The average interest rate on a two-year fixed mortgage has cleared 6 per cent according to new data from Moneyfacts. The rate has gone from 5.98 per cent on Friday to 6.01 per cent today as lenders continue to increase the interest charges on their mortgages. The average interest rate on a five-year fixed mortgage has grown from 5.62 per cent to 5.67 per cent.

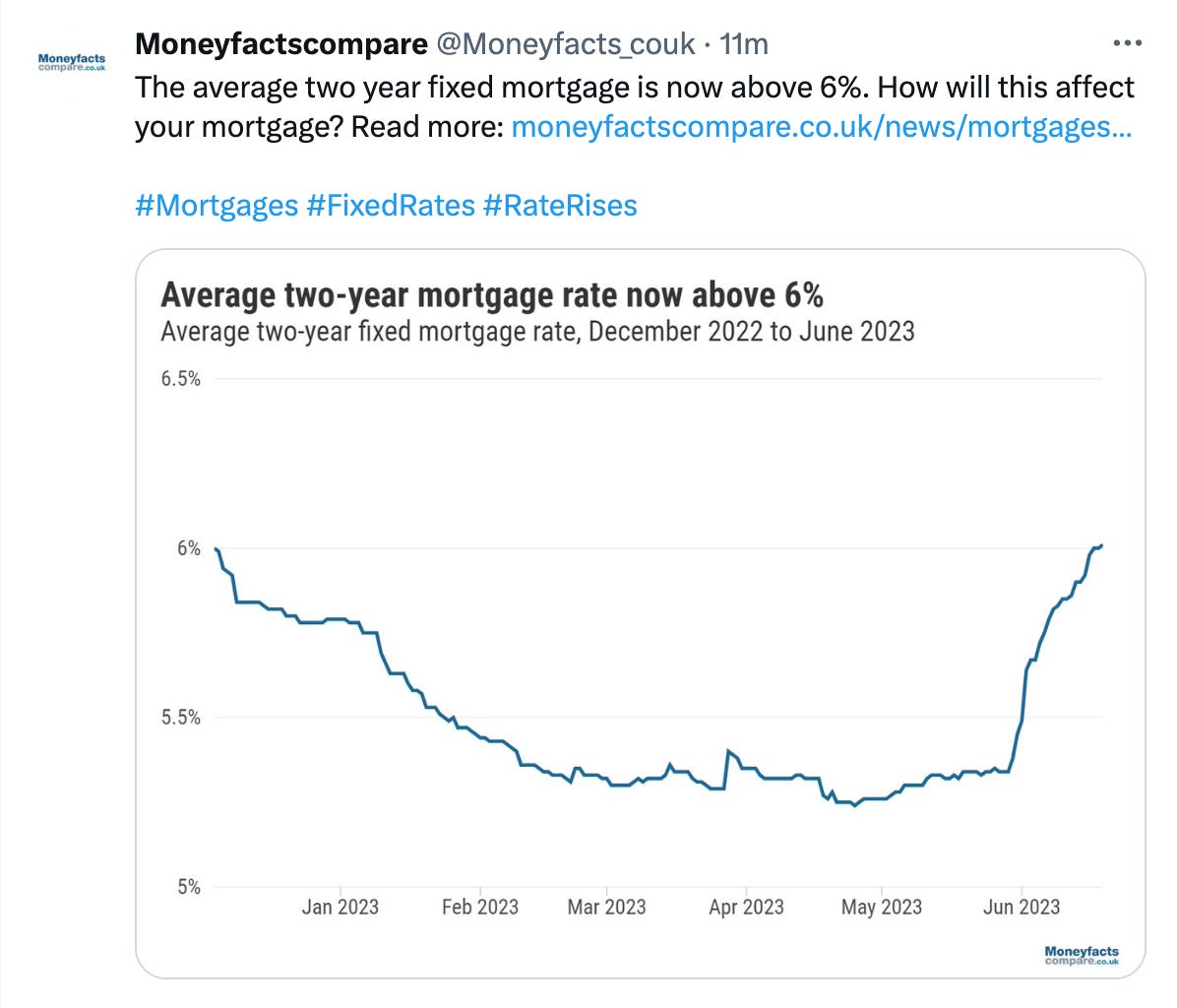

Mortgage rates last cleared 6 per cent in the aftermath of Liz Truss and Kwasi Kwarteng’s mini-Budget. But before that mortgage rates had not been at this level since the turn of the century. This Moneyfacts chart shows how rates have moved this year…

The sharp rise in mortgage rates over the last month was sparked by worse-than-expected inflation data. That data showed inflation was still 8.7 per cent in the UK in April, higher than economists had forecast. It caused the yield on gilts to rise as traders bet that the Bank of England would have to increase interest rates further to get inflation under control and closer to its 2 per cent target.

This week we will get the latest update on inflation and interest rates. The inflation data for May will be published by the Office for National Statistics on Wednesday morning. The consensus among economists is that the consumer price index, the main measure of inflation, will drop to 8.4 per cent. For context, it is 4 per cent in the US.

Then at noon on Thursday the Bank of England will announce its latest decision on interest rates, after the nine members of its rate-setting Monetary Policy Committee have voted on what to do. A collection of property analysts have told The Daily Mail that the Bank should hold-off on more rate rises until the impact of what they have done so far is fully understood…

But that is unlikely. The consensus in the City is that the Bank will increase interest rates from 4.5 per cent to at least 4.75 per cent…

Rishi Sunak has ruled out government support for households struggling with their mortgage bill. The government needs to focus on helping households by getting inflation down, Sunak said in an interview this morning. This is what he said to ITV’s Good Morning Britain:

The debate about mortgages, interest rates and inflation could look different by the end of the week depending on the inflation data and the Bank’s decision. Just as the debate over the last month was sparked by that inflation data for April, better-than-expected inflation data this week could lift some of the doom and gloom. Likewise, the outcome of the Bank’s vote and the minutes of its meeting will make for fascinating reading. How many members of the MPC will vote to hold rates because of concerns about the impact on the economy of more rate rises? Do the minutes of the meeting show that the Bank expects to make more rate rises or will it try to dampen expectations in the City that rates could reach 6 per cent? We will know more soon.

New data from Rightmove suggests that the housing market is starting to feel the impact of rate rises and the squeeze on households. The average asking price for a newly listed property on Rightmove over the last month fell by £82 compared to the previous month to £372,812. This decline is tiny - it is 0 per cent in percentage terms - but is the first monthly drop of any kind this year and the first drop for the month of June since 2017. You can find the full report here

Despite Sunak ruling out support for households, the political fall-out from rising mortgage payments is growing. Andrew Neil wrote in The Daily Mail on Saturday that the Conservative party had isolated a generation of renters and homeowners. You can read that piece here. Meanwhile, Theresa May’s former adviser Nick Timothy has written that no-one in British politics is proposing the policies needed to control inflation and boost the economy. You can read his Telegraph column here. And Mark Carney, the former governor of the Bank, has said that Brexit is the reason that inflation is worse in the UK than in other countries. He made the comments in an interview with The Daily Telegraph, which you can read here

Other stories that matter…

1. London is the top destination for foreign investment in England but the north-west of England and the West Midlands have overtaken the south-east as the leading destinations outside the capital. Data from EY, the accountancy firm, shows the UK saw a 6 per cent fall in the number of new projects funded by overseas backing in 2022. However, new projects in the north-west rose 19 per cent to 88. The West Midlands recorded 74 new projects, down 5 per cent year-on-year, a smaller drop than other regions. There were 299 new projects in London, well ahead of the rest of the UK, while Scotland recorded 126 new projects. You can find more on the research here

2. An interesting media story from Semafor. Left-leaning activists in the US want to invest in local media and social media influencers to try to boost their political campaigning. The local media industry has suffered in the US in a similar way to the UK, with outlets closing as advertising has shifted online. The story is included in Semafor’s latest media newsletter here

3. The first geothermal project in the UK for 37 years has started operating at the Eden Project in Cornwall. A well that goes 5km below the surface will heat greenhouses and the Eden Project’s enclosed rainforests. Financial Times story here

4. The chief executive of Belfast-based IT group Kainos is standing down after 22 years. Brendan Mooney will be succeeded by Russell Sloan, who has been at Kainos for 24 years. Kainos is in the FTSE 250 and valued at £1.7 billion. Shares in the company have fallen by more than 5 per cent today following the announcement, which you can find here. We wrote about why Kainos is such an interesting company - and spoke to Mooney - last year. You can find that piece here

5. Cancer cases are growing in younger age groups at a faster rate than older generations according to an alarming but important feature by the Financial Times. The reason for this rise in cancer in young people is unproven but researchers in the piece suggest it is linked to changes in our diets since the 1960s. Piece here.

And finally…

An optimistic note to finish. This clip of Andy Murray discovering his kids were in the crowd to see him with a trophy for the first-time will brighten your day if you haven’t seen it yet…

Thanks for reading. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, and contribute to the work of Off to Lunch

Best

Graham