly against the dollar this year. That is true, this is the euro…

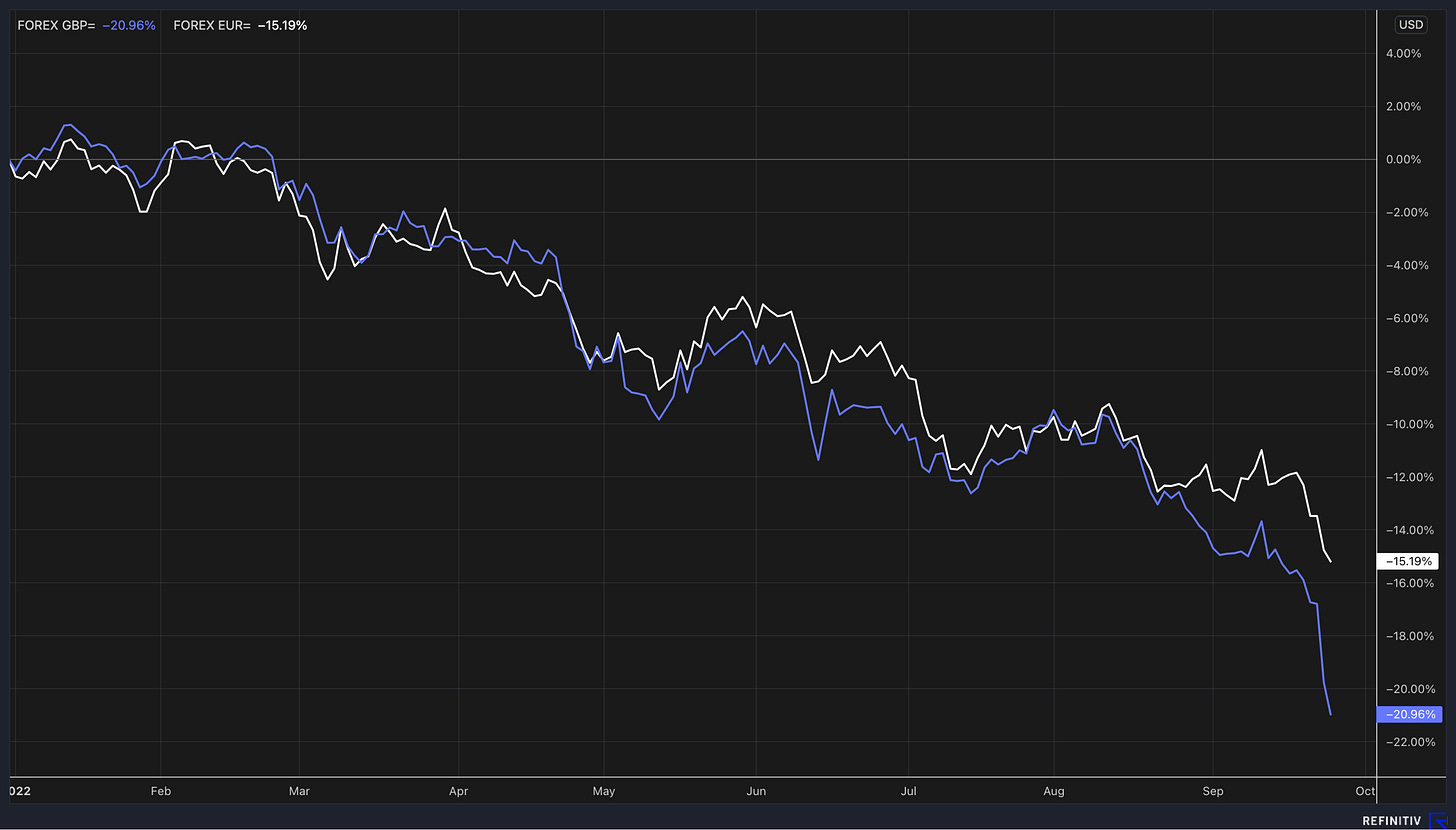

However, the pound has performed notably worse than the euro since around mid-August. This is the pound and euro’s performance against the dollar plotted together. The pound is blue, the euro white - they have diverged in recent weeks…

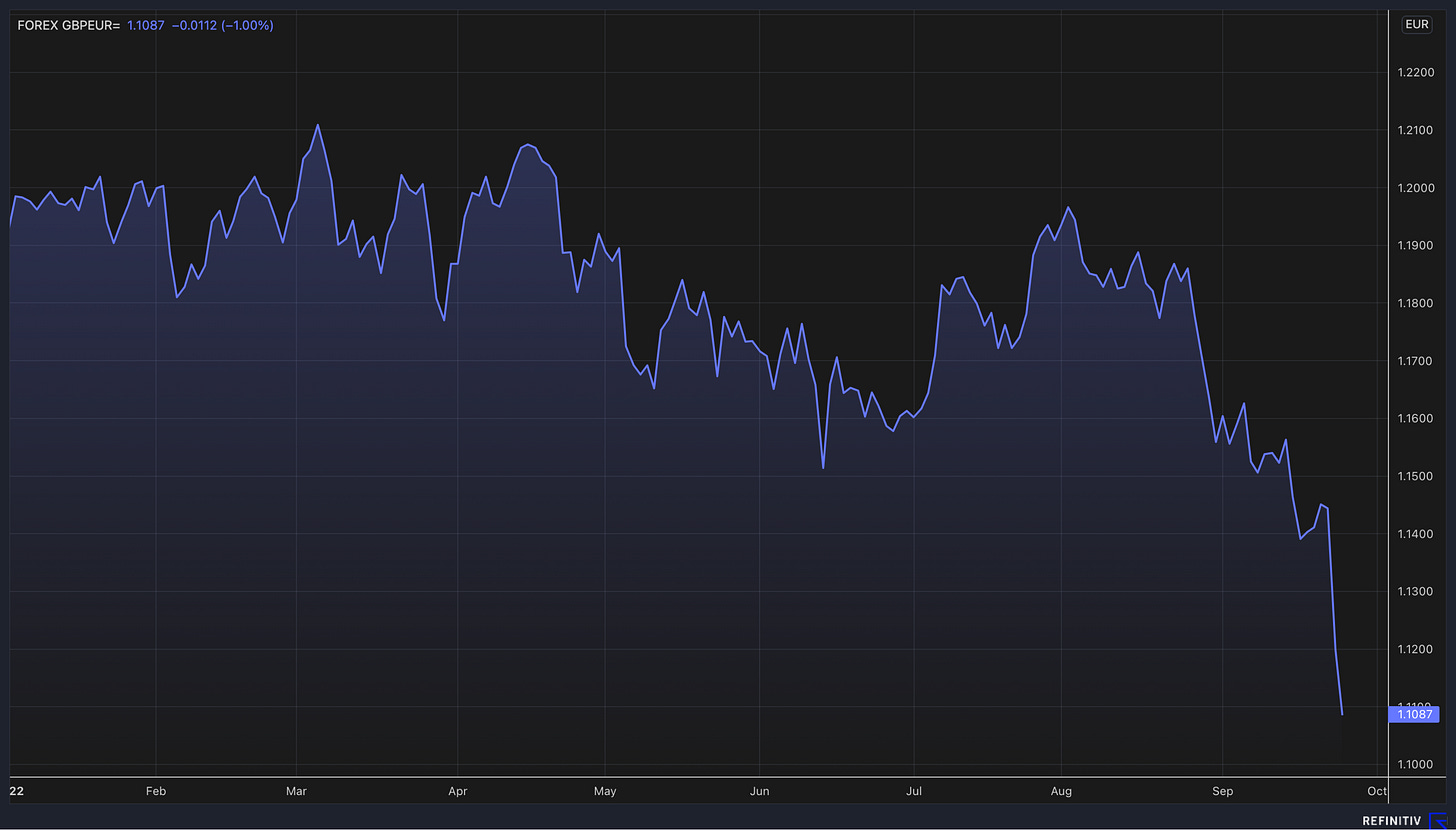

Finally, here is the pound against the euro in 2022. It was up and down until August, but has fallen sharply in recent weeks.

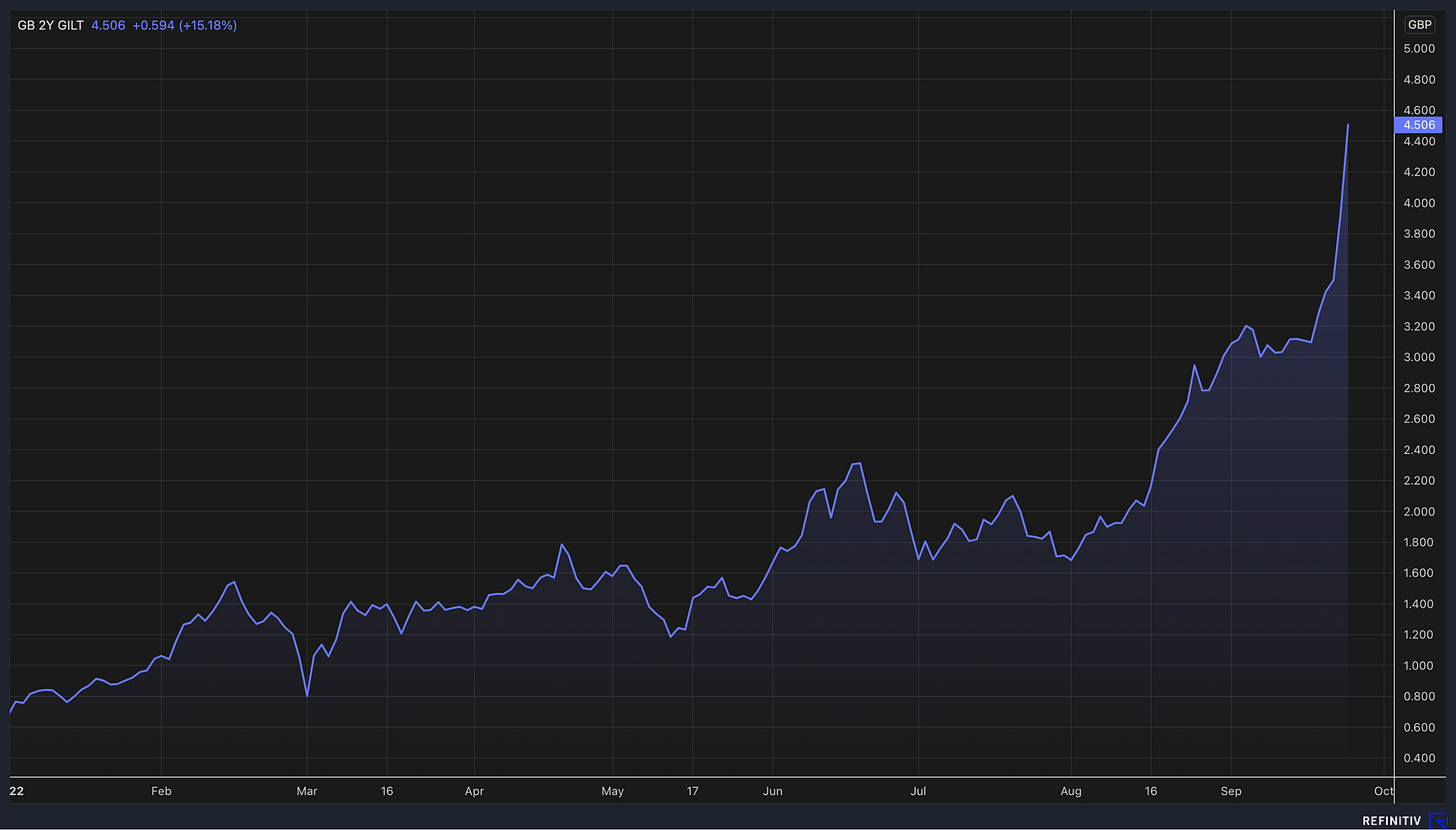

It is not just the falling pound that is unsettling traders and economists, but the combination of the pound falling and yields on government bonds rising. That is unusual for a developed economy and is why some traders and economists have claimed that UK assets are behaving like an emerging market…

This is the two-year gilt yield graph so far this year, updated for trading this morning. The yield reflects the interest that government has to pay on short-term debt. The sharp rise in the yield is traders betting that the Bank of England is going to have to respond to the pressure on the pound with a sharp rise in interest rates, potentially at an emergency meeting as soon as this week, potentially with a rise of as much as 1 percentage point or more.

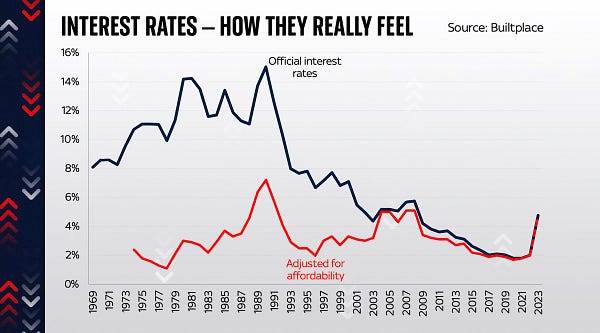

This could all mean a lot of pain for households through increased monthly repayments on their mortgages. Ed Conway, economics editor at Sky News, has been posting some really interesting stuff on this over the weekend. He has produced graphs that show that a base rate of 5 per cent would cause as much pain for households as 15 per cent interest rates did in the early 1990s. This is because houses are now much more expensive and mortgages are therefore much bigger. Remember, the price of an average house is now nine times average annual earnings - a historic high in the UK. That gap between annual income and the price of a house has been filled with cheap debt. But that cheap debt is no longer available.

This is the graph that Ed tweeted showing how interest rates feel adjusted for income, house prices and size of mortgages…

The reaction in markets today suggests traders are calculating that interest rates will hit 6 per cent early next year. What is concerning is that a lot of fixed rate-mortgage deals are due to end early next year. People on two-year or five-year deals are going to see their interest rate go from under 2 per cent to more than 5 per cent, adding hundreds of pounds to their repayments every month. This Sunday Times piece from yesterday gave an example of someone with a £200,000 mortgage for 25 years. If they are fixed at 1.15 per cent then their monthly repayments are currently £767. But a rate of 4 per cent would mean monthly repayments of £1,056, nearly £300 a month more…

As an aside, this potentially dramatic increase in interest rates is going to have a big impact on businesses too, many of which are still weighed down from debt built up in the aftermath of the financial crisis, as this post warns…

Kwarteng started his mini-Budget speech on Friday by saying: "Let me start directly with the issue most worrying the British people – the cost of energy.” But for many people, the real worry will soon be - or already is - an increase in their mortgage repayments. In trying to get down energy bills and cut taxes to free up more cash for people to invest and spent, the government risks sparking an increase in interest rates that will leave households with an even bigger problem…

Podcast…

Our Business Studies podcast has launched this morning with an interview with Archie Norman, the chairman of Marks & Spencer and one of the most influential figures in British business over the last 40 years. Episodes of Business Studies will be released every Monday and we have another cracker coming next week. The podcast takes a second look at big business stories from the past and asks: did these stories happen the way we think they did and what can we learn from today? You can expect success stories, failures, individual careers, deals and much more.

In this episode Archie Norman explains why M&S had a “manifesto for failure” and could collapse within a decade, as well as much more. Why does he now question whether selling Asda to Walmart was the right decision? What was it like being an MP? Why did so many businessmen and women thrive while working under him and go on to successful careers? Find out all of that in the podcast.

There will be bonus content from the interview for paying Off to Lunch members later this week, including extra questions and answers and some thoughts from me.

You can listen to the podcast here…

Or, for those who prefer to listen on Spotify, you can find Business Studies here. It will be available for free on all big podcast platforms…

Unilever…

A brief timeline of events at Unilever in 2022…

January 19, 2022: Unilever says it will not increase an already-rejected £50 billion takeover bid for Glaxosmithkline’s consumer healthcare business after opposition from shareholders

May 31, 2022: Unilever announces that activist investor Nelson Peltz will join the board as non-executive director after acquiring an 1.5 per cent stake

September 26, 2022: Unilever says that Alan Jope will stand down as chief executive at the end of 2023

This timeline tells its own story about what has gone on at Unilever in 2022. Alan Jope is one of the brightest and affable chief executives I have come across and speaks with a clarity that you only get in the very best leaders. However, the unexpected bid for the GSK assets and the challenging economic environment has made trading tough for Unilever and unsettled shareholders.

The company says that Jope has decided to retire at the end of next year after five years as chief executive and 35 years at Unilever. It is now launching an internal and external hunt for his successor with Nils Andersen, Unilever’s chairman, saying: "Alan's retirement next year will mark the end of a remarkable career with Unilever. Under his leadership, Unilever has made critical changes to its strategy, structure and organisation that position it strongly for success. This work continues, and we will thank Alan wholeheartedly for his leadership and contribution to our business when he leaves next year.”

Despite this praise, it is fair to wonder whether Jope has been encouraged to make this decision or doesn’t agree with the strategy that some shareholders want him to pursue in the future. It will be interesting to see how history judges his approach for GSK’s consumer healthcare business. While short-term market and economic volatility may have eventually killed the deal anyway, long-term I would not be surprised if it turns out to have been an opportunity missed for Unilever, similar to Prudential’s failed bid for AIA in 2020.

The share price graph below shows that while Unilever (in blue) has underperformed the FTSE 100 (in white) over the last year, the company’s stock has actually been recovering since the start of 2022. Indeed, Unilever shares are now up 3 per cent in 2022 compared to a 5 per cent drop for the FTSE 100. Shares in the company rose about 1 per cent today on the back of the news of Jope’s departure…

Other stories that matter…

Foreign direct investment into the north of England has risen by almost three-quarters in the past five years despite falling in every other part of the UK. Lord O’Neill says the rise in investment is the only “notable success” of the Northern Powerhouse lobbying effort so far (Financial Times)

An interesting look at Apple’s AirPods and how they have become one of the biggest tech success stories of the last decade (Bloomberg)

Natwest is to give male bankers a year off when they become a dad, including six months fully-paid. At present new dads get just two weeks of statutory paternity leave (Telegraph)

It’s not been a great year for air passengers, with disruption at airports and flights cancelled. So this list of the best airlines of 2022, as voted for by passengers, is worth reading. Qatar Airways is number one ahead of Singapore and Emirates. British Airways is eleventh, which may surprise some, while Virgin Atlantic is 19th (Bloomberg)

Businesses are making increased efforts to build alumni networks which can help boost a company’s brand, lead to talented people being rehired, and help with referrals or recommendations (Wall Street Journal)

Finally, Off to Lunch’s Sunday press review was sent to paying members yesterday and rounds up what was interesting in the papers, including lots of reaction to the mini-Budget, an activist investor for Rentokil Initial and River Island looking at opening shops in the US (Off to Lunch)

And finally…

The brilliant Eliud Kipchoge did something special yesterday, setting a new world record for the marathon of 2:01:09. As this Guardian story covers, the Kenyan’s speed in the early part of the race in Berlin was ridiculous. He ran the first 10km in 28min 23 secs, a time that would have been good enough for 18th place in the 10,000m final at last year’s Toyko Olympics. Kipchoge went through the halfway mark at 59.51 minutes but couldn’t quite sustain that pace to the end. Nonetheless, this remarkable performance makes you think that he is capable of breaking the 2-hour mark in an official marathon. Kipchoge has already run the 26.2 mile-marathon distance in less than 2 hours but this was in a specially-organised event backed by Ineos in Vienna in 2019.

Thanks for reading. Off to Lunch will be back on Wednesday. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham