£32 billion a year - that’s the cost of the measures that Jeremy Hunt announced in a short televised statement just after 11am this morning. In that statement he scrapped most of what Liz Truss and Kwasi Kwarteng set out in their mini-Budget on September 23. Here it all is in a helpful tweet…

This is what the government’s tax proposals in the mini-Budget growth now look like. The crossing-out is from me. They are mostly gone. We have just seen a staggering U-turn…

Look at the number of black lines in that table and also the size of the numbers behind those lines. As Hunt said, the changes he announced today will boost the public finances by £32 billion a year. The table above doesn’t even include the announcement that the energy price cap will be reviewed after next March. This proposal caps the average household bill at £2,500 a year and was estimated to cost £31 billion in its first year.

Hunt announced that the proposal to cut the basic rate of income tax from 20p to 19p next April would be scrapped. Not just delayed, but scrapped. That is particularly astonishing because Rishi Sunak, Truss’s rival in the Tory leadership race this summer, introduced that policy as chancellor. So Truss has scrapped a tax cut that her rival wanted. It should be said however, Sunak would not have gone ahead with the cut to national insurance and you can see from the table above that remains a big move…

Hunt sounded sensible and calm in his statement, a welcome change to the grandstanding we have seen from senior politicians in recent weeks. He said it was important that the UK provided “certainty about the stability of public finances”, that governments “cannot eliminate volatility in markets but can play their part” and that “growth requires confidence and stability and the UK must pay its way”.

Hunt said he couldn’t go-ahead with the cut in income tax because “it is not right to borrow to fund this tax cut”. Check out the link below to Dominic Lawson’s piece in the Daily Mail today for more on this. In short, while Truss claims to be some sort of new Margaret Thatcher, Thatcher’s chancellor Lord Nigel Lawson - his father - only cut taxes when the UK public finances were in surplus. Ominously, Hunt also said: “There will be more difficult decisions I am afraid on tax and spending.”

The Bank of England appears to have played a key role in all this. Andrew Bailey, the governor of the Bank, made some eye-opening comments at the weekend, saying: “Flying blind is not a way to achieve sustainability.” Bailey said he had already spoken to Hunt: “I can tell you that there was a very clear and immediate meeting of minds between us about the importance of fiscal sustainability and the importance of taking measures to do that.” More here. Bailey also made comments about how the energy price cap will help to make inflation even higher in its second year. Well, the second year of the price cap is now gone. Coincidence?

What does this all mean for households? Well, energy bills are unlikely to be capped for two years now. Instead, the support that limits household bills is likely to become more targeted. But we won’t know more until the Treasury has completed its review.

As for mortgages, well let’s look at the financial markets for that. It is the rise in the yield on government bonds - gilts - that has led to banks putting up their mortgage rates in recent weeks. This is because the yield on gilts - the interest rate that the government pays on debt, effectively - flows through to the interest rate that a bank gets on the money it then lends to households.

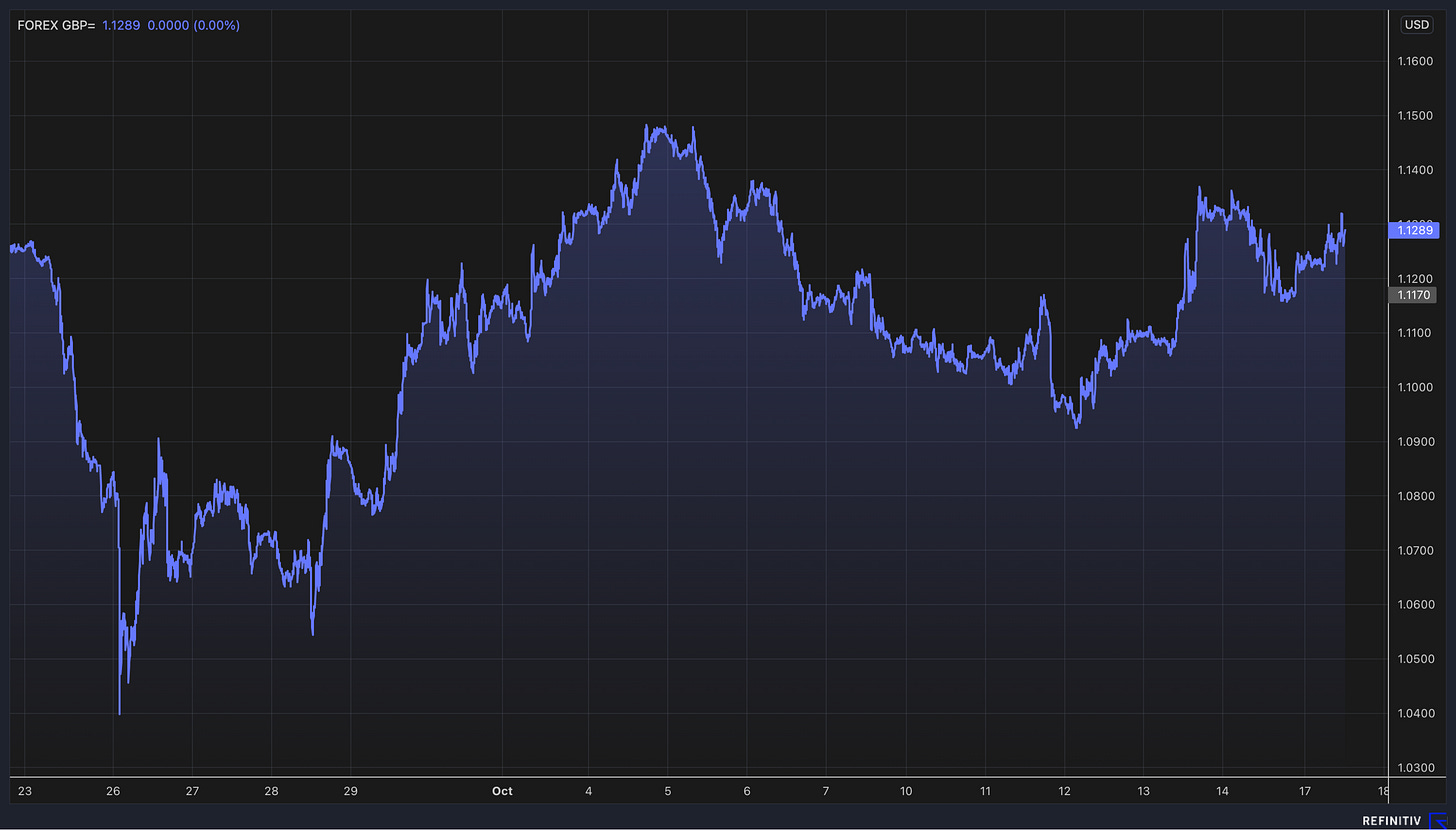

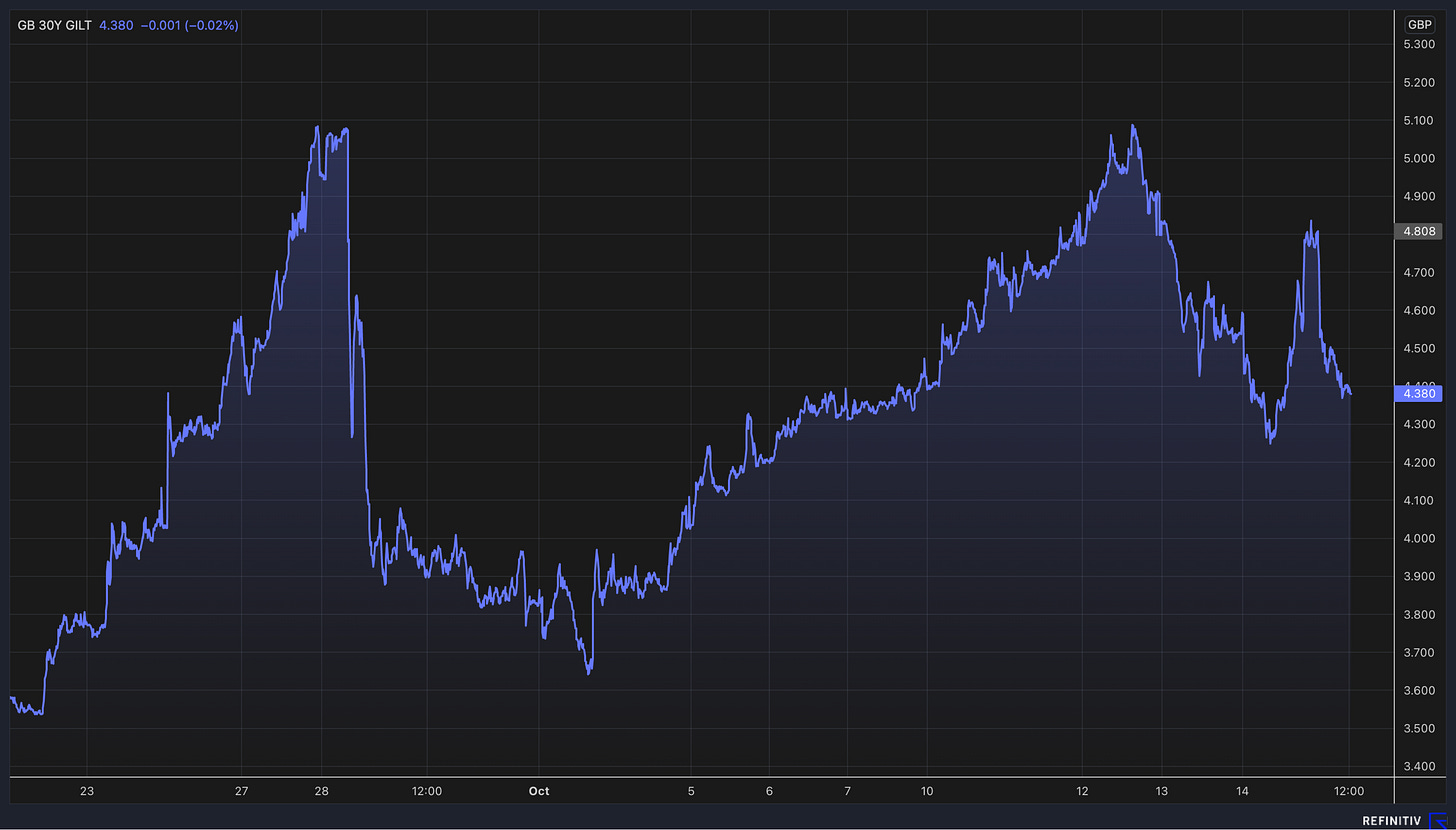

So, here is the pound v dollar, the two-year gilt and the 30-year gilt yield since the mini-Budget. The 30-year market is important because that is the one that moved so dramatically and caused problems for pension funds.

This is the pound v dollar. The pound has risen more than 1 per cent against the dollar today and is now notably above the lows it hit immediately after the mini-Budget…

This is the 2-year gilt yield. It is almost back to where it was before the mini-Budget and has fallen today…

And this is the 30-year yield. The sharp rise at the start of this graph is the reaction to the mini-Budget, the cliff-edge drop on September 28th is when the Bank of England announced it would pump £65 billion into the gilt market to support struggling pension funds and the drop at the end is what has happened today. The drop today is welcome news for the UK economy, but the yield on 30-year gilt yields is still well above where it was before the mini-Budget…

Podcast episode 4…

The latest episode of our Business Studies podcast went live this morning. You can listen wherever you get your podcast or on Substack here. This episode features an interview with Tim Steiner, the co-founder and chief executive of Ocado. It looks at how Ocado became one of the few British tech businesses to make it big in the 21st century - making it to the FTSE 100 and expanding around the world. Along the way, Steiner and Ocado have faced big challenges, big questions and big rivals. This is a fascinating look at the mindset Steiner has built within the business, why he founded it, and his thoughts on the future…

There will be bonus content for Off to Lunch’s paying members on Friday. We will look at Tim Steiner’s thoughts on the outlook for the grocery and food delivery market, specifically rapid delivery and what comes next for the likes of Getir, Gorillas and Ocado’s own service Zoom. You can sign up here to make sure you receive that…

Other stories that matter…

I missed this last week, but this from Dominic Sandbrook, the historian and co-host of The Rest is History podcast, on whether Liz Truss has had the worst start of any prime minister in British history is worth your time. The short answer is - yes, she probably has (Unherd)

Dominic Lawson has written about how his father, Margaret Thatcher’s chancellor Lord Nigel Lawson, would never have gone ahead with the tax cuts proposed by Liz Truss and would instead have favoured Rishi Sunak’s cautious approach. To be fair, he said the same during the leadership campaign. The crucial difference between Lawson cutting taxes in the late 1980s and Truss doing it now? Britain’s national finances were in surplus then, we owe billions of pounds of debt now… (Daily Mail)

A look at the 20 leading deeptech unicorns in Europe - those companies with a valuation of more than $1 billion who are working on advanced technology. The list includes five British companies, such as Newcleo and its small nuclear power plants, Graphcore and its chips for artificial intelligence and Improbable and its virtual reality world (Sifted)

Ikea has put up the price of some of its furniture by as much as 80 per cent over the last year (Retail Week)

Chapel Down, the UK’s largest winemaker, has reported a record harvest after the warm summer. It said its total harvest was more than 2,000 tonnes of grapes, up from around 1,400 tonnes last year (Chapel Down) For more on the flourishing sparkling wine industry in the UK you can read Off to Lunch’s analysis of the sector and my visit to Chapel Down here.

The Times has described the redevelopment and restoration of Battersea Power Station as a “triumph” in its leader column. I agree. It has been a regeneration project that has taken years and billions of pounds, much of that from overseas. There is much to be learned from the 40-year battle to redevelop the site (The Times)

Flagging this piece again as the link I put into Friday’s newsletter was broken, apologies. It is about how we need to rethink productivity and how self-help books get us asking the wrong questions about our lives. Check out the digital detox cabins too… (Mastery in your 20s)

Off to Lunch’s paying members received a full round-up of the Sunday press yesterday, you can sign-up here to read it and get next week’s straight into your inbox.

And finally…

Bad Sisters concluded on Apple TV+ on Friday and the 10-episode series is now fully available to watch. It is worth your time. The black comedy is about five Irish sisters, the Garveys, and the death of the odious JP, who is married to one of the sisters, Grace. You find out at the start of the series that JP dies and that his sisters-in-law wanted to kill him for his controlling, coercive, bullying, and generally repulsive behaviour. The series is about how this happened. It gets very dark at points and probably could have been shorter, but TV reviewers seem to agree it is among the best things to have been on this year. JP is one of the great TV villains and I honestly don’t know how Danish actor Claes Bang made him so awful yet keeps you watching. It also helps that it is filmed on the beautiful Irish coast north and south of Dublin, which is where my wife’s family is from and an area everyone should visit at least once….

Thanks for reading. Off to Lunch will be back on Wednesday. If you enjoy Off to Lunch then please share it with others and spread the word. If this newsletter was shared with you then please sign-up below to become a member, get Off to Lunch sent directly to your inbox, attend our forthcoming events and contribute to the work of Off to Lunch

Best

Graham